Overnight saw Wall Street put in another strong session on the back of a two year high in US consumer confidence as traders position for tonight’s FOMC meeting. The USD remains firms against the major currency pairs with the Australian dollar looking unsteady as we go into this morning’s much anticipated CPI print.

US bond markets saw a small lift across the yield curve as interest rate expectations increased, with the 10 year lifting through to the 3.9% level while oil prices again rallied on European macro concerns with Brent crude advancing beyond the $83USD per barrel level. Gold is trying hard to hold on with another small lift higher above the $1960USD per ounce level.

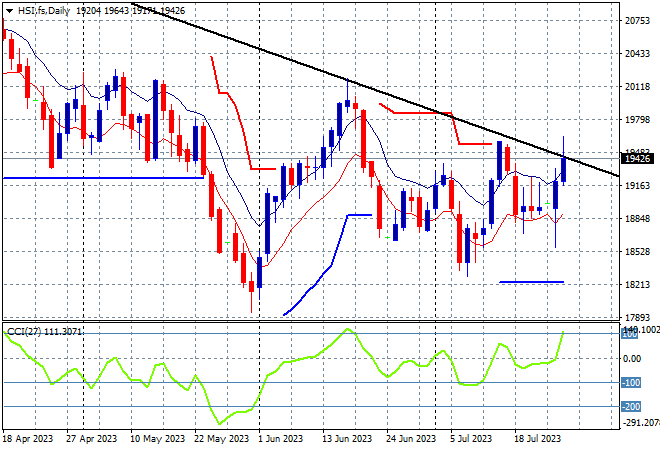

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets zoomed higher with the Shanghai Composite finishing more than 2% higher at 3231 points while in Hong Kong the Hang Seng Index doubled that, up more than 4% to burst through the 19000 point level, closing at 19445 points.

The daily chart is still showing how strong that 19000 point level remains as a point of control below the dominant downtrend (sloping higher black line) as confidence is trying to clawback here after almost touching the May lows. Another big breakout is brewing here as momentum gets overbought again:

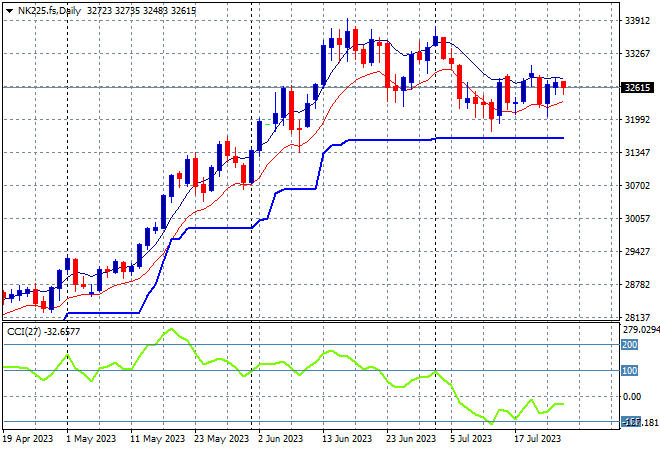

Japanese stock markets however finished flat with the Nikkei 225 closing at 32682 points.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with a welcome consolidation above that level. Daily momentum has retraced from overbought to slightly negative settings with this retracement down to the support zone possibly not yet over, as we watch for a possible breakout on any weakening Yen trend:

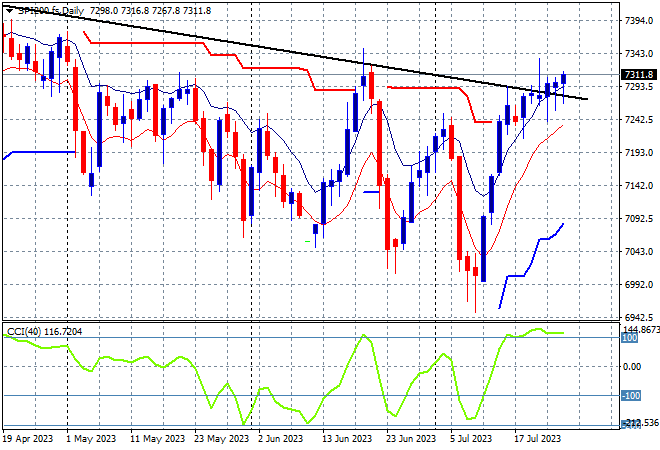

Australian stocks are putting in a better session in sympathy with Chinese stocks, with the ASX200 closing 0.5% higher at 7333 points.

SPI futures are up more than 0.5% due to the continued rally on Wall Street overnight, which could prove that the 7300 point level has firmed as short term support instead of resistance. Medium term price action remains on a downtrend with the daily chart just oscillating further down despite this continued bounce although price is about to beat the June highs for a potential breakout:

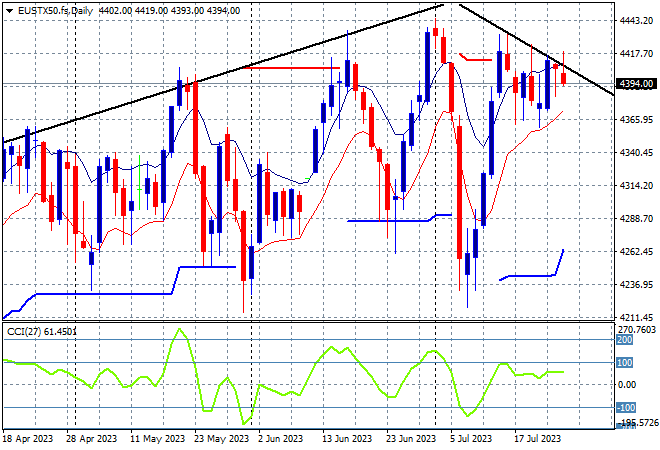

European markets were again unable to extend their recent gains with a mixed effort across the continent as the Eurostoxx 50 Index gained just 0.2% to remain under the 4400 point level, closing at 4391 points.

The daily chart showed this potential bull trap building even though weekly support at 4200 points had been continually defended, with weekly resistance at the 4350 points level the actual area to beat. Support has been broadly defended at 4200 points, touched three times now in as many months but the 4400 point resistance level is again firming so I remain wary on the short term Euro weakness:

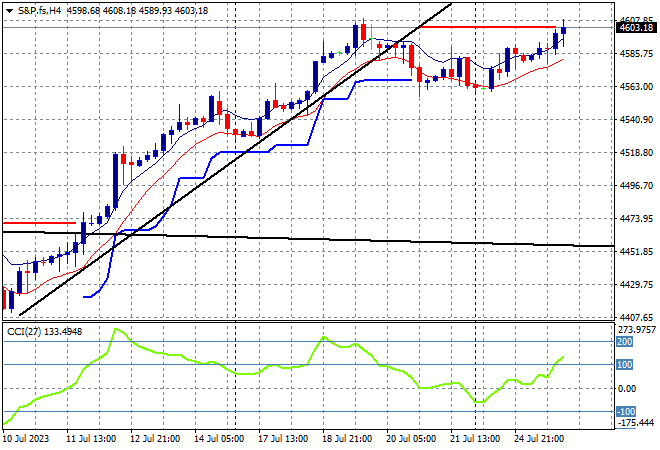

Wall Street had lifts across all three bourses with the NASDAQ this time leading the way, up nearly 0.7% while the S&P500 had a solid session gaining 0.3% to finish at 4567 points.

The four hourly chart shows that while the two week rally from the 4400 point low is technically over with resistance quite firm at the 4500 to 4600 point zone, the former highs are being tested again as earnings season surprises to the upside. The potential for a short term retracement below the 4550 area is slowly passing as resistance looks like weakening here:

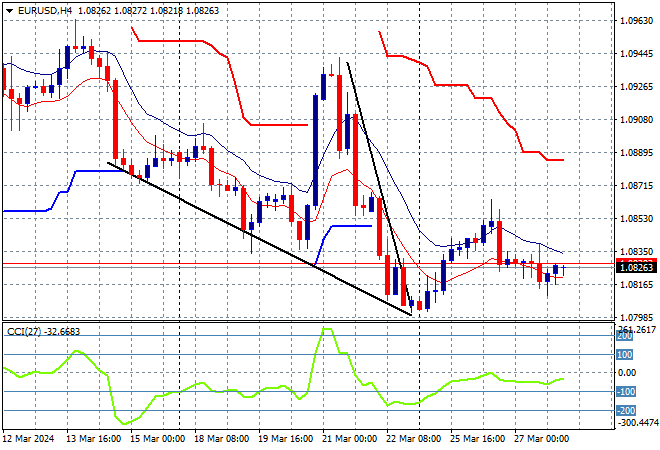

Currency markets continue to firm more and more to USD as traders await the first of this week’s triple whammy of central bank meetings with the FOMC setting the stage later tonight. The solid consumer confidence print saw USD advance against Euro again.

The union currency continues to decline after hitting resistance above the 1.12 handle all last week and subsequently broken through trailing four hourly ATR support back down to the mid 1.10 level. There’s almost no buying support evident here which I’m always cautious of!

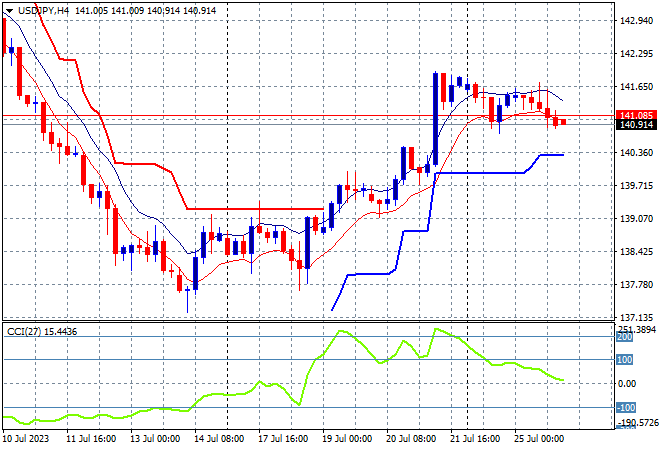

The USDJPY pair is trying hard to hold on to its Friday night gains as the BOJ signals a potential uplift in inflation targeting amid a stronger USD, with price action holding just above the 141 handle following an epic selloff in the previous week.

Four hourly momentum is still looking overcooked to the upside here with the return well below the June lows at the 140 level providing a firmer support level. This now stronger bounce has pushed through short term ATR resistance and could swing higher but momentum is moderating:

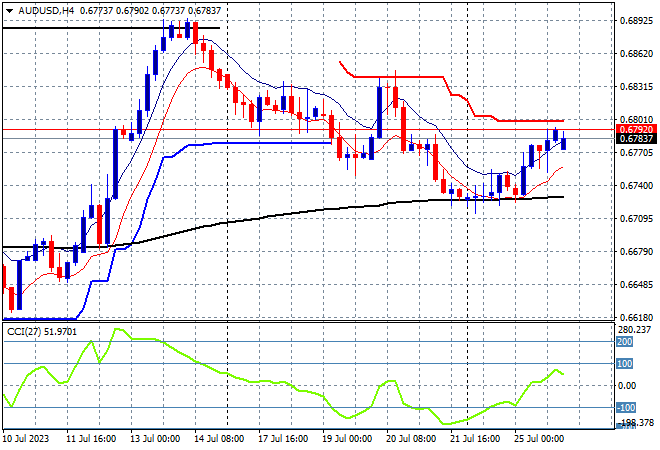

The Australian dollar remains in cautious mode although a small rally yesterday on the back of the PBOC stimulus action is seeing the 68 cent level tested as short term overhead resistance as price action is sniffing for a little move higher before today’s CPI print.

Recent price action put ATR resistance and 200 EMA (black line) levels under threat but short term momentum remains negative here without medium term upside potential building. Watch for a breakdown below the 200 EMA next if CPI undershoots:

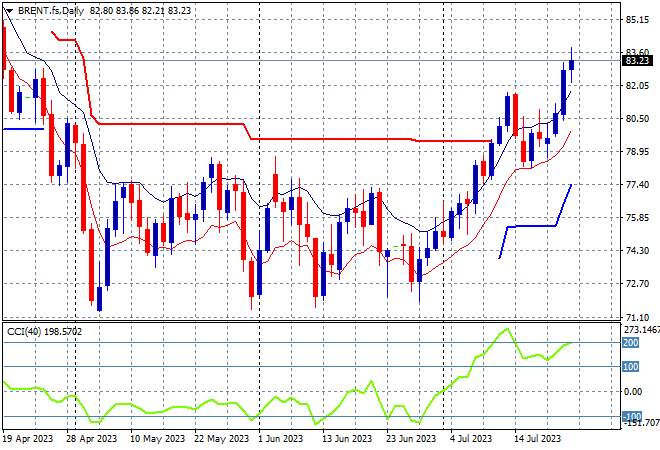

Oil markets are spiking again with another strong lift higher overnight this is brewing into a new uptrend with Brent crude pushing strongly through the $83USD per barrel level for a three month high.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance and setting up for a new potential uptrend:

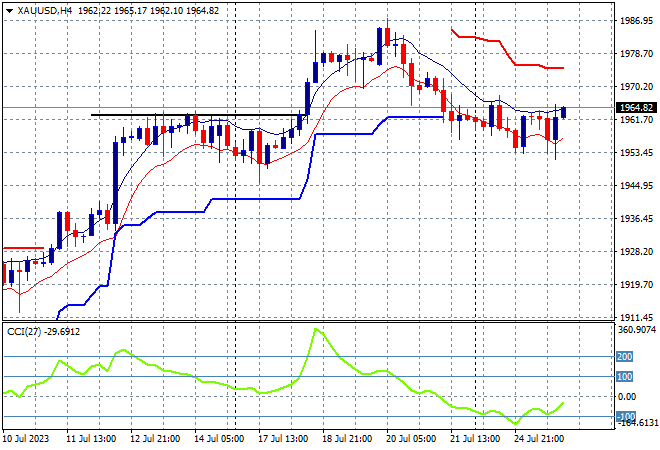

Gold had been helped along by the weaker USD in the previous trading week after recently threatening to rollover through the $1900USD per ounce level, but is still struggling to find direction here as it settles at the $1960 level, creating a potential bearish reversal pattern here.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level is over for now as the $1960-70 zone remains a point of control or perhaps resistance with price action looking like reverting back to the $1900 level first: