The December US jobs report aka NFP came and went on Friday night, and while unemployment went down with more jobs than expected, it was the lower wage growth figures that got markets excited. Wall Street rallied over 2% and the USD slumped as the possibility of lower and fewer Fed rate hikes due to the jobs report was pushed to the forefront. Everything undollar went up with the Australian dollar almost getting back above the 69 handle. Bond markets sold off with US 10-year Treasury yields falling 16 points to 3.56% while the commodity complex saw oil prices consolidate again from their recent losses as Brent crude steadied at the $78USD per barrel level while gold zoomed up to a new monthly high above the $1860USD per ounce level.

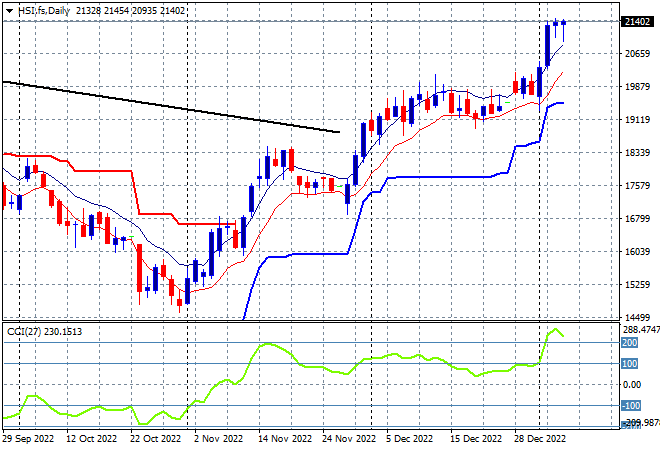

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets lifted higher going into the lunch break but took back most of those gains at the close with the Shanghai Composite finishing just a handful of points higher at 3157 points while the Hang Seng Index also eased off its recent strong bounce, down nearly 0.3% to remain well above the 21000 point level. The daily chart continues to look quite boisterous here with a series of step ups since the nadir in October last year as daily momentum remains in to extreme overbought mode. It looks like weekly support at the 19000 point level is quite firm as traders bet on a post zero-COVID economic liftoff, but the question is this move sustainable:

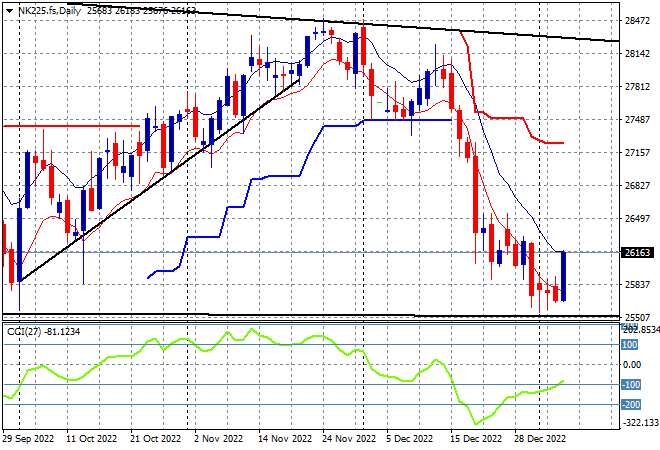

Japanese stock markets tried to regain lost confidence with the Nikkei 225 eventually finishing 0.6% higher at 25973 points. The market will be closed for another holiday today with the weaker Yen on Friday night translating into bigger gains on the open tomorrow as a swing long trade develops here after bottoming out at the 25000 point level. Daily momentum was oversold and support has held here with futures indicating a big bounce ahead:

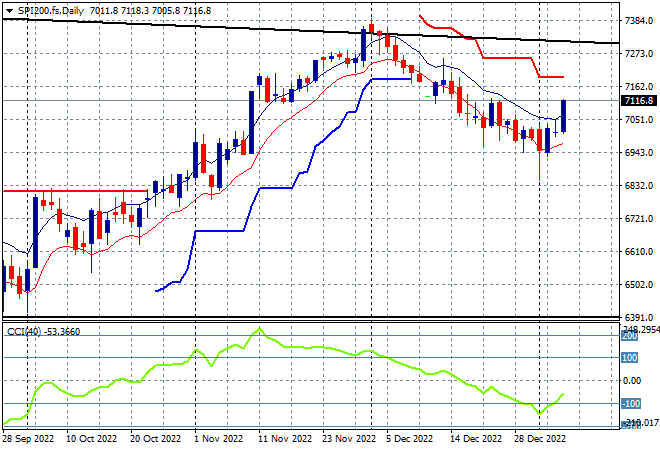

Australian stocks finished the week in a better fashion with the ASX200 eventually lifting some 0.6% to remain above the 7000 point level at 7109 points. SPI futures are up at least 1% as they gain confidence from the big surges on Wall Street bounce Friday night. The daily chart has been showing price action and daily momentum in a decline since the start of December so the NFP catalyst could be what is required to get that confidence moving again with a breakout likely here above the high moving average:

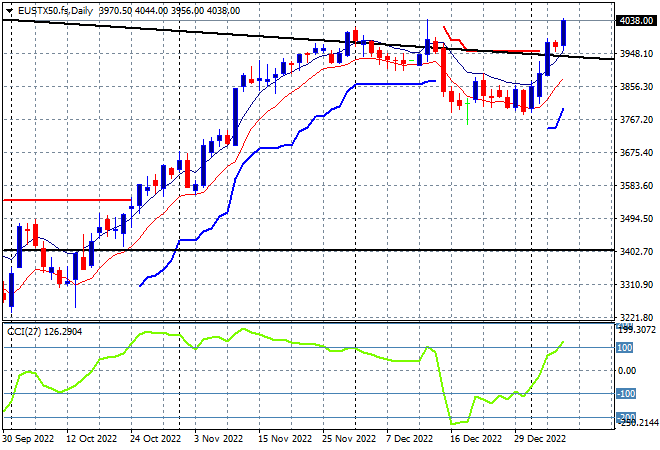

European markets were able to translate the recent stumble into some better gains despite the higher Euro with the Eurostoxx 50 Index bouncing well above recent price highs to finish the week at 1.5% higher and finally breaking through the 4000 point level. The daily chart showed key overhead resistance at the 3900 point area under contention before the NFP print as daily momentum built up from a swing trade into a proper breakout. The 4000 point level is the key psychological resistance level that could be turned into support going forward:

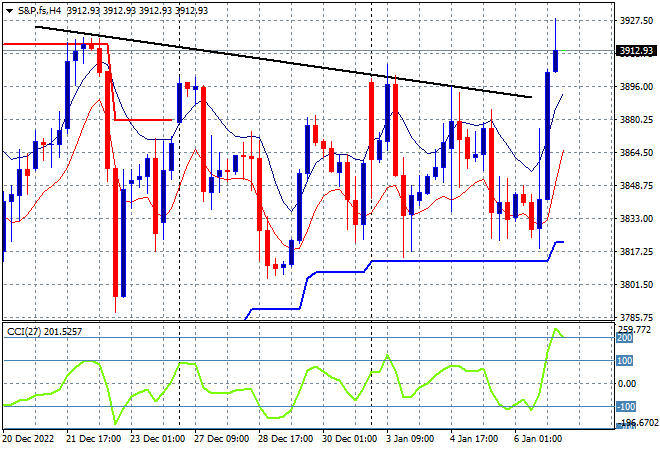

Wall Street rallied hard on the good-but not so good NFP print after failing to make any headway through the trading week with the NASDAQ lifting more than 2.5% higher while the S&P500 gained 2.2% to close above the 3900 point level and breaking the series of lower daily highs since Xmas. Price action has broken above the dominant medium term trendline after hovering around weekly support at the 3800 point level, but it must punch through the December highs next to seal the deal for the rest of the month before the next NFP:

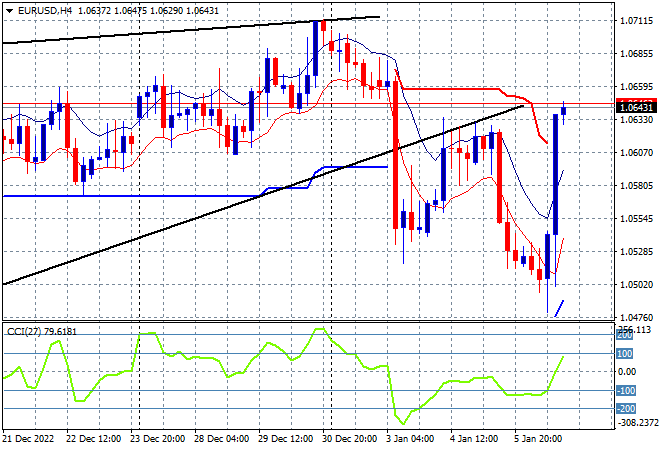

Currency markets saw USD whipped into shape following the US jobs report, with Euro pushed straight back through the 1.06 handle as a result. The 1.0530 area wasn’t defended as strongly as it should have before the print, enticing in quite few short sellers before zooming back up towards but not above the start of week area. This keeps price action just near the lower edge of a bearish rising wedge and needs more upside from here at the 1.07 level at a minimum before calling this a bottom:

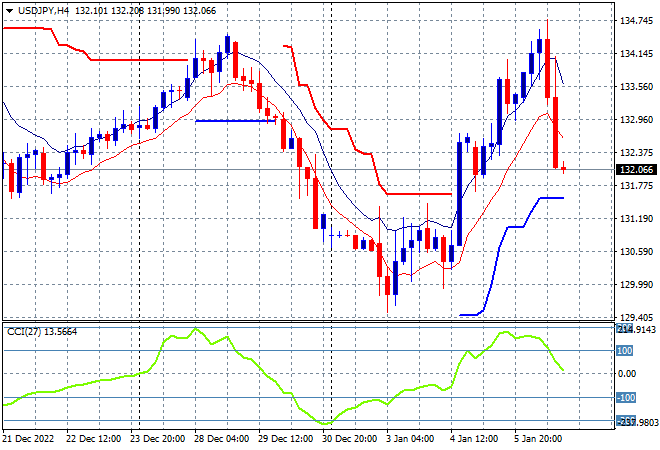

The USDJPY pair lost ground as a result, despite a mid week breakout on the back of more hawkish Fed talk with a retracement back down to the 132 handle. A swing back up to the Xmas highs around the 134 handle was nearly complete before the NFP print on Friday night, matching the previous end of year highs but unable to extend further. This could find more support at trailing ATR support near the 131 mid level or overshoot back down to the start of year level around 129 or so:

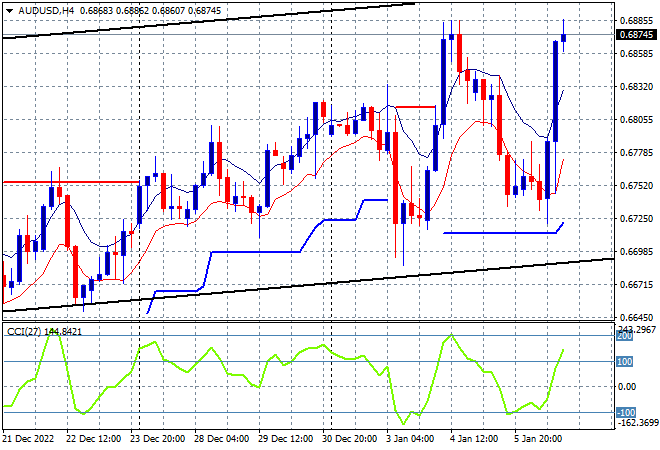

The Australian dollar was under the pump again, pushed back to the recent highs just below the 69 level in a broad USD negative mood. The recent surge back above the 68 handle had found resistance just below the 69 level with short term momentum now back to the same levels so the question is can the Pacific Peso break through it again or keep oscillating in this broad weekly uptrend channel:

Oil markets remain under pressure as energy prices falter in a warm northern hemisphere with Brent crude stabilising somewhat at the $78USD per barrel level again on Friday night, hovering just above the December lows. Daily momentum is looking to return to oversold settings after failing to get into positive territory with overhead ATR resistance and the dominant downtrend still in play:

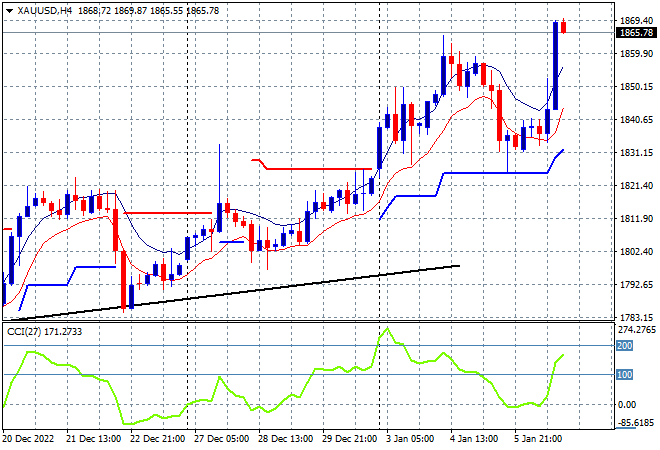

Gold is still being the most resilient undollar, even though it overshot recently it retraced back in full on Friday night, zooming up to a new monthly high at the $1860USD per ounce level. Trailing ATR support at the $1820 level remained intact which is a very solid sign for more upside potential. The key area to watch as 2023 gets underway is for the $1800 zone to turn into a solid area of support, and hopefully not turn into resistance, with a view to staying above the daily uptrend line: