Risk sentiment remains solid despite the ECB coming out flying with a 50bps rate hike overnight, with Wall Street and European stocks actually not that fussed, while currency markets absorbed it with aplomb. The USD remains somewhat weak against the majors although Euro didn’t fly as high as expected, with the Australian dollar firming above the 69 cent level. Bond markets saw more round-tripping of yields with 10 year Treasuries retracing back below the 3% level as US interest rate futures still imply a near 80bps rate rise at the next Fed meeting. Commodity prices were still volatile with Brent crude falling back to the $100USD per barrel level before recovering while copper and gold both lifted, although the latter did round-trip violently below the $1700USD per ounce level.

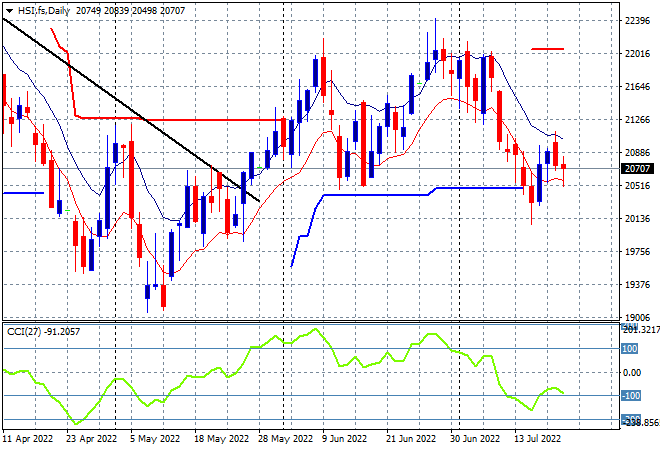

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets tried to claw back their early morning losses but slumped going into the close with the Shanghai Composite finishing down 1% to 3272 points while the Hang Seng Index has retreated further to lose 1.5%, closing at 20574 points. Sentiment continues to wane on the daily chart with considerable overhead resistance and daily momentum readings remaining oversold as the previous swing play reverts back to the downtrend:

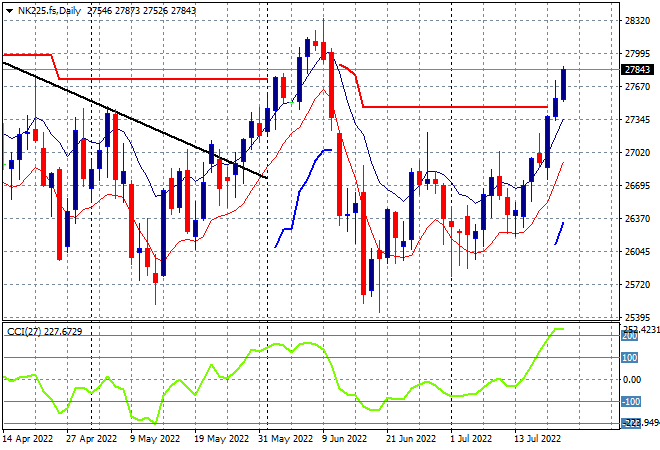

Japanese stock markets continued their surge, with the Nikkei 225 up 0.4% to 27803 points. The daily chart is suggesting this breakout to continue despite a rise in Yen overnight on the ECB rate hike, with resistance at the 27000 point area now turning into short term support as daily momentum remains nicely overbought. Price has made a new weekly high, which should support further upside here as the better lead from Wall Street should help in the short term:

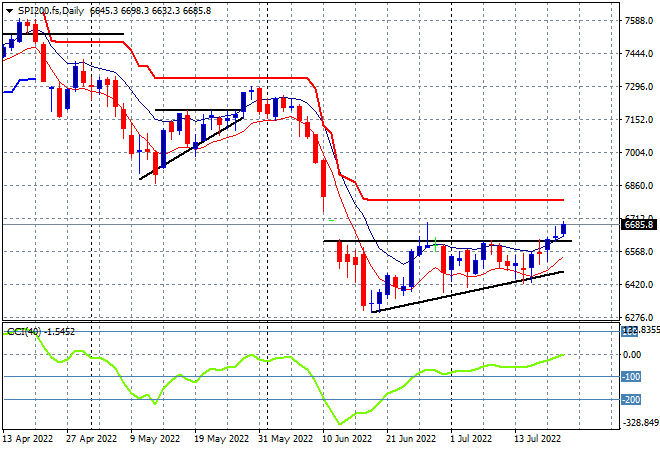

Australian stocks had another solid session, with the ASX200 closing 0.5% higher at 6794 point. SPI futures are up a handful of points despite the solid returns on Wall Street overnight, possibly weighed down by the higher Australian dollar. The daily chart is showing a breakout situation in the short term at least after trafficking sideways for sometime, as a potential bottom is forming here as support firms strongly around the 6600 point level. Daily momentum is still nominally negative but looks like translating into upside action with a breakout above short term resistance here:

European stocks were somewhat mixed with the ECB rate hike upsetting the apple cart, with German stocks a drag as the Eurostoxx 50 index eventually closing 0.3% higher at 3596 points. The daily chart looks bearish in the medium term with the previous breakout not yet translating into punching through overhead resistance as a bottom is trying to form here at the 3400 point level. Daily momentum is now very positive, with nascent buying support turning into a proper close above the high moving average to at least confirm a swing play:

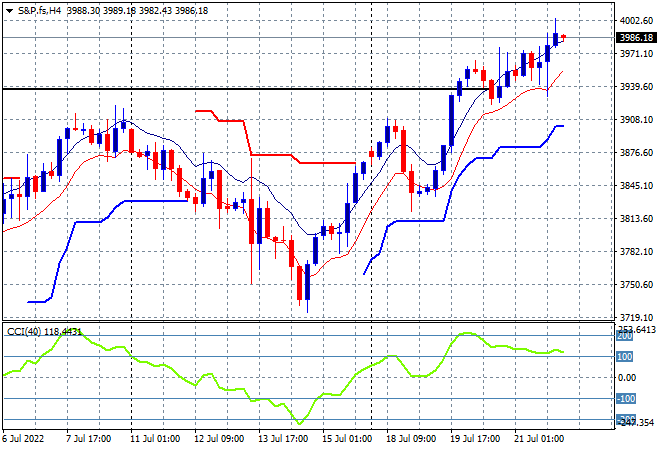

Wall Street however stayed in buying mode, with the NASDAQ up 1.4% while the S&P500 lifted nearly 1% to finish at 3998 points. The four hourly chart shows the previous rejection of the weekly highs at the 3920 point level which is now turning into something more sustainable and possibly turning into a proper recovery. With short term momentum overbought and ready to push prices higher, a warning that any failure here will likely see a retracement back to the end of June lows at 3730:

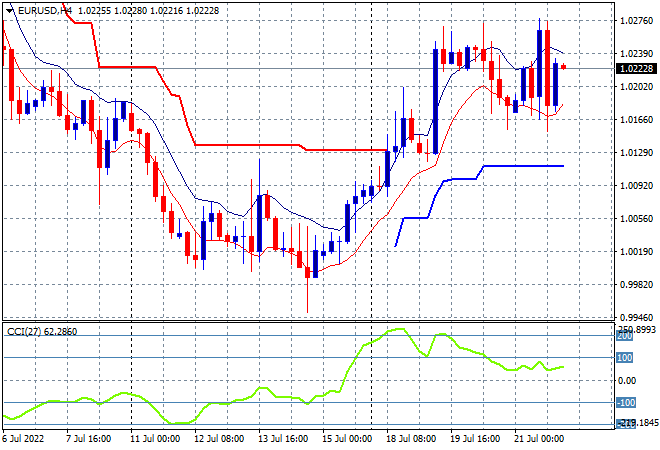

Currency markets reacted the most to the ECB rate hike with the USD falling back against most undollars although not as much as expected, given the Fed is way ahead of the game here. Euro round-tripped through to the mid 1.01 level up to the high 1.02s before recovering to just above the 1.02 handle this morning. The should provide a potential springboard for more upside but will require a better momentum reading in the overbought zone before getting excited next:

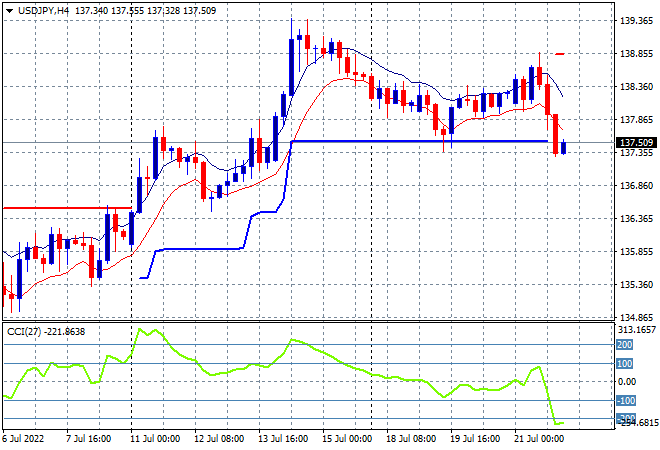

The USDJPY pair flopped on the ECB hike overnight, revealing the internal weakness that had been brewing all week after recently finding some support and a sort of consolidation as it failed to get above the 138 level. As I said yesterday, nothing was indicating more upside potential, so this retracement back to the low moving average on buying exhaustion wasn’t unexpected. Watch for ATR support at the 137 mid level to probably turn into resistance in the short term at least:

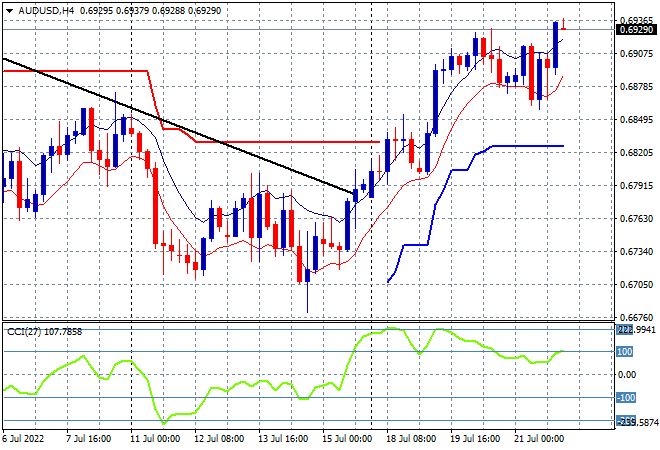

The Australian dollar joined in the afray against USD overnight on the ECB hike after waning slightly beforehand in yesterday’s session, able to firm through the 69 level overnight. This is looking better for the Pacific Peso although I still note that in the short term, momentum is not yet overbought. Watch for a possible retracement below the 69 level on hesitation going into the final sessions of the trading week:

Oil markets are still trying to recover with the recent short covering rally flopping overnight with Brent slipping back down to the $100USD per barrel level before recovering to the $103 level this morning. Price action is still continuing last week’s bounce off the $90’s lows but the downtrend line is yet to be beaten and nor is daily momentum out of its negative funk, so watch for another potential retracement back to the $100 level that has again turned into key psychological support:

Gold round-tripped violently around the ECB meeting and rate hike with a break down to the $1680 level before finishing this morning at its start of week position at the $1717USD per ounce level. It seems making a new monthly low was the bottoming process before the rate hike catalyst after price action had been stuck at the $1700 level. In the short term ATR resistance has been cleared, but not recent price highs at the $1720 level so this is only a short covering rally so far: