* Asian shares hampered by worries over Sino-U.S. trade war

* Emerging market currencies seen fragile despite latest rebound

* U.S. markets closed for Labor Day

By Hideyuki Sano

TOKYO, Sept 3 (Reuters) - Asian stocks dipped on Monday on worries about further escalation of the U.S-China trade war and unstable emerging market currencies.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.2 percent while Japan's Nikkei .N225 fell 0.4 percent though trade could be subdued due to a U.S. market holiday on Monday.

"It looks almost certain that Trump will impose 25 percent tariffs on $200 billion worth of imports from China," said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley (NYSE:MS) Securities.

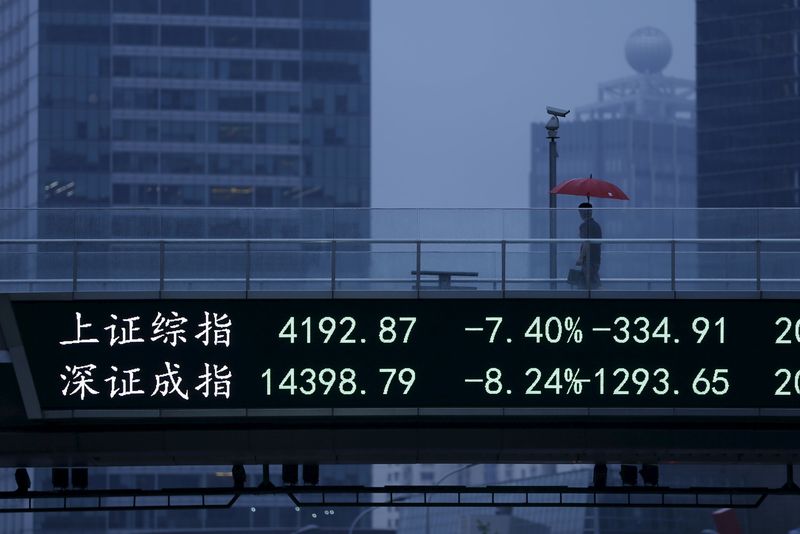

Trump said last week he is ready to implement the new tariffs as soon as a public comment period on the plan ends on Thursday, which would be a major escalation after it has applied already tariffs on $50 billion of exports from China. shares .SSEC fell 5.3 percent last month on worries about the trade war while U.S. shares, especially technology shares, have fared better thanks in part due to the strength of the current economic data and corporate profits.

The Nasdaq index .IXIC gained 5.7 percent last month.

Major economic U.S. data due this week, such as a manufacturing survey on Tuesday and employment report on Friday, is also expected to show solid conditions.

"U.S. shares and only a handful of countries are likely to continue to attract global funds," said Mitsubishi's Fujito.

Trade war worries have lifted the safe-haven Swiss franc, which hit a four-month high of 0.9654 franc to the dollar CHF= and one-year high of 1.1240 per euro EURCHF= on Friday. It last stood at 0.9696 and 1.1250.

The Australian dollar AUD=D3 , sometimes used as a proxy for bets on China, changed hands at $0.7191, having hit a 20-month low of $0.7171 on Friday.

The euro traded little changed at $1.1600 EUR= while the yen changed hands at 111.12 per dollar JPY= , also flat.

The British pound slipped 0.3 percent to $1.2923 GBP=D4 after European Union's chief Brexit negotiator Michel Barnier reportedly said he was strongly opposed to UK Prime Minister Theresa May's proposals on future trade. remained wary of some battered emerging market currencies, which have been through one of the biggest selloffs in recent years, although though they rebounded slightly on Friday.

The Turkish lira stood at 6.6000 per dollar TRYTOM=D3 in early Monday trade, down 0.8 percent.

Oil prices held near their highest levels since mid-July, supported by impending U.S. sanctions on Iran's oil industry and falling Venezuelan output.

Benchmark Brent crude oil LCOc1 was almost flat at $77.59 per barrel, not far from Thursday's seven-week high of $78.03 per barrel.

U.S. crude futures CLc1 fetched $69.82 per barrel, not far off $70.50 marked on Thursday, their highest levels since July 20.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ MSCI, Nikkei datastream chart

http://reut.rs/2sSBRiD

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>