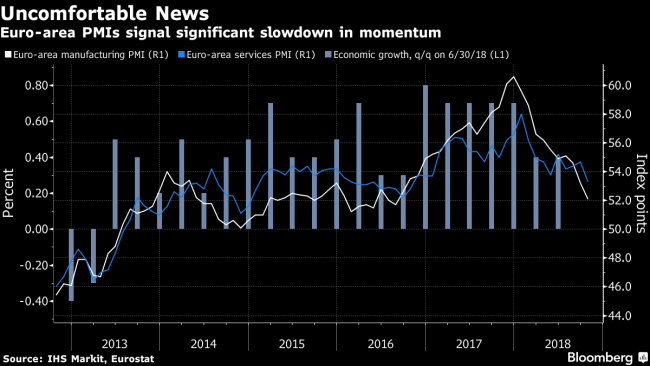

(Bloomberg) -- U.S. stocks extended losses for a sixth day, led by declines in communication services and technology companies, as concern lingers that profit growth has peaked and tariffs weigh on optimism. The dollar strengthened as a weaker-than-expected manufacturing gauge reading in Europe helped undercut the euro.

The S&P 500 Index traded near the lows of the day, hurt as disappointing earnings from AT&T (NYSE:T) Corp. and Texas Instruments (NASDAQ:TXN) Inc. The Dow Jones Industrial Average got an initial boost before fading after its biggest component by weighting, Boeing (NYSE:BA) Co., rallied on a positive profit forecast. Shares of home builders slumped after new home sales fell more than expected, showing that the consequences of higher interest rates are trickling down to the consumer.

“There’s just right now a heightened sensitivity to what can go wrong,” Kate Warne, investment strategist at Edward D. Jones & Co., said in an interview at Bloomberg’s New York headquarters. “So we will have more of these days where stocks move a lot within the day as everyone’s trying to sort through what do today’s reports mean.”

The pound weakened on Brexit worries, and European bonds followed Treasuries higher. The euro dropped following disappointing manufacturing data.

Sentiment remains fragile as global shares chart a course for the worst month in more than three years. The cautious mood was further damped by renewed worries over the impact of tariffs after industrial bellwether Caterpillar Inc (NYSE:CAT). warned about rising costs due to higher steel prices. European politics is also in focus, with Italian Prime Minister Giuseppe Conte doubling down on his government’s budget and U.K. Prime Minister Theresa May’s cabinet descending into conflict.

Retailers were the biggest winners in the Stoxx Europe 600 Index. A turnaround in China’s markets helped the MSCI Asia Pacific Index avoid a bear market even as it edged down.

“Right now markets are still trying to reprice,” said Chris Zaccarelli, chief investment officer at the Independent Advisor Alliance. “What’s happening with earnings is exaggerating market moves.”

Elsewhere, oil rebounded after touching the lowest in almost two-months on a pledge by Saudi Arabia to meet any shortfall that materializes from Iranian sanctions. Emerging-market currencies and shares climbed.

Here are some key events coming up this week:

- Earnings season rolls on with notable highlights including Twitter, UBS and Total.

- Monetary policy decisions are due in Sweden and Canada.

- ECB policy makers could on Thursday confirm that asset purchases will end this year, reiterating its pledge to keep interest rates at record lows through summer 2019. President Mario Draghi will hold a press conference.

- U.S. gross domestic product growth may have slowed in the third quarter, yet remained near its best pace since mid-2015, according to forecasts ahead of Friday’s release.

These are the main moves in markets:

Stocks

- The S&P 500 dropped 1.3 percent as of 11:09 a.m. in New York, while the Dow Jones Industrial Average slumped 1 percent and the Nasdaq Composite Index eased 1.6 percent.

- The Stoxx Europe 600 climbed 0.5 percent, the first increase in six days.

- The U.K.’s FTSE 100 gained 0.7 percent, the first increase in three days.

- Germany’s DAX Index gained 0.1 percent higher, the first increase in six days.

- The MSCI Emerging Market Index eased 0.3 percent.

- The MSCI Asia Pacific Index slumped 0.3 percent.

Currencies

- The Bloomberg Dollar Spot Index was 0.3 percent stronger after reaching the highest level of the year.

- The euro declined 0.6 percent to $1.1405.

- The British pound fell 0.4 percent to $1.2928.

- The Japanese yen weakened 0.1 percent to 112.56 per dollar.

Bonds

- The yield on 10-year Treasuries dropped five basis points to 3.12 percent, while the two-year note yield fell two basis points to 2.86 percent.

- Germany's 10-year yield fell one basis point to 0.40 percent.

Commodities

- West Texas Intermediate crude rose 0.6 percent to $66.83 a barrel.

- Gold was little changed at $1,231.02 an ounce.