Risk sentiment remains negative following the latest jobs report from the US on Friday night which has set the tone for risk taking until the next Federal Reserve meeting as both the USD and bond yields launched higher and stocks much, much lower. Wall Street was down around 1% across the board while European stocks had scratch sessions overnight, which is likely to translate into sideways action on the ASX on the open. The USD is still pushing higher against the major undollars with Euro about to trip below the 97 handle while the Australian dollar continues to make new lows. US bond markets were closed while commodities saw a slight pullback in oil prices with Brent crude unable to push through the $100USD per barrel level while gold fell sharply below the $1700USD per ounce level, currently at $1666 this morning.

Looking at share markets in Asia from yesterday’s session where Chinese share markets have reopened after last week’s holidays with the Shanghai Composite down 1.6% to cross well below the 3000 point barrier while the Hang Seng Index remained in reversal mode, closing more than 2.9% lower to start the week at the 17216 point level. The daily futures chart had been showing a very bearish mood for weeks here, with a bear market entrenched as daily momentum remains well deep into a negative funk. This dead cat bounce has returned price action to the dominant trendline, which is no surprise, but watch for any break below the 17000 point level that will accelerate the selloff:

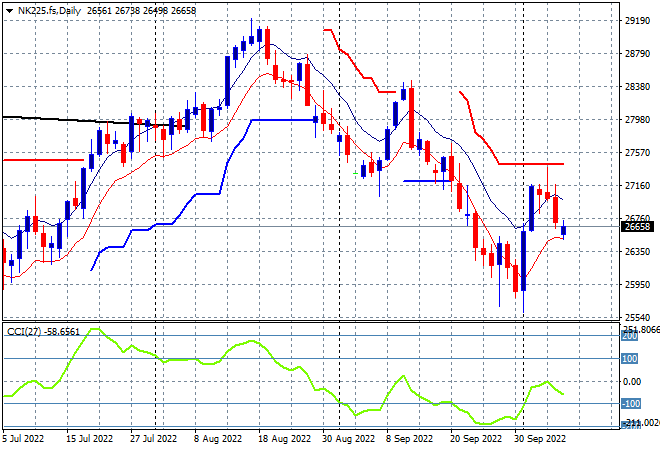

Japanese stock markets are of course having another long weekend. The daily futures chart shows similar price activity to other stock markets, with another dead cat bounce that has rejected overhead resistance at the 27500 level. Futures are indicating more downside on the continued Wall Street slump, so this is another market is likely to see the recent returns wiped out as daily momentum fails to confirm a swing play:

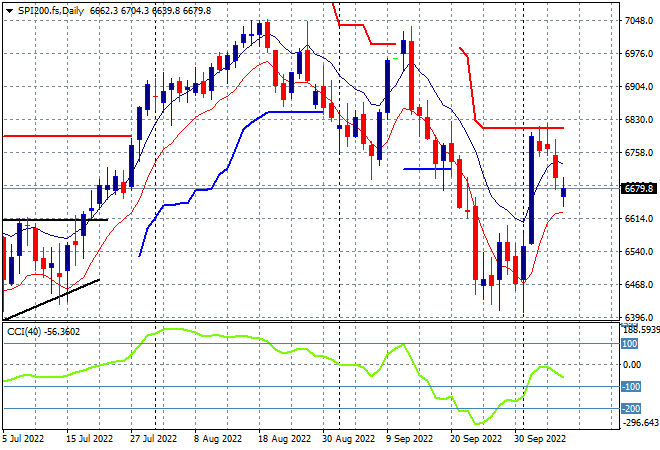

Australian stocks joined in with the selling, with the ASX200 finishing down 1.4% to start the week out below the 6700 point level at 6667 points. SPI futures are indicating a minor lift at the open, although its likely to be wiped out as volatility returns afresh. Yet another daily chart that shows price reverting and creating another dead cat bounce after failing to get back to the August highs. Another return to the June lows is on the cards here as daily momentum never got into positive mode, now pointing into negativity:

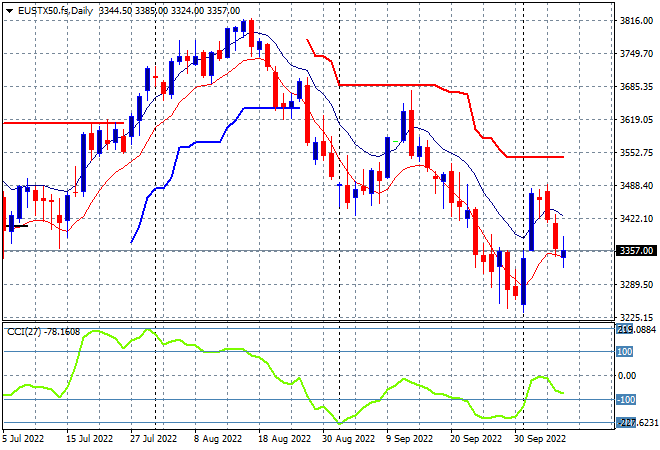

European stocks were still hesistant overnight, with some minor falls and scratch sessions across the continent as risk sentiment remains negative, with the Eurostoxx 50 Index closing 0.5% lower at 3356 points. The daily chart has shown price action never really threatening overhead resistance at the 3550 level, with daily momentum able to swing out of its oversold position but never translate that into anything positive. Watch another dead cat bounce here that looks set to return to the June lows:

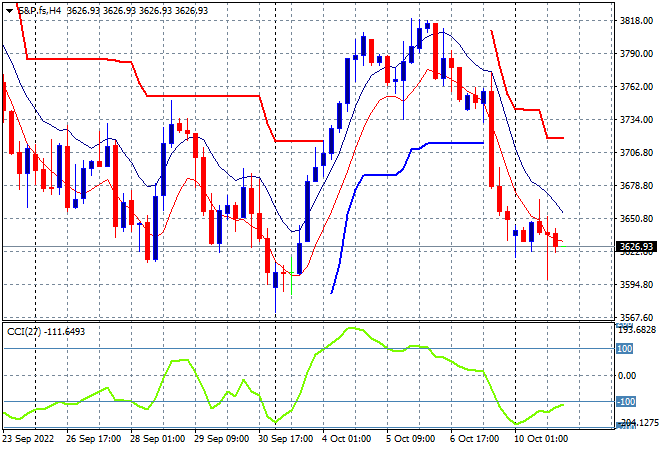

Wall Street is still reeling after Friday’s NFP print, with the NASDAQ down another 1% while the S&P500 lost another 0.75% to start the week just above the 3600 point level at 3612 points. The four hourly chart does show some price action deceleration here, coming up to the previous weekly lows at the 3600 point level which could be building as support. However, there is no buying evident here above the 3650 point level so yet another dead cat bounce that could see the corpse push through the 3600 point area next:

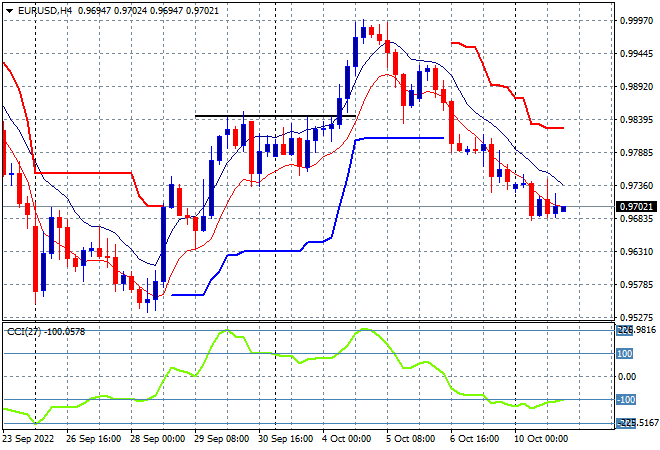

Currency markets continue to bow at the throne of King Dollar, after presaging the dead cat bounces on stock markets late last week and then falling further on the solid NFP print. Euro continues its steady downtrend, now threatening the 97 handle as it looks to take back most of its last two weeks of upside action. With short term momentum oversold we are likely to see a fall back to the 95 level next, but watch for potential support building at the 96.80 level here:

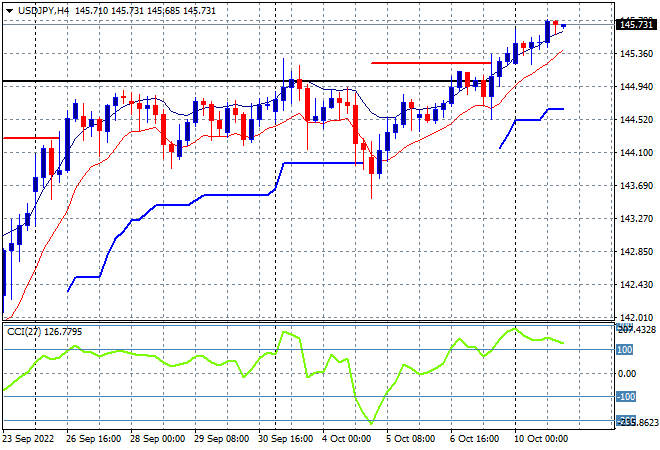

The USDJPY pair continues to push above its previous holding pattern, now looking to get above the 146 level after hitting a new high on the four hourly chart. Short term momentum has remained in overbought mode since Friday with the USD just too strong despite the usual firm correlation with the defensive Yen. Watch for a potential pullback if North Korean tensions increase, but the 144 level is firming as solid weekly support:

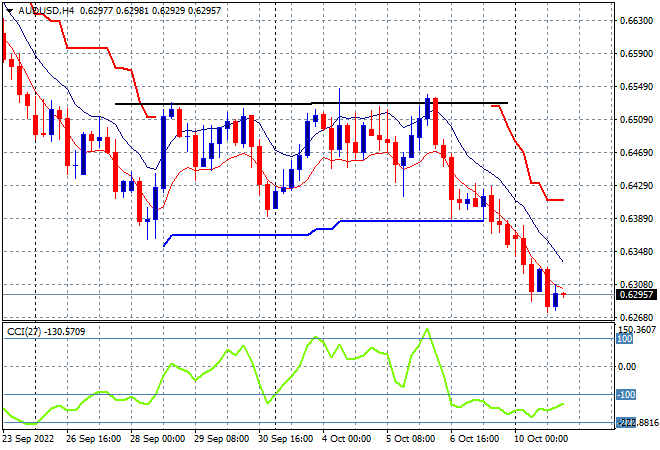

The Australian dollar continues its rollover, now below the 63 handle after the NFP print solidified the Fed’s intentions vs the RBA’s stunned mullet’s moves. This continues to firm my contention that resistance is just too strong at all the previous levels with the 68 handle still the area to beat in the medium term. Short term momentum remains oversold with a steady series of new four hourly lows continuing here:

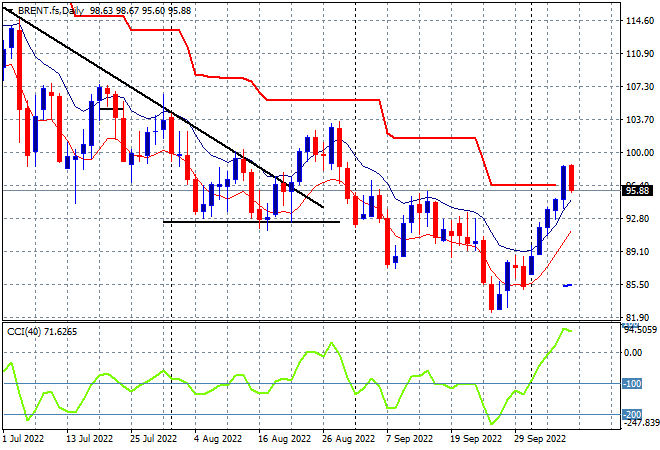

Oil markets came back slightly overnight despite the greater tensions in Iran and Ukraine, but this was due to a technical overextended move, with Brent crude pulled back sharply after getting too far ahead of itself trying to push through the $100USD per barrel level. Last night it fell back below the $96 level instead, and while daily momentum has switched to a more positive setting than before, with price action building strongly above the high moving average, the sticking point here to watch is short term resistance at the $96 level:

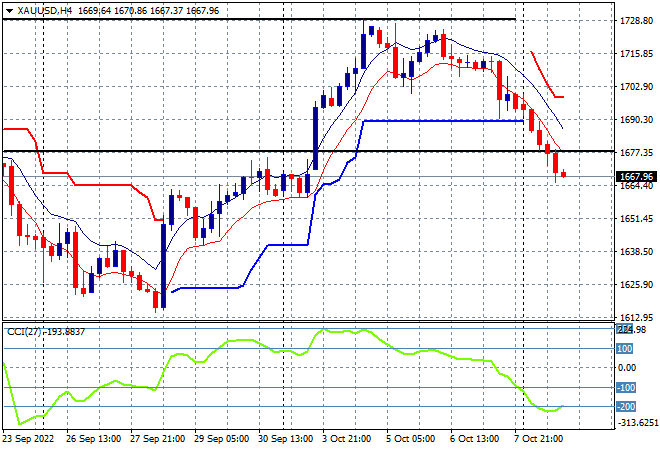

Gold has completely rolled over below the $1700USD per ounce level following its failure to hold on to that level on Friday night, finishing overnight at the $1667 level in what has been a steep selloff with no buying support. This shows how week internally the shiny metal really is, unable to clear easy resistance levels, and brings back into focus the multi-monthly bearish setup and potentially ends the early stages of a bottoming action: