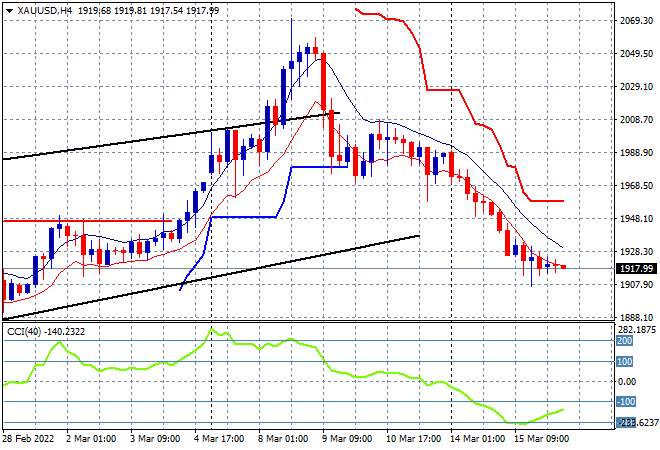

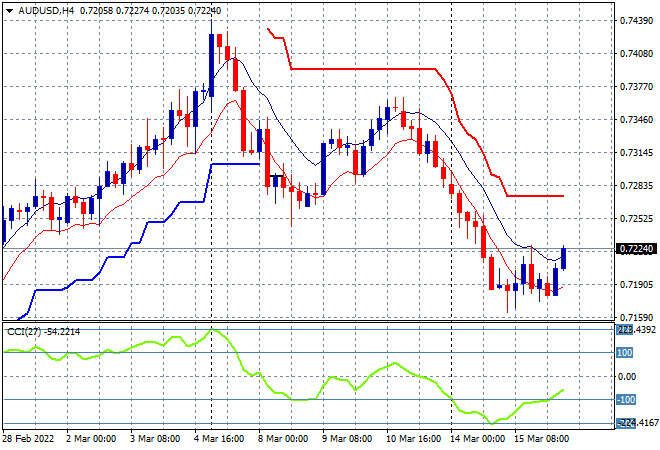

Chinese stock markets bounce back after the huge selloffs at the start of the week, with the rest of the region following in modest fashion, particularly as Wall Street had a solid overnight session. The USD remains strong in the lead up to the highly anticipated Federal Reserve meeting tonight but the Aussie dollar is bouncing back as well in the risk-on mood, currently just above the 72 handle with oil prices coming back slightly as Brent crude sneaks above the $100USD per barrel level. Meanwhile gold is trying to find a bottom here after being pushed down more than $100below the $2000USD per ounce level, currently at $1917:

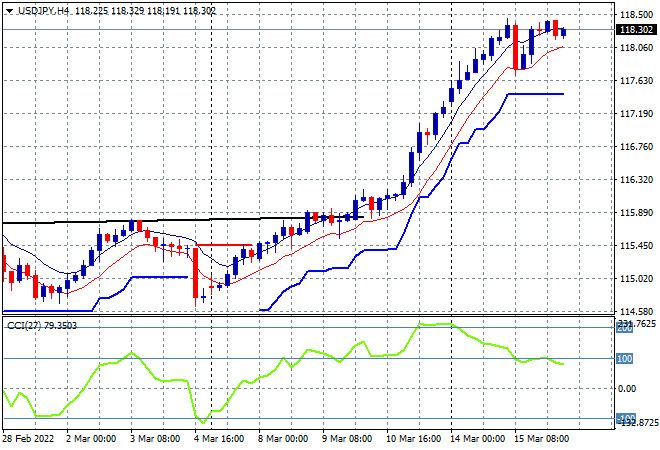

Mainland Chinese shares have bounced back extremely sharply after selling off for more than a week, with the Shanghai Composite currently up more than 3.3% to 3167 points while the Hang Seng Index is stonking it in, up more than 6% as it tries to get back above the key 20000 point barrier, currently at 19733 points. Japanese stock markets have advanced as well with the Nikkei 225 closing 1.6% higher at 25753 points with the USDJPY pair pausing on its epic breakout as it remains above the 118 handle in a very over-extended move:

Australian stocks did fairly well, overshadowed by the Chinese rallies with the ASX200 finishing 1% higher to get back above the 7100 point level, closing at 7175 points. Meanwhile the Australian dollar is trying to find a bottom here as it pips back above the 72 handle after falling all week:

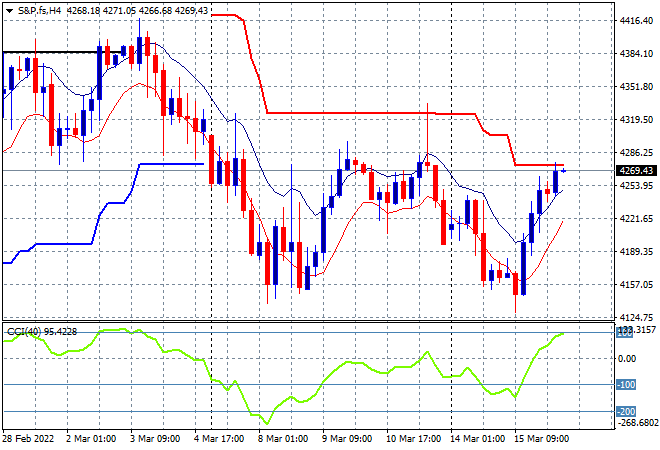

Eurostoxx 50 and Wall Street futures are up more than 0.5% or more across the board as the S&P500 four hourly chart comes up against considerable overhead resistance at the 4300 point level that hasn’t been breached for two weeks or so but short term momentum is quite strong for now:

The economic calendar gets really exciting tonight, because after the latest US retail sales print we get what should be the first of several rate hikes from the Federal Reserve has they start their March meeting.