Wall Street worries turned into outright selling overnight with more earnings downgrades particularly in the bank sector plus mixed economic messages souring risk sentiment. This spilled over into European stocks with the USD firming against nearly everything. The Australian dollar is dicing with the 66 cent level as traders await today’s inflation print. 10 year US Treasury yields trumbled in the wake of a poorer than expected consumer confidence print, down to the 3.39% level. Meanwhile the commodity complex is not liking this double whammy with Brent crude almost finishing below the $80USD per barrel level as gold remains the odd one out, unable to get back above the $2000USD per ounce level but staving off a larger selloff compared to other undollars.

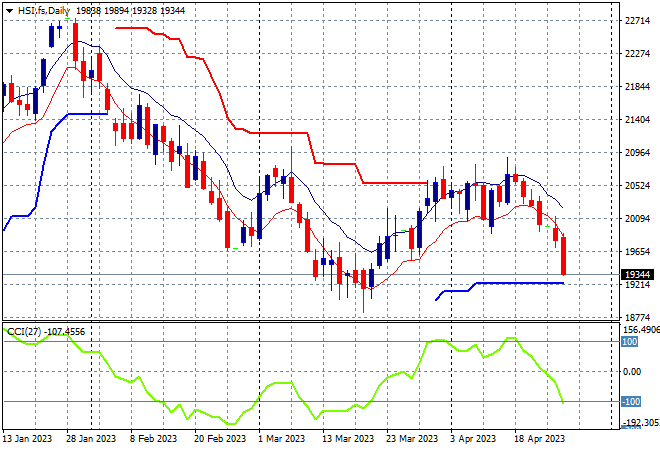

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets failed to recover from their recent sharp falls with another negative session, the Shanghai Composite down 0.3% to remain well below the 3300 point level, closing at 3264 points. Meanwhile the Hang Seng dropped even further, falling nearly 1.7% lower to its start of March position, closing at 19617 points. The daily chart was showing resistance building at the 20500 point level before this rollover with daily momentum unable to get into a clear overbought mode, as price action returns to the start of year correction phase. Watch for any break below the 19000 point level as an ominous sign:

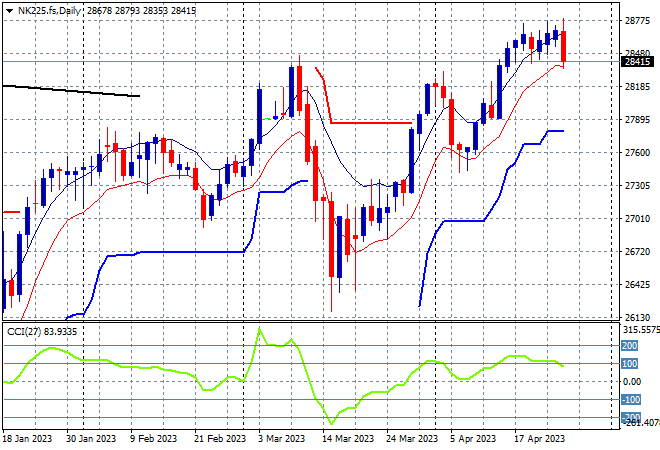

Japanese stock markets were again the best in the region, but only relatively speaking, with the Nikkei 225 closing 0.1% lower at 28620 points. Futures are indicating a much bigger pullback on the open in line with Wall Street woes as daily momentum reverts out of its overbought conditions as price action will now test support at the low moving average area with resistance firm just below the 29000 point level:

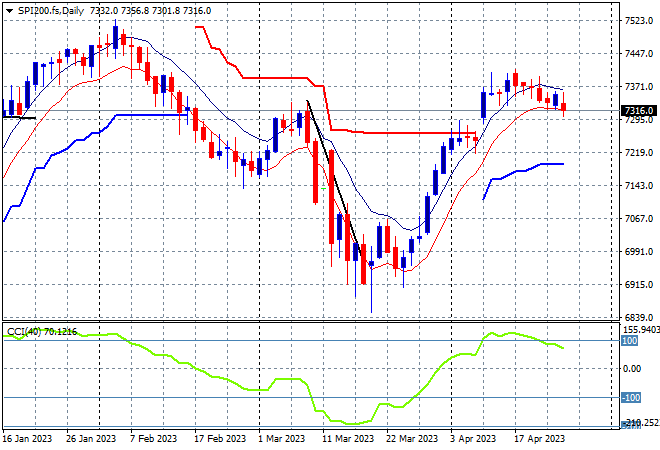

Australian stocks were closed yesterday with SPI futures indicating the ASX200 is likely to selloff at least 0.6% or more on the open and could be rattled more by the latest inflation print as well. This market looks a little more robust than others, helped by the lower Australian dollar, but the attempt to get back to the January levels is looking dicey at best as deceleration is likely to turn into selling here as a rounding top pattern is formed. Daily momentum has retraced from overbought and while this trend is well supported watch the low moving average for signs of a breakdown:

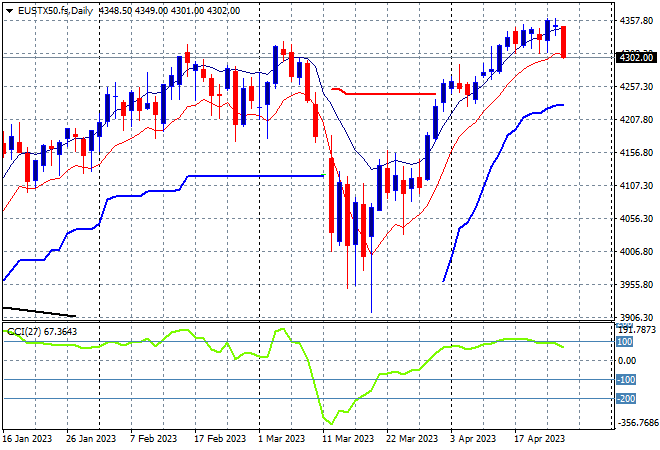

European markets were doing much better but caught the Wall Street bug with a selloff outside of German markets pushing the Eurostoxx 50 Index 0.5% lower to close at 4377 points. Another market that wants to extend above its previous March highs but daily momentum never really got into the overbought zone. This was looking like setting up for further gains but the volatility from Wall Street is now dragging down spirits as the low moving average on the daily chart is under threat so watch for another breakdown tonight:

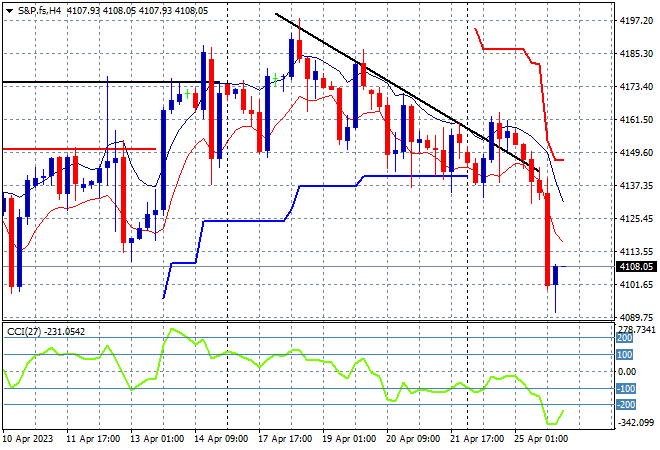

Wall Street lost its cool overnight with clear breaks across the major bourses as the NASDAQ finished nearly 2% lower while the S&P500 lost more than 1.5% to finish at 4071 points. The four hourly chart shows price action falling sharply back to the early April lows after breaking through short term support at the 4140 point level. There is a modicum of support here with the 4100 point are likely to turn into a contested space later on tonight:

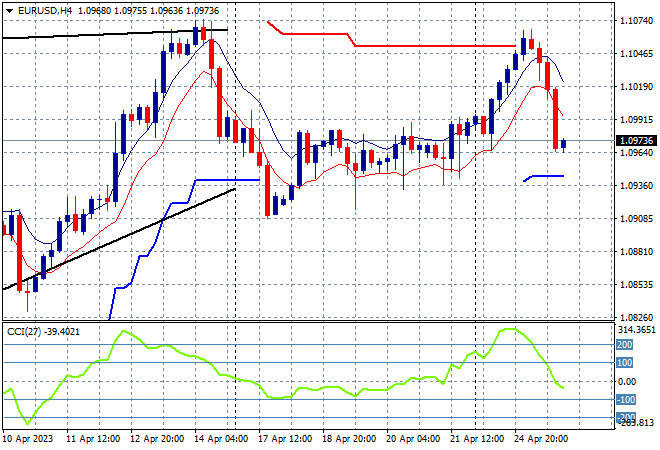

Currency markets are seeing the USD firm against almost everything as this week’s economic calendar provides continued upside volatility for the King Currency, with Euro slammed back overnight after hitting the 1.10 handle at the start of the week. The Union Currency is now back to last week’s point of control at just above the mid 1.09 level with support at the low 1.09’s likely to come into play very shortly:

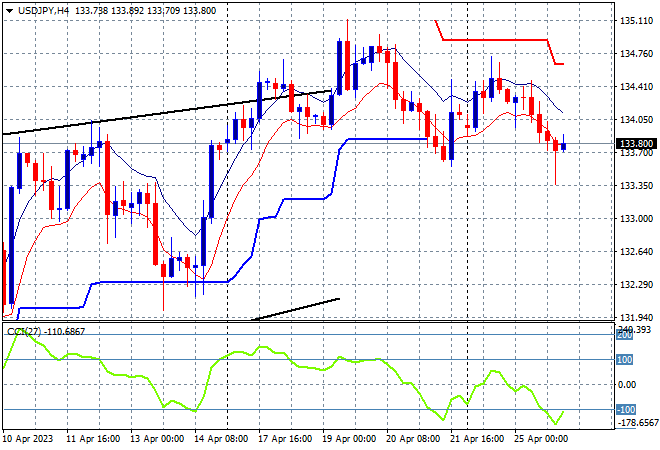

The USDJPY pair is seeing a lot of Yen safe haven buying as risk correlations build with a return below the 134 handle overnight. The four hourly chart is looking like forming a bearish head and shoulders pattern here with short term momentum readings remaining quite oversold. Support at the recent lows is the areas to watch here with further falls below previous trailing ATR support possible:

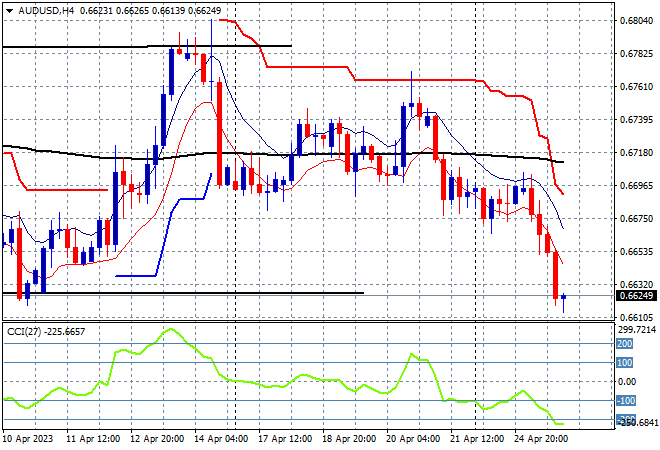

The Australian dollar is following risk markets with a breakdown overnight as domestic traders scramble after yesterday’s holiday. The Pacific Peso had been under pressure here at or around the 67 handle with overall price action remaining quite weak in the face of domestic economic data, with the firming USD now taking it back to the early April lows with the potential to undershoot again if today’s inflation data surprises to the low side:

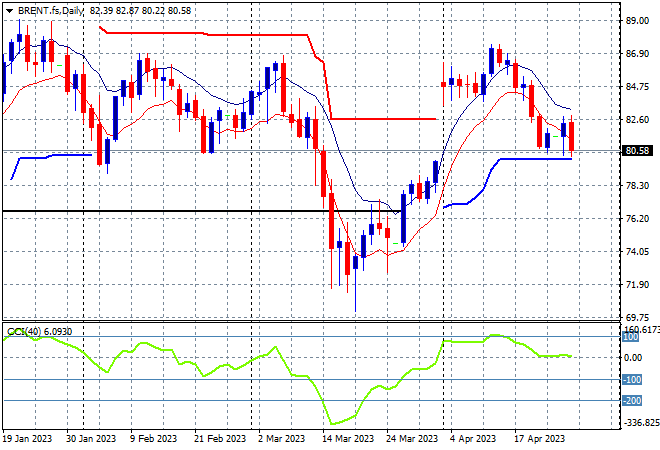

Oil markets are not enjoying the USD volatility or latest oil rig and supply data with Brent crude selling off again to return to its recent daily lows below the $81USD per barrel level. As I mentioned last week, the overall trend from a longer term perspective could still see a rangebound condition that falls back to the December lows around the $78 level so this break below the low moving average on the daily chart is a definite sign of buying pressure exhausting but not yet complete abandonment. Watch for trailing ATR support at the $80 level that must not be breached:

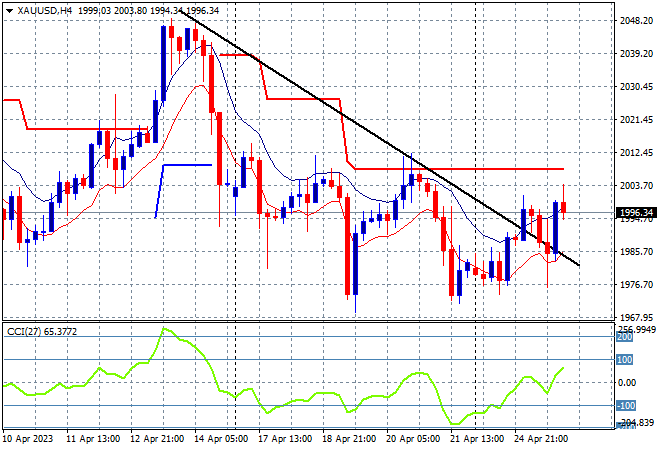

Gold is moving around independently more and more here after following the undollar trend, unable to move back above the $2000USD per ounce level overnight yet maintaining buying support just below. The four hourly chart shows the previous short term downtrend now broken as momentum moves to the positive side, yet trailing ATR resistance and the psychologically important $2000 level need to be breached soon to have any hope of turning this into a recovery: