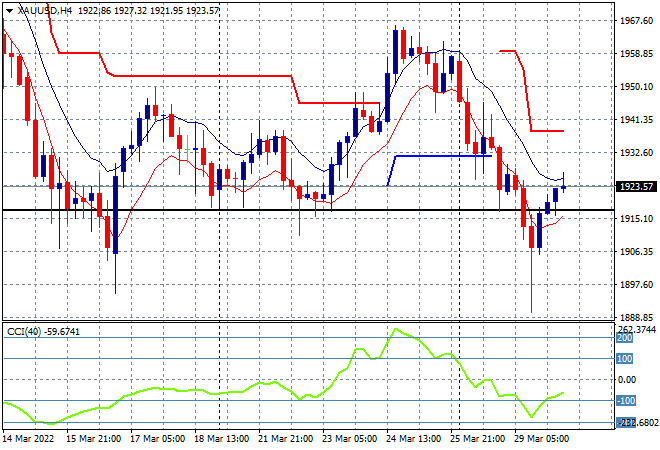

Asian stock markets have bifurcated in risk again with Japanese shares lagging due to some poor retail sales data and a stronger Yen while Chinese and Australian shares continue to rebound. The USD is losing ground against everything, with Yen, Euro and Aussie all higher going into the London session with oil prices pulling back again, as Brent crude remains below the $110USD per barrel level while gold is licking its wounds after it bounces off its previous weekly lows, currently just above the $1920USD per ounce level:

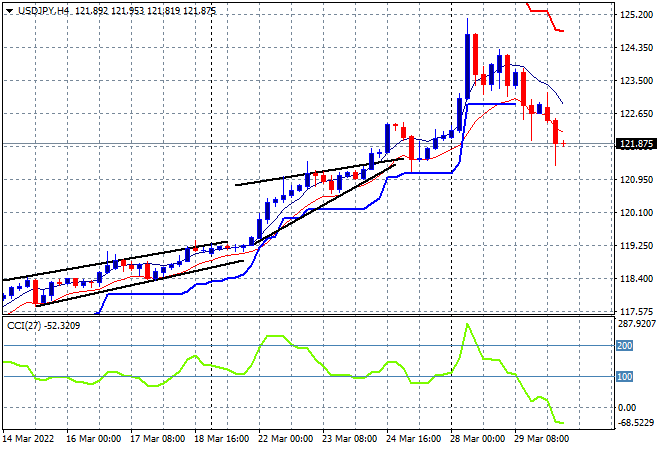

Mainland Chinese shares are zooming higher in the afternoon session, with the Shanghai Composite currently up 1.4% to 3249 points while the Hang Seng Index has continued its bounceback to climb 1.3%, currently at 22214 points. Japanese stock markets are in retreat however on the poor retail sales print and higher Yen with the Nikkei 225 down 1.3% to 27783 points while the USDJPY pair has reversed course to be back below the 122 handle after getting way ahead of itself:

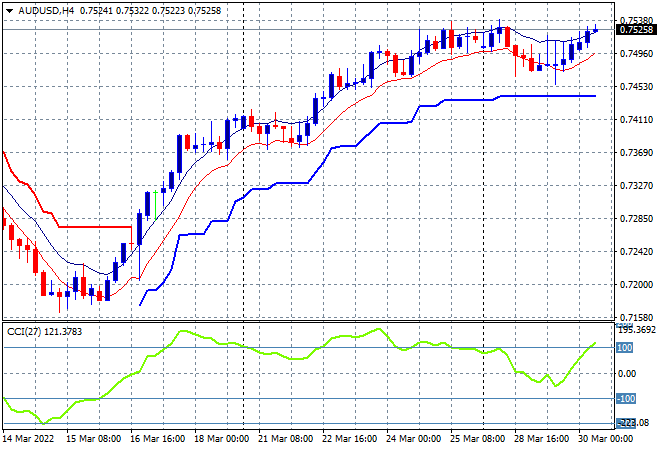

Australian stocks had a very solid session with the ASX200 closing 0.7% higher to 7514 points in post Budget bliss. Meanwhile the Australian dollar has picked up slightly in the afternoon session to be just above the 75 level after running out of puff overnight, gaining momentum in the short term:

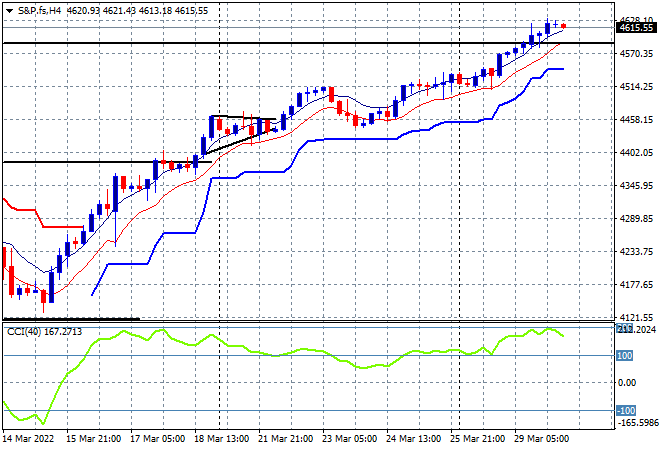

Eurostoxx and Wall Street futures are lifting slowly higher, still absorbing the previous night’s run with the S&P500 four hourly chart showing a desire to climb beyond the 4600 point level after last week confirming support at the 4400 point area as daily and four hourly momentum remain in overbought mode:

The economic calendar includes German inflation and the latest US GDP estimates plus private oil data prints.