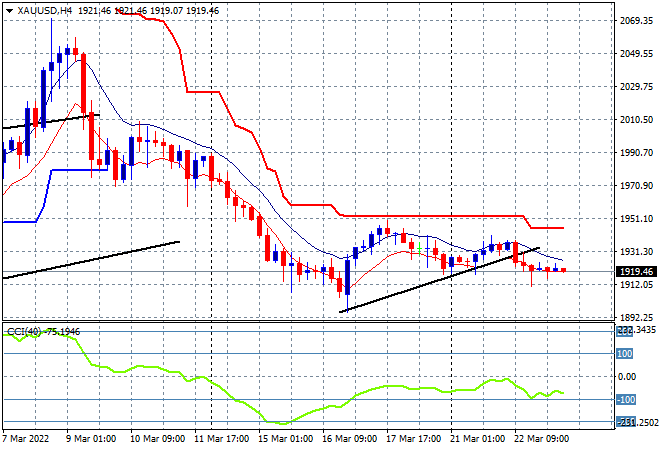

Asian stock markets are continuing their mid week surge after an equally good run overnight on Wall Street as bond market volatility is seeing yields rise alongside greater risk taking. The USD remains strong against Yen and Euro although the latter is being lifted a little by a resurgent Pound Sterling while the Aussie is being held back slightly as resistance comes in. Oil prices remain elevated with Brent crude advancing towards the $120USD per barrel levels as gold goes nowhere after failing to breakout at the start of the week, now retracing back below the $1920USD per ounce level:

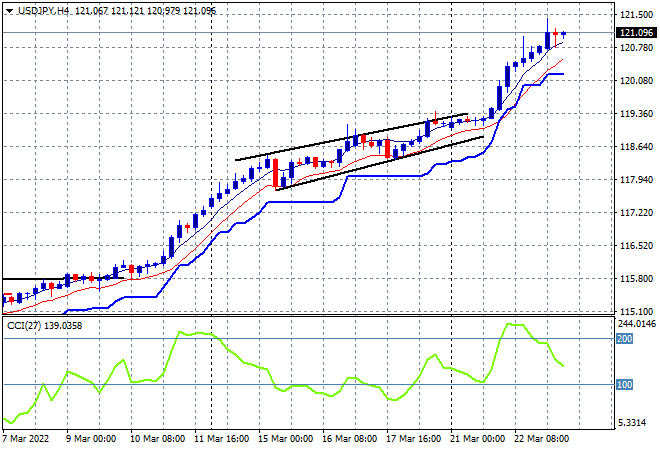

Mainland Chinese shares are oscillating and somewhat directionless going into the close, with the Shanghai Composite currently up 0.2% at 3267 points while the Hang Seng Index is having another great session, up 1.5% at 22234 points. Japanese stock markets continue to cruise higher on the lower Yen with the Nikkei 225 closing up a stonking 3% higher to 28045 points while the USDJPY pair has now taken out the 121 handle for yet another historic high:

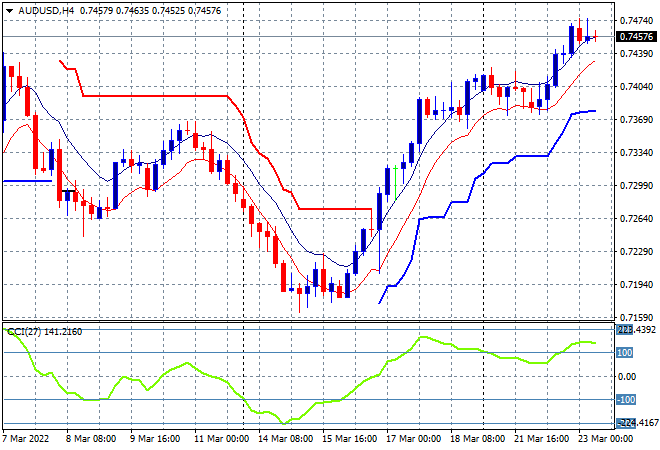

Australian stocks were the relative laggard, with the ASX200 lifting “just” 0.5% to finish at 7377 points. Meanwhile the Australian dollar is treading water at the mid 74 level, possibly coming up against stronger resistance which makes sense after such a good run in the last week or so:

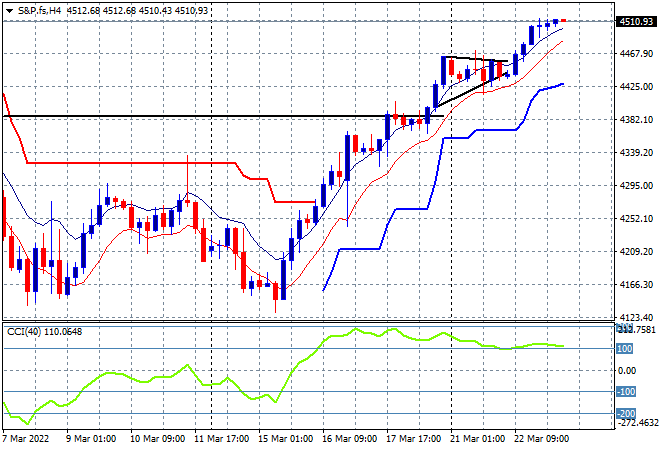

Eurostoxx and Wall Street futures are inching slightly higher with the S&P500 four hourly chart showing a desire to keep pushing through the 4500 point level after casting aside resistance at the 4400 point area, which should act as short term support going forward:

The economic calendar gets quite busy tonight with UK core inflation print, another round series of Fed speeches including from Chair Powell then new home sales in the US.