- Inflation data, Fed FOMC meeting minutes, start of Q3 earnings season will be in focus this week.

- AMD is a buy as it holds its annual 'Advancing AI 2024' event.

- Delta Air Lines is a sell with disappointing earnings, soft guidance on deck.

- Looking for more actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

Stocks on Wall Street ended higher on Friday, with the Dow Jones Industrial Average closing at a fresh record after encouraging U.S. employment data helped soothe fears of a recession.

All three major U.S. stock indexes posted a fourth straight week of gains, with the blue-chip Dow and benchmark S&P 500 both increasing about 0.2% for the period. The tech-heavy Nasdaq Composite added 0.1% during the week.

Source: Investing.com

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for the economy and interest rates.

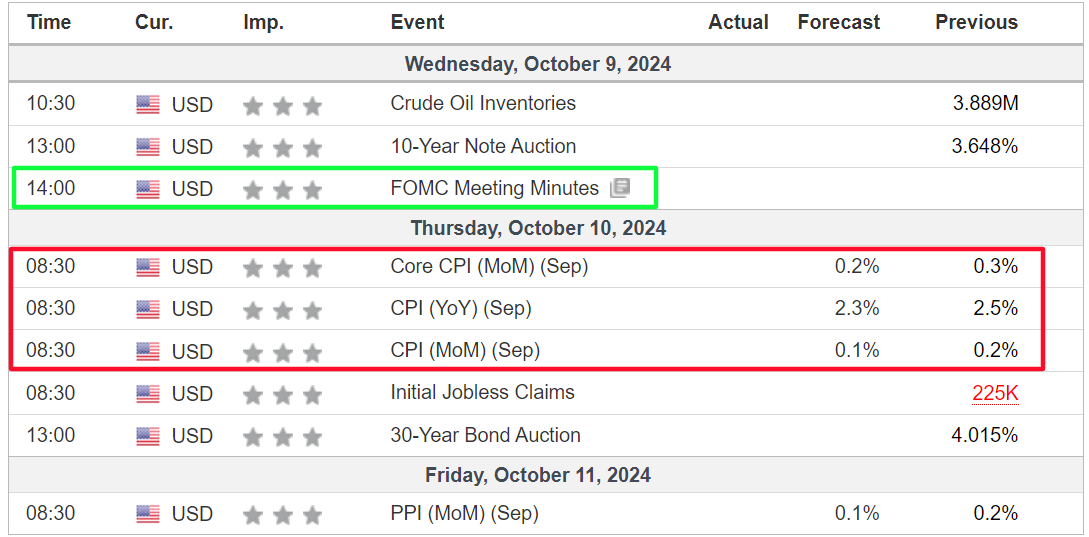

On the economic calendar, most important will be Thursday’s U.S. consumer price inflation report for September, which is forecast to show annual CPI rising 2.3%, slowing from the 2.5% increase recorded in August.

The CPI data will be accompanied by the release of the latest figures on producer prices, which will help fill out the inflation picture.

Source: Investing.com

Also on the agenda will be the minutes of the Federal Reserve’s September FOMC policy meeting, due on Wednesday.

As of Sunday morning, investors see a 93% chance of the Fed cutting rates by 25 basis points at its November meeting, and a 7% chance of no action, according to Investing.com’s Fed Monitor Tool.

Elsewhere, the third-quarter earnings season is set to get underway, with JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), BlackRock (NYSE:BLK), PepsiCo (NASDAQ:PEP), and Delta Air Lines (NYSE:DAL) some of the big names due to report.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, October 7 - Friday, October 11.

Stock to Buy: Advanced Micro Devices

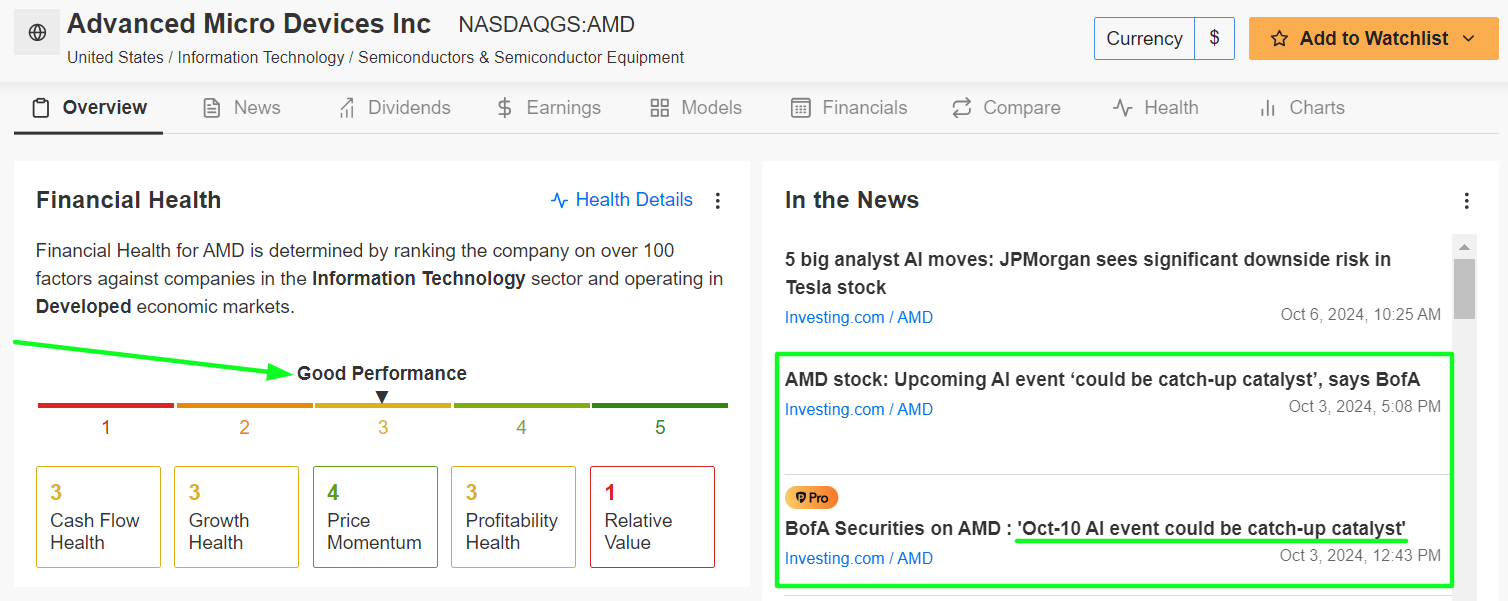

Advanced Micro Devices (NASDAQ:AMD) stands out as a top buy this week, with its highly anticipated 'Advancing AI 2024' event set to be a major catalyst for the chip stock.

AMD stock jumped 5% on Friday to end the week at $170.90, its best level since July 16. Shares of the semiconductor company have gained 16% in the year to date. At its current valuation, Santa Clara, California-based AMD has a market cap of $276.6 billion.

Source: Investing.com

AMD’s highly profile AI event will take place on Thursday at 12:00 PM ET in San Francisco and it will spotlight AMD’s next-generation Instinct accelerators and 5th Gen AMD EPYC server processors, key products in the AI and high-performance computing space.

Additionally, AMD is expected to discuss innovations in networking, AI PC updates, and its AI solutions ecosystem.

With CEO Lisa Su leading the charge, the event will also include AMD executives, ecosystem partners, and developers who will discuss the tech company's transformative role in reshaping AI and high-performance computing.

AMD shares tend to rally during the week of its AI events. Last year, the stock surged nearly 10% the day after the event, and analysts expect a similar response this time around.

The chipmaker has a has a strong track record of receiving several analyst upgrades following its major product presentations.

As InvestingPro points out, AMD has an above-average Financial Health Score of 3.0/5.0, supported by its upbeat profitability outlook and strong sales growth prospects thanks to the buzz around its next-gen AI products.

Source: InvestingPro

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to InvestingPro with an exclusive 10% discount and position your portfolio one step ahead of everyone else!

Stock to Sell: Delta Air Lines

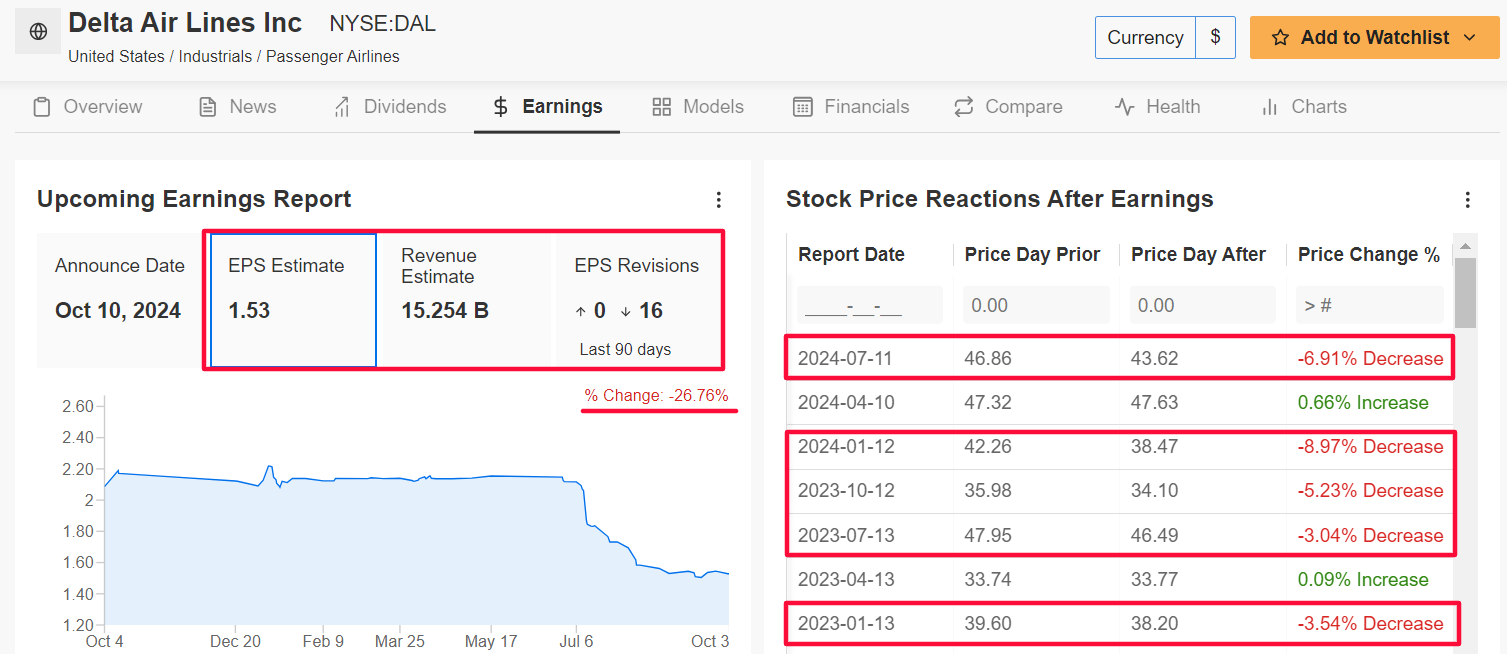

In contrast, Delta Air Lines is facing mounting headwinds as it approaches its Q3 earnings release on Thursday at 6:30 AM ET. Soft consumer spending, driven by a challenging economic environment, as well as higher oil prices have put pressure on Delta’s profitability and revenue.

As could be expected, an InvestingPro survey of analyst earnings revisions reveals growing pessimism ahead of the Q3 print, with all 16 analysts covering Delta revising their profit estimates downward in the last 90 days.

Source: InvestingPro

Market participants expect a sizable swing in DAL stock after the print drops, according to the options market, with a possible implied move of 6.5% in either direction.

Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with Delta’s stock gapping down nearly 7% when the company last reported quarterly numbers in July.

Wall Street sees the Atlanta, Georgia-based airliner earning $1.53 a share, a sharp decline of 24.6% from last year’s EPS of $2.03. This significant drop is attributed to rising operational costs and shrinking operating margins, which are weighing heavily on the company’s bottom line.

Meanwhile, Delta is expected to post a modest 4.4% increase in revenue, up to $15.2 billion.

Looking ahead, Delta CEO Ed Bastian is likely to strike a cautious tone regarding the company’s fiscal 2025 outlook, reflecting ongoing concerns over weakening demand for air travel, as well as increasing pressure from higher fuel costs and broader economic concerns.

DAL stock closed at $49.28 on Friday. Shares are up 22.5% in 2024.

Source: Investing.com

At current valuations, Delta has a market cap of $31.6 billion, making it the most valuable airline company in the world, ahead of industry peers such as Ryanair (NASDAQ:RYAAY), United Airlines (NASDAQ:UAL), Southwest Airlines (NYSE:LUV), LATAM Airlines (NYSE:LTM), and American Airlines (NASDAQ:AAL).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and unlock access to several market-beating features, including:

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.