Last night saw European stocks play catchup to Wall Street’s inversion on Friday night due to the stonking US jobs report that cause a massive lift for USD, with US stocks again underperforming overnight. Euro was pushed further below the 1.08 handle, while the Australian dollar initially gapped higher but resumed its downward trajectory, currently at the 68 cent level before today’s long anticipated RBA meeting. 10 year Treasury yields pushed higher again with another bond selloff, cracking through the 3.6% level while the commodity complex saw oil prices stabilise with Brent crude hovering around the $80USD per barrel level. Gold was flummoxed by the NFP print, and after a mild gap higher remains very weak at the $1865USD per ounce level.

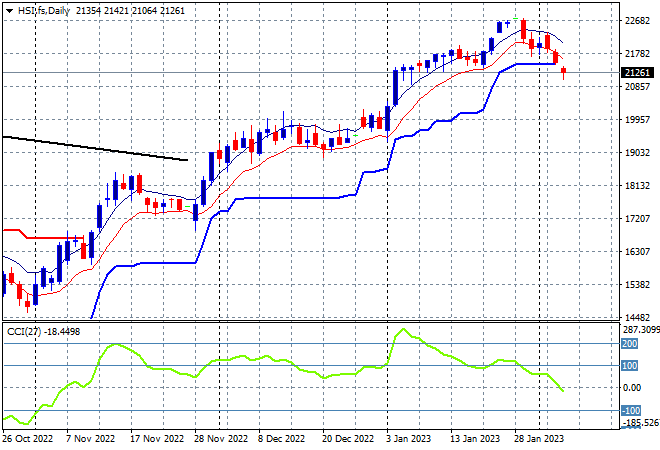

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets fell at the open and stayed down into the close with the Shanghai Composite down 0.7% to 3238 points while the Hang Seng is doing worse, off by more than 2% to 21222 points. The daily chart had being showing a nice breakout with daily momentum well overbought but unable to breach the 23000 point level as it rolled over most of last week. Price action has now rolled over completely and through ATR support with momentum crossing into negative territory for a corrective phase:

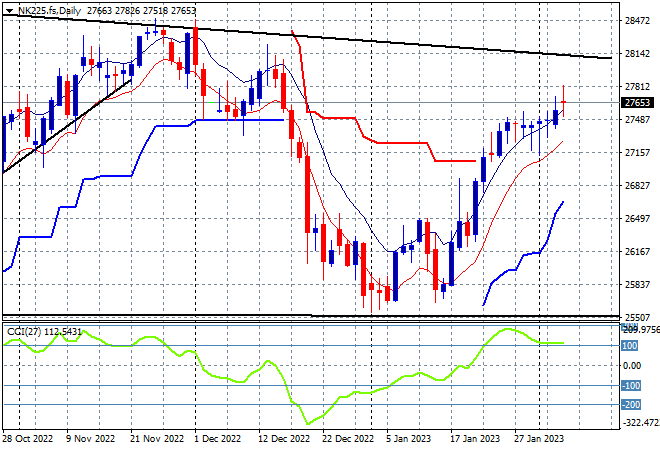

Japanese stock markets however started the week in a more positive mood with the Nikkei 225 closing 0.7% higher at 27698 points due to a substantially weaker Yen. After bottoming out at the 25000 point level the recent positive correlation performance with Wall Street was helping lift price action back to the November highs, but unable to clear the 27500 point level. Clearing daily ATR resistance and getting daily momentum back into overbought mode should set up a further move higher to the 28000 point level next:

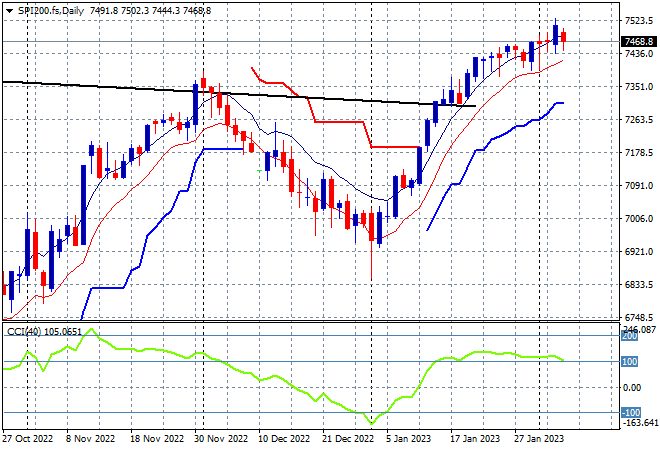

Australian stocks were again the best performers in the region, relatively speaking, with the ASX200 closing just 0.2% lower to hold on above the 7500 point level, closing at 7539 points. SPI futures are dead flat given the continued falls on Wall Street overnight. The daily chart is showing the breakout above the 7300 point level taking a breather before a probable next stage higher. Previous overhead ATR trailing resistance at the 7200 point level is firming as short term support as daily momentum remains slightly overbought:

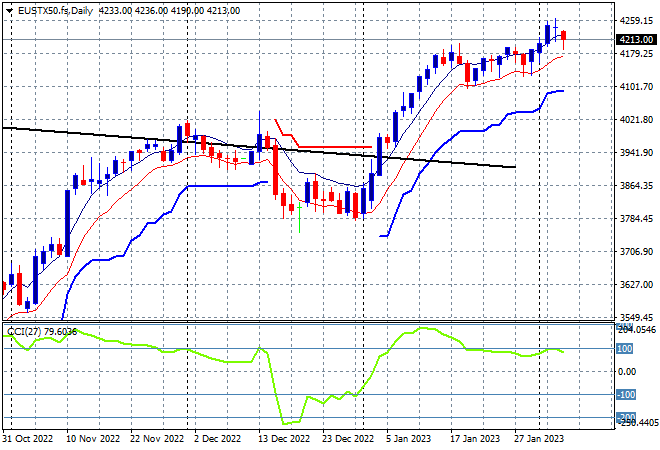

European markets all pulled back in response to Wall Street’s Friday night selloff with the Eurostoxx 50 Index pulling back some 1.2% to 4205 points. The trend above the 4000 point level remains somewhat stable but daily momentum is not yet back into its previously overbought settings. The 4000 point level was the key psychological resistance level here that has now turned into support going forward, but I’m watching for signs of a possible rollover ahead:

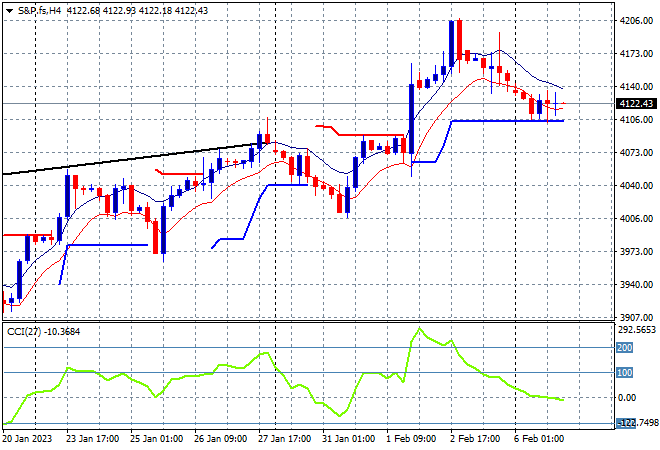

Wall Street is still selling off in the wake of Friday’s jobs report and some disappointing earnings with the NASDAQ down another 1% while the S&P500 lost another 0.6% to finish at 4111 points. The four hourly chart shows price coming up against short term support at the 4100 point level with momentum moderating at a neutral zone so its not all bears and selling just yet. There could be a further retracement to test the low moving average on the daily chart at the 4050 point level to take a little heat out of the market in the post-NFP analysis:

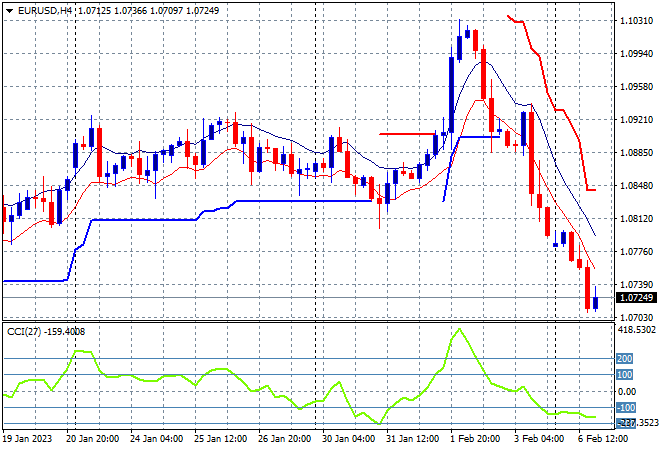

Currency markets remain flummoxed by the huge NFP print on Friday night, with USD remaining quite strong against everything undollar. Euro failed to make a dent over the weekend, opening weakly and continuing to selloff overnight, now well below the 1.08 handle. As I mentioned last week, with price action retracing all of the post Fed move, it left the union currency in a weird position here with resistance at the 1.09 handle firming which has now resulted in a serious test of the weekly lows following the NFP print. Watch the 1.07 level to come under threat next:

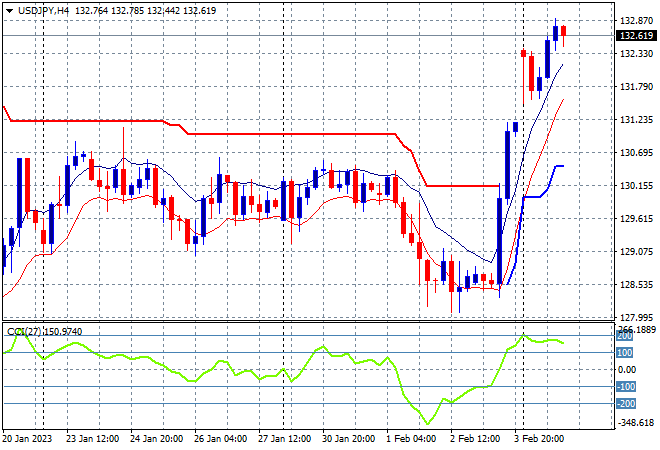

The USDJPY pair gapped significantly higher over the weekend and then advanced further above the 132 handle to continue its one way move from Friday night. Before the print price action had bunched up near the 129 level that I presumed would all but assure a further drop to the Xmas lows at the 127 handle but it seems support was much firmer as the USD bulls stepped in. This should be a good lead for Japanese stocks at least but I’m wary of this going too far, too fast:

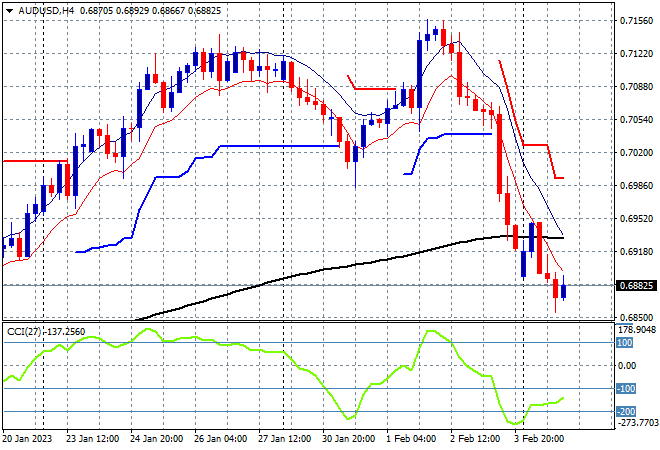

The Australian dollar followed Euro and others with a one way trade on Friday night, sending it down to a two week low to almost cross below the 69 handle, but managed a decent gap higher yesterday morning. However on the London open and through the night it sold off to make an even lower low below the 69 handle where it sits now in anticipation of today’s February RBA meeting. I expect a small bounce or consolidation around the 69 level here as a result of a 25 bps rise:

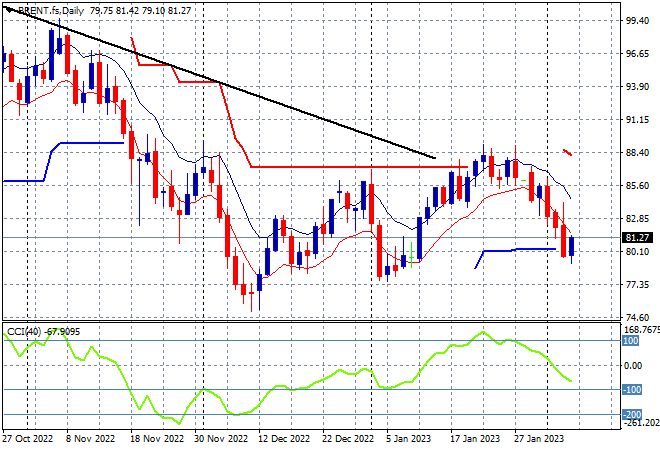

Oil markets failed to gain traction all last week and accelerated selling on Friday night saw Brent crude prices sliding down through the $80USD per barrel level for a new weekly low in the wake of a stronger USD. Overnight saw a mild bounceback but nowhere near out of trouble yet, with price action still quite unsettled with daily momentum pointing the way to a further retracement in the wake of a lack of support:

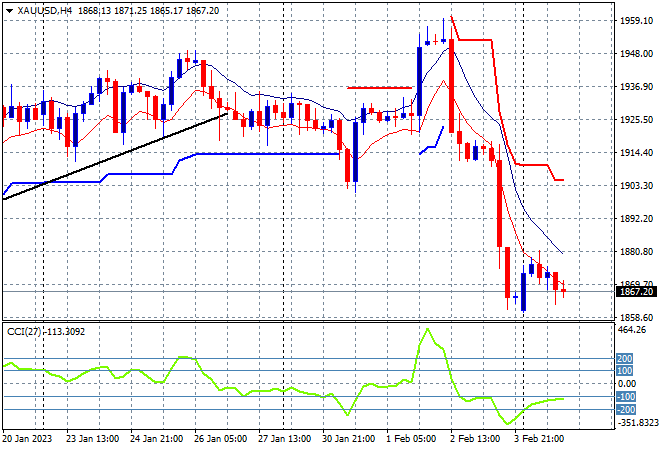

Gold suffered the most of the undollars on Friday night a major selloff sending it down to a new monthly low just above the $1865USD per ounce level and despite a gap higher yesterday morning it still has failed to find any further support. This price action negates all of the positive moves in previous weeks with daily momentum remaining quite oversold and all support levels taken out. Not a pretty sight: