Risk markets are still unsettled with more stronger economic prints out of the US overnight combined with some Fed hawkishness keeping bond markets elevated as the 10 year Treasury almost lifted through the 4% level. Wall Street fell back alongside European shares while the USD only really lost ground against Euro as German inflation came in higher than expected and ECB members indicating higher interest rates are likely. The commodity complex saw oil prices lift slightly again with Brent crude pushing above the $84USD per barrel level while gold continued its recent leap out of its depressed funk, managing to lift up towards the $1840USD per ounce level.

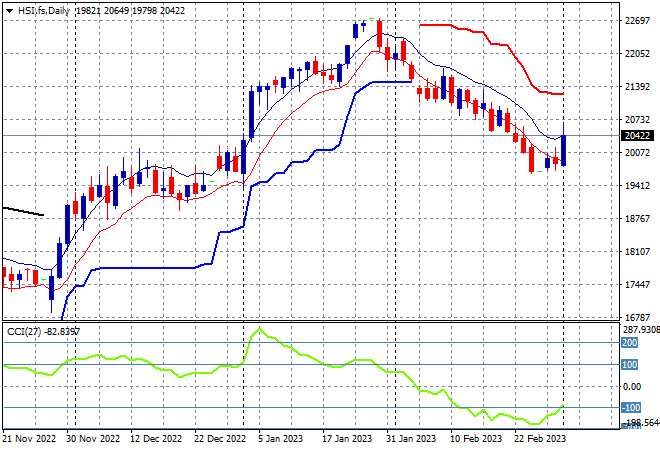

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets moved faster and higher going into the close with the Shanghai Composite up 1% to break above the 3300 point barrier while the Hang Seng surged more than 4% to push well over the 20000 point level, closing at 20619 points. The daily chart is showing this rollover going from slowing down to possibly reversing although price action is still well below previous ATR support as momentum remains in oversold territory. Watch now for this bounce off support at the 20000 point level to be a bit more sustainable:

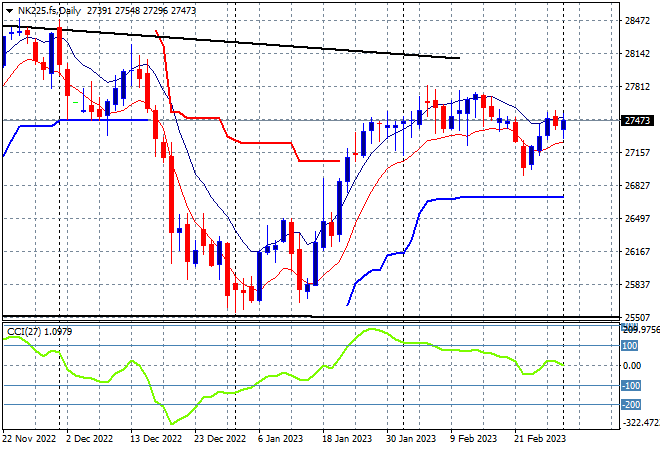

Japanese stock markets were mixed again with the Nikkei 225 up slightly to 27497 points. A slight bounceback is still in effect after last week’s rollover with daily momentum getting back into the positive zone with support clearly evident at the 27000 point area but not strengthening much. Futures continue to be mixed given the lack of an overnight lead which could lead to a further lack of confidence with short term resistance at the 27400 point level needing to be cleared:

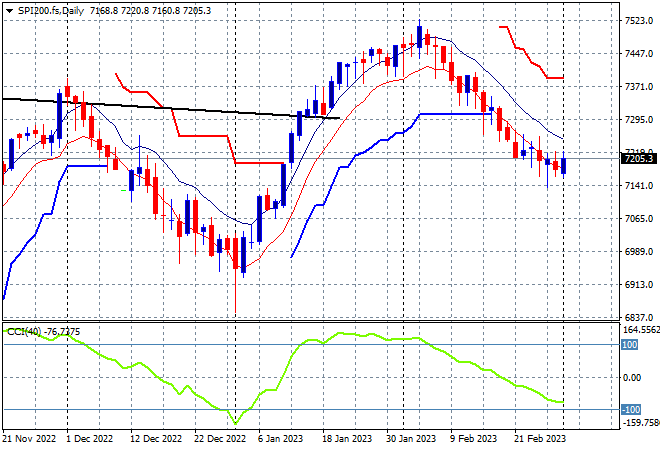

Australian stocks were unable to gain any traction in the wake of the GDP and inflation prints with the ASX200 closing 0.1% lower to remain above the 7200 point level, finishing at 7251 points. SPI futures are also dead flat again despite the minor pullback on Wall Street overnight. The daily chart is still showing a clear downtrend after being unable to take out 7500 points, with a retracement below ATR support at the 7200 point level possibly firming as daily momentum continues its reversion. However I do note the classic long tail of buying support that maybe indicating a potential bottom or deceleration at least on the daily candle:

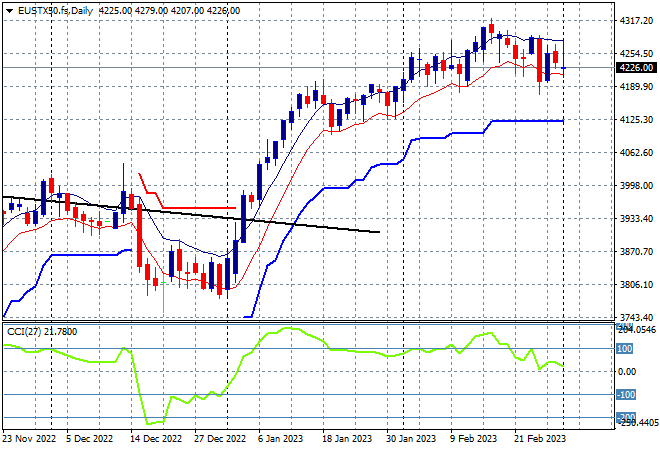

European markets deepened the previous session losses across the continent, as the Eurostoxx 50 Index closed more than 0.5% lower to 4215 points, as it fails to get back to the recent new weekly high. Futures are indicating a slight pullback of those gains as Wall Street fizzed into the close where I’ll be watching the ability to stay above the 4200 point level to see if support remains firm. Daily momentum has moderated but remains in the positive zone:

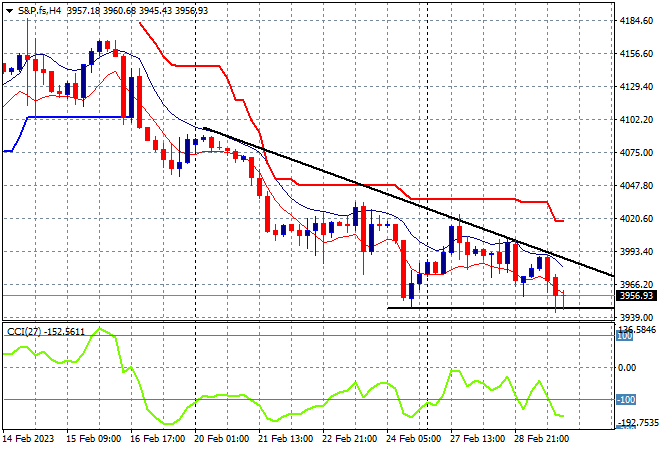

Wall Street again was unable to build yet again with the NASDAQ finishing 0.7% lower while the S&P500 managed another 0.4% loss to remain well below the key 4000 point support level, closing at 3951 points. The four hourly chart shows price action still below last week’s downtrend with former ATR and psychological support at the 4000 point area possibly turning into resistance. Daily momentum has switched back into oversold reading again so I’m looking for potential further falls ahead this week:

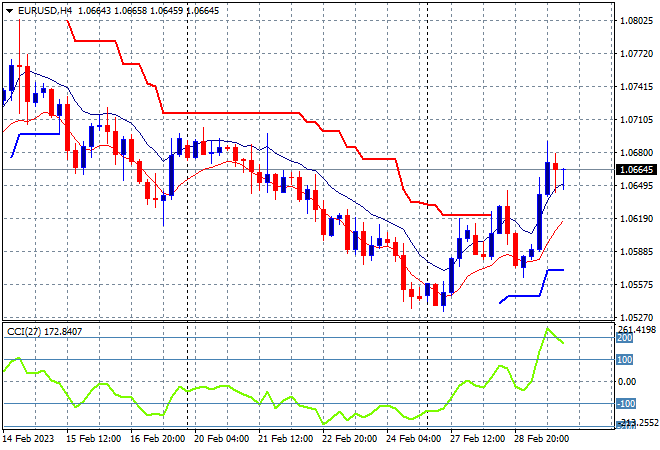

Currency markets are finally getting out of the uber USD strength with stronger than expected German inflation helping lift Euro to a new almost two week high, as it almost got through the 1.07 handle overnight. The four hourly chart was showing a dominant downtrend with a failure to make any new highs all of last week but this bounce off the 1.05 level has now pushed through short term resistance and could have the legs to push the union currency back to the 1.07 handle:

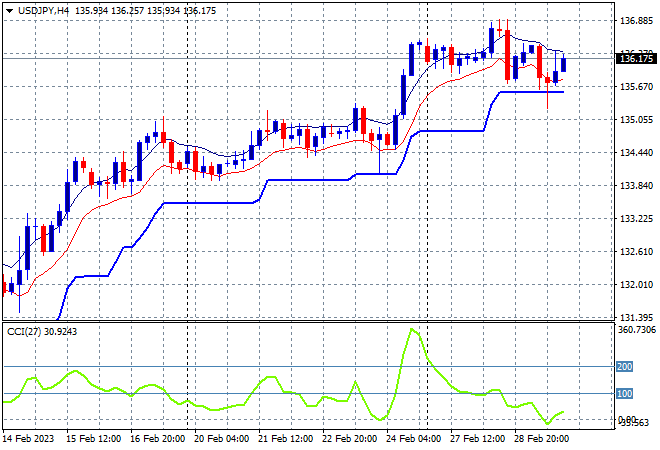

The USDJPY pair remains in its sliding sideways position with the mid week attempted breakout failing to push through the 137 level. Short term momentum has retraced from being seriously overbought to barely positive with price action now getting close to trailing ATR support so this minor consolidation must be watched for a possible selloff, with the mid 135 level the key area of contention:

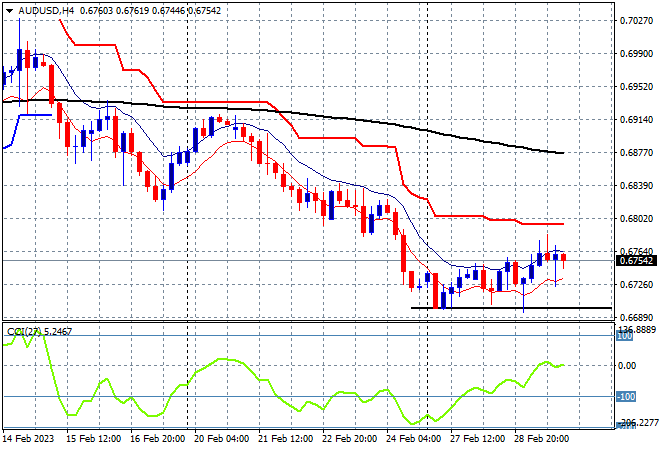

The Australian dollar was again unable to follow Euro amid USD weakness with another very small lift above the 67 level overnight, sitting in a very weak position as of this morning. Overall price action remains weak following the previous week’s unemployment numbers that has not yet challenged interest rate expectations with my view of a further pullback and new weekly lows coming to pass. The new monthly low is holding here at least but overhead resistance at the 68 level looms large:

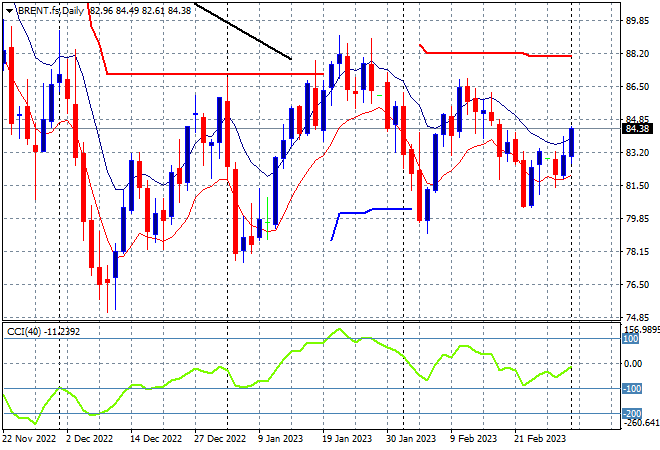

Oil markets are trying to bounceback with a stronger session overnight pushing Brent crude back above the $84USD per barrel level. Daily momentum had sharply inverted into the negative zone but never got oversold, indicating some buying support below. Overall however, price action has still failed to beat the $88 highs from January so this sideways at best move will continue:

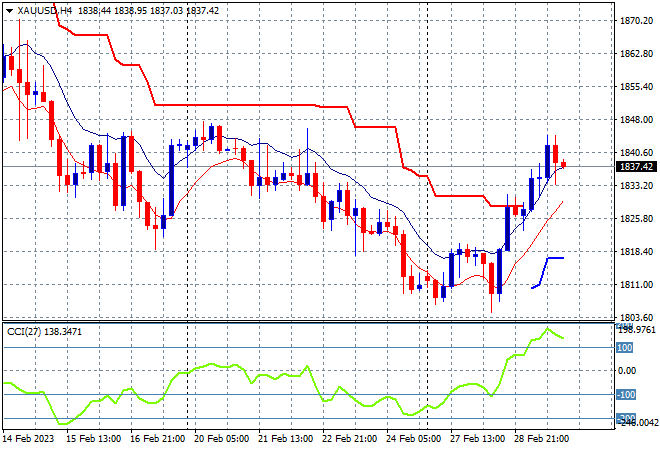

Gold remains depressed but managed a continuation of a proper lift off the recent bottom, closing at the $1837USD per ounce level to stave off another daily low and to clear short term resistance on the four hourly chart. The next level to beat is overhead resistance on the daily chart at the $1850 level so there’s still a little while to go before calling this a bottom. I would contend we could see another rollover and a test of the start of year position below the $1800 level: