Well its going to be a busy end to the trading week with the best upside session on Wall Street in two years just because inflation came in softer than expected. Stocks rallied over 5% across the board which will translate into big returns here in Asia. The USD tumbled against all the majors overnight with Euro almost pushed up to the 1.02 level while the Australian dollar also made a new monthly high above the 66 cent level. US bond markets rallied with 10 year Treasury yields slashed significantly down to the 3.8% level while commodities were mixed as oil prices went nearly nowhere, Brent crude steady at the $93USD per barrel level while gold launched into the stratosphere making a new monthly high above the $1750USD per ounce level.

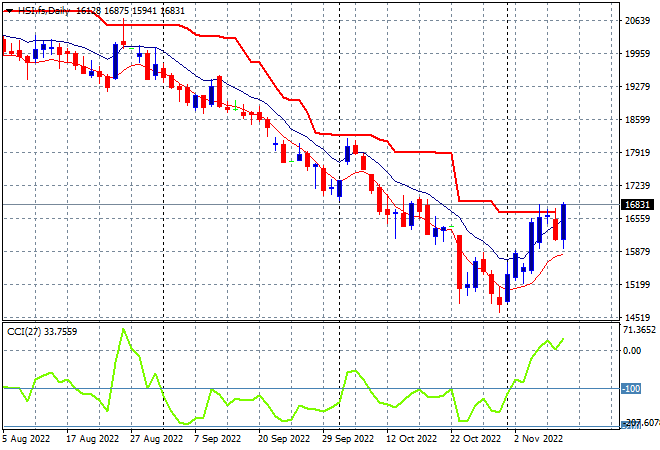

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets pulled back again, with the Shanghai Composite closing down 0.4% to finish at 3036 points while the Hang Seng Index also slumped, down more than 1.7% to be just above the 16000 point level, closing at 16081 points. The daily chart is showing a potential bottoming action brewing here after almost testing the 2008 lows, as the 15000 point level turns into a solid level of support. The previous session bullish engulfing candle is setting up for a clearance of overhead trailing ATR resistance:

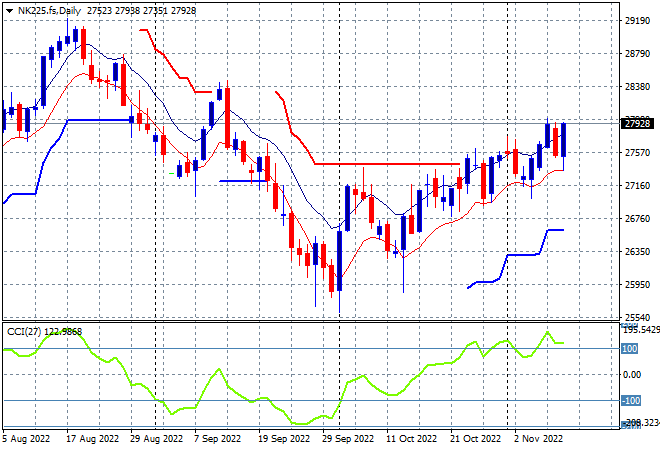

Japanese stock markets were also in sell mode, with the Nikkei 225 closing 1% lower at 27446 points. The daily price chart was showing a breakout brewing as overhead resistance at the 27500 level is cleared but with these wobbles it will require a better lead from Wall Street to get confidence to reappear. So here we are – futures are on fire indicating a grand finish to the trading week with momentum likely to reengage back into overbought status:

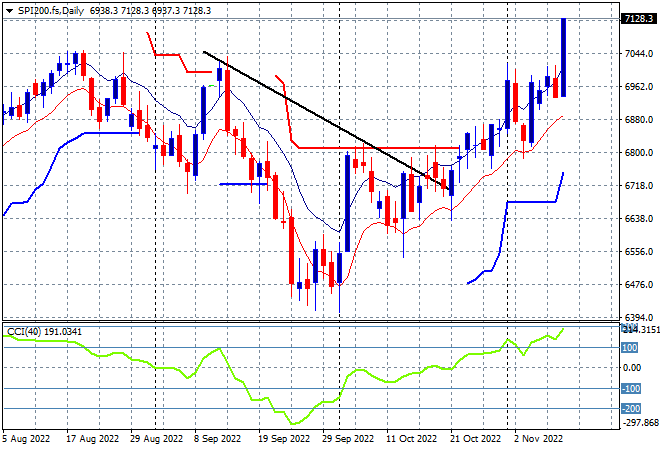

Australian stocks couldn’t escape the selling with the ASX200 closing 0.5% lower, again failing to breaking into the 7000 point level to finish at 6964 points. ASX 200 Futures are up more than 2.5% on the surge on Wall Street overnight so it looks like the 7000 point level will be wiped out today. The daily chart is still looking very similar to Japanese stocks, with daily momentum having maintained itself above the positive zone and is again solidly overbought, with strong support below at the low moving average as the uncle point:

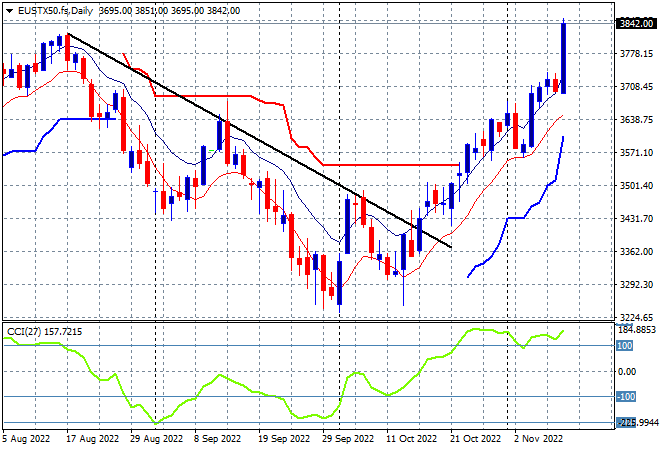

European markets surge higher overnight across the board with large upside sessions across the continent. The Eurostoxx 50 Index gained more than 3% on the US inflation print to finish at 3846 points as a result. The daily chart was also showing similar price action to Asian markets, but with much more momentum as it recently cleared resistance at the 3550 level and bounced off the 3600 point area. Daily momentum is surging at overbought levels as price action clears overhead resistance and goes back to the October highs:

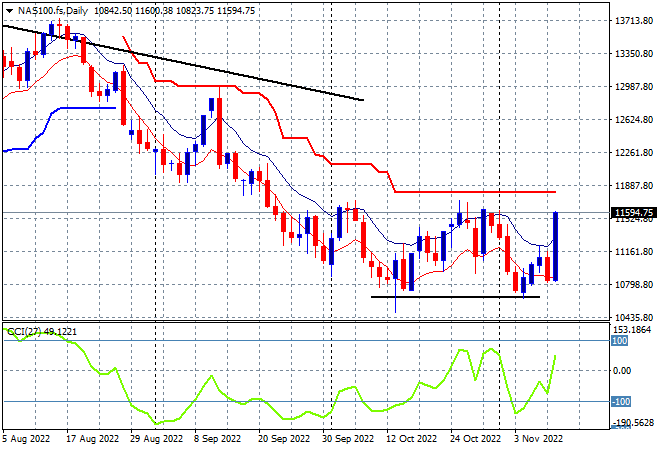

Wall Street had another volatile session overnight but it was all upside with huge moves across the complex. The NASDAQ gained more than 7% but it needs to be put into context with the daily chart showing a basing action almost complete but not yet out of danger:

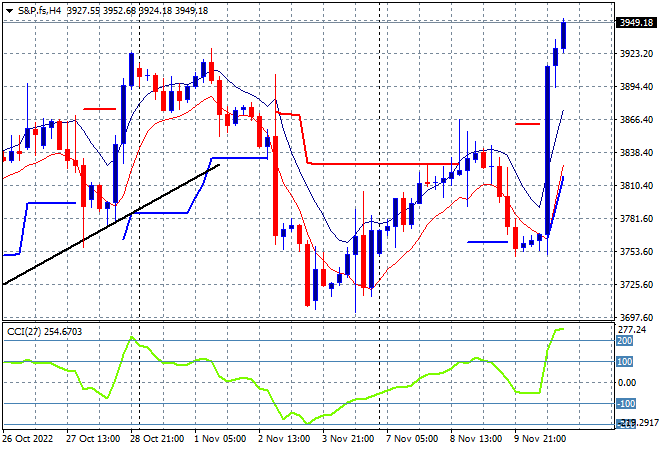

Meanwhile the S&P500 finished 5% higher at 3948 points, releasing a lot of pent up pressure as I explained recently that US stock charts were nowhere near as bullish as others, having stumbled with the mid term elections post the latest Fed interest rate rise. I had said this was looking more and more like a return to the 3600 point level by the end of the year, but this inflation print has put that dog to bed!

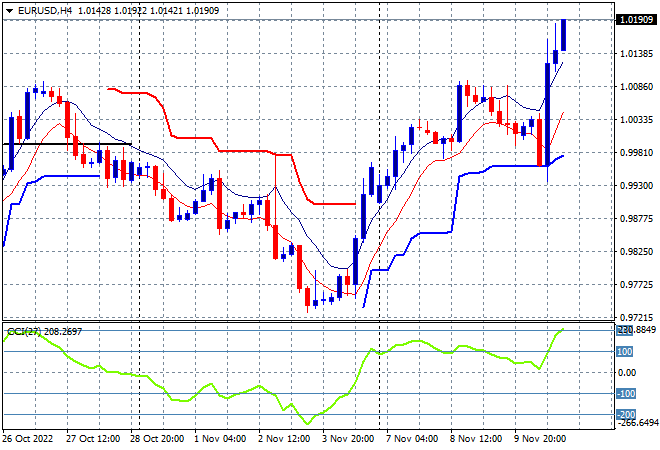

Currency markets were again on the move, and then some – with USD pushed lower against everything on the back of the inflation print. Euro zoomed nearly 200 pips higher to almost break through the 1.02 level as the October high resistance levels were wiped out. This looks like a solid level to launch even higher if the next inflation print confirms this one:

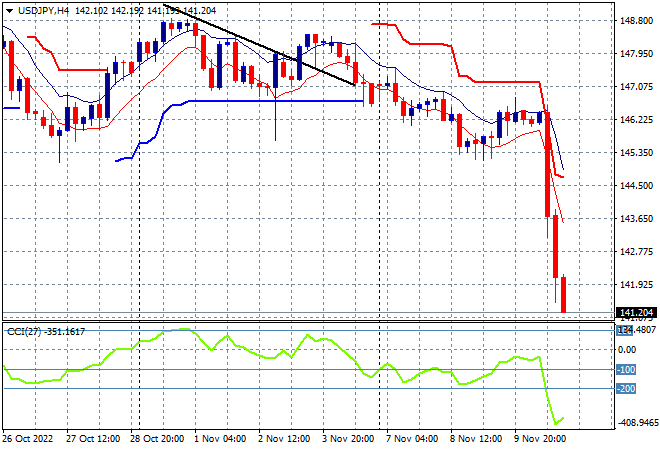

The USDJPY pair was slaughtered with a huge move lower, losing 400 pips overnight to crush into the 141 handle. This wipes out all of the October and September rallies but in context there is still a lot of room below to take back. This had been setting up in the short term but the inflation print was the bullet that sent the dead horse over:

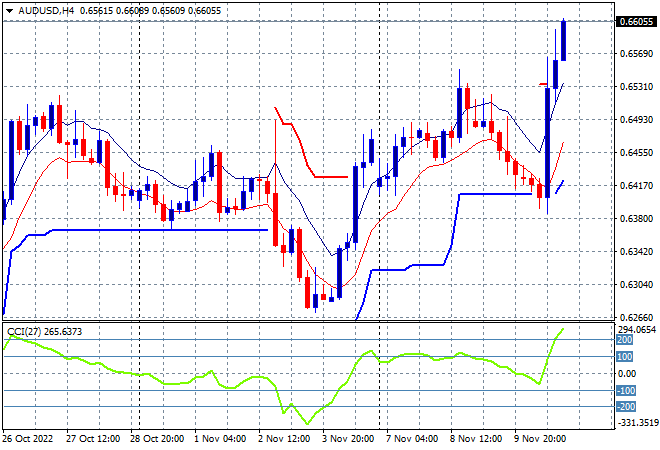

The Australian dollar also zoomed higher in line with other major currencies, eventually pushed through the 66 level this morning. My contention that resistance is still too strong at the 65 handle is no longer intact although short term momentum is possibly indicating a small pullback here, its likely that the 65 area will turn into support going forward:

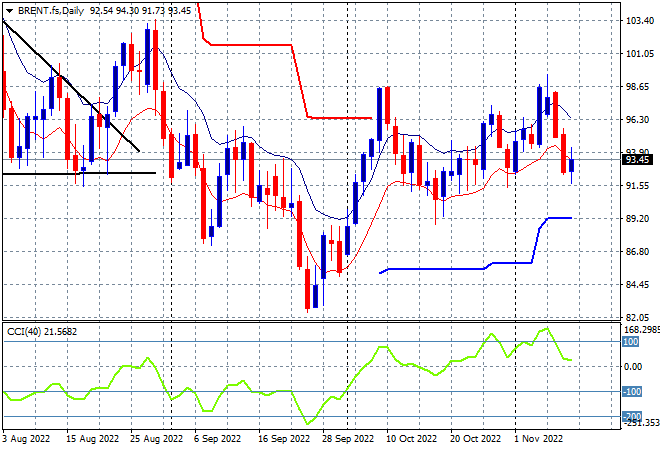

Oil markets again failed to move higher overnight, after recently matching the former October highs Brent crude again finished at the $93USD per barrel level. Daily momentum was really building here with stronger overbought readings and price action wanting to return to the magical $100 level but shorter term resistance at the $98 level remains the area that must be cleared next:

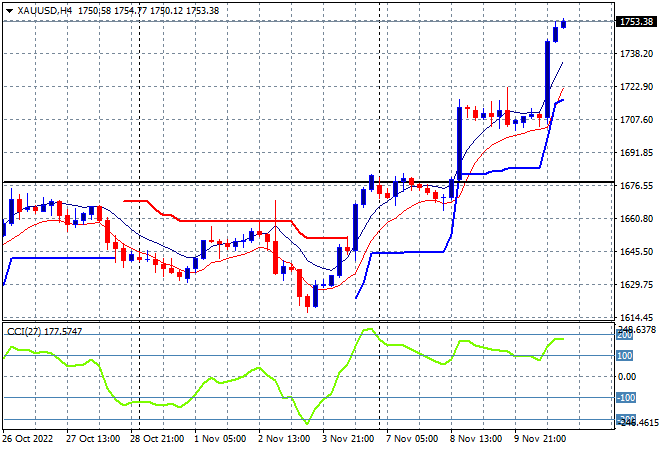

Gold has doubled down on its recent stonking session with another huge advance well past the October highs (upper horizontal black line) to finish well above the $1750USD per ounce level overnight in line with other undollars. This completely negates the idea of a dominant downtrend as the lower inflation print looks set to let loose the gold bugs with the $1800 level the next target: