Wall Street bounced back overnight on the initial jobless claims numbers but it wasn’t enough to stave off USD buying as the risk complex remains on edge. The USD held on to its recent gains with Euro below the 1.06 handle while the Australian dollar broke below the 68 cent level before bouncing back later this morning. The commodity complex saw oil prices bounce back but only marginally with Brent crude getting back above the $81USD per barrel level while gold is still in a depressed funk, slumping down to the $1820USD per ounce level.

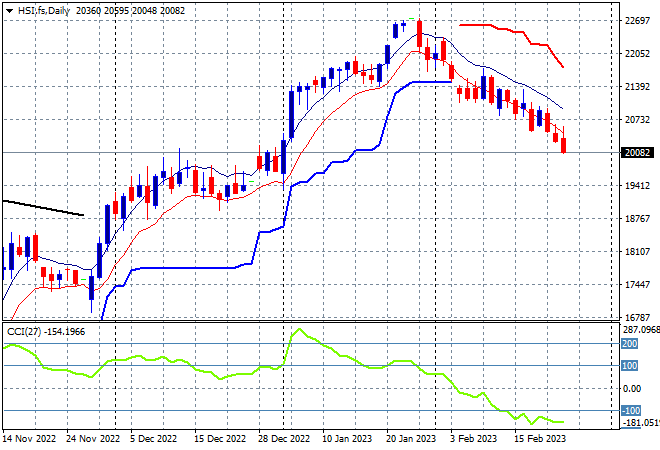

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were relatively flat with the Shanghai Composite closing 0.1% lower at 3287 points while the Hang Seng was actually up 0.5% at one stage before closing 0.3% lower at 20351 points. The daily chart is showing this rollover accelerating with price action continuing well below previous ATR support as momentum remains in oversold territory. Watch now for support at the 20000 point level to come under pressure:

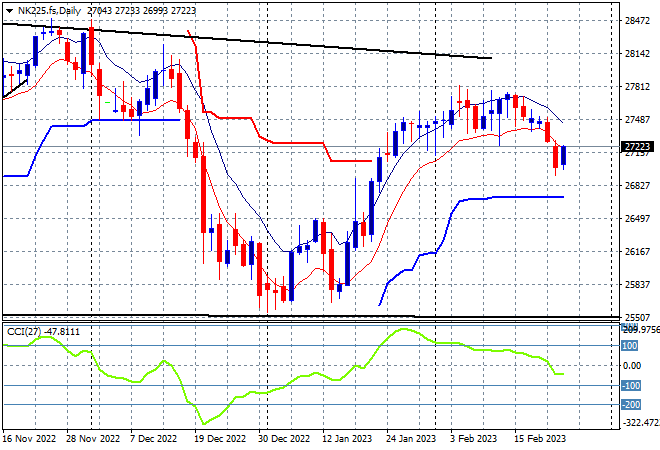

Japanese stock markets were closed for yet another holiday with Nikkei 225 futures suggesting a bounceback on the open this morning. After topping out at the 27500 point level, a rollover is still in effect as price action plays catch up to other risk markets. Daily momentum has reverted out of overbought mode and had been suggesting a slide back below the low moving average next with support fading. While futures are indicating a bounceback to finish the week this could lack confidence with short term resistance at the 27400 point level needing to be cleared:

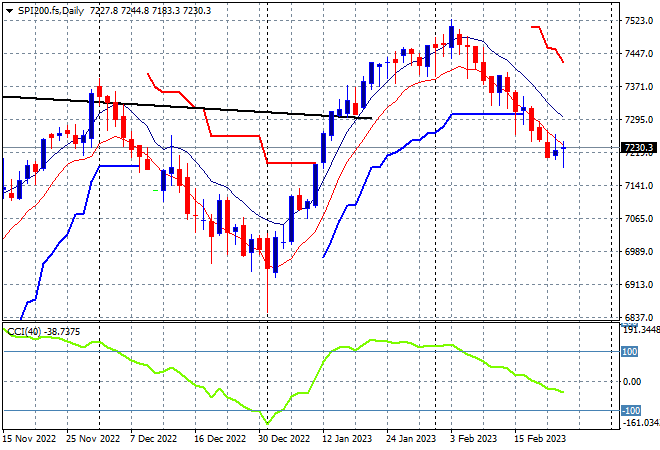

Australian stocks again failed to gain traction with the ASX 200 closing 0.3% lower to push below the 7300 point level to close at 7285 points. SPI futures are up slightly on the bounce on Wall Street overnight. The daily chart is still showing a clear rollover after being unable to take out 7500 points, with a retracement below ATR support at the 7200 point level firming as daily momentum continues its revert from being overbought to negative status:

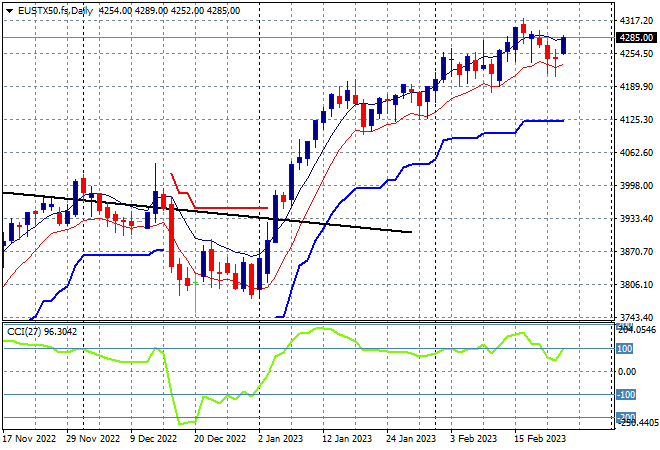

European markets were able to put on very modest gains with the Eurostoxx 50 Index closing more than 0.3% higher at 4258 points, with a view to getting back to the recent new weekly high. Futures are indicating more gains tonight, trying to get back on trend above the 4200 point level as daily momentum remains broadly positive. The 4000 point level remains the key psychological resistance level that has now turned into support going forward, with no close below the low moving average keeping this intact for now:

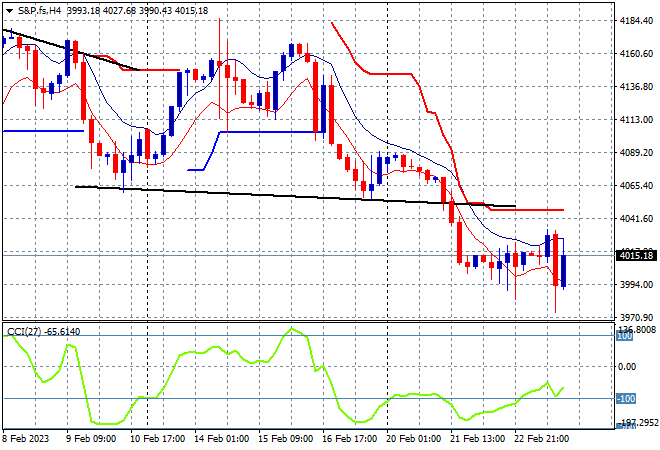

Wall Street was lacking confidence throughout the session until a big U-turn near the close with the NASDAQ able to gain nearly 0.7% while the S&P500 lifted some 0.6% to cross back above the key 4000 point support level, closing at 4014 points. The four hourly chart shows price action still stuck near the previous two weekly lows and setting course for a full correction if it can’t get back above the former ATR support at the 4100 point area where I’m looking for a potential further selloff tonight:

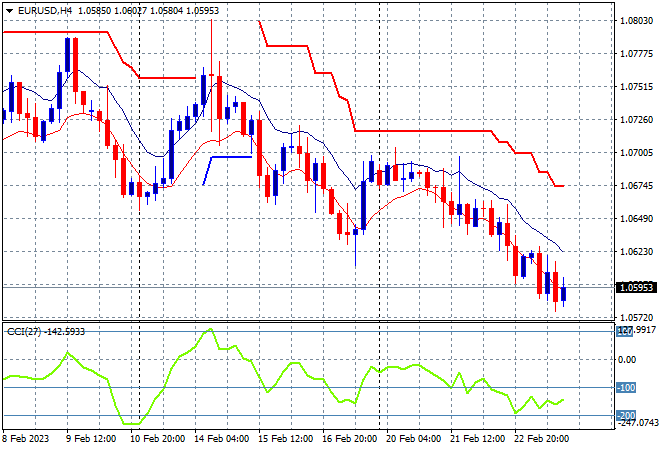

Currency markets continued to rally in favour of the US post the hawkish nature of the FOMC minutes and the strong jobs data with Euro retreating below the 1.06 handle after failing to hold on mid week below the 1.07 level. The four hourly chart had been showing a clear downtrend in recent weeks with a failure to make any new highs with short term momentum now very oversold and heading lower although watch for a potential swing back up to the mid 1.06 level before another downturn:

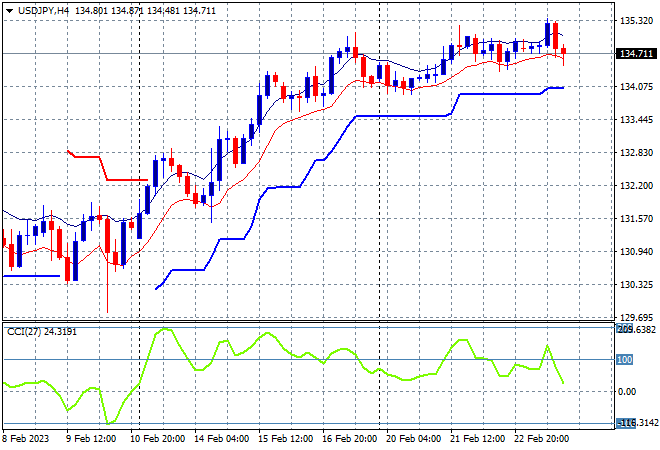

The USDJPY pair continues to slide sideways with a strong bullish bias with a failed breakout late in the session to bring it back below the 135 level. This trend has seen it always respect trailing ATR support with internal strength obvious following the recent weekly uptrend and while resistance had been building at the 135 handle this is now under stress again. Short term momentum has reverted back into overbought status so watch for any test below the low moving average here:

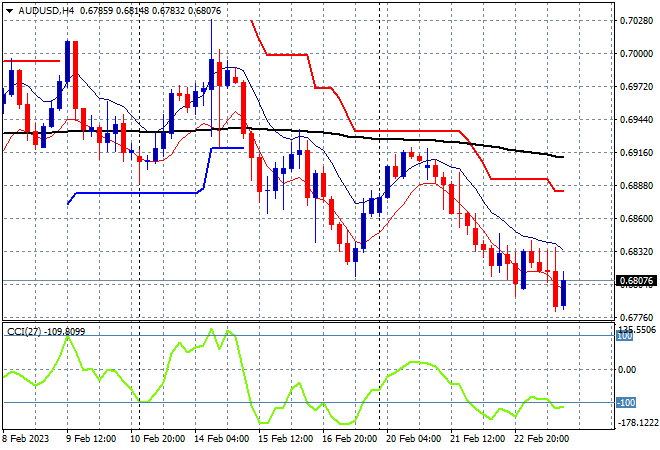

The Australian dollar was unable to make any traction overnight with yet another volatile session that continued continuing this rollover, breaking through the 68 level before bouncing back slightly before the Sydney open this morning. This weak overall price action comes after a weak response to last week’s unemployment numbers that has not yet challenged interest rate expectations and I’m still watching for a further pullback or even new weekly lows next:

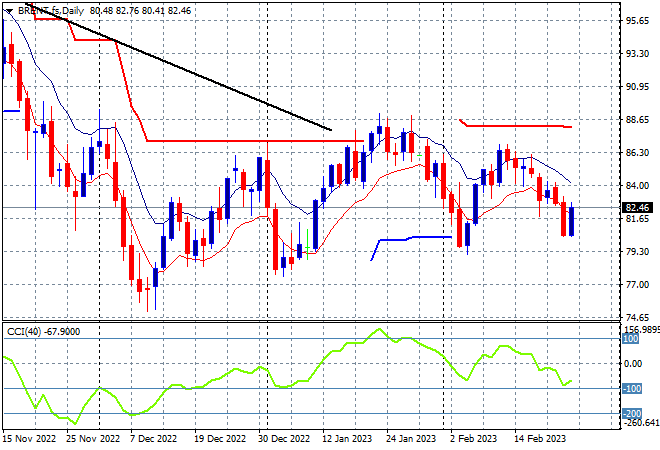

Oil markets tried to bounceback overnight following a steady week or more of selling with Brent crude breaking back above the $82USD per barrel level to stave off another lower daily session. Daily momentum has sharply inverted into the negative zone and is almost oversold but not quite, indicating some buying support below. Overall however, price action has still failed to beat the $88 highs from January so this sideways at best move will continue:

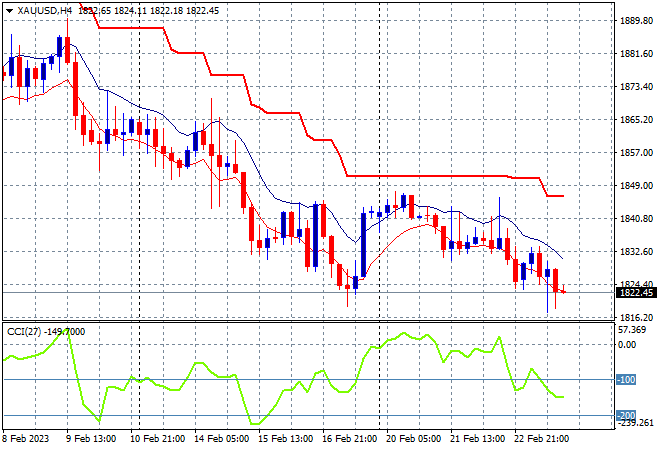

Gold remains depressed despite a pause in selling mid week with more falls overnight, closing at the $1822USD per ounce level right on the weekly low. This continued negative price action has not yet abated with overheard resistance too hard to beat and the daily chart still indicating more downside below. I’m watching for a continued rollover and a test of last week’s low at the $1820 level: