Asian stock markets are mixed again with unsteady behaviour across the region despite a very positive lead from overnight markets. Local stocks were the best performing as traders await tonight’s US CPI print. The currency complex is indeed still dead against USD with Yen soaring higher while Euro remains above the 1.10 handle and the Australian dollar jumps above 67 cents on Governor Lowe’s inflation comments.

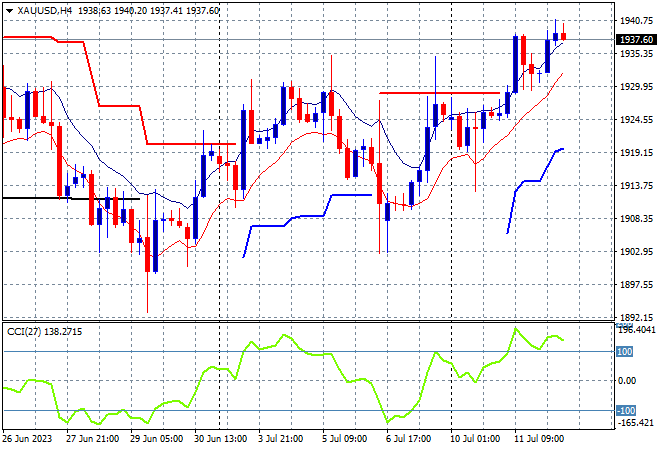

Oil prices are pushing higher with Brent crude above the $79USD per barrel level while gold is also finding a bit more life here climbing above the $1930USD per ounce level:

Mainland Chinese share markets were unable to hold on to a positive session with a selloff at the close seeing the Shanghai Composite finish some 0.5% lower at 3202 points while in Hong Kong, the Hang Seng Index went the other way, lifting nearly 0.8% to close at 18810 points, continuing the start of week bounce.

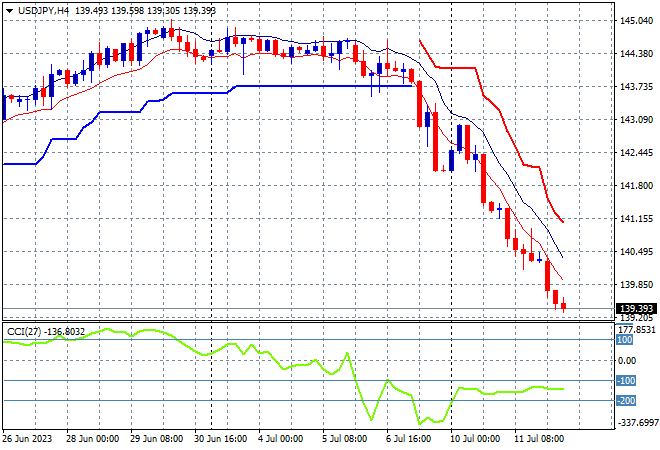

Japanese stock markets have switched from cautious to risk-averse as Yen appreciates, with the Nikkei 225 closing 0.8% lower to 31946 points with the USDJPY pair continuing its own selloff with a sharp fall below the 140 level after gapping through the 142 handle previously:

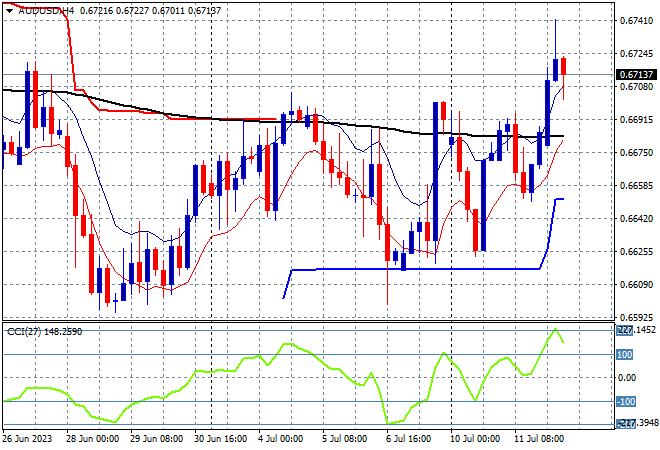

Australian stocks were the odd ones out, still rising with the ASX200 closing 0.4% higher at 7135 points. The Australian dollar also continued its breakout as traders react positively to RBA Governor Lowe’s staunch tackle of inflation, getting right above the 67 handle which had proved too tough as short term resistance until recently:

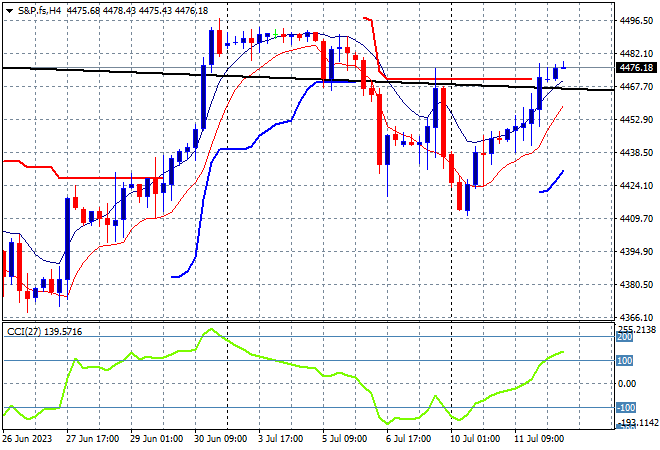

Eurostoxx and S&P futures are up nearly 0.4% despite the mixed result here in Asia with the S&P500 four hourly chart showing price action wanting to fill its rollover from Friday night but may find resistance at the 4500 point level too hard to beat:

The economic calendar tonight includes the much anticipated June US CPI print that is surely going to stir up the risk spirits!