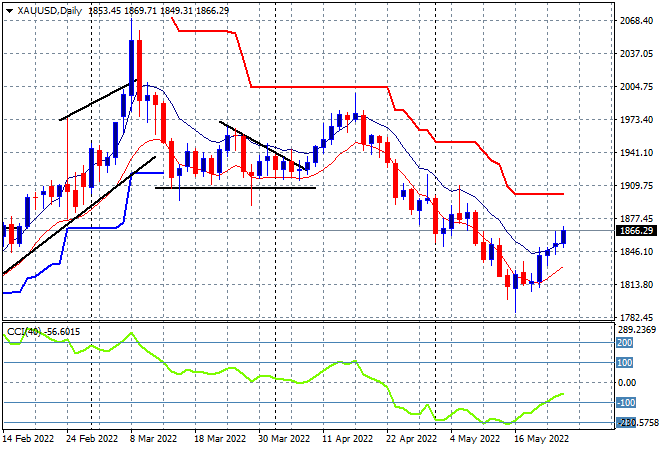

Wall Street had the wobbles again overnight, led by a steep selloff in tech shares with European shares also unsteady with new PMI surveys coming in under expectations. The bond market saw some strength in response, with the 10 year US Treasury yield pushed down to the 2.7% level, with interest rate markets still continuing to price in a 50 bps rise for the Fed’s June meeting and a slightly lower 195 points at the end of the year. Meanwhile the USD continues to lose ground against Euro, while the Australian dollar remains contained at the 71 handle. Commodity prices were unsteady with oil prices only a little higher with WTI and Brent crude up by nearly 1% while gold finished just above the $1866USD per ounce level .

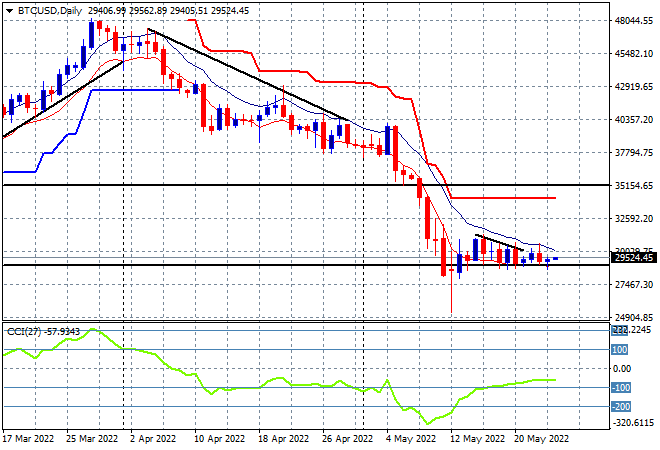

Bitcoin is still going nowhere – literally unmoved with very low volatility – remaining below the $30K level as price is well contained at the recent near 50% loss lows. After cracking through the $25K level in the previous week, momentum remains heavily negative as trailing ATR resistance remains way overhead for now. This is ready to crack lower:

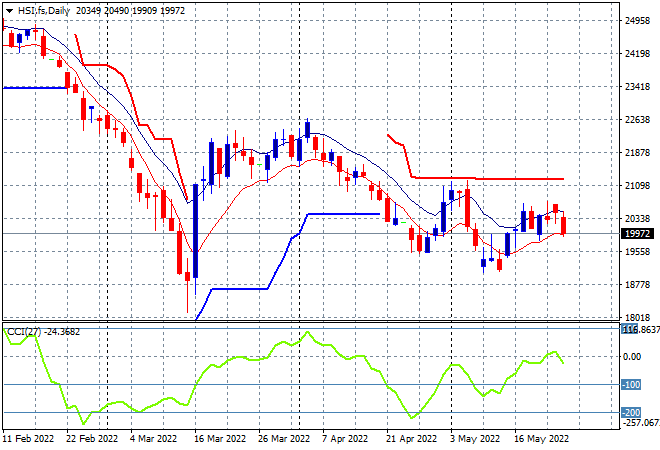

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets started poorly and accelerated the selloff into the close with the Shanghai Composite losing more than 2.4% to finish at 3070 points while the Hang Seng Index has similarly inverted, down 1.8% at 20173 points. The daily chart is showing price action unable to lift higher and remaining contained below trailing daily ATR resistance at the 21000 point level that has firmed as strong resistance:

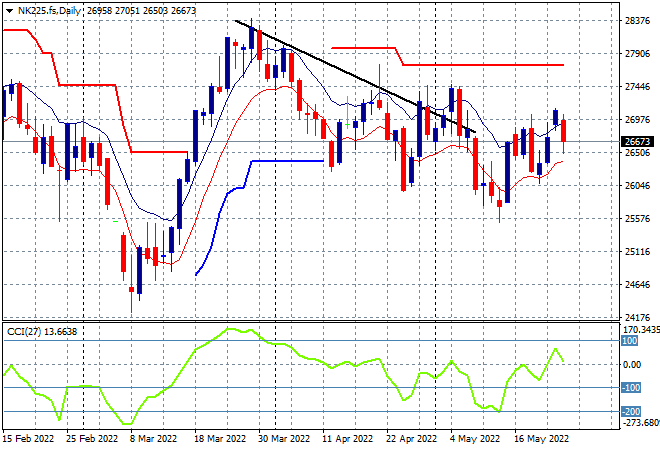

Japanese stock markets caught up with the selling as the Nikkei 225 index lost nearly 1% to close at 26748 points. The daily chart of the Nikkei 225 still has a bearish bent with another attempt to get back above the previous daily/weekly highs near the 27500 point level seeming to fail before it even gets going. To properly reverse the downward trend from the March highs requires a substantial move above the 27000 point level but futures are indicating a further pullback below that level today:

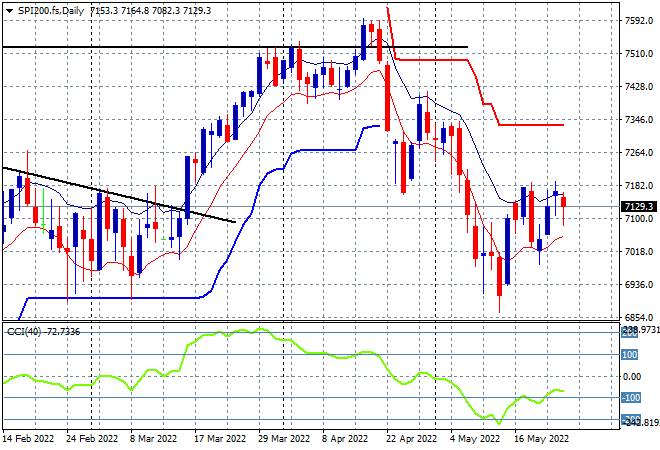

Australian stocks were the best in the region, relatively speaking, with the ASX200 finishing only 0.3% lower at 7128 points, keeping the 7100 point support level intact for now. SPI futures are down only 10 points given the very unsteady finish on Wall Street overnight. The daily chart is showing a bunching up of price here at the 7100 point level with a second bounce that could turn into a proper swing action up to the resistance level at 7200 points, but daily momentum readings remain tenuous:

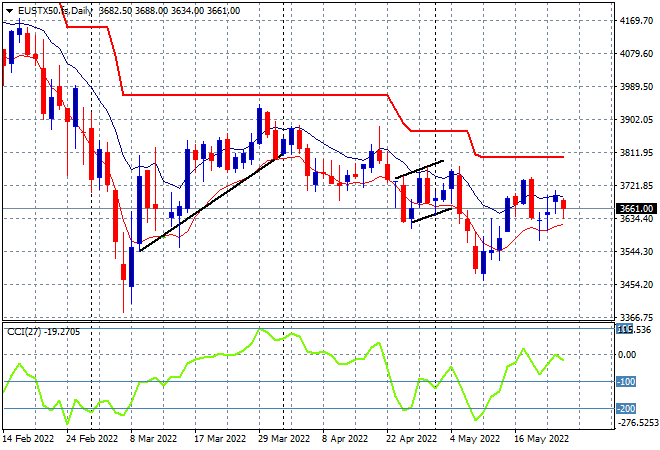

European markets started off in a poor position and continued that throughout the session with the Eurostoxx 50 index finishing 1.6% lower at 3647 points, taking back the start of week gains. The daily chart picture remains bearish in the medium term, and while the short term picture is suggesting a potential move back up to trailing ATR resistance at around 3800 points, daily momentum is nowhere near enough to fulfill that move:

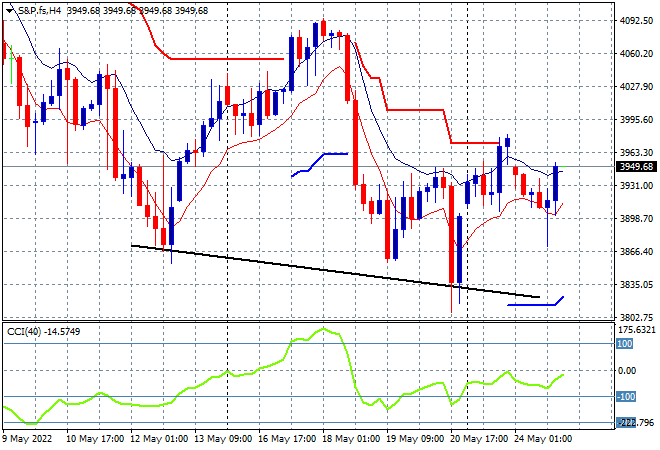

Wall Street continued its highly volatile moves from Friday with the NASDAQ now in full bear market mode, falling more than 2% while the S&P500 closed nearly 1% lower as it returned back to the 3900 point anchor level, still unable to get back above the psychologically important 4000 level. The four hourly chart is lolling wobbly indeed as substantial resistance at the 4100 point level remains a distant memory with the new weekly low still suggesting a bear market is around the corner. Watch for a break below the 3850 point level as a catalyst for further selling:

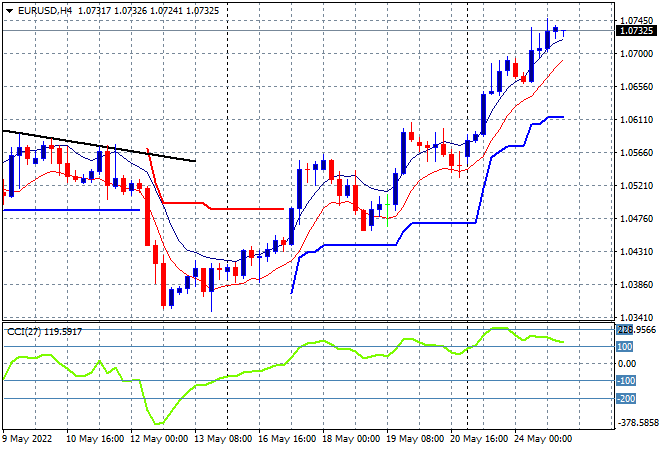

Currency markets are still seeing Euro lead the way, as the union currency broke through the 1.07 handle overnight, filling in a 300 pip plus move since bottoming a only a week or so ago. The 1.06 level had been strong resistance for sometime now as momentum resurged into a very overbought setting so while a short term retracement on exuberance is probable here, a new uptrend is definitely underway:

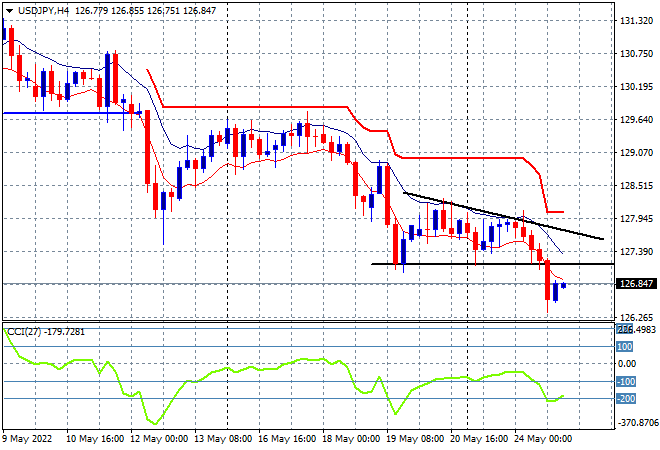

The USDJPY pair is still suffering from some defensive Yen bidding, having lost key support at the 129 level last week and making another new weekly low overnight, breaking through the 127 level. As I said yesterday, with no move above high moving average for sometime now, more downside was inevitable, but watch for an attempted swing move back up to the previous weekly low at the 127 handle:

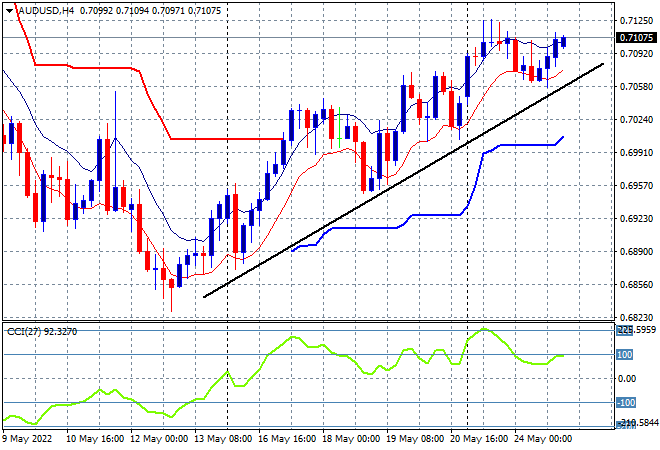

The Australian dollar remains on a solid uptrend from last week’s low, but again was stalled overnight at resistance at the 71 handle, matching the previous session highs. Four hourly momentum has retraced from extremely overbought levels so we could see a further hold here to catch up to the trendline before a proper move above the 71 cent level:

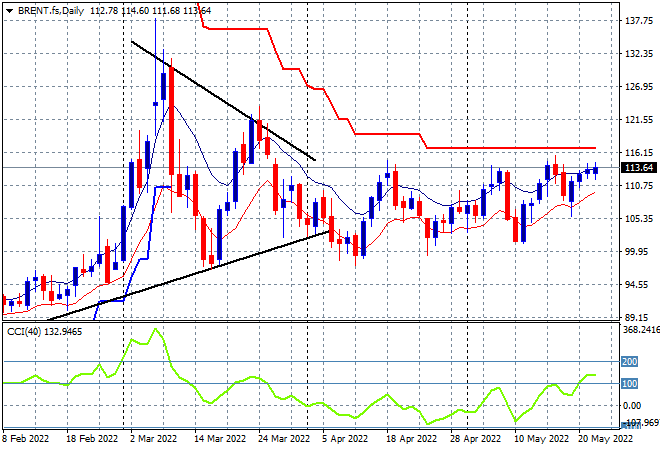

Oil markets continue to bounce along, as traders consolidate and await further catalysts arising out of the Russian invasion of Ukraine, although the signs are there that short positions are no longer building. Brent crude closed back above the $113USD per barrel level, still a bit shy of its previous weekly high, but without any downside to the session. Daily momentum has pushed into overbought status with trailing ATR daily resistance at the $116 area the next level that has to be broken through or we continue this sideways play:

Gold had another positive session and a new daily high with another finish above the $1850USD per ounce level, finishing at the $1866 level. This is looking better and while it firms up the possibility of a bottom forming in the short term, the downtrend will remain entrenched as long as daily momentum remains stuck in oversold territory. The January lows around the $1800 level remain the downside target that has yet to transform into a new support level: