Overnight stock markets were quite mixed with European bourses pulling back while Wall Street initially made a new low before a late surge saw them barely recover to the Friday night starting position, as the correction mode remains intact. Bond markets are where the action really is with 10 Year US Treasury yields making a new high, pushing through the 3% level with a 50 basis point rise by the Fed coming just around the corner. The USD remains on a tear against everything, near a 20 year high on the US Dollar Index, while commodity prices oscillated, as WTI and Brent crude oil both firmed a little while copper and gold prices flunked, the latter pushed well below the $1900USD per ounce level.

Today’s RBA meeting will be the highlight of the Asian session with a rate rise expected.

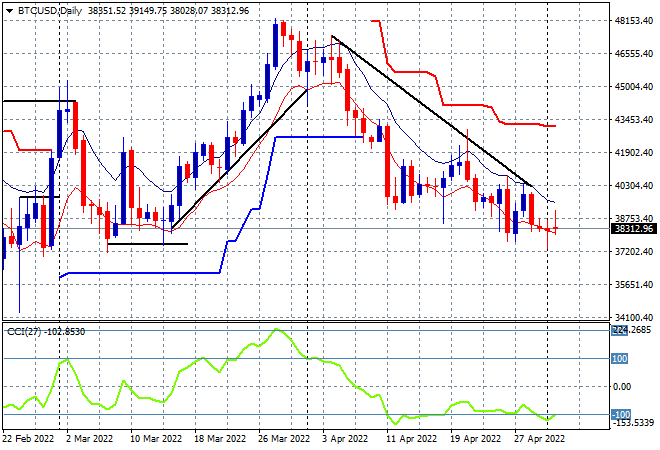

Bitcoin is still on a downward trend from its March highs, almost making a new daily low overnight as it remains anchored below the $40K level. The lack of confidence in the crypto world is still building for a further retracement down to the February lows at the $37K level, so I’m watching for a breakdown below that level next as daily momentum remains nicely oversold and price action lacks upside potential in the short term:

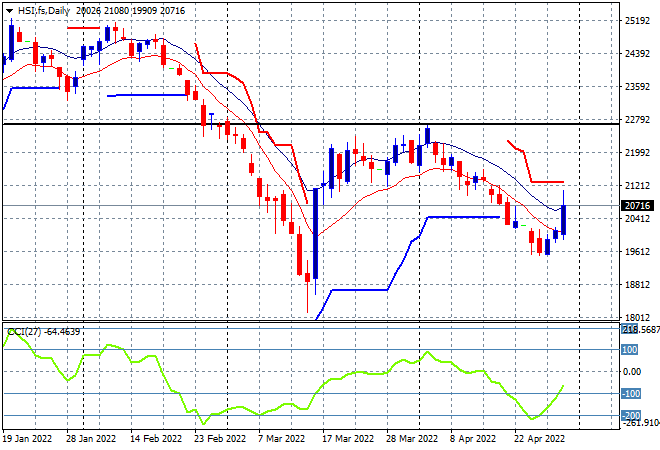

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were closed for May Day holidays, with the Hang Seng Index re-opening today. The daily chart shows the end of last trading week’s surge trying to hold back the falls on COVID and growth fears with a return to the early March lows at 18000 still possible here although this swing trade could be brewing to push through the 21000 point level temporarily:

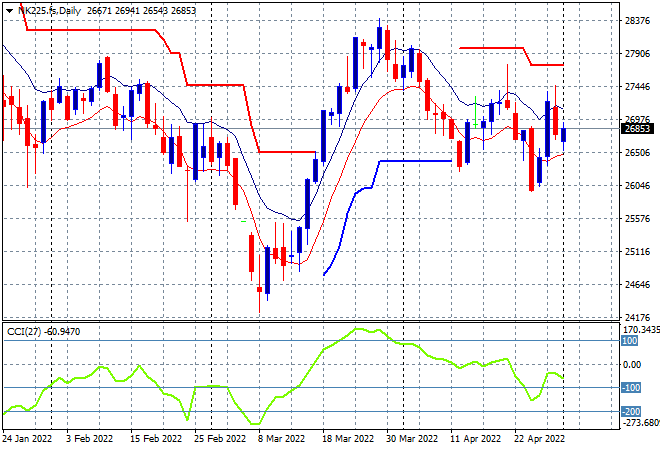

Japanese stock markets can’t find traction however despite some lower volatility in Yen, with the Nikkei 225 closing 0.1% lower at 26818 points with futures indicating a small uplift at the open. The lack of direction in overnight markets, including Yen are not giving much buying support here as price remains held below the previous daily highs near the 27500 point level. Daily momentum is still in a negative state after climbing out of an oversold status so I’m watching price action to possibly rollover here on any further correlated risk bad news:

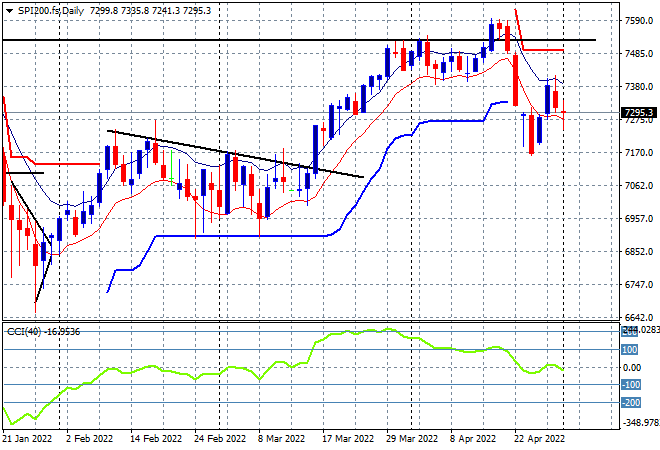

Australian stocks finished down considerably, with the S&P/ASX 200 taking back more than 1% on the open of the trading week, finishing at 7346 points. SPI futures are down a further 0.3% or so, with a possible retracement below the 7300 point level at the open of the session. This could widen on today’s expected RBA rate hike, so watch for a further retracement down to the 7100 point level which has acted as strong support in this little corrective phase so far. The upside potential is still there, but barely with a close above the high moving average next around 7400 points still required:

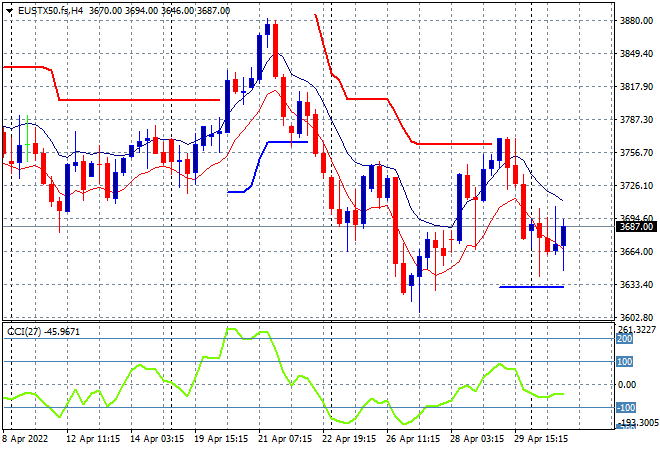

European shares had a very mixed session, with the FTSE closed for the May day holiday as continental markets remain concerned over interest rates and growth dominated risk taking. The Eurostoxx 50 index closed nearly 2% lower at 3732 points with the daily chart picture still remaining quite bearish. Price is possibly finding a bottom here at the 3600 point level, with long tails of intrasession buying support helping in the last couple of sessions, but what is required is a larger breakout above the high moving average around the 3730 point level and then well above trailing daily ATR resistance at the 3800 level proper before calling a bottom. I still contend another breakdown with a return to the February lows is brewing, as the energy crisis and Ukrainian invasion risks widen:

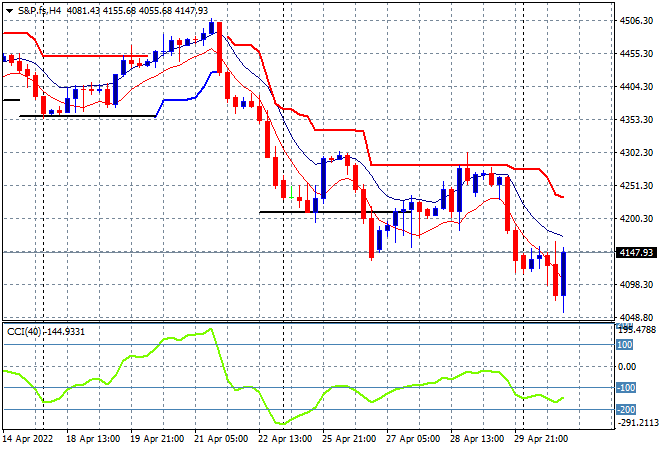

Wall Street made a new 12 month low overnight before rebounding later in the session, with the NASDAQ remaining the most volatile to launch more than 1.6% higher while the S&P500 lifted some 0.5% higher to close at 4155 points. Price action on the four hourly chart was already showing a capitulation from Friday night that continued throughout the pre-open futures and into the session itself before the BTFD crowd finally stepped in. But this is nowhere near a reversal or a recovery with trailing ATR resistance still a distant memory, as another dead cat bounce is setting up here as the medium term target remains at or below the 4000 point level:

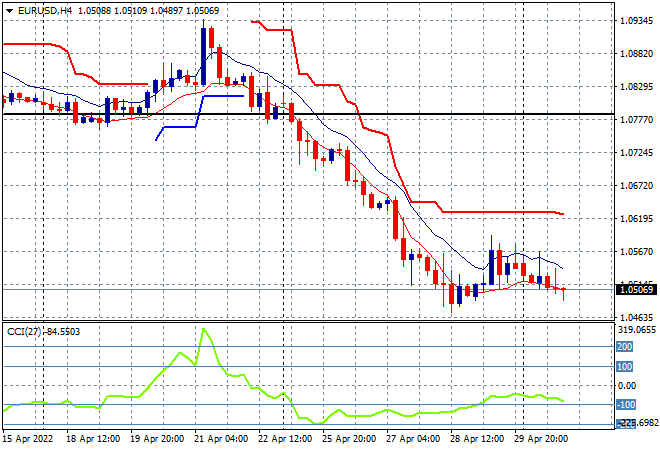

Currency markets remain dominated by a strong USD which continues to push Euro and Pound Sterling to further structural lows overnight, with both failing to make good on a very mild blip higher on Friday night. The union currency remains anchored here at the 1.05 handle with short term momentum nearly moving back into oversold conditions again, with another rollover very possible below last week’s intrasession low at the 1.0460 level on the road down to parity:

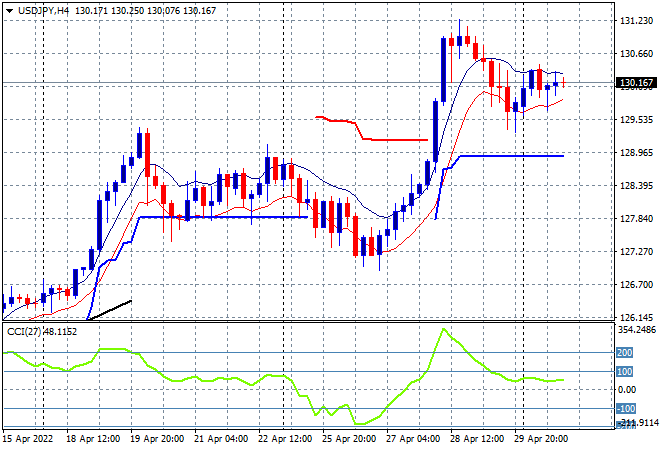

The USDJPY pair had almost no movement overnight as it continues to consolidate following last nights big move after the BOJ bond market operations, still slightly below the previous highs at the 131 handle. These moves are always filled with caution, but you can’t fight the central bank on this one, so I expect any small retracements to be filled from here:

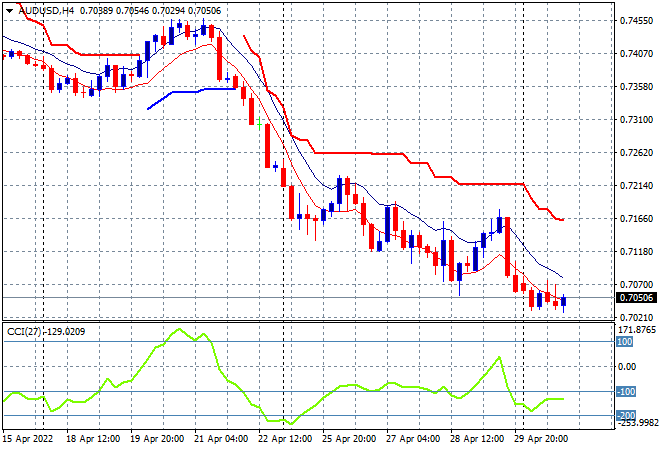

The Australian dollar is still under enormous pressure from USD, starting the new trading week with another slip, this time finding a modicum of support at the 70 level. This comes after traders start to manage expectations of today’s RBA meeting, where the first rate rise in an age is expected, although if it underwhelms – as expected – there is a likelihood of a crack below the key 70 handle into the 60’s as the Federal Reserve will be far more aggressive. Short term momentum remains nominally oversold:

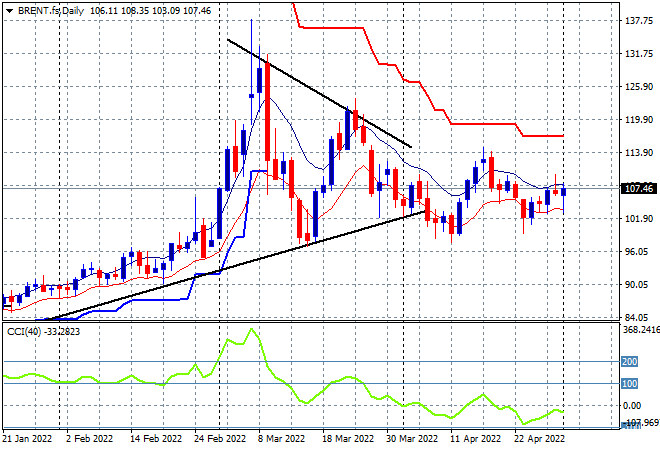

Oil markets continue to stabilise with a fairly firm session overnight with Brent solidifying above the $107USD per barrel support level but failed to make a substantial new daily high. Daily momentum is slowly retracing out of the negative zone, but a drawback or breakdown below the key $100 level is still possible given no new weekly highs being made for sometime now:

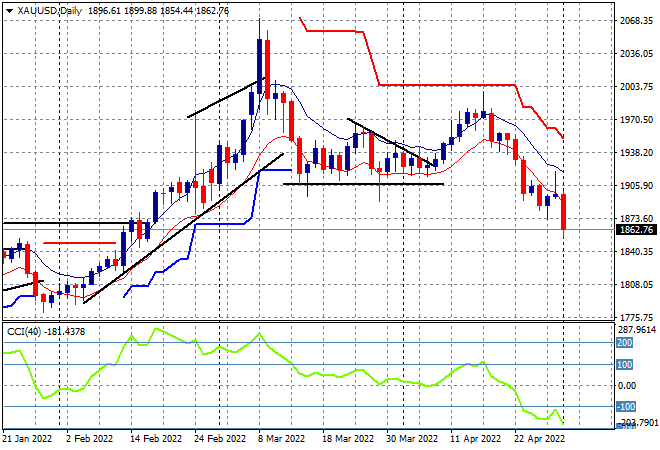

Gold remains under a lot of pressure with a big selloff overnight having failed to climb back above the $1900USD per ounce level all of last week with a bad finish at the the $1862 level. Daily momentum is now very deep into oversold territory with the January lows around the $1800 level the next possible downside target: