A bath of blood on Wall Street overnight following the recent rate hike by the US Federal Reserve, as the risk complex lost all confidence in the wake of double rate hikes from the ECB and BOE, sending both European and US shares down well over 3% as the USD reasserted itself against most of the major currency pairs. Recession fears are now to the forefront in the US and Europe as King Dollar is coming back, although not that strongly against Euro while the Australian dollar was slammed back to the 67 cent level. US Treasury yields dropped again with the 10 year pushed down to the 3.4% level while the commodity complex saw oil prices pull back slightly at Brent crude retracing back below the $82USD per barrel level as gold slumped further below the $1800USD per ounce level to just over $1776.

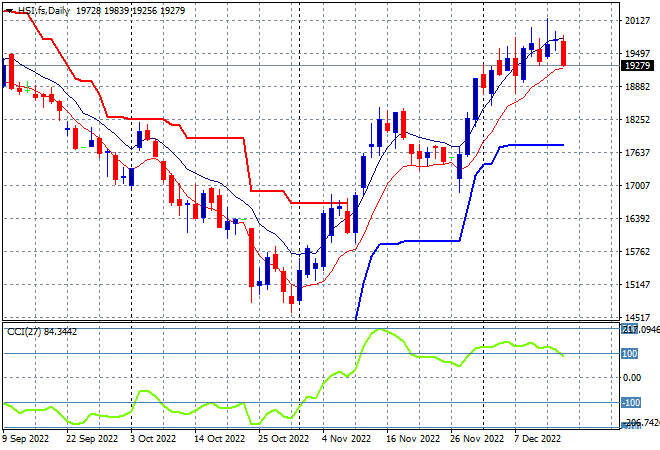

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets again fell into the close with the Shanghai Composite staying below the 3200 point level, down 0.2% at 3168 points while the Hang Seng Index has fallen over 1.5%, down to 19368 points. The daily chart is showing the typical end to a breakout that has run out of steam with momentum and price action rounding off in recent days. Watch support to remain strongly defended at the 17600 area with the low moving average to come under pressure next as overhead resistance is just too strong:

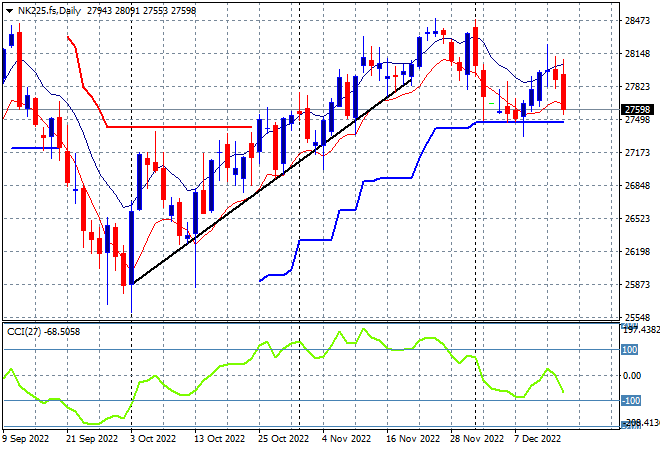

Japanese stock markets held up remarkably well despite the stronger Yen, with the Nikkei 225 closing 0.4% lower at just above 28000 points. Futures are indicating a rather stark finish to the trading week with the very poor lead from Wall Street not helping at all as heavy resistance at the 28400 point level remains the key area to beat to get price back on trend. The rollover into short term ATR support at the 27500 point level is possibly going to convert into a breakdown here so watch for any close below:

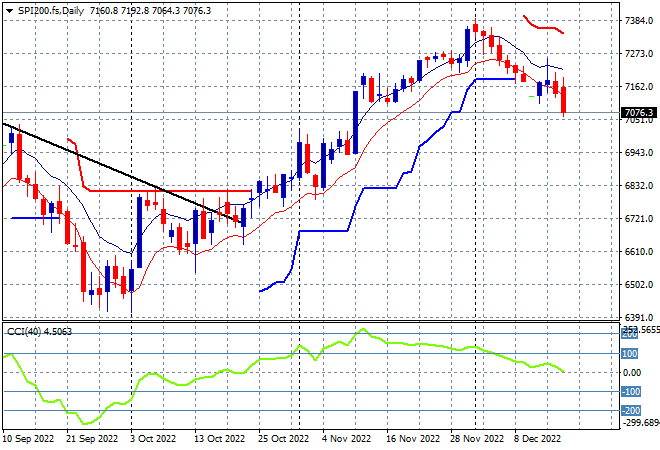

Australian stocks couldn’t escape the selling with the S&P/ASX 200 still holding on just above the 7200 point level, finishing 0.6% lower at 7204 points. SPI futures are down over 1.2% indicating the Wall Street volatility will again be translated into a very poor session here that is likely to see the 7100 point level taken out as well. The daily chart has been showing price action and daily momentum retracing to neutral or even negative territory in recent session with ATR support at the 7200 point area looking to fail here so watch carefully for a breakdown as confidence is nowhere to be found:

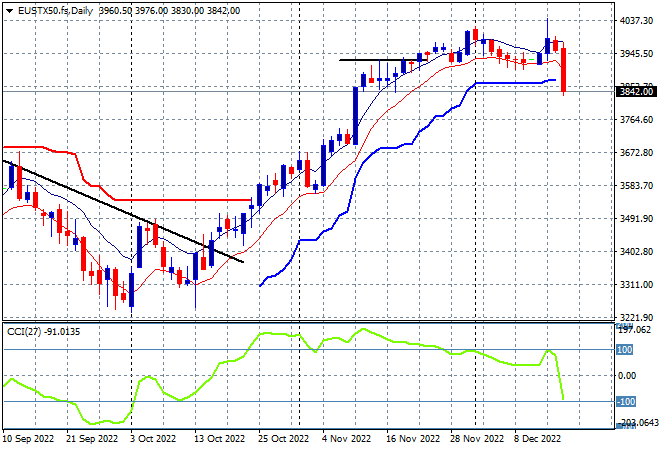

European markets have been unable to translate previous solid sessions into anything higher and this was proven again and then some overnight as it followed Wall Street, as the Eurostoxx 50 Index was smashed 3.5% lower to 3835 points. The daily chart shows key overhead resistance at the 3900 point area just unable to be pushed aside with daily momentum retracing firmly to the negative side as price action still indicates a battle against resistance that could not be won. The 4000 point level is proving key psychological resistance so far as this could turn into a steep rollover:

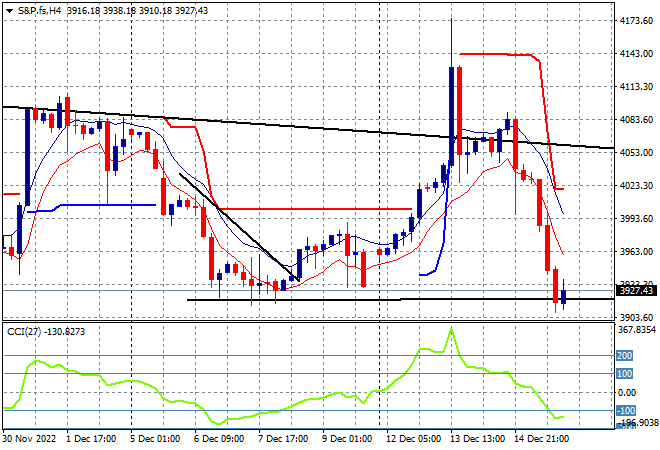

Wall Street has been having troubling volatility all week around US inflation and Fed expectations with the latest machinations not all unsurprising, if relatively large in execution. The NASDAQ finished down 3.2% while the S&P500 was off by more than 2.6% and solidly below the 4000 point psychological barrier at 3927 points. I’ve been saying for sometime now that the chart picture had been showing more layers of resistance compared to other markets and really needed to clear the 4000 point level, but has been more attracted to the dominant medium term trendline. Price is now at the recent weekly low and could break here again tonight:

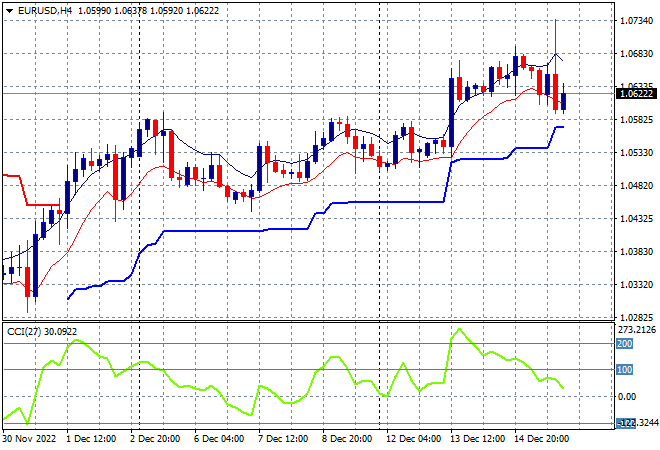

Currency markets were less volatile but very mixed when it came to the USD with Euro pushed higher into the 1.07 handle before retracing into the low 1.06s but still well and truly holding on to its recent highs. As I noted last week, this level still remains a weekly and monthly high with strong support evident at the mid 1.02s with signs pointing to a possible top in USD, but Pound Sterling and other majors have suffered much greater falls. This price action could be slow moving as a result and may play catchup later tonight so watch for a retracement below short term ATR support at the high 1.05s:

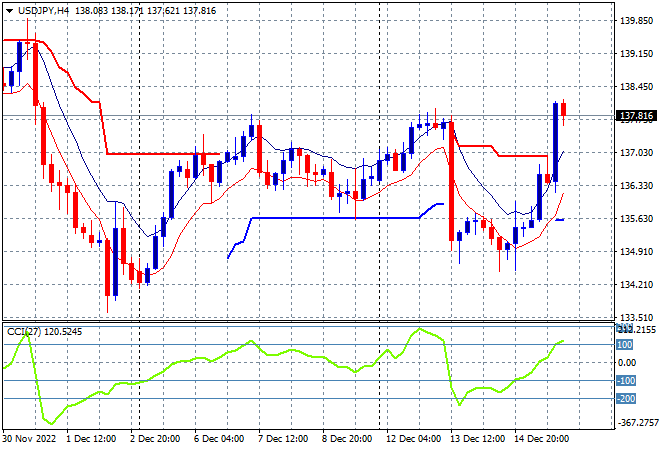

The USDJPY pair had more intrasession volatility but eventually finished at a new weekly high just shy of the 138 handle in a big signal that Yen is getting sold off much quicker than anticipated. After being depressed here at the 135 handle and unable to climb above the 137 level in recent weeks this big move could be something to watch closely as short term momentum gets nicely overbought. By clearing overhead ATR resistance and the recent price highs this does setup more upside potential here but be wary of the overall medium term picture:

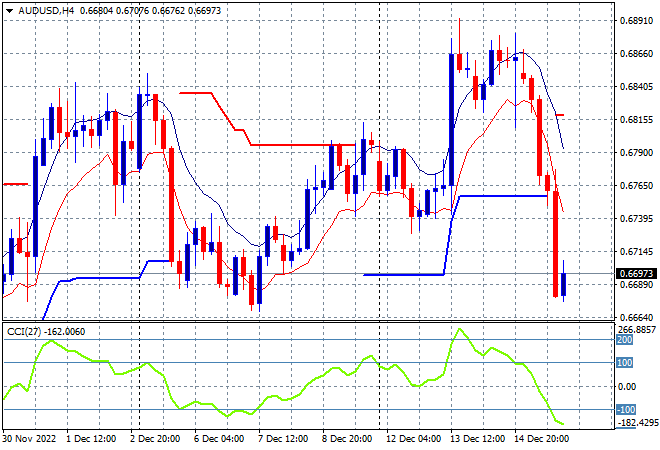

The Australian dollar was slammed down by the double rate hike whammy trade, losing over 200 pips in the last 24 hours after finding a lot of resistance just below the 69 handle, now sitting just below the 67 cent level this morning. Watch for the RBA to get out of this wreck come, well…February! Interest rate expectations will drive this trade for the rest of the year and while price hasn’t dropped below the December lows yet, it bears (sic) watching:

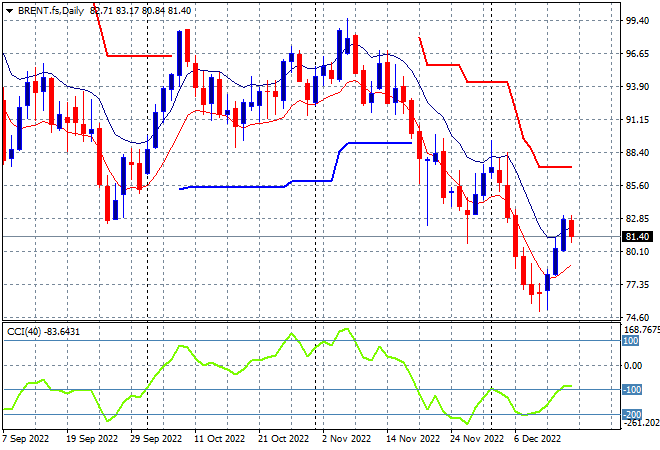

Oil markets were slowly building back in the wake of the weakening USD, but that was suspended overnight as Brent crude finished slightly lower at below the $82USD per barrel level. Daily momentum is still oversold but setting up a swing play here with price action trying to translate into some more meaningful gains. This still signals a lot of internal weakness but with no new daily low the chance of a swing trade up through the $80 level is now rising, but not certain:

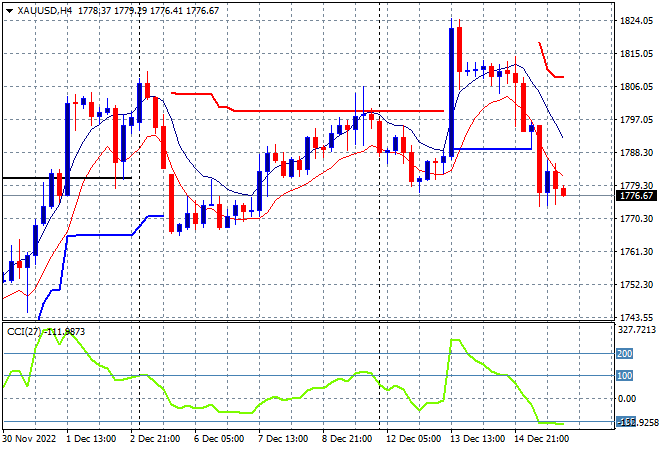

Gold acted like the Aussie dollar with another breakdown below the $1800USD per ounce level but failed to recover, almost making a new daily low at the $1776USD level this morning. As I mentioned post the inflation print, the key thing to watch now is for $1800 to turn into a solid area of support, which it has not been defended robustly at all, so I expect another test of the recent lows below the $1770 level: