Last night saw the release of several economic reports that contributed mainly to upside volatility on stock markets, with the latest UK unemployment print ticking up while US PPI came down unexpectedly. However, late in the session the news of Russian missiles hitting Poland pushed risk markets around and are likely to result in more volatility on the open here in Asia. The USD continued to fall against the major undollars with Euro jumping through to the 1.05 level before retracing sharply on the missile attack while the Australian dollar punched through the 67 cent level. US bond markets were relatively calm although 10 year Treasury yields pulled back below the 3.8% level while commodities remain mixed as oil prices fluctuated as Brent crude finished at the $93USD per barrel level. Gold had another solid session, maintaining its current uptrend to extend above the $1780USD per ounce level for a four month high.

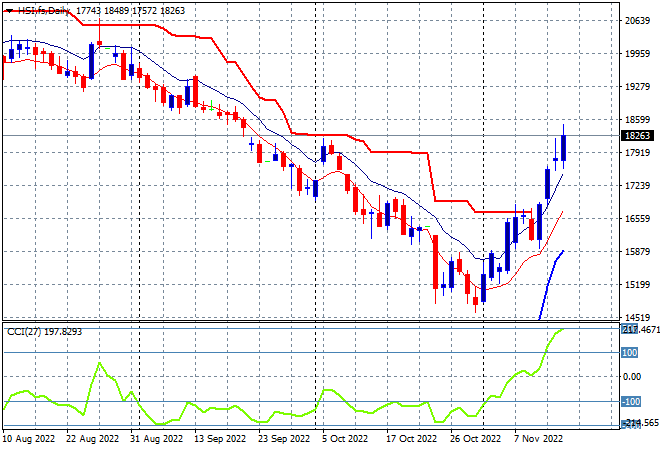

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets picked up strongly going into the close with the Shanghai Composite finishing more than 1.6% higher, breaking through 3100 points while the Hang Seng Index continued to surge, closing up more than 4% at 18434 points. The daily chart is showing a big reversal of fortune here, having gained nearly 4000 points since almost testing the 2008 lows. The previous session bullish engulfing candle and clearance of overhead trailing ATR resistance continues to build this breakout here but momentum is getting ahead of itself before the magical 20000 point level is reached, so watch for a potential retracement shortly:

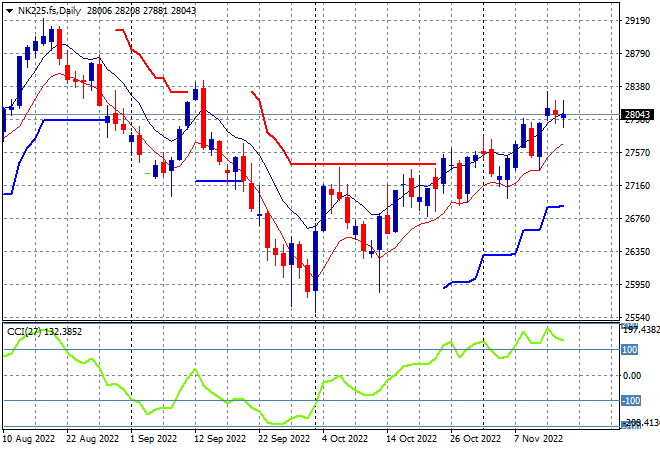

Japanese stock markets were able to finally finish in the green, with the Nikkei 225 closing just 0.1% higher at 27990 points. The daily price chart was showing a breakout brewing as overhead resistance at the 27500 level is cleared but more wobbles are appearing here as the too strong Yen bites down on confidence amid other macro concerns. A potential pullback is building here as price action stalls amid although daily momentum remains overbought. Support needs to hold at the 27500 point level:

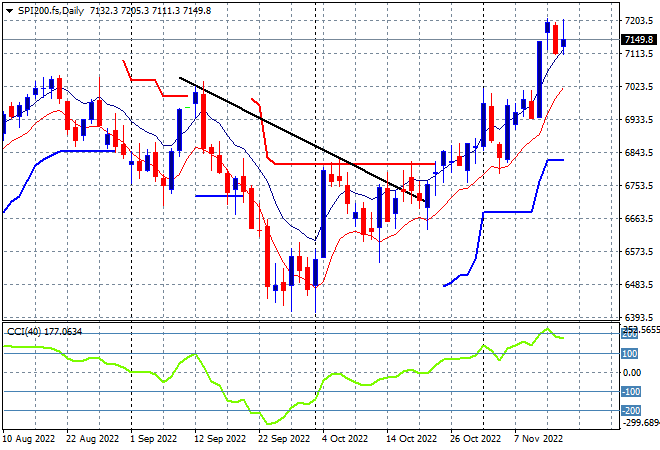

Australian stocks were again in scratch territory today with the ASX200 closing dead flat at 7141 points. SPI futures are down nearly 0.2% so we are likely to see a continuation of a mild pullback with the daily chart still looking very similar to Japanese stocks, albeit with more upside potential. Daily momentum remains solidly overbought, with strong support below at 7000 points as the uncle point on any pullback:

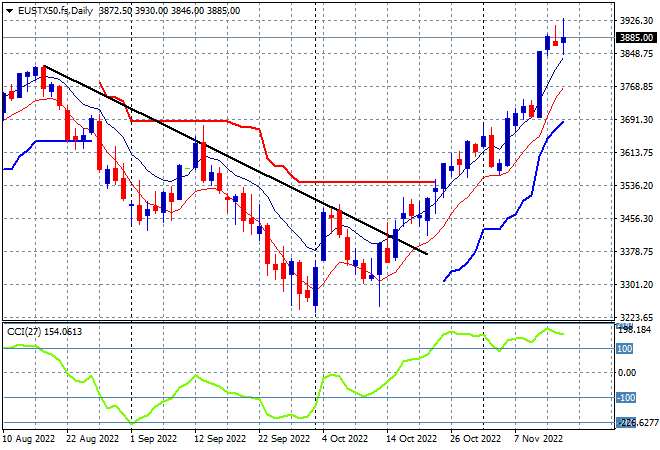

European markets were green across the board except for Brexit land, with the Eurostoxx 50 Index eventually gaining 0.7% to finish at 3915 points. Again, another daily chart picture that looks similar to Asian markets, but with much more momentum as it recently cleared resistance at the 3550 level and bounced off the 3600 point area. The key point going forward will be the reaction to the Polish missile strikes, with daily momentum already over extended this is ripe for a reversal so watch for any moves below the high moving average here at the 3850 point level:

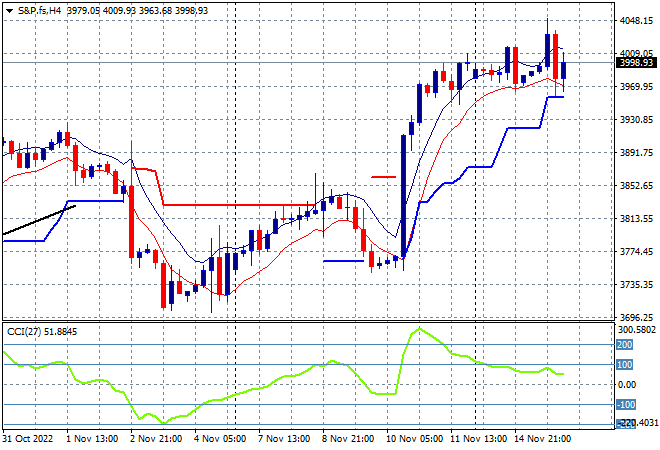

Wall Street was eventually up across the board after a volatile session with the NASDAQ gaining more than 1.4% while the S&P500 finished 0.8% higher at 3991 points, but this was all taken back in post futures trade. The chart picture remains slightly different to other stock markets as it is battling many more layers of resistance that must be overcome to get back to the August highs, with the October highs cleared and the 4000 point psychological level the next to beat this trading week. Watch for a potential rollover below trailing ATR support here on the four hourly chart:

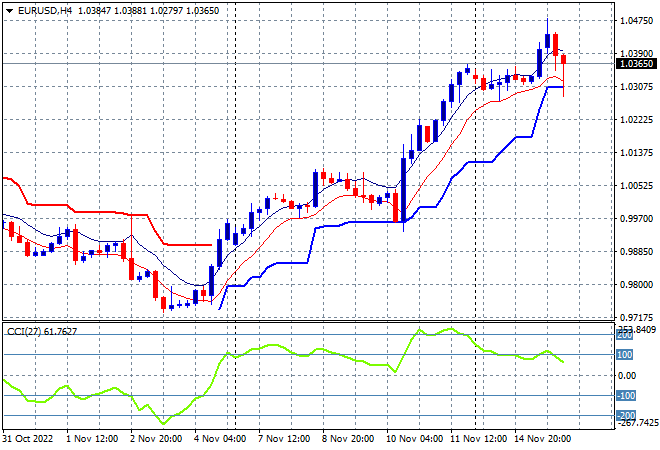

Currency markets were volatile in the wake of multiple economic releases with Pound Sterling pushing to a new three month high against USD while Euro zoomed up to the 1.05 level on the ZEW survey before retracing sharply to the 1.03 level on the Polish attack. This keeps it above the 1.03 level and technically a solid level to launch even higher but as I warned yesterday I’m wary of a very crowded trade here with a one-way move usually meaning a pullback – potentially violent – is forthcoming:

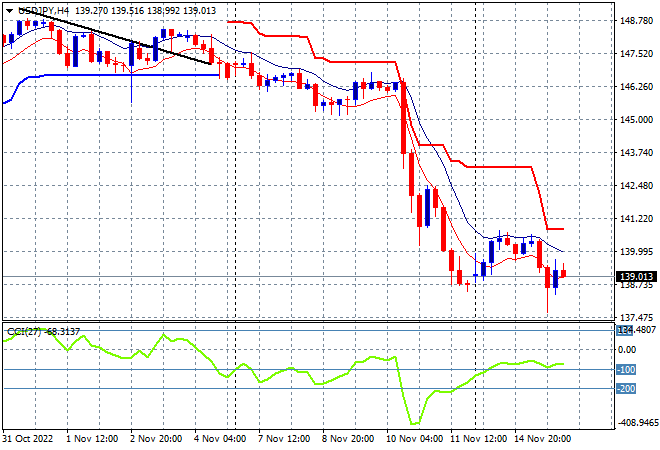

The USDJPY pair was depressed again overnight with a return below the 139 handle, stabilising just above that level this morning. This keeps price action near the new monthly low as the October and September rallies are all but wiped out, with more potential for downside action. While there is some evidence of deceleration at the 139 handle as momentum rebounds out of extremely low oversold readings, price action is pointing to another test of the recent lows instead:

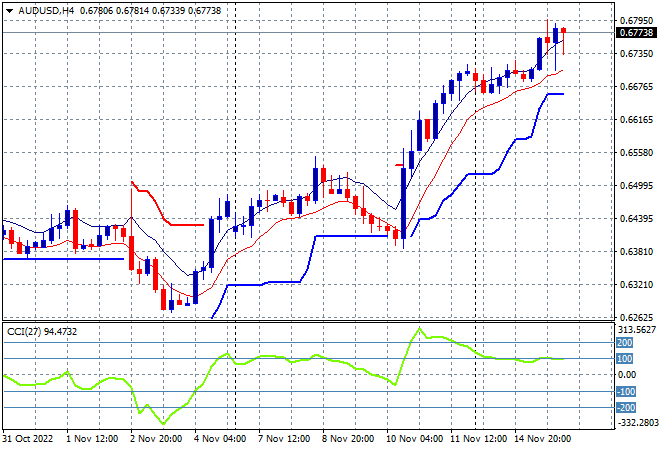

The Australian dollar also zoomed higher in line with other major currencies, having pushed up through the 67 level in afternoon trade prior, but managed to look through the European volatility to remain there this morning. My previous contention that resistance was still too strong at the 65 handle is no longer intact as this outsize move rejigs the Pacific Peso as the Fed is more likely to be in line with the RBA on future interest rate rises. That still means less upside potential in my view, but negates the idea of a crash below the 60 handle:

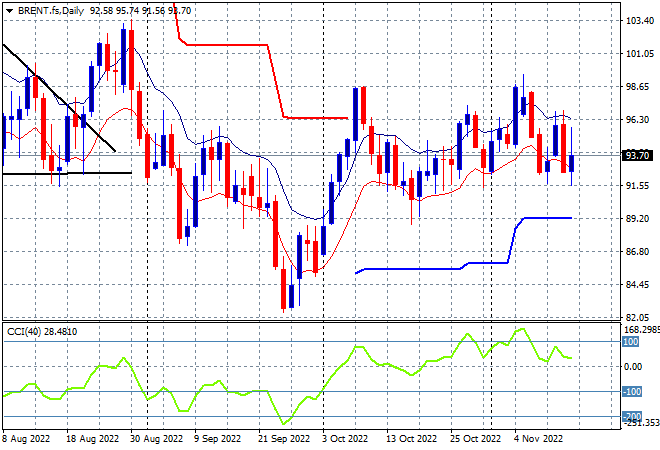

Oil markets had wide ranging sessions overnight, but still echoed the recent failed attempt earlier last week to break above the former October highs as Brent crude finished slightly above the recent weekly lows at the $93USD per barrel level. Although daily momentum remains positive, the lack of new daily highs is quite telling here as is the inability of price action to return to the magical $100 level as it keeps coming up against resistance at the $98 level:

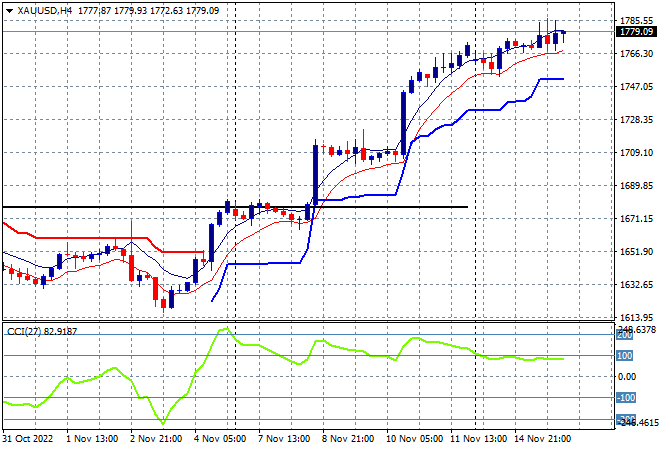

Gold is slowly climbing and consolidating here after its recent upmoves that took it well past the October highs (upper horizontal black line), advancing almost through the $1780USD per ounce in a surprisingly smooth lift overnight. Again, this trend completely negates the idea of a dominant downtrend as the lower inflation print looks set to let loose the gold bugs with the $1800 level the next target: