Wall Street was unable to follow through on its recent two day surge, as concerns about the upcoming earnings season mounted with European shares also treading water after a solid start to the trading week. The USD remains under stress against the majors with Euro holding firmly above the 1.09 handle while the Australian dollar does the same above the 70 cent level. US bond markets saw a small lift in yields to start with but finished a little tighter with 10 year Treasury yields down a few basis points to still finish just above the 3.5% level while the commodity complex saw oil prices move lower as Brent crude was unable to extend its recent gains, falling back to the $87USD per barrel level. Gold oscillated around its recent weekly high but was able to advance later in the session to finish below the $1940USD per ounce level.

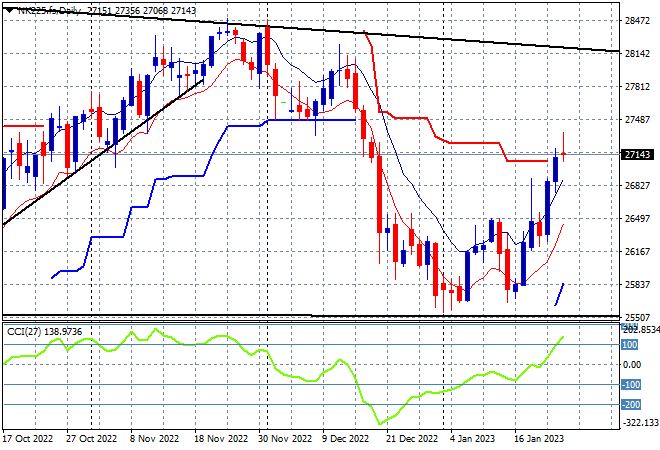

Looking at share markets in Asia from yesterday’s session where mainland and offshore Chinese share markets are closed for Lunar New Year holidays this week. Japanese stock markets are doing the heavy lifting again with the Nikkei 225 closing 1.5% higher to 27299 points. The potential for a bottom to develop here at the 25000 point level is now quite firm after a lot of oscillation around the BOJ and bond market problems, with firm positive correlation with Wall Street’s performance now lifting the market and swinging daily momentum higher to make ready for a breakout above short term resistance:

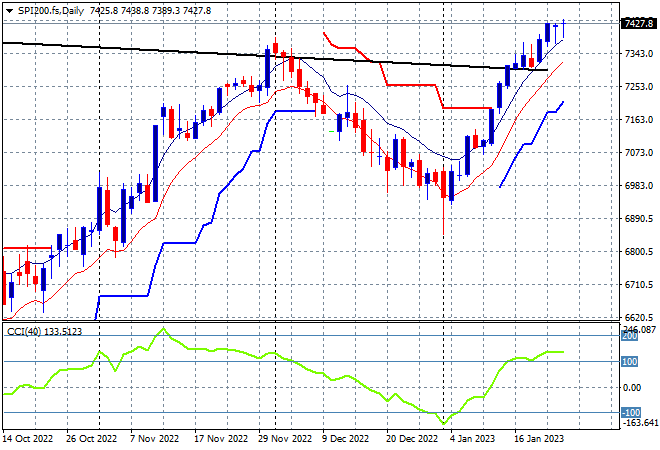

Australian stocks were able to finally advance after a false start to the trading week with the ASX200 finishing 0.4% higher at 7490 points. SPI futures are down slightly as Wall Street takes a pause overnight. The daily chart had been showing price action and daily momentum in a decline since the start of December but a new breakout building here above the 7300 point level still has lots of legs. Previous overhead ATR trailing resistance at the 7200 point level is firming as short term support with resistance at the November highs now cleared:

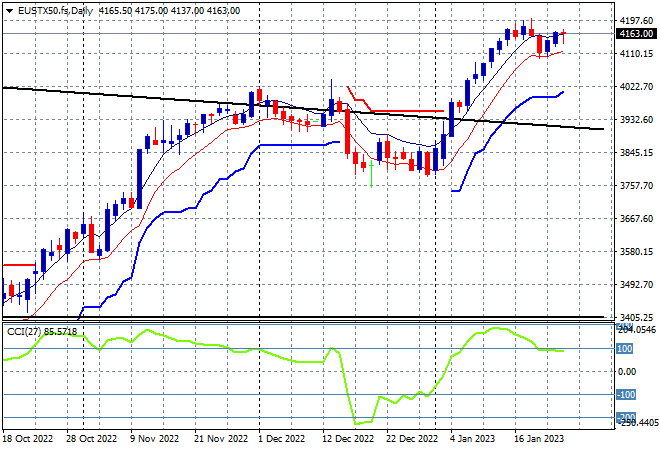

European markets a little unsettled with the FTSE losing ground while the German DAX put in a scratch session as the Eurostoxx 50 Index closed a handful of points higher at 4153 points. The trend above the 4000 point level has stabilised for now with the potential for a rollover abating but still possible as daily momentum takes a breather from its previously overbought settings. The 4000 point level is the key psychological resistance level here that could be turned into support going forward, but I’m wary of a top forming at the 4200 point level:

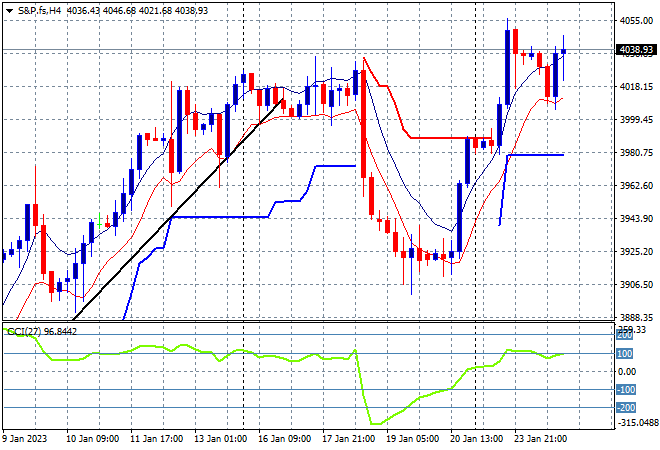

Wall Street was unable to extend its breakout with earnings season concerns dominating, with the NASDAQ down 0.3% while the S&P500 treaded water, still managing to finish above the 4000 point level, down to 4016 points. After breaking the series of lower daily highs since Xmas, price action has been trying to get further above the dominant medium term trendline after hovering around weekly support at the 3800 point level and with this breakout the bulls have seemingly cleared the way. While the technical level above 4000 points has been broken, I’m still wary of a bull trap as we head into an interesting earnings season:

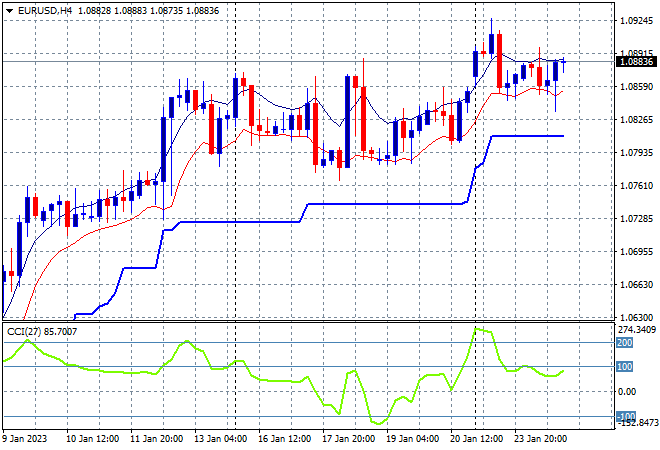

Currency markets were again in a sideways bearish mood against USD with Euro lifting through the 1.09 handle briefly before retracing back to where it started. After gapping slightly higher over the weekend, most of the major currency pairs are holding on to their gains against King Dollar. Continued retracements below the 1.08 level for Euro are being met with strong support as trailing ATR support remains intact. While price action is still well above the recent weekly highs and short term momentum remains somewhat overbought, there is little upside potential here if resistance cannot be cleared decisively:

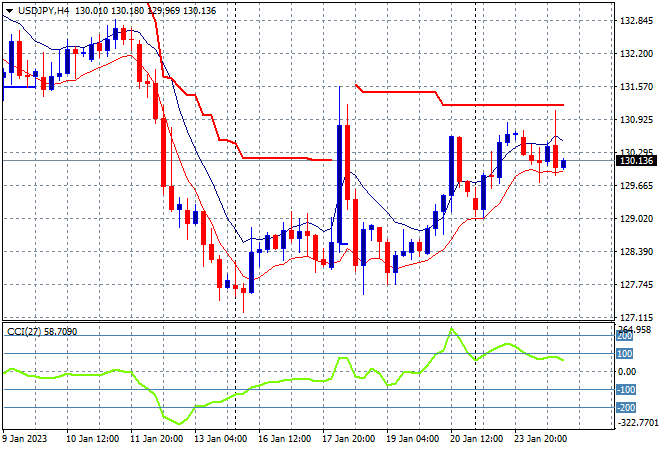

The USDJPY pair had a false breakout above the 131 handle that was smacked back down to the 130 level later in the session as it remains in a sideways consolidation phase below weekly resistance. Price action can’t seem to break above last week’s intrasession high as the previous move higher kept the pair below the start of year position but as I stated before it could still be setting up for more downside below if it doesn’t translate into a proper swing rally soon:

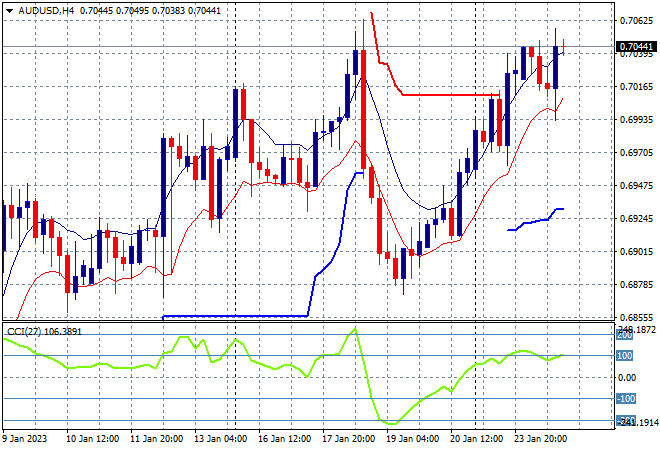

The Australian dollar was pushed below the 70 cent level briefly before coming back and matching last week’s intrasession high as it sets up for another attempt to properly clear this handle. Hesitant price action may well be in anticipation of the upcoming RBA meeting and while it remains well above the broad weekly uptrend channel limits, the lack of a new weekly high above the 70 cent level could be setting up for a larger retracement if not definitively breached soon:

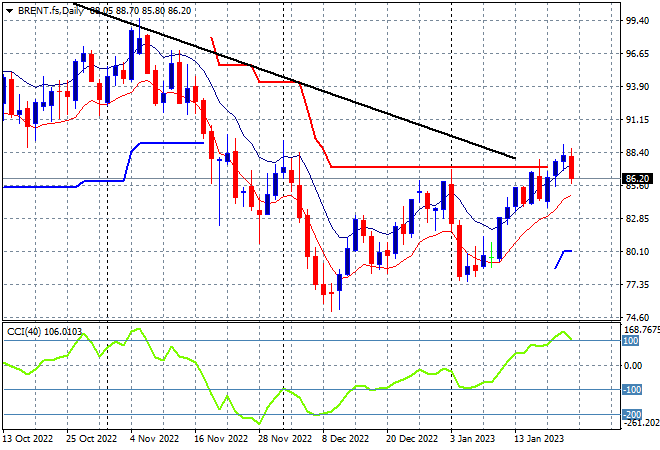

Oil markets had been gaining more traction in the last week or so but suffered a mild pullback overnight with Brent crude retracing back down to the $86USD per barrel level after recently making a new weekly high. After hovering around the December lows last week, price action wants to get moving as daily momentum returns to overbought settings with the overall trend showing price ready to tackle overhead ATR resistance and the dominant downtrend, but not decisively as yet:

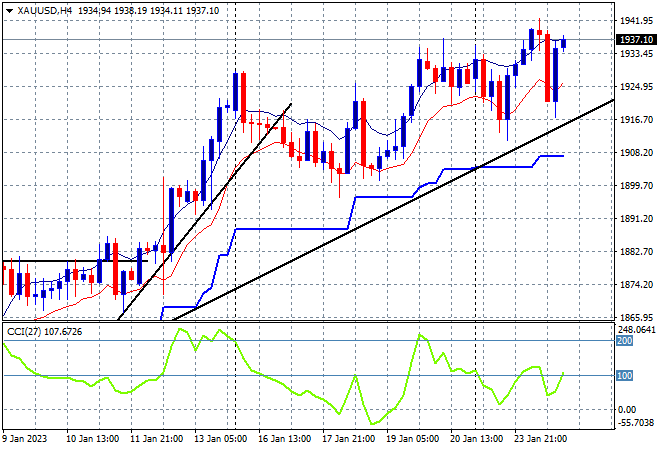

Gold is still trying to moderate its previous boisterous price action with a relatively volatile session overnight, putting in a new daily high to extend its recent weekly high, finishing just below the $1940USD per ounce level. Price action on the four hourly chart shows a move back towards the more sustainable uptrend line as short term momentum remains somewhat overbought but not overextended and keeps above trailing ATR support. There is a lot of upside potential here as new highs are made with higher lows but watch that trend line: