The Fed upset the apple cart overnight with its sixth rate rise in a row, launching up 0.75% while stock markets tanked on both sides of the Atlantic. Wall Street fell between 2 and 3% with Asian stock futures not looking pretty this morning. The USD of course surged against the majors with Euro retreating down to the 98 cent level, while the Australian dollar also saw a major retracement to the mid 63 level. US bond markets saw more curve flattening with 10 Year Treasury yields pushing through to the 4.1% level while commodities were mixed with oil lifting slightly as Brent crude pushed through the $95USD per barrel level but gold was crushed under pressure to finish well below the $1640USD per ounce level.

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets continued to rebound sharply after their recent sharp falls with the Shanghai Composite up nearly 1.3% to 3009 points while the Hang Seng Index has lifted more than 2.4% to climb further above the 15000 point level at 15828 points. The daily chart shows a potential bottoming action here but its questionable if it is sustainable or just short covering. Just below this level is the 2008 lows, as the 15000 point level becomes the battleground between authorities stepping in and sellers wanting to move their money out – watch for another close above the high moving average here as a sign the swing play has more potential:

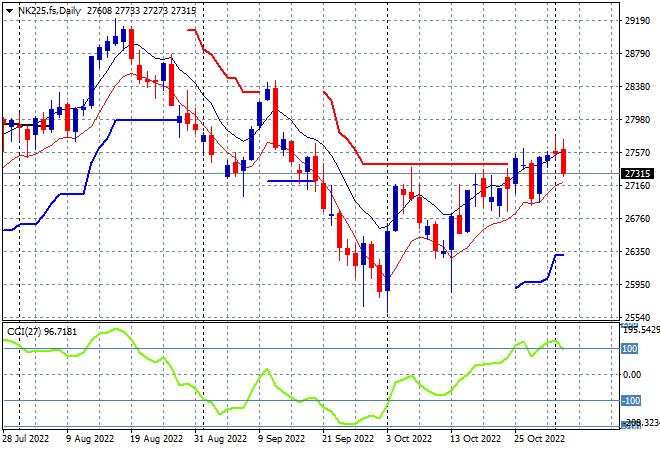

Japanese stock markets were still wavering with scratch sessions as the Nikkei 225 closed 0.1% lower at 27663 points. The daily price chart was showing a possible breakout brewing here under overhead resistance at the 27500 level however the poor lead from Wall Street and mixed fortunes in China explains the hesitation. Futures are indicating a larger retracement on the Fed outcomes, with momentum likely to retrace from overbought levels but watch price action if it breaks below the low moving average which would signal an end to the October bounce:

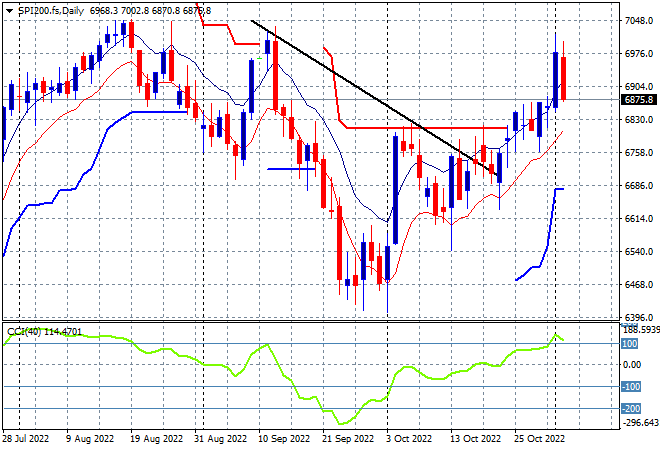

Australian stocks also seemingly took the day off, with the ASX200 closing 0.1% higher, unable to cross above the 7000 point level to finish at 6986 points. SPI futures are down more than 1.5% flat due to the selloff on Wall Street overnight. The daily chart was looking very similar to Japanese stocks, with the big breakout post the RBA meeting looking to be pulled back nearly in its entirety today and possibly back down to trailing ATR resistance at the 6800 point level. Daily momentum has maintained itself above the positive zone and is now solidly overbought, but this may well be a KC Signal:

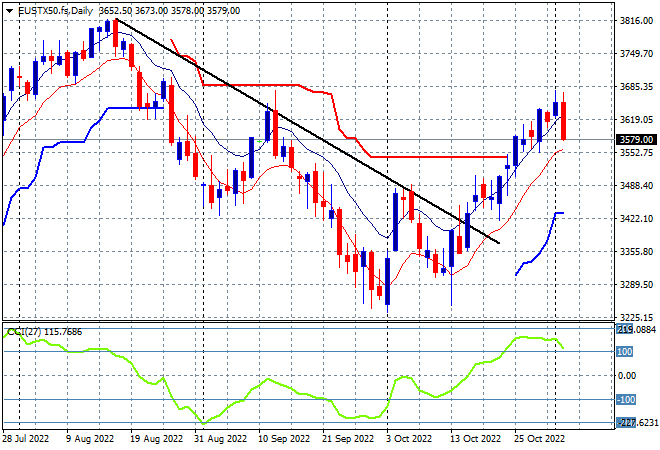

European stocks were initially positive across the continent, until the Fed meeting saw losses instead with the Eurostoxx 50 Index losing 0.8% to 3622 points. The daily chart was also showing similar price action to Asian markets, but with more momentum as it cleared resistance at the 3550 level. The breakthrough of the downtrend from the August highs combined with overbought daily momentum should provide further moves higher here, but its the correlation with Wall Street that will put a stop to further increases:

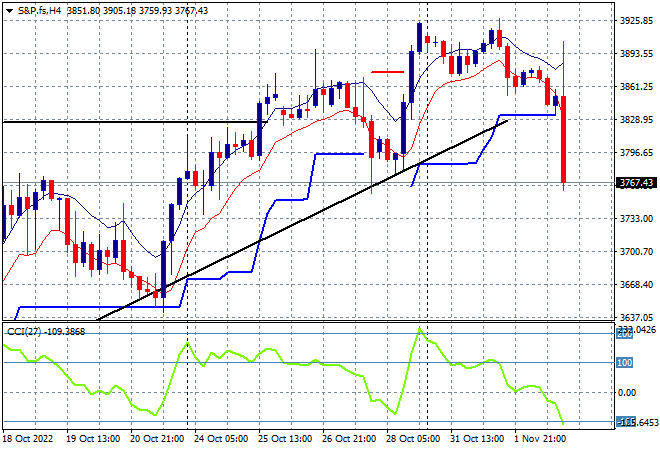

Wall Street really caught itself on the back foot with the latest Fed rate rise, with the NASDAQ losing over 3% while the S&P500 fell back 2.5% to fall well below the 3800 point barrier, closing at 3759 points. The four hourly chart shows how the first move was relatively benign given the series of up steps in the last couple of weeks that has seen the 3850 point resistance level taken out, but last night’s action has seen the trendline definitively break. The lift up to the 4000 point level has been thwarted by a still aggressive Fed and looks set to wind back the October gains so far:

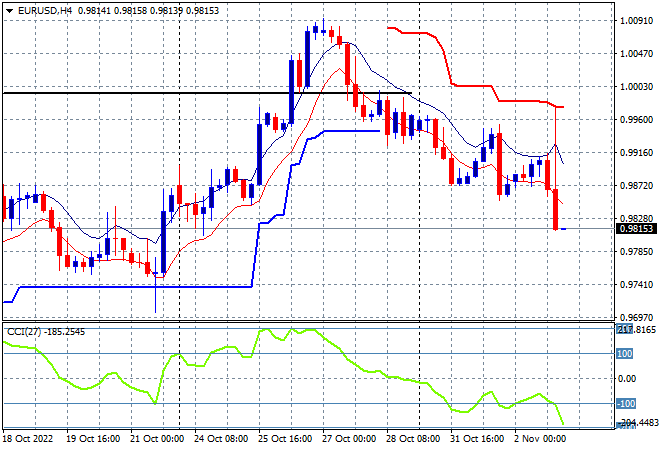

Currency markets fell back sharply on the Fed rate rise, already trying to push back a stronger USD post the non-ECB decision. Euro slumped and heading back to the October low overnight, with the 98 handle now under threat. The union currency could crack faster below as negative momentum swells, with the mid 97 level at the October lows the next target:

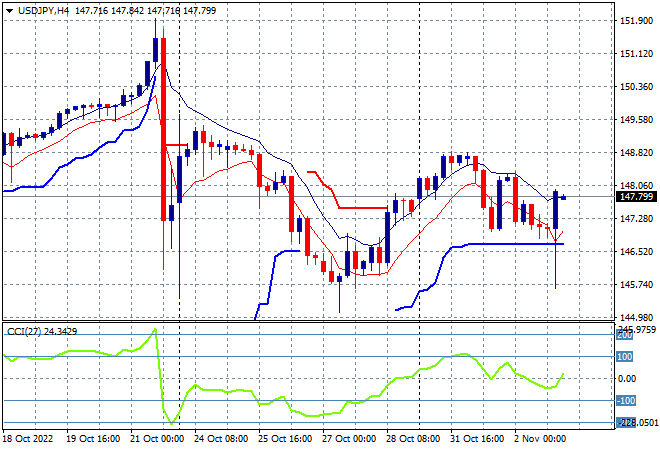

The USDJPY pair eventually finished at the 148 level but had a wild ride through the FOMC meeting and press conference with volatility increasing to the downside here. As I said previously, there looked like continued upside potential here as price pushed above trailing resistance but momentum is only just positive and not yet overbought with the previous intrasession high at the 148.80 level the area that must be cleared:

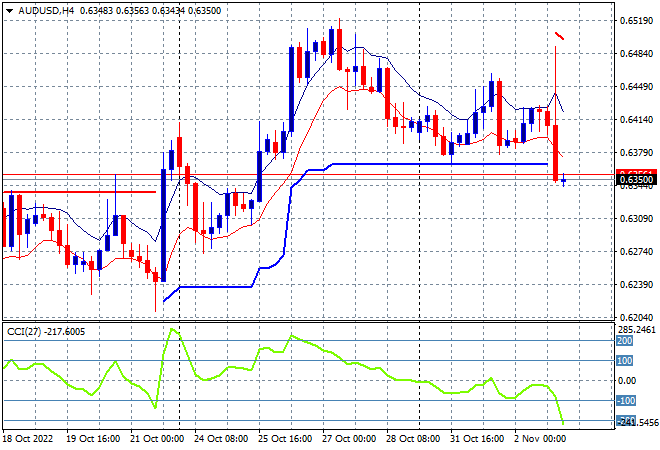

The Australian dollar also ramped up prior to the Fed meeting but was crushed overnight, heading straight to the mid 63 level and breaking below trailing ATR support as a result. As I keep saying, resistance is still too strong at all the previous levels with the 65 handle still the area to beat in the medium term as traders will now position to the downside as the Fed is much more hawkish than the boffins at Martin Place, with short term momentum having now retraced completely to the dark side:

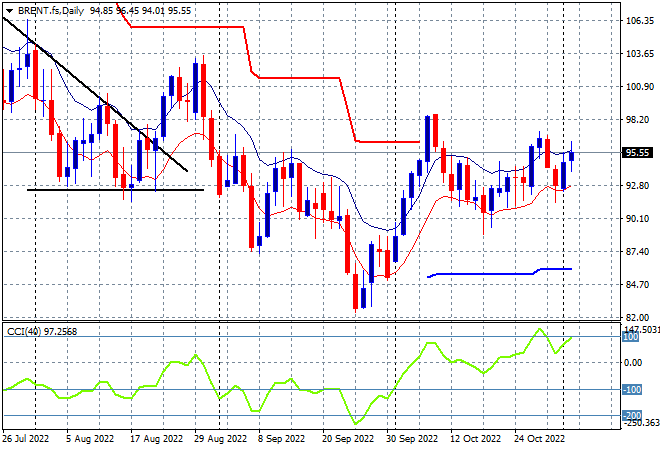

Oil markets are regaining some of their recent lost confidence as Saudi/Iranian ructions continue with Brent crude rebounding overnight, getting through the $95USD per barrel level. Daily momentum was looking like settling in to a positive mood here, but price action just can’t translate into a return to the magical $100 level with shorter term resistance at the $98 level the area to watch out for in any of these upside blips before getting too excited about a new move higher:

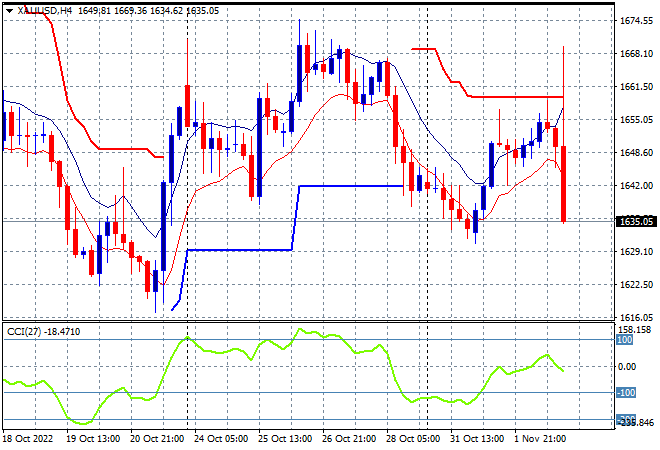

Gold started the trading week poorly and has continued to do so with big volatility overnight – over $50 intrasession – finally falling flat at the recent weekly low at the $1630USD per ounce level instead. As I reckoned last week, while there was a potential inverse head and shoulders pattern forming on the four hourly chart, the multi-month bearish setup remains in place as seen, forcing price back to the dominant downtrend. Overhead resistance at the $1675 level just can’t be cleared from here so watch for a return to the October lows at $1600: