It was all about the ECB overnight which lifted rates at its latest meeting, following a hawkish pause from the Federal Reserve in the previous session. A lower USD combined with a better than expected retail sales print lifted Wall Street overnight, but European stocks stumbled.

Meanwhile currency markets saw a broad selloff in USD which had already been in decline following the FOMC meeting with Euro rebounding to a three week high while the Australian dollar almost hit the 69 handle.

10 year Treasury yields had a big one day drop, off by nearly 8 pips as the latest US retail sales data rose unexpectedly while oil prices came back slightly on the subsequent USD weakness following the ECB rate hike, with Brent crude finishing above the $75USD per barrel level. Gold rebounded even further after a major dip following the Fed pause and was pushed back up to the $1960USD per ounce level.

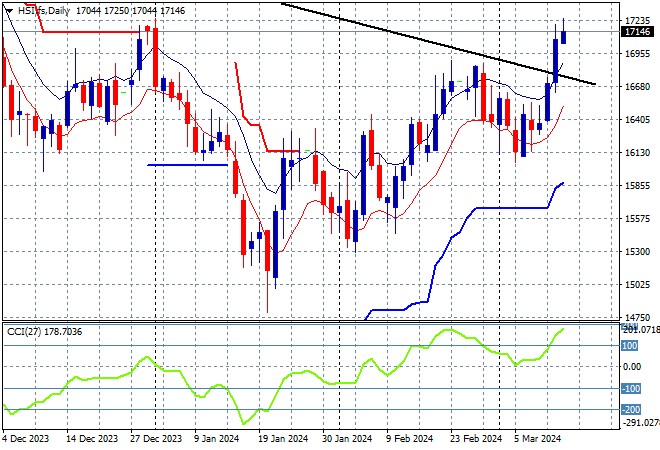

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are lifting going into the close with the Shanghai Composite up 0.7% to climb above the 3200 point level at 3252 points while the Hang Seng Index is pushing even higher, up more than 2% to extend past the 19000 point level at 19828 points.

The daily chart is showing series of strong sessions that are getting it back above the previous resistance zone as daily momentum becomes positive and nearly overbought, retracing most of the May losses:

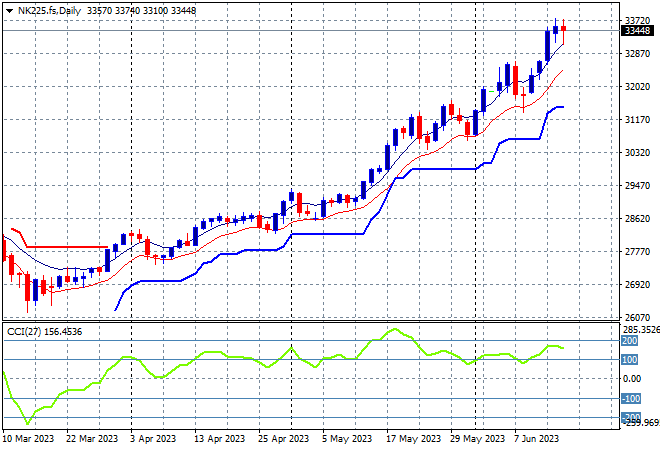

Japanese stock markets are finally having a breather with the Nikkei 225 putting in a scratch session to finish at 33485 points. Futures are indicating another pause to finish the trading week.

Trailing ATR daily support keeps ratcheting higher as the 33000 point level is now breached with daily momentum still quite above overbought settings as this market remains very well supported by a weaker Yen. But another consolidation back to 31000 points is sorely needed to take some heat out:

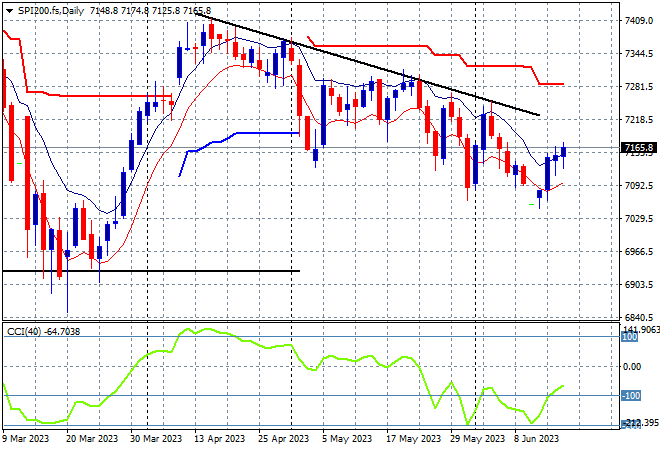

Australian stocks also put in yet another minor positive session with the ASX200 closing just 0.2% higher at 7179 points.

SPI futures are suggesting a better gain on the open, currently up nearly 0.4% on the continued moves higher on Wall Street overnight but I still contend that with an entrenched downtrend since the April highs its looking like a tough road ahead. Daily momentum is now trying to get out of the oversold zone as price action remains near its new monthly low as recession jitters mount.

Price action has been able to break above the high moving average band in recent sessions so watch for a potential follow through above the 7200 point level:

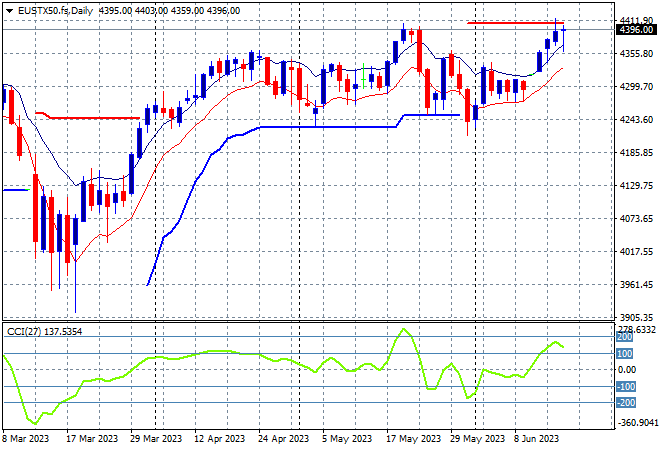

European markets continue to find more confidence with solid gains across the continent that saw the Eurostoxx 50 Index push more than 0.25% lower to finish at 4365 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but support at the 4200 point level has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next with price action indicating a building breakout:

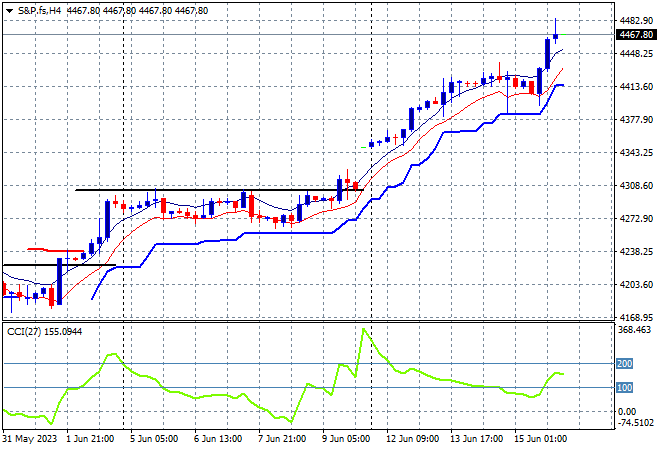

Wall Street continues its own hopium trend higher on the Fed pause as the NASDAQ and the S&P500 both gained more than 1.2% with the latter finishing at 4425 points with futures indicating more potential upside in tonight’s session.

The four hourly chart shows how support has been very strong above the 4200 point level with the post NFP bounce pushing straight through the 4300 point area which had been medium term resistance (upper black line). This clears the previous lack of conviction to confirm a new uptrend, with the soft CPI print now absorbed, and a crack through the 4400 point level, price action is slightly overcooked:

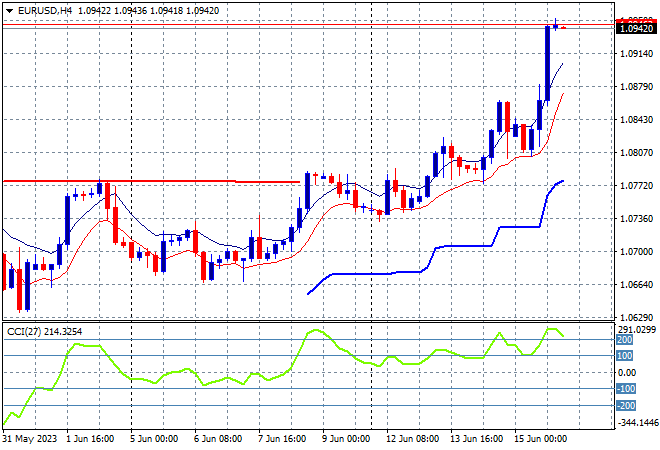

Currency markets reacted sharply to the latest ECB rate hike with USD knocked off its perch by most of the majors. Euro zoomed straight through the 1.09 handle after building up steam post the FOMC meeting and the soft US PPI print, making a new three week high.

Short term price action had been building quite positive before the meeting, having bounced off the mid 1.07 level that was resistance last week short term momentum overbought and ready to engage higher. The union currency had been on a longer term downtrend but the April highs above the 1.10 handle are now in sight:

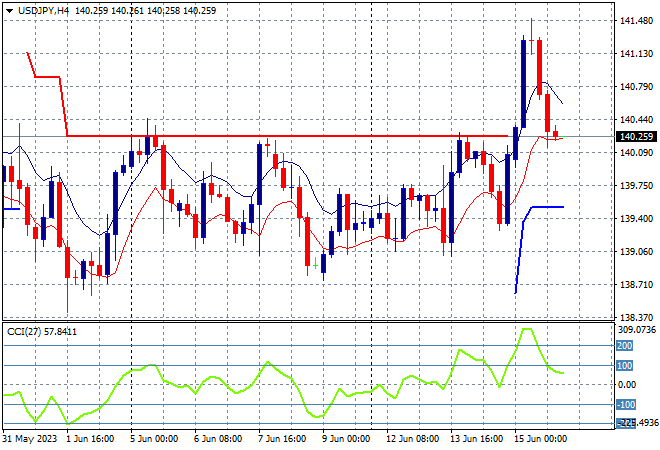

The USDJPY pair conversely took back all of its recent breakout gains to finish right smack on what was thought to be cleared resistance at the 140 level in a swift roundtrip.

The previous consolidation back down to trailing ATR support is repeating itself here without any new daily or weekly highs for awhile now, which could become a medium term consolidation. The 140 handle was supposed to be an upside breakout but now we wait to see if it again turns into weekly resistance ahead, with short term momentum still nominally positive:

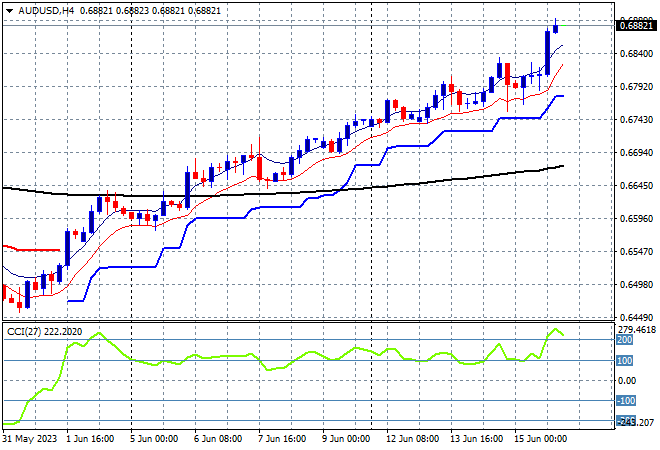

The Australian dollar loved the ECB hike and is continuing its uptrend, having pushed through the 68 cent level after finding some hesitation in the previous session despite the latest Fed pause.

There had also been some hesitation building previous to the RBA meeting, but the Pacific Peso is looking to put previous overhead resistance at 67 cents behind to make this bounce stick, with short term momentum is nicely overbought. While the possible rounding top pattern has been negated, price action in ahead of itself here with a potential pullback to take some steam out down to the 68 cent level likely:

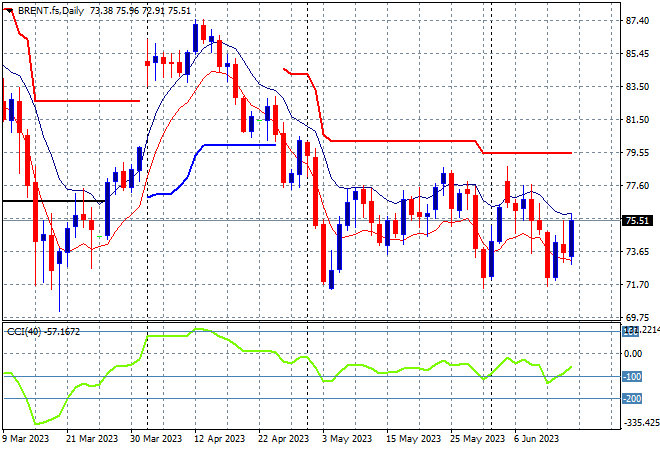

Oil markets were able to oscillate back to a nominal point of control but not make any new daily highs with Brent crude reverting back above the $75USD per barrel level, mainly due to the more hawkish bent of the ECB as USD waned.

This keeps price contained around the December levels (lower black horizontal line) and the March lows with daily momentum still failing to get out out of oversold mode. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

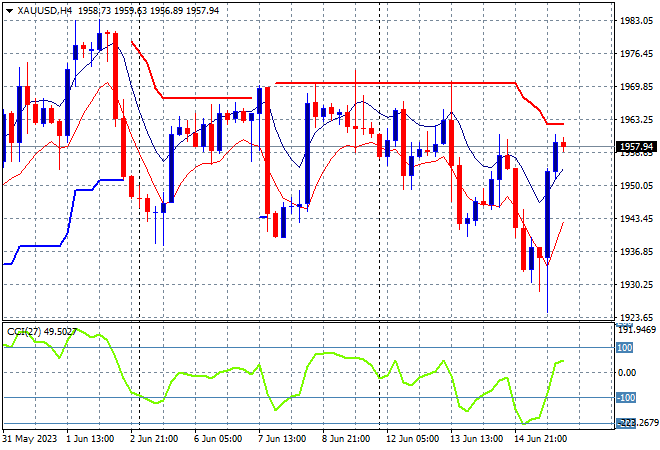

Gold fell back sharply on the US PPI print in the previous session and this was looking like falling through with a dip to the $1920USD per ounce level overnight but the ECB rate hike and subsequent USD weakness saw it pop back up to almost above $1960 this morning.

The four hourly chart had been showing this whipsaw movement in recent weeks but with a continued failure to get back above the psychological $2000USD per ounce level still holding it back, with short term ATR resistance the level to beat here. I’m still watching for signs of capitulation below $1930: