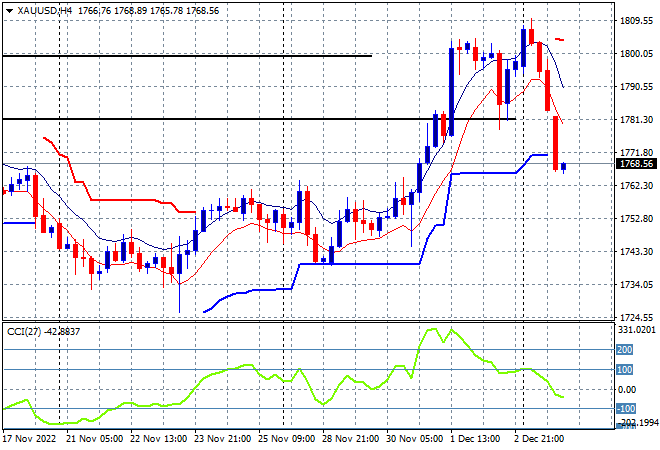

Last night’s US ISM services PMI shot higher than expected, sending USD back into uber-strength and making Wall Street get the willies, with near 2% falls across the board. This will translate into a surfeit of risk taking here in Asia today with futures indicating some strong pullbacks. In currency land, Euro dropped below the 1.05 handle while the Australian dollar sank further to finish below the 67 cent level and could sink lower today if the RBA puts in a mild rate rise. US Treasury yields lifted slightly, arresting their weekly decline with the 10 year yield getting back above 3.6% while the commodity complex saw oil prices pullback sharply, with Brent crude below the $83USD per barrel level while gold followed the undollars path, slammed well below the $1800USD per ounce level.

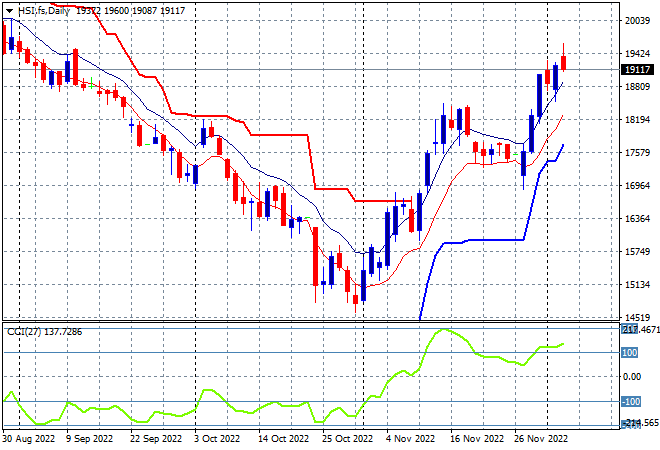

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets gapped higher at the open and built further into the close with the Shanghai Composite finishing more than 1.7% higher to advance past the 3200 point level while the Hang Seng Index is going up much faster, closing 4.5% higher to 19518 points. The daily chart was showing a perfect breakout here with a big surge up towards the 19000 point level, although futures are indicating a mild pullback which maybe good in the short term to take some exuberance out of the trend as support is still defended at the 17600 area:

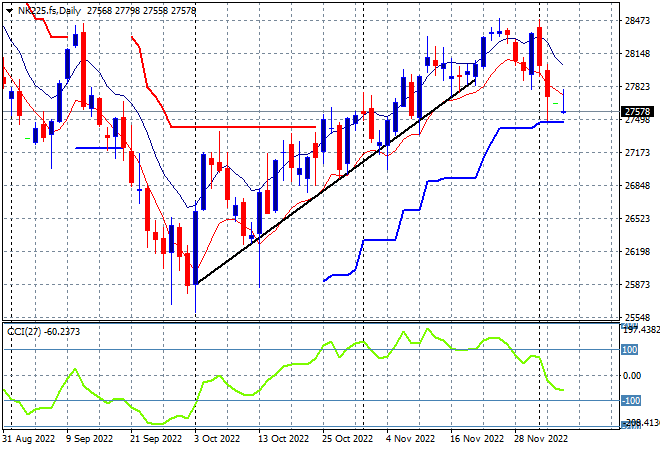

Japanese stock markets can’t find a bid however with the Nikkei 225 finishing 0.1% higher at 28120 points. The lack of a clear lead from Wall Street combined with heavy resistance at the 28400 point level has turned this pause into a rollover into short term support. The daily chart shows this pullback is likely to continue with futures indicating the 28000 point area to come under pressure as daily momentum switches from positive to negative. Watch ATR support next at the 27500 point level:

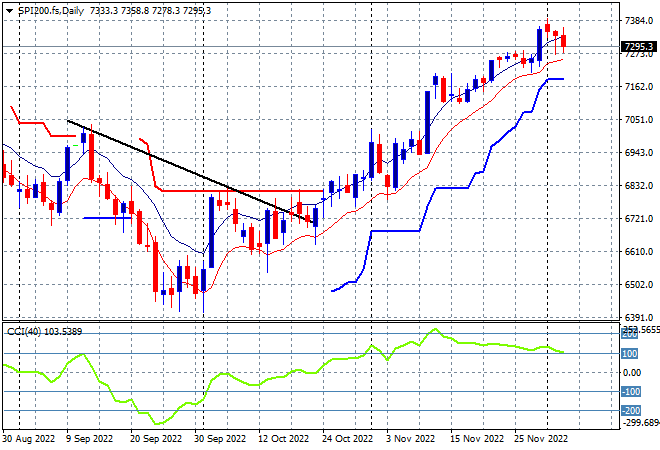

Australian stocks were able to put on a solid start to the trading week, with the ASX200 finishing 0.3% higher at 7325 points. SPI futures are down about 0.6% due to the poor finish on Wall Street overnight with the daily chart still looking quite bullish as daily momentum remains solidly overbought. This could change today with the RBA meeting and more rate talk, so while support remains very strong throughout this uptrend, watch for a potential slowdown or reversal with ATR support at 7200 to be tested:

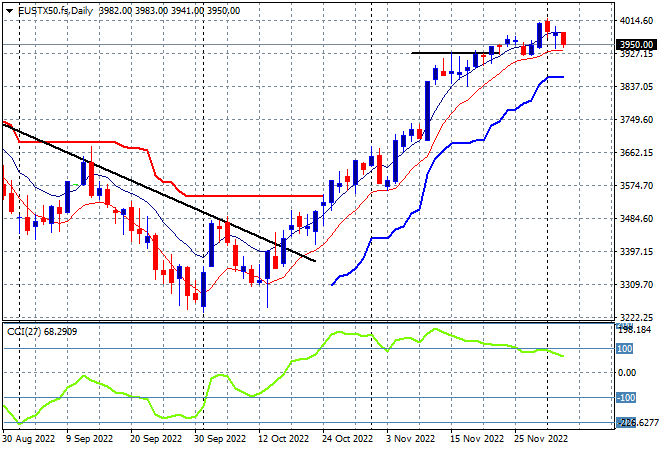

European markets had a mixed start to the trading week with some losses across the continent, although the FTSE managed a positive finish with the Eurostoxx 50 Index closing some 0.5% lower at 3956 points. The daily chart shows key overhead resistance at the 3900 point area having been cleared but daily momentum not yet heading back into overbought status, indicating a short term build up of resistance. This small pause hasn’t translated into a drop yet, although the 4000 point level is proving key psychological resistance so far:

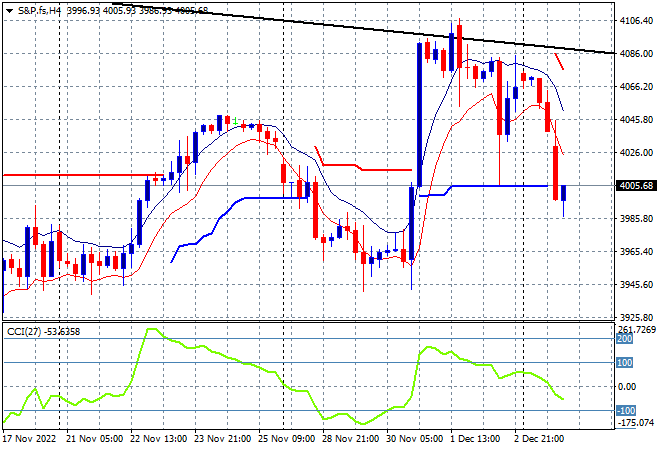

Wall Street got the jitters with falls across the board as Fed hikes remain in the forefront of risk taking, the NASDAQ losing nearly 2% while the S&P500 went down 1.8%, closing just below the 4000 point psychological barrier. The chart picture is still showing more layers of resistance compared to other market with the key 4000 point psychological level the area to watch as it must provide solid support going forward after being defended in Friday night’s NFP print:

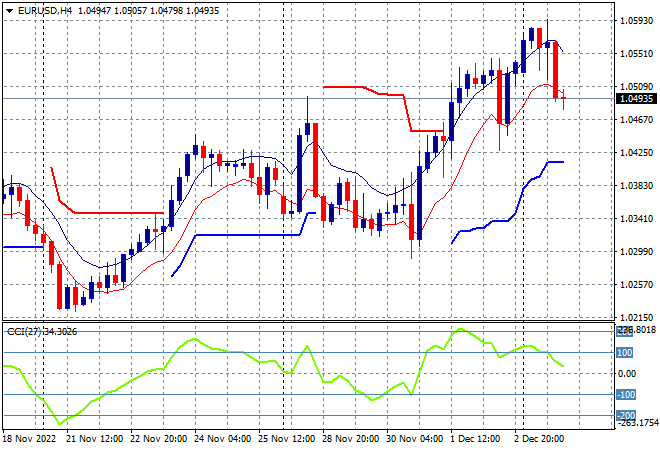

Currency markets remained volatile following the NFP print with the USD bears caught out proper this time in the wake of the ISM services print, with big falls across the board. Euro was looking to extend its post NFP gains above the 1.06 handle but was pushed lower, although not significantly, finishing at just below the 1.05 level and still at the Friday highs. This still remains a weekly and monthly high with strong support evident at the mid 1.02s with signs still pointing to a possible top in USD:

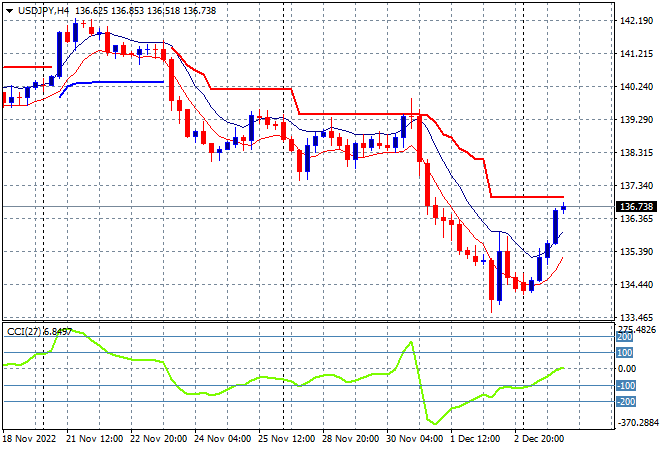

The USDJPY pair had a similar, yet inverse ride, with a lift up to the 136 handle but not through overhead ATR resistance. Yen safe haven buying coupled with USD weakness around inflation concerns has been smashing this pair into new territory having broken weekly support that has held all calendar year, but this next stage could see a proper reversal but only if the 140 area is threatened in the medium term:

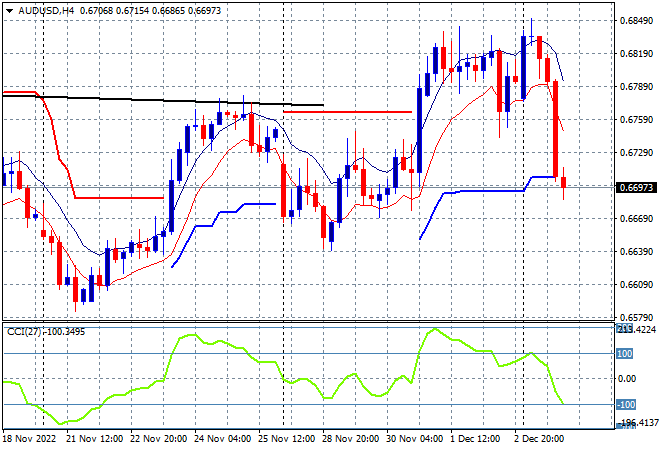

The Australian dollar was not as lucky as Euro with a smackdown to last week’s intrasession lows, just below the 67 level. This continues the wild ride of last week with price action no longer confirming a breakout above the 67 level. Momentum has retraced again into negative territory with a further pullback to the recent lows around the 66 level possible:

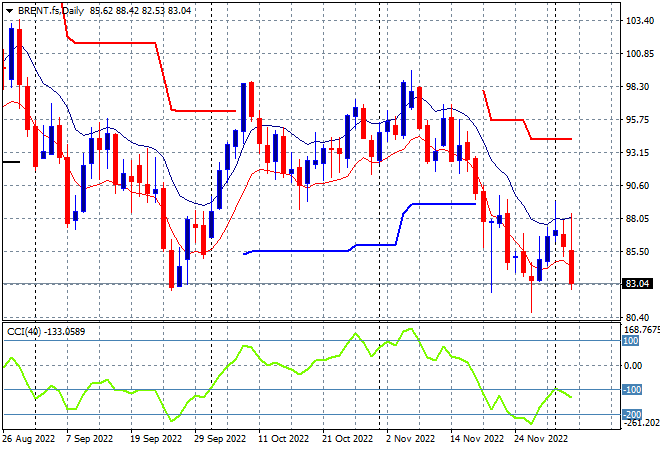

Oil markets dived on the stronger USD trade and the moves in OPEC land, with Brent crude selling off to finish right on the $83USD per barrel level. Daily momentum had been oversold and setting up a weak swing trade but price never moved above the key high moving average area. Medium term the target remains resistance at the $98 level, but I still contend there is scope to return to the September lows at $80 or so on any reversal in risk sentiment – and here we are:

Gold was slammed back like the other undollars following the PMI print with the surge in USD sending it way below the $1800USD per ounce level, closing at $1768 this morning. This move has flummoxed last week’s surge and gains following the recent inflation print and while I warned it looked way overextended in the short term, this was a pretty abrupt reversal. I’m watching for support to come under pressure here with price action likely to further retrace down to last week lows around the $1750 level: