Not a fun night of action if you’re a commodity trader overnight as risk sentiment crumbled in the wake of recession fears across both sides of the Atlantic, with European shares dropping sharply while Wall Street returned from its long weekend almost unscathed. The USD rose strongly on the defensive mood against all the undollars, with Euro and Pound Sterling smashed down to new lows, while the Australian dollar returned below the 68 handle despite yesterday’s big rate rise by the RBA. Bond markets saw a tightening of yields across the curve, with 10 Year Treasuries falling back to 2.77%, with interest rate futures also pulling back slightly. Commodity prices were hammered, with oil losing more than 9%, copper down 5% to almost make a two year low while gold fell more than 2%, crushed below the $1800USD per ounce level.

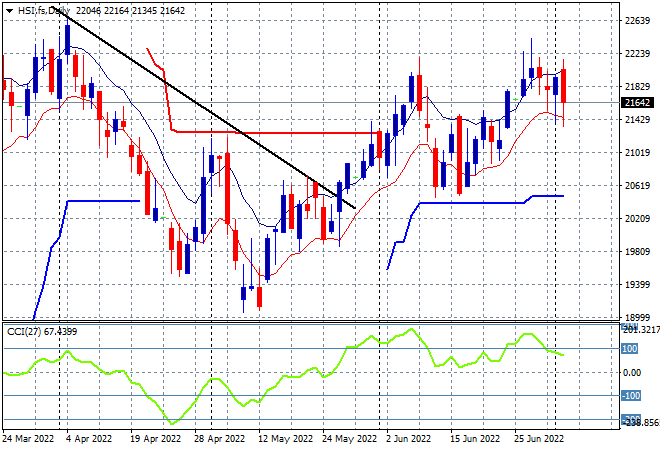

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were dropping sharply going into the close before recovering with the Shanghai Composite closing only a handful of points lower at 3404 points, while the Hang Seng Index finished also dead flat, closing 0.1% higher at 21853 points. The daily chart was showing a desire to breakout above the previous highs at the 22000 point level but considerable resistance is still keeping this market in check, with session highs failing to match the previous false breakout tops. Momentum continues to rollover here, so be cautious of low volatility that could beget higher downside volatility soon:

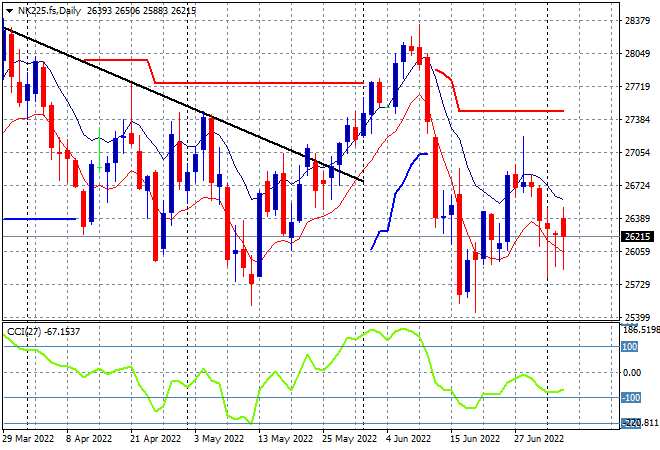

Japanese stock markets however had a much better session with the Nikkei 225 index closing up 1% at 26423 points. Risk sentiment on the daily futures chart however still shows possible further downside with price action still unable to make any move above the high moving average. Daily momentum is building on the negative side as this looks more and more like a dead cat bounce, with a large pullback probable for today’s session:

Australian stocks absorbed the RBA rate rise with aplomb with the ASX200 finishing 0.2% higher, closing at 6629 points. SPI futures are down a solid 1% on overnight volatility with more potential falls brewing as the impact of yesterday’s RBA meeting is felt. The daily chart remains an ugly picture with my contention of price needing to recover well above the 6600 point level before calling any bottoming action still holding, as daily momentum could easily return back to the very oversold zone and threaten new weekly lows:

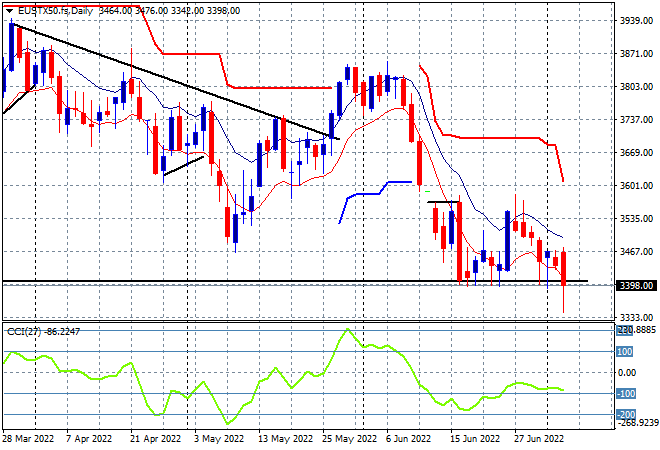

European stocks slumped the most overnight with 2-3% losses across the continent and in Brexit-land with the Eurostoxx 50 index eventually closing 2.7% lower at 3359 points. The daily chart picture remains in a very bearish state here with price action pushing through the March dip lows as this classic swing action has completely turned into a dead cat bounce instead. With daily momentum remaining negative, there’s little chance of price getting back well above the 3570 point area so watch for an imminent rollover:

Wall Street came back from the long weekend, with volatility ruling throughout the session, with only the NASDAQ putting on meaningful gains, up 1.7% while the S&P500 put in a scratch session lifting just 0.1% to close at 3831 points. The four hourly chart shows some buying support building, pushing off nascent support at a lower 3700 point level, with price unable to get back above the previous resistance zone from the last false rally. A proper recovery out of this correction requires a rally back through the psychologically important 4000 point zone, which is becoming more and more unlikely:

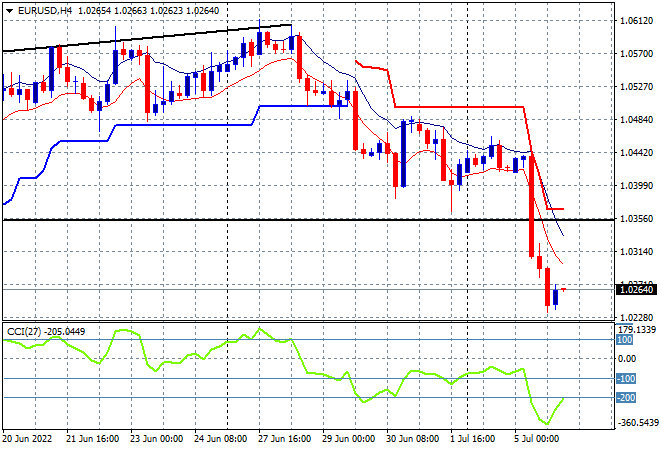

Currency markets had been waning in volatility which is always a clear sign that volatility is about to shoot higher and thats what we got overnight as the defensive USD threw the undollars to the floor. Euro retraced straight through to the 1.02 handle, after failing to defend support at the 1.035 mid zone. The writing was on the wall here with parity the next target below:

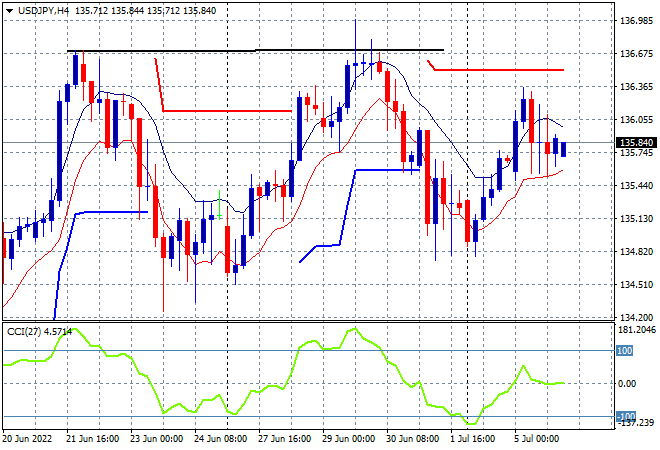

The USDJPY pair is still trying to push higher, but keeps getting stuck below the 136 handle after failing to push above last weeks intrasession high. Support remains firm at the 134 mid level as short term momentum gets out of the oversold zone while price itself bounces back above the Friday lows, but it all looks illusory. I remain cautious here, watching for a potential break back to the mid 134 area and then a potential breakdown if not supported:

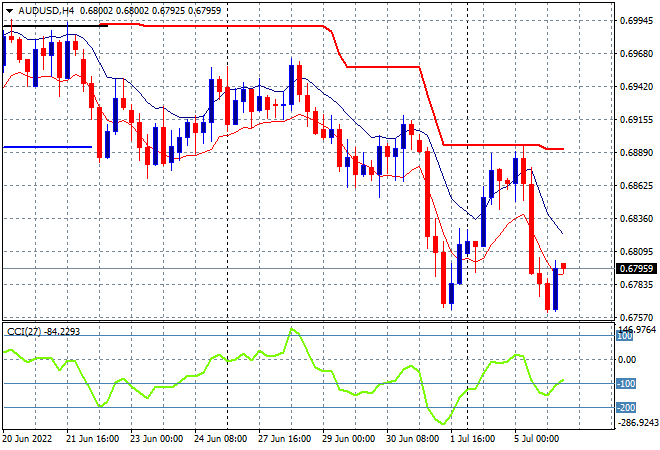

The Australian dollar absorbed the latest RBA rate rise but then did nothing else before the European session pushed it straight back down to the put in an impressive bounce following its walloping on Friday night with price coming up to key trailing ATR resistance and the key 69 cent level overnight. However its not enough to send a clear signal coming in to today’s interest rate meeting, where a 50bps rise is expected, but still not enough to catch up with the Fed. Four hourly momentum has swung from being quite oversold to relatively neutral as this swing trade takes a pause:

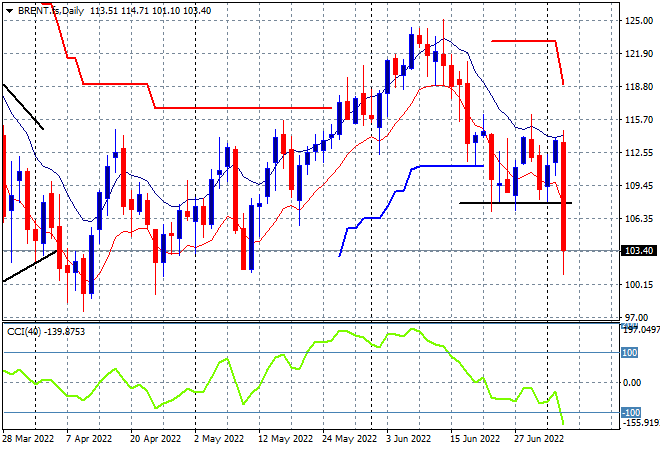

Oil markets are trying to stabilise with another upside session that saw Brent crude pushed back above the $113USD per barrel level, bouncing off the previous weekly low. Daily momentum is still on the negative side, with price support holding firm at the $106 level. The lack of a substantive move above the high moving average around the $115 area is now weighing on sentiment, which could turn into a push down to the $100 psychological support level next:

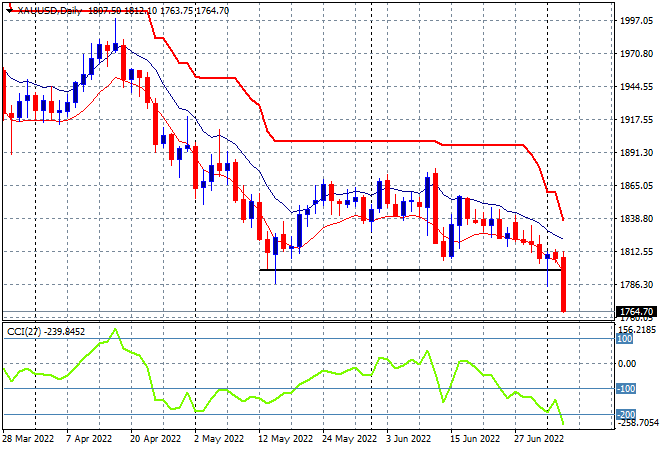

Gold is having a similar ride to the Australian dollar with a swing trade after being considerably oversold on Friday night turning into some form of stability overnight, as its sideways bearish oscillation returns, closing at the $1807USD per ounce level. Resistance is very firm at the $1830USD per ounce level with four hourly momentum still quite negative with signs of another crack below the $1800 zone building: