Stocks have continued to rally post the latest FOMC minutes, in anticipation of tonight’s US unemployment print, with Wall Street and European markets both pushing much higher. The USD continued to rise however against all the undollars, with Euro approaching parity although Pound Sterling lifted off of near decade lows after Boris Johnson’s resignation. Meanwhile the Australian dollar pushed a little higher above the 68 handle in a very meek bounce. Bond markets continued their post minutes reversal with 10 Year Treasuries pushing through the 3% level, with interest rate futures continuing to firm up at least a 70bps rise at the next Fed meeting. Commodity prices remain volatile with oil prices bouncing back more than 4%, copper also lifting 4% while gold remains on the ropes at the $1750USD per ounce level.

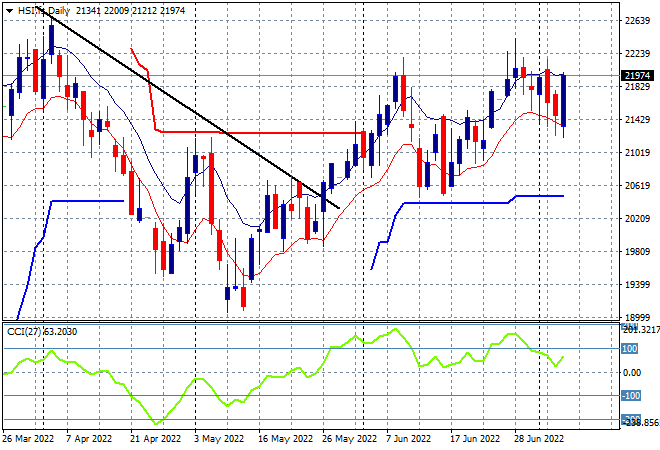

Looking at share markets in Asia from yesterday’s session, where Chinese share markets dropped at the open but recovered going into the close with the Shanghai Composite up nearly 0.3% to 3364 points while the Hang Seng Index eventually recovered too for a similar result, closing 0.3% higher at 21643 points. The daily chart was showing a potential rollover building here as price action rejected the previous highs at the 22000 point level as considerable resistance still keeps this market in check. Futures are suggesting more upside on the open, so we could see another attempted breakout here to end the week:

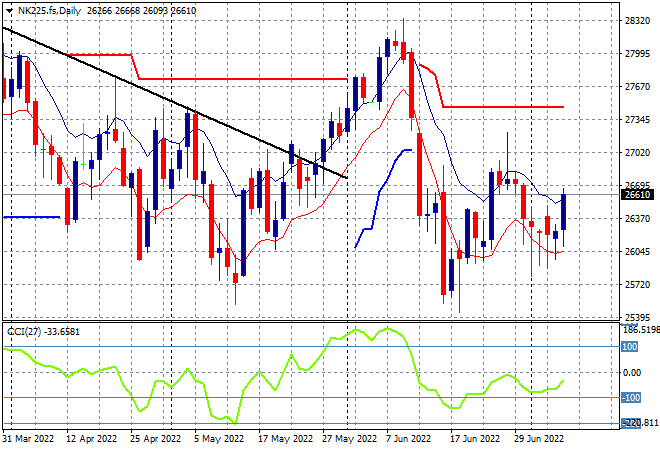

Japanese stock markets were the best in the region, with the Nikkei 225 index closing more than 1.4% higher at 26490 points. Risk sentiment on the daily futures chart is slowly reversing here with another solid session likely to end the trading week with a second move above the high moving average. While daily momentum is still on the negative side, the key area to watch is previous short term resistance at the 27000 point area that once breached could spell another short term rally:

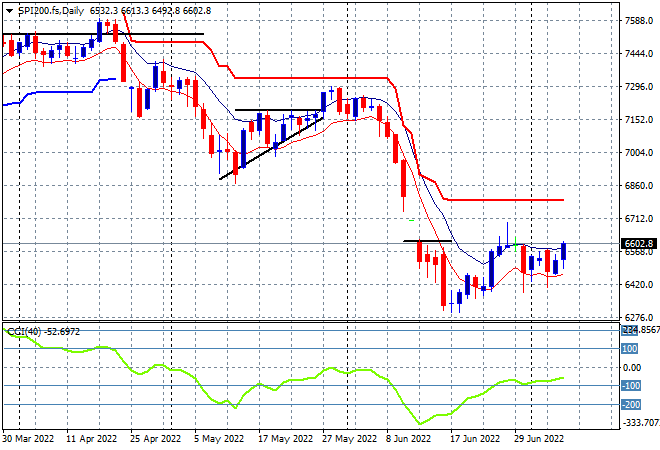

Australian stocks have had a solid session as well, with the ASX200 finishing 0.7% higher at 6641 points. SPI futures are up 0.7% given the better result overnight on Wall Street, so at least this trading week will see some stability at the end of the session looking through the RBA’s rate rise. The daily chart however remains an ugly picture with my contention of price needing to recover well above the 6600 point level before calling any bottoming action still holding, as daily momentum could easily return back to the very oversold zone and threaten new weekly lows:

European stocks continued their recovery on better sentiment with the Eurostoxx 50 index eventually closing 1.9% higher at 3488 points. While the daily chart picture remains in a very bearish state here with price action hanging around the March dip lows there is the possibility of a bottom forming. Daily momentum is still quite negative, but not yet oversold, so a growing chance of price getting back to above the 3570 point area is for the time being staving off another rollover as a cheaper Euro continues to help:

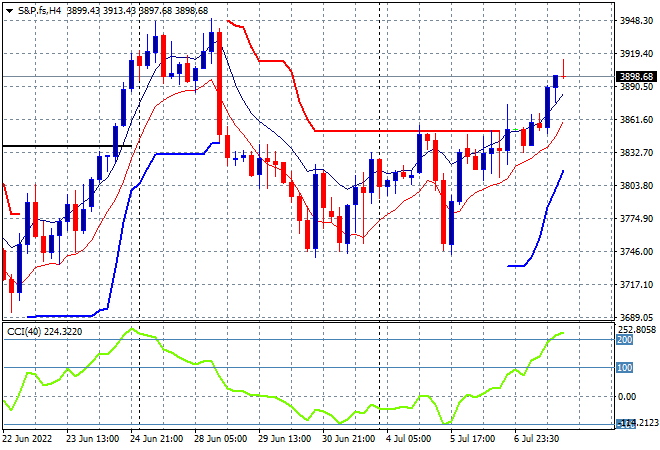

Wall Street saw much more confidence return with the NASDAQ lifting more than 2% while the S&P500 gained more than 1.4%, closing at 3902 points to almost get back to the previous weekly high. The four hourly chart had been showing more buying support building, pushing off nascent support at a lower 3700 point level, with price now wanting to get back above the previous resistance zone from the last false rally after breaking out above short term ATR resistance. I still contend a proper recovery out of this correction requires a rally back through the psychologically important 4000 point zone, which is still unlikely:

Currency markets continue to see no change in USD strength as it pushes almost everything lower, save Pound Sterling which rallied on the news that the clown at No.10 is finally leaving. Euro remains under stress as it continues its falls below the 1.02 handle, as support at the 1.035 mid zone (horizontal black line) was wiped out previously. Parity remains the target below, with the potential for a swing trade on the oversold price action not yet appearing here:

The USDJPY pair is still trying to push higher, but keeps getting stuck below the 136 handle after failing to push above last weeks intrasession high. Support remains firm at the 134 mid level as short term momentum gets out of the oversold zone while price itself bounces back above the Friday lows, but it all looks illusory. I remain cautious here, watching for a potential break back to the mid 134 area and then a potential breakdown if not supported:

The Australian dollar is trying to bounceback after falling below the 68 handle post the FOMC minutes after it recently bottomed out at the lower edge of its monthly downtrend channel (lower sloping black line). This small bounce maybe running out of puff as it reaches the weekly downtrend line (upper sloping black line) as the recent bounceback in commodity prices maybe illusory:

Oil markets tried to comeback overnight with Brent crude surging more than 4% to push back above the $100USD per barrel level, finishing at $104 but still shy of the key price support at the $106 level. This is an expected bounce after overshooting the $100 psychological support level, so watch for another potential rollover if the commodity crash spreads:

Gold continues to have a tough time alongside other undollars and commodities with no real signs of a bottom forming overnight, instead maintaining its lows at the $1740USD per ounce level. Resistance had been far too strong at the $1830USD per ounce level with daily momentum picking up into the oversold zone before this move and now the flood gates are quite open for more downside (turn the chart upside down and you’d be buying). Momentum is extremely oversold however, so I expect a minor bounce in the short term: