Despite some more Fed talk that the pace of interest rate rises could slow, US stocks pulled back overnight with Wall Street down around 1% while in currency land, USD continued to fall against the major undollars. Euro is holding above the 1.03 level while the Australian dollar is trying again to go above the 67 cent level. US bond markets were again relatively calm with 10 Year Treasury yields still hovering above the 3.8% level while commodities were mixed as oil prices dropped with Brent crude finishing at the $92USD per barrel level. Gold had another solid session, maintaining well above the $1770USD per ounce level for a four month high.

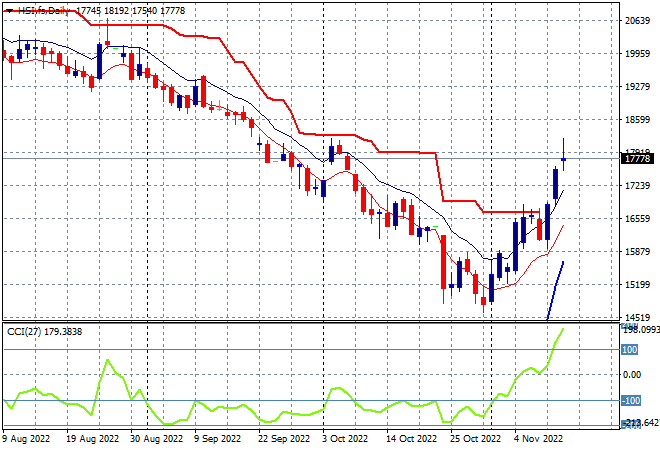

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were more modest with the Shanghai Composite finished dead flat at 3083 points while the Hang Seng Index continued to surge, closing 1.7% higher at 17619 points. The daily chart had been showing a potential bottoming action brewing here after almost testing the 2008 lows, as the 15000 point level turned into a very solid level of support. The previous session bullish engulfing candle and clearance of overhead trailing ATR resistance is building for a bigger breakout here with a gap higher and the potential to zoom straight up to the 20000 point level so watch daily momentum readings to remain overbought:

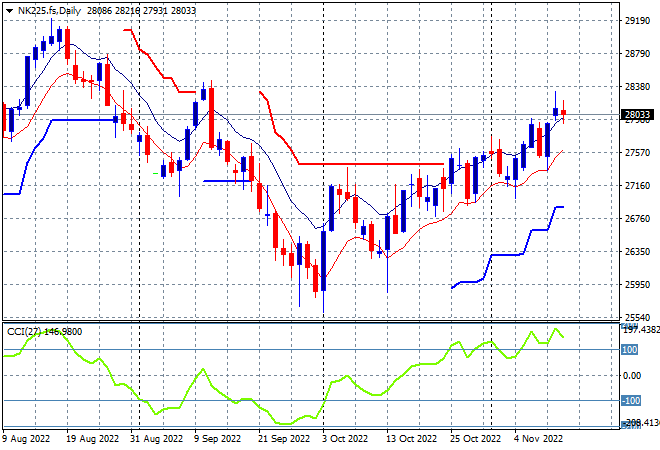

Japanese stock markets were the biggest losers in the region, with the Nikkei 225 closing 1% lower at 27943 points. The daily price chart was showing a breakout brewing as overhead resistance at the 27500 level is cleared but more wobbles are appearing here as the too strong Yen bites down on confidence. As I said yesterday, the Friday gap higher does represent both an opportunity and potential for a pullback however on a much appreciated Yen in the wake of a weaker USD so I’m cautiously optimistic here with daily momentum remaining overbought. Support should hold at the 27500 point level:

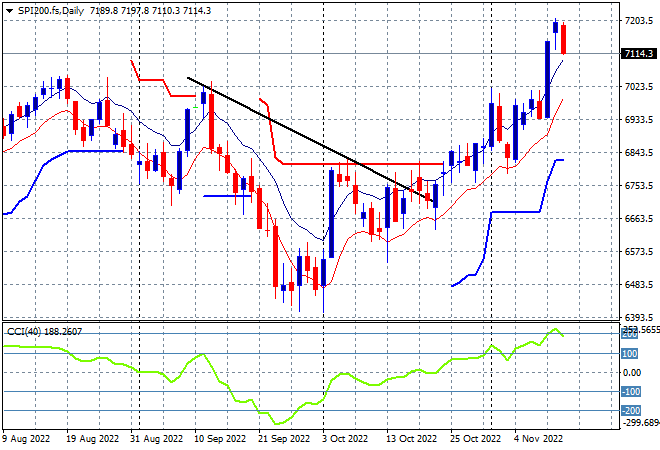

Australian stocks tread water yesterday with the ASX200 closing 0.2% lower, finishing at 7146 points. SPI futures are down nearly 0.3% so we are likely to see a continuation of a pullback as the new trading week begins given how far ahead the market got going into last week. The daily chart is still looking very similar to Japanese stocks, with price action gapping significantly higher and daily momentum being solidly overbought, with strong support below at 7000 points as the uncle point on any pullback:

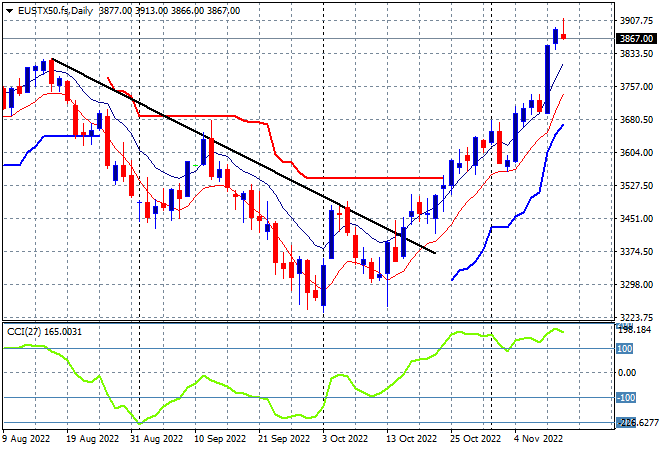

European markets were green across the board but only with modest returns with the Eurostoxx 50 Index eventually gaining 0.5% to finish at 3887 points. Again, another daily chart picture that looks similar to Asian markets, but with much more momentum as it recently cleared resistance at the 3550 level and bounced off the 3600 point area. Daily momentum is surging at overbought levels as price action clears overhead resistance and surpasses the October highs, but there is resistance building here on the lower timeframes as the market got way ahead of itself, so I expect a pullback to the high moving average next:

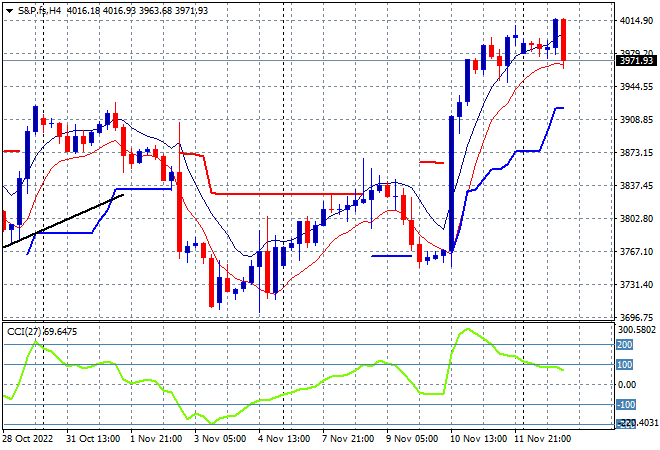

Wall Street was down across the board with the NASDAQ off by 1% while the S&P500 finished 0.6% lower at 3970 points, unable to build on the huge surge in the previous session on the back of the US inflation print. The chart picture remains slightly different to other stock markets as it is battling many more layers of resistance that must be overcome to get back to the August highs, with the October highs cleared and the 4000 point psychological level the next to beat this trading week. Watch for a potential rollover here on the four hourly chart:

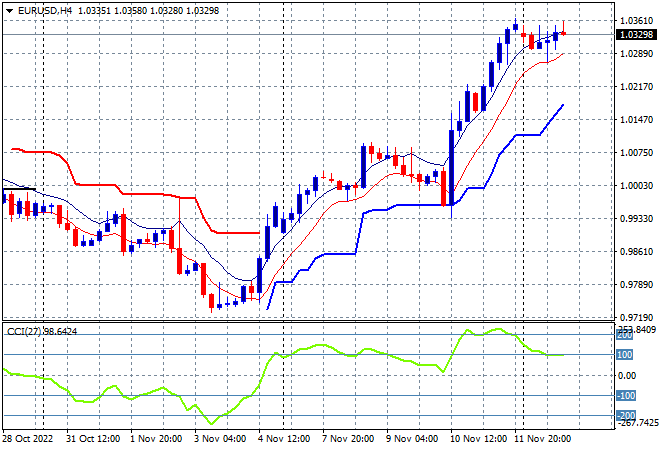

Currency markets were able to consolidate their gains against USD pushed with the recent Fed talk about slowing paces of rate rises confirming the post inflation print moves. Euro remained slightly above the 1.03 level as the October high resistance levels are a distant memory. This looks like a solid level to launch even higher if the next inflation print confirms this one but I’m wary of a very crowded trade here with a one-way move usually meaning a pullback – potentially violent – is forthcoming:

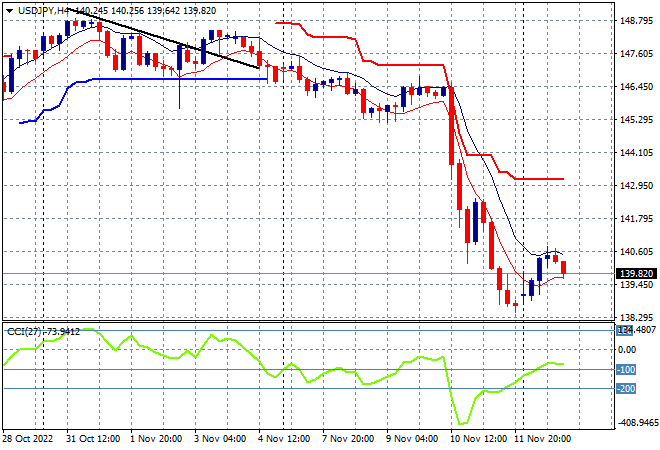

The USDJPY pair was unable to make good on a small post weekend swing trade with a return to the 140 handle over before it started, moving back below this morning. This keeps price action near the new monthly low as the October and September rallies are all but wiped out, with more potential for downside action. While there is some evidence of deceleration at the 139 handle as momentum rebounds out of extremely low oversold readings, price action is pointing to another test of the recent lows instead:

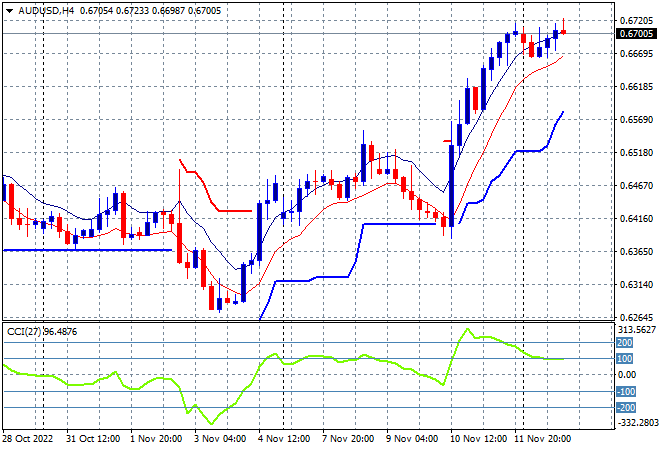

The Australian dollar also zoomed higher in line with other major currencies, eventually pushed up through the 67 level in its final push on Friday night. My previous contention that resistance was still too strong at the 65 handle is no longer intact as this outsize move rejigs the Pacific Peso as the Fed is more likely to be in line with the RBA on future interest rate rises. That still means less upside potential in my view, but negates the idea of a crash below the 60 handle:

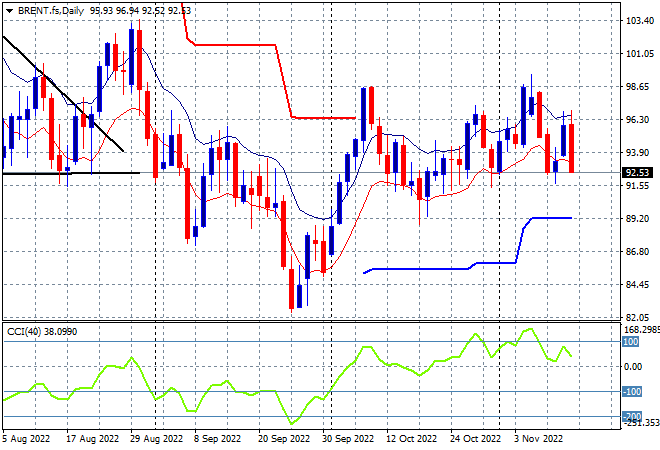

Oil markets took back all of there recent gains overnight, echoing the recent failed attempt earlier last week to break above the former October highs. Brent crude finished at the recent weekly lows just below the $93USD per barrel level and although daily momentum remains positive, the lack of new daily highs is quite telling here. The inability of price action to return to the magical $100 level as it keeps coming up against resistance at the $98 level remains the theme here:

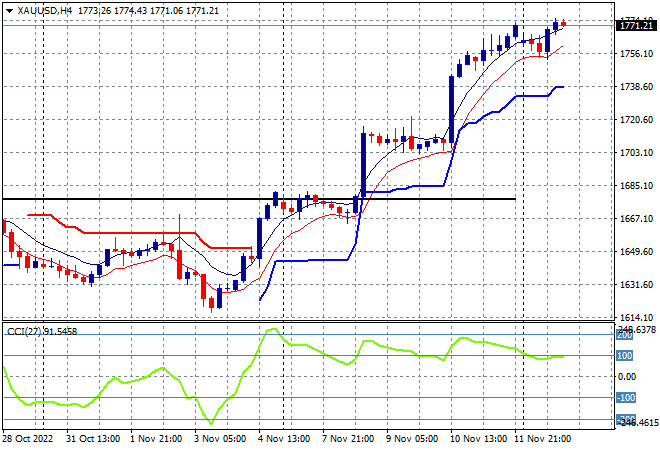

Gold is still climbing and consolidating here after its recent stonking session that took it well past the October highs (upper horizontal black line), finishing above the $1770USD per ounce level after the usual post weekend gap volatility. This completely negates the idea of a dominant downtrend as the lower inflation print looks set to let loose the gold bugs with the $1800 level the next target: