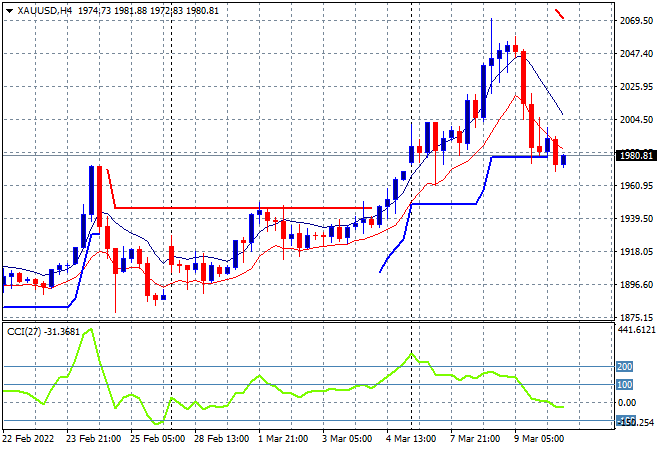

Stock markets are enjoying a big bounce across Asia in response to the risk on moves in European markets, although it remains to be seen if this is just short covering or a wider move as the situation in Ukraine has not changed. Tonight’s ECB meeting and then the US core inflation print will be in focus next, with Oil steady after dropping over 10% overnight while the Australian dollar is oscillating around the 73 handle. Meanwhile gold is deflating after getting crushed overnight, now down to the $1980USD per ounce level on a much overdue correction:

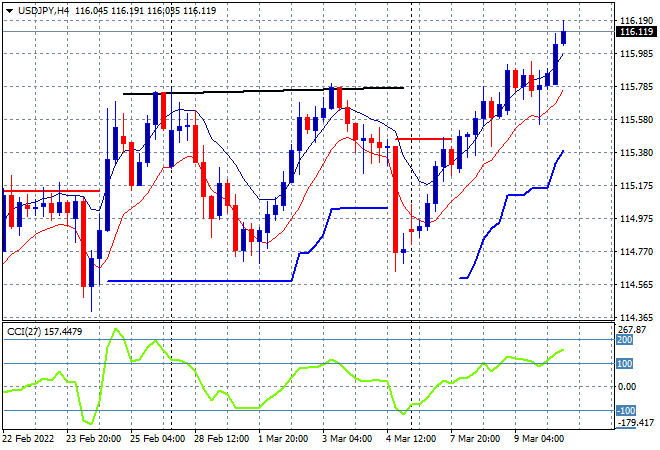

Mainland Chinese shares are doing pretty well so far with the Shanghai Composite currently up 1.4% to 3300 points even while the Hang Seng Index is dragging the chain, up only 0.7% to be at 20750 20311 points. Japanese stock markets are putting in stonking sessions, with the Nikkei 225 closing nearly 4% higher at 25670 points with the USDJPY pair continuing its bounceback to exceed the previous weekly highs and breach the 116 handle in a strong move:

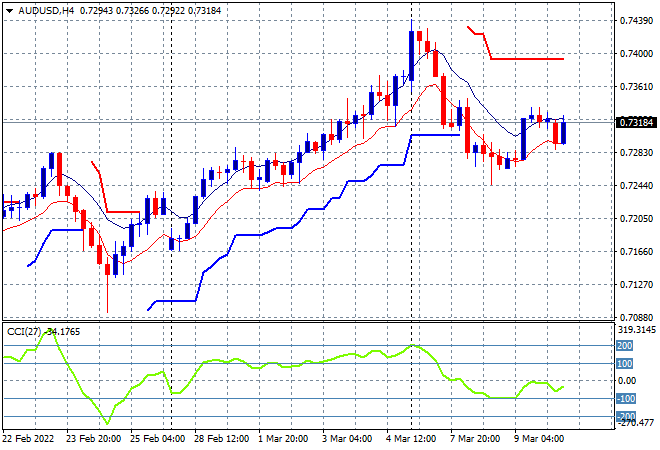

Australian stocks had a solid run with the ASX 200 finishing 1.1% higher to get back above the 7100 point level, closing at 7130 points. Meanwhile the Australian dollar is oscillating around the 73 handle, unable to make headway after its start of week descent, still pushing on short term support as the London session gets underway:

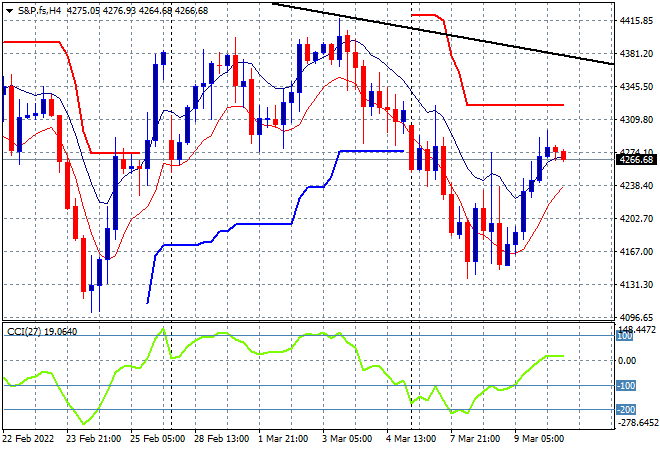

Eurostoxx and Wall Street futures are holding on to their overnight gains as the possibility of a bottom building is exciting traders across both sides of the Atlantic but the S&P500 four hourly chart shows a lot of overhead resistance that needs to be cleared first before getting too excited:

The economic calendar ramps up with the latest ECB meeting and US core inflation.