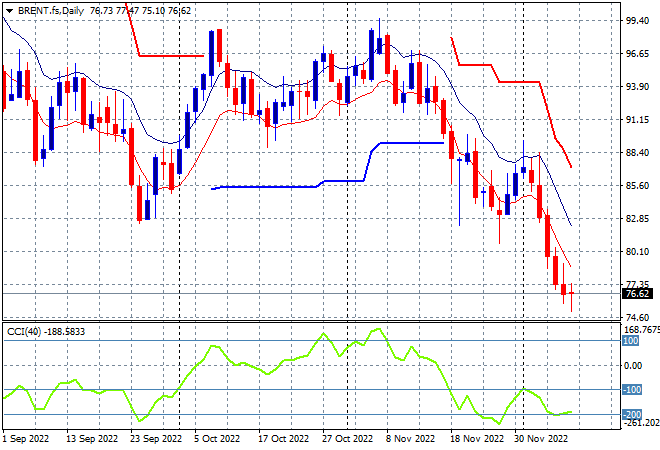

The relief rally on Wall Street finished before it even started with a rout on Friday night almost sending US stocks back to their previous weekly lows, which will be a negative dampener on sentiment as Asian markets reopen this morning. In currency land, the USD continued to give back its recent gains with Euro and Pound Sterling firming back near their highs while the Australian dollar almost climbed back above the 68 cent level. US Treasury yields lifted slightly, arresting their weekly decline with the 10 year yield almost pushed back to the 3.6% level while the commodity complex saw oil prices pullback sharply again, with Brent crude below the $77USD per barrel level while gold is also clawing back its recent losses but is still shy of the $1800USD per ounce level.

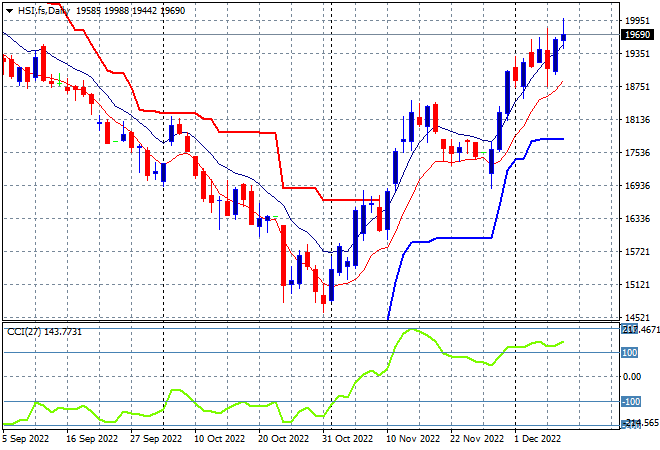

Looking at share markets in Asia from Friday’s session where Chinese share markets meandered around post the inflation print but eventually finished in positive territory with the Shanghai Composite lifting 0.3% to close the week above the 3200 point level while the Hang Seng Index has lifted again following the news that the HK government may ease COVID restrictions, gaining more than 2.3% to 19900 points. The daily chart was showing a perfect breakout here with a big surge up towards the 19000 point level, with more potential upside here to start the new trading week on a positive note, ex external factors, with support still strongly defended at the 17600 area and daily momentum remaining nicely overbought:

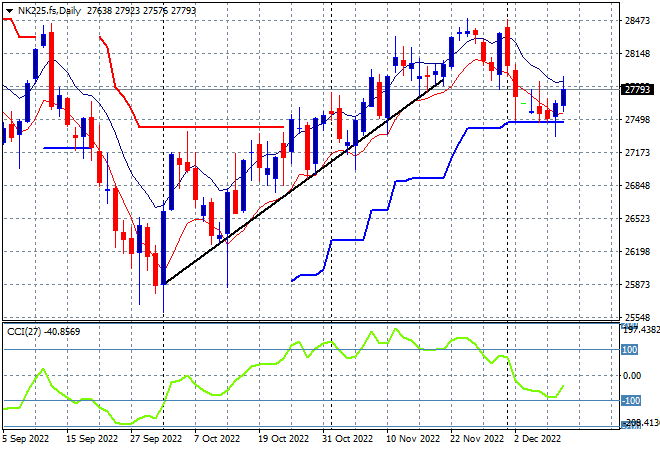

Japanese stock markets played catchup finally, with the Nikkei 225 finishing more than 1% higher at 27901 points. The lack of a clear lead from Wall Street combined with heavy resistance at the 28400 point level had turned this pause into a rollover into short term support but the late week rally saw price bounce off that level but not yet above its own high moving average. The daily chart shows this pullback is possibly finished here if ATR support can be defended at the 27500 point level as we start the new trading week:

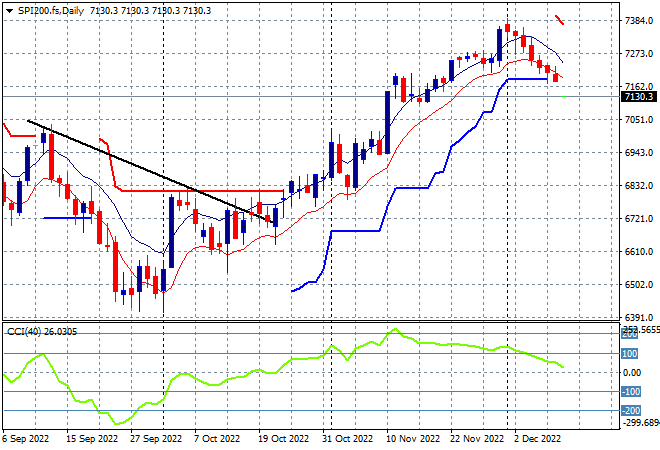

Australian stocks found a strong bid but were still mixed across the sectors as the ASX200 finished nearly 0.5% higher at 7211 points. SPI futures are down nearly 0.6% due to the selloff on Wall Street from Friday night with the daily chart showing price action and daily momentum retracing in nearly negative territory. This could break below ATR support at 7200 next so be mindful of a gap down that remains down all session as a sign confidence has evaporated:

European markets were still in a mixed, hesitant mood although eventually put in positive sessions across the continent, with the Eurostoxx 50 Index closing 0.5% higher at 3942 points. The daily chart shows key overhead resistance at the 3900 point area now being tested as support again after previously clearing out with daily momentum retracing from its overbought status, indicating a continued build up of resistance. This small pause hasn’t translated into a proper drop yet, although the 4000 point level is proving key psychological resistance so far:

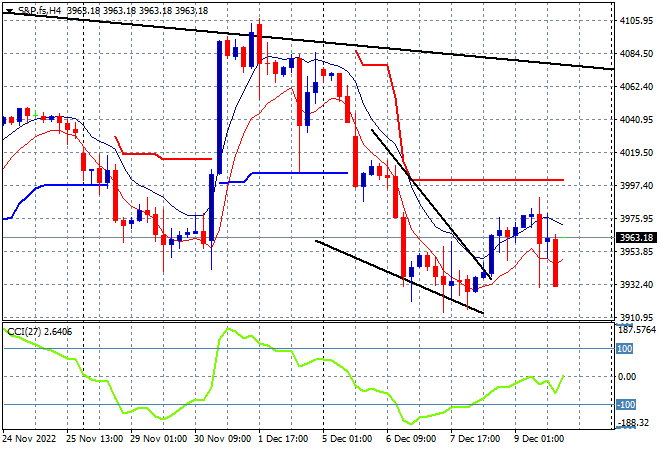

Wall Street’s got back on the selling wagon following a short term relief rally with the NASDAQ and S&P500 both losing 0.7%, the latter closing at 3934 points, still shy of the 4000 point psychological barrier. The chart picture had been showing more layers of resistance compared to other markets and while the short term falling wedge pattern allows for a bullish breakout here, it didn’t clear the 4000 point level and nor did short term momentum go positive. The medium term picture remains down:

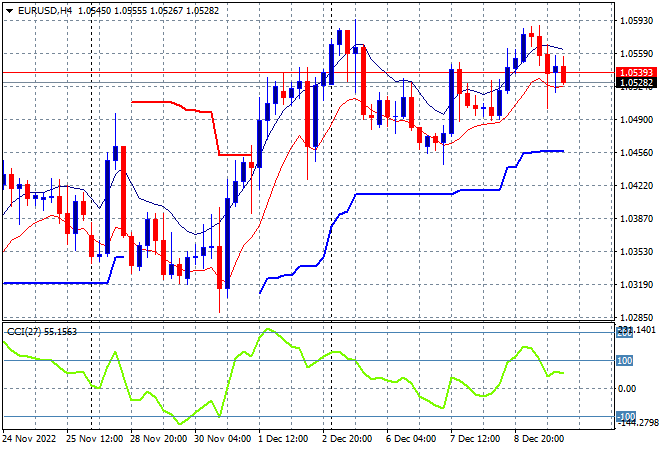

Currency markets continued to rebuff the strong USD following the start of week reversal with Euro still putting up more of a fight as it stays above the 1.05 handle. As I noted last week, this level still remains a weekly and monthly high with strong support evident at the mid 1.02s with signs still pointing to a possible top in USD. However I am concerned that a double top short term bearish pattern is forming here as price can’t seem to breach the 1.06 level:

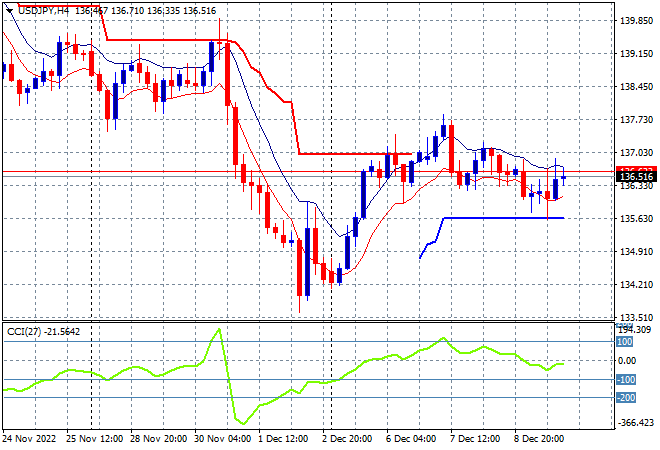

The USDJPY pair is sliding around doing almost nothing again, keeping well maintained below the 137 handle without any buying conviction that cannot properly clear overhead ATR resistance. While promising, this next stage after bouncing off the 135 lows should see a proper reversal but only if the 140 area is threatened in the medium term:

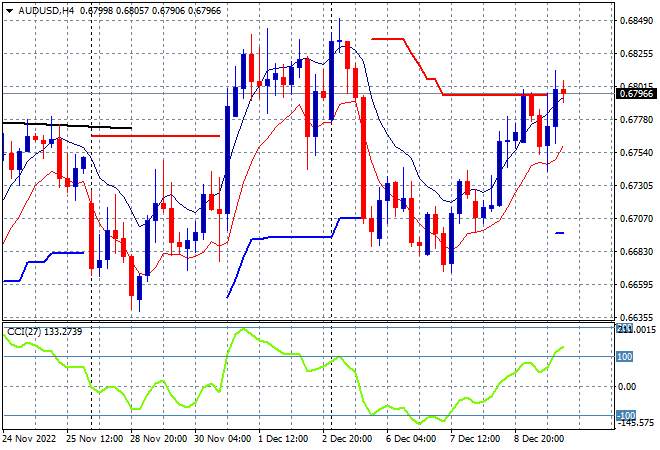

The Australian dollar finally caught up to Euro and others with a rally against the USD almost translating into a finish above the 68 handle on Friday night. This continues the wild ride of the previous week with price action now looking much more clearer here in the short term, but overhead resistance at the 68 level remains the key area to watch as short term momentum becomes overbought but unable to breach the previous weekly high:

Oil markets continue to dive on macro conditions, with Brent crude selling off to finish the week below the $77USD per barrel level. Daily momentum had been oversold and setting up a weak swing trade but price never moved above the key high moving average area signalling a lot of internal weakness here before the start of week selloff. My contention of a return to the September lows at $80 or so on any reversal in risk sentiment has come to pass with further falls from here as daily momentum remains oversold:

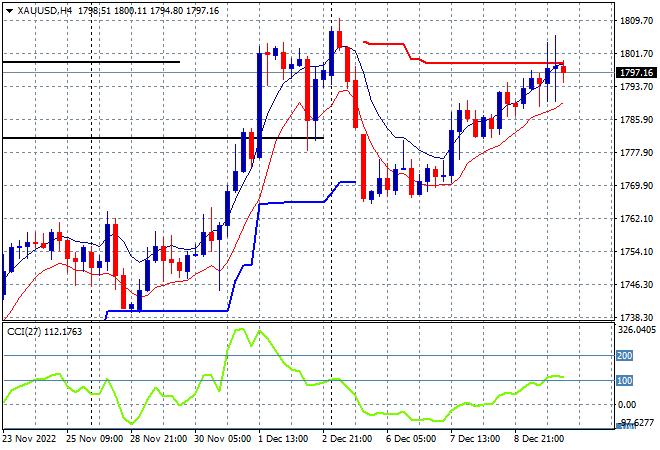

Gold is trying to get back to its previous highs above the $1800USD per ounce level had have a fair crack at it from the start of the week and almost got there at the end, finishing at the $1798 level on Friday night. This is looking good for another attempt this week with daily and short term momentum now overbought but if resistance is too hard to clear we could see a pullback to the last weekly low very promptly: