Another economic print upset the apple cart overnight with stronger than expected producer price inflation and further aggressive talk around interest rates from Fed officials sent Wall Street lower and the USD higher. Currency markets saw a continuation of USD strength with Euro remaining depressed below the 1.07 handle to make a new weekly low, while the Australian dollar was dumped well below the 69 cent level. 10 year Treasury yields lifted again through the 3.86% level to make a new high for the year. The commodity complex saw oil prices fall back slightly with Brent crude pushed below the $85USD per barrel level while gold is still in a depressed funk, falling back again to close at the $1835USD per ounce level.

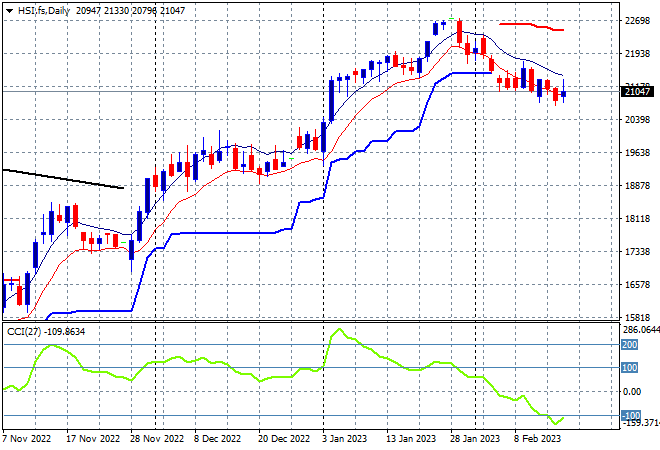

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets launched higher from the open but lost all of this and more at the close, with the Shanghai Composite losing more than 1% to close at 3249 points while the Hang Seng has finally stopped its recent falls, up 0.8% to 20897 points. The daily chart had being showing a nice breakout with daily momentum well overbought but still unable to breach the 23000 point level. Price action has now rolled over through ATR support with momentum crossing into oversold territory as a possible corrective phase is starting to firm here as support at the 20000 point level comes under pressure:

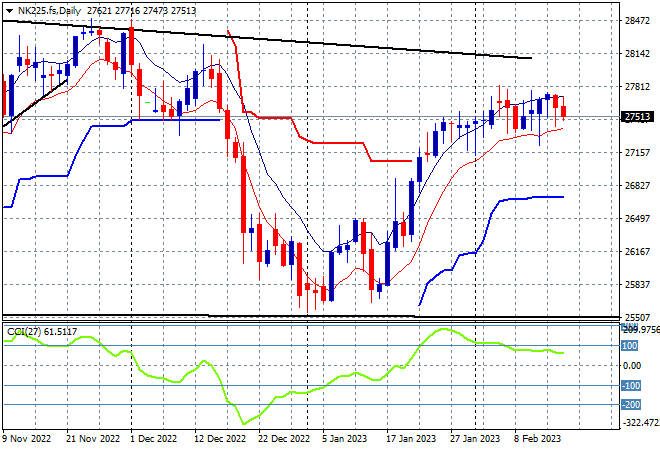

Japanese stock markets were able to take back their recent losses with the Nikkei 225 closing 0.7% higher at 27696 points. After bottoming out at the 25000 point level the next level to clear is still 27500 points, which is now coming under pressure as this market slowly melts higher. Daily momentum has reverted out of overbought mode and was suggesting a slide back below the low moving average next but support is holding quite strongly although futures are indicating a pullback on the open:

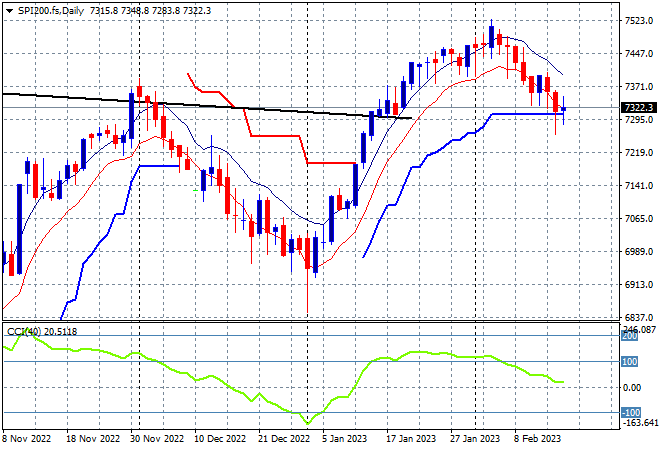

Australian stocks looked through the unemployment print with the ASX200 gaining some 0.7% to finish back above the 7400 point level, closing at 7410 points. SPI futures are down nearly 0.3% on the pullback on Wall Street overnight but could slump even further on the open. The daily chart is still showing a clear rollover after being unable to take out 7500 points, with a retracement below ATR support at the 7200 point level looks like firming here as daily momentum continues its revert from being overbought to almost negative status:

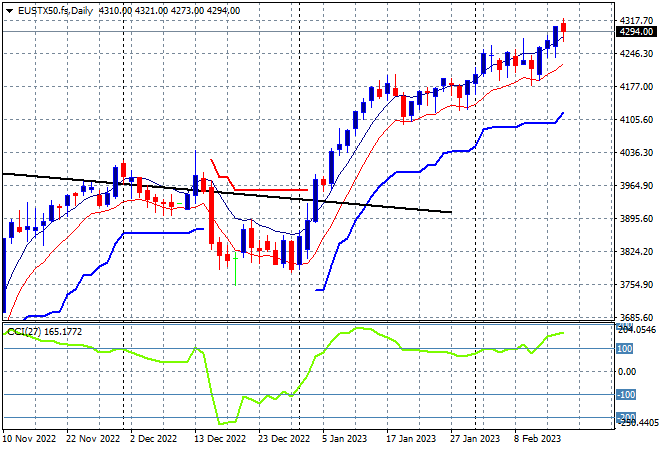

European markets were again able to advance overnight with the Eurostoxx 50 Index eventually closing 0.4% higher at 4297 points, advancing the new weekly high but futures indicate it will pullback in line with Wall Street. The trend above the 4000 point level remains somewhat stable with daily momentum now back into its previously overbought settings. The 4000 point level was the key psychological resistance level here that has now turned into support going forward, with a melt up higher still in effect:

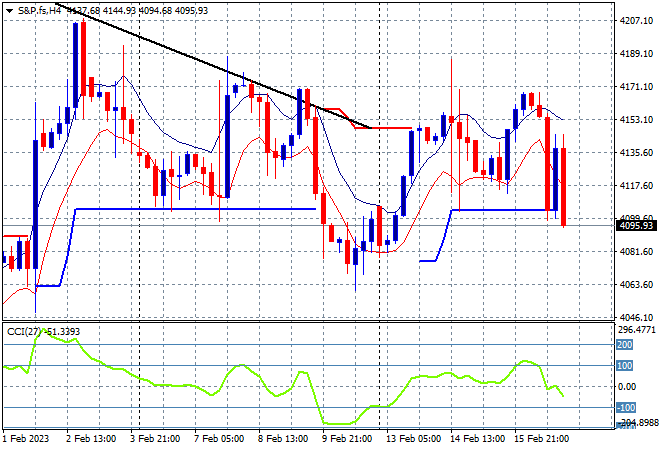

Wall Street fell back across all three main markets with the NASDAQ Composite falling the most, down 1.8% to break back below the 12000 point level, while the S&P500 lost over 1.3% to finish at 4090 points. The four hourly chart shows price volatility extending around the 4150 point level which may now be turning into resistance as Fed hawkishness weighs on the market. The key level to beat is still last week’s intrasession high at the 4180 point area but short term momentum readings are indicating further downside:

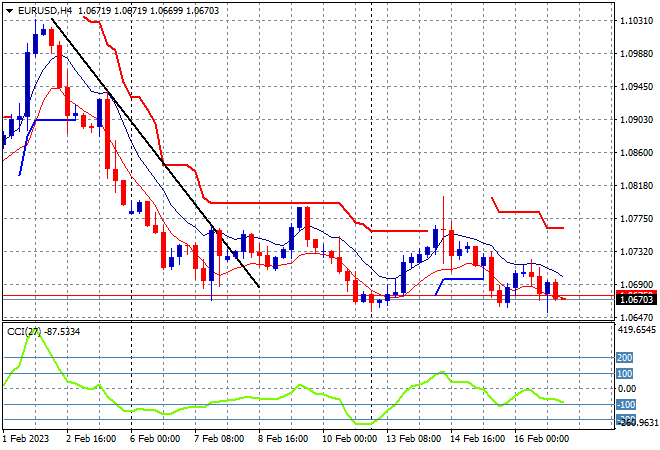

Currency markets are taking hit after hit with stronger USD still prevailing amidst these economic prints with King Dollar making or returning to highs against most of the major currencies. Euro fell further below the 1.07 handle to its start of week position which has almost negated its recent bottoming action and rejection of overhead resistance at the mid 1.07 level. I’m watching for a retest below the 1.0650 mid level next:

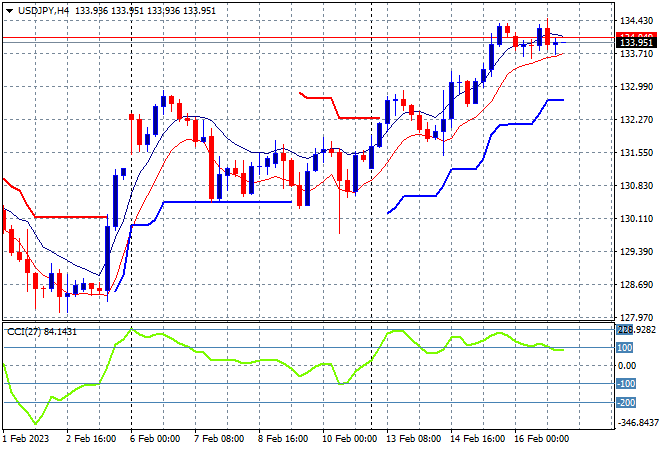

The USDJPY pair tried again to lift up through the 134 handle as Yen remains weak providing a good hit to Japanese stocks although resistance does seem to be building here again. Short term momentum has reverted from being extremely overbought in this move with price action looking very toppy again in the short term:

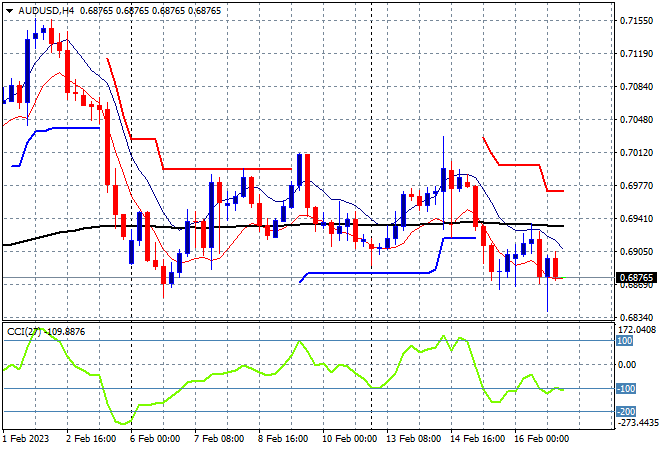

The Australian dollar followed Euro somewhat overnight, slammed down through the 69 handle before reverting slightly in late trade this morning but still in a very weak state. This comes after a weak response to yesterdays unemployment numbers that has not yet challenged interest rate expectations. I’m still watching for a potential pullback to the recent weekly lows at the high 68’s in the wake of the stronger US prints:

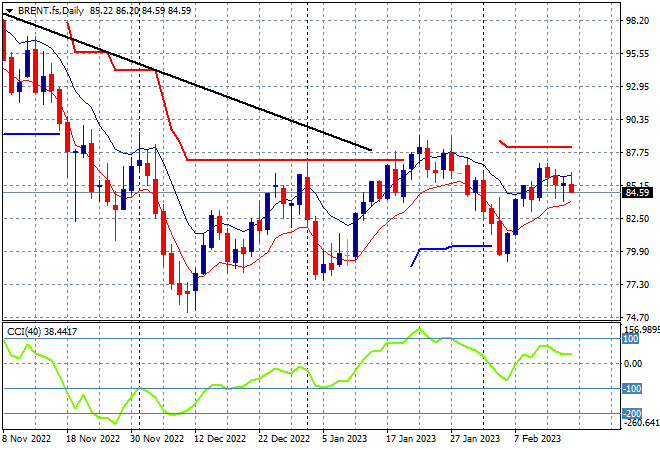

Oil markets are failing to follow through on their recent bounce from the Russian cutbacks but Brent crude was again pushed below the $85USD per barrel level to pull back further from the recent new weekly high. Daily momentum remains in the positive zone but is nowhere near overbought as buying support falters somewhat and price action remains well below the $88 highs from January:

Gold remains very depressed and with that comes more volatility with a ranging session overnight where it eventually finished where its started below its recent post NFP lows at the $1835USD per ounce level, holding on to a new weekly low. This price action negates all of the positive moves in previous weeks with daily momentum remaining quite oversold and all support levels taken out. Another possibility of a swing trade building here as momentum inverts from oversold mode but its a stretch: