The trading week has not advanced risk sentiment that was quite positive on Friday night, with a series of Fed speeches overnight that were more hawkish than expected pulling back risk taking on Wall Street and hence the rest of the risk complex. The USD jumped higher with Euro and Yen falling while the Aussie dollar failed to push higher, retreating below the 74 handle. Bond markets saw a mild selloff with the 10 year Treasury yield spiking above the 2.3% level as commodities saw another surge in oil prices with Brent crude up more than 6% while most metals fell back, although gold prices pushed slightly higher later in the session.

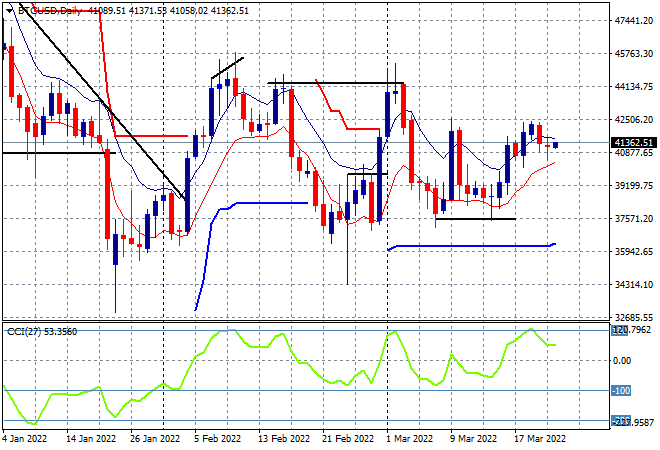

Bitcoin was again contained after seemingly bottoming out here with support evident but no buying keeping it at around the $41K level. This still keeps price below the previous weekly highs with the $42K zone the next level of resistance to get past with short term resistance quite solid here:

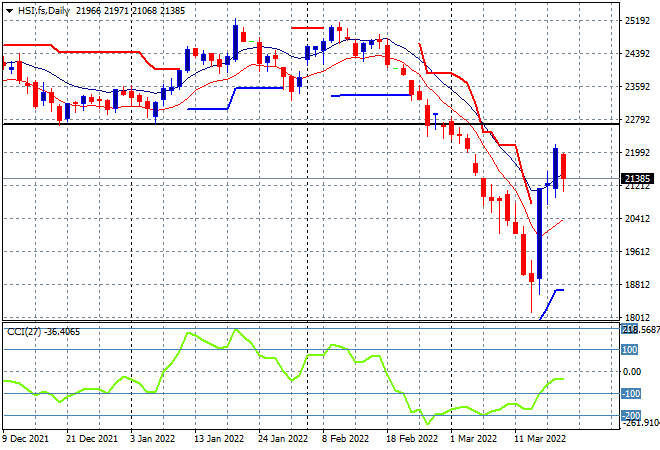

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares were again pausing their sharp bounceback with the Shanghai Composite down 0.7% mid session before closing dead flat at 3253 points. Meanwhile the Hang Seng Index was unable to recover, finishing 0.9% lower at 21221 points as this continued volatility remains hard to trade, to say the least, as this bounceback falters. The daily futures chart looks pretty good at first glance but momentum is rolling over here again:

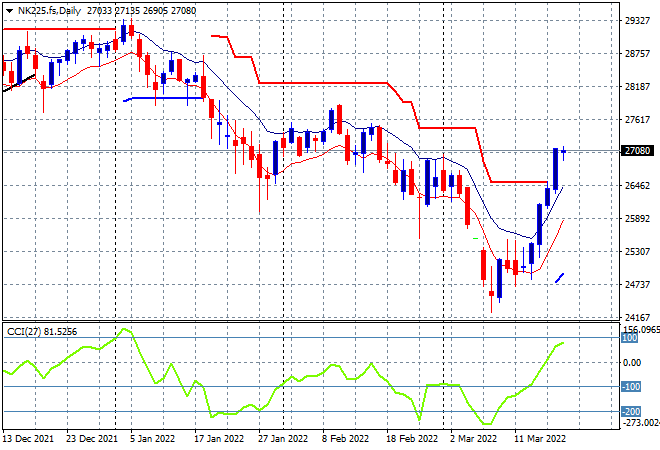

Japanese stock markets are closed for yet another holiday, with Nikkei 225 Futures indicating an open around the 27000 point level supported by a much lower Yen overnight. The daily futures chart is still showing a lot more potential upside here as a bottom has formed alongside Wall Street’s surge. Overhead ATR resistance on the daily chart has been taken out and momentum has swung into the positive zone:

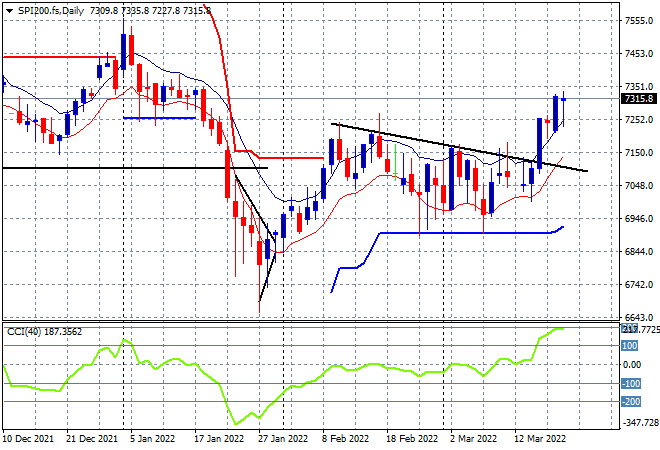

Australian stocks were looking good to start with but died off in the close, with the ASX200 finishing 0.2% lower to 7278 points. SPI futures are up, indicating an open around the 7300 point level but this is going against a flat Wall Street result overnight. The daily chart is still showing a lot of potential here as the lower resistance line overhead is taken out for a new weekly high. Momentum is getting a bit ahead of itself but should stabilise as we start the new trading week:

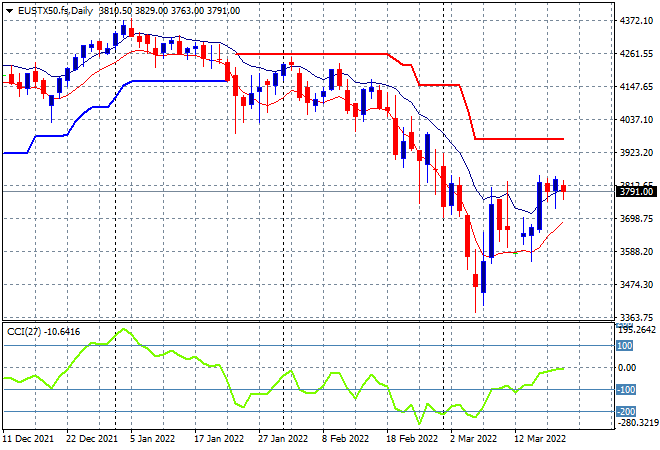

European shares saw some mild pullbacks with only the FTSE lifting overnight, a poor start to the trading week with the Eurostoxx 50 index finishing 0.5% lower at 3881 points. While price action is slowly moving the market closer away from a pure swing trade and into a reflation rally, it really needs to clear the 4040 point area next:

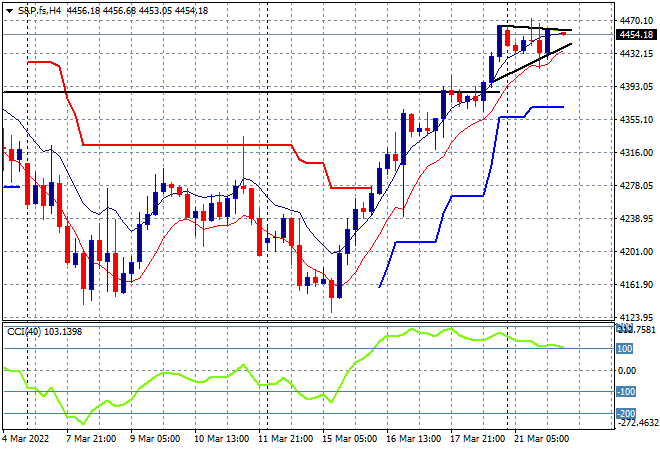

Wall Street was disappointing as traders responded a bit harshly to some hawkish comments from the Fed, with the Dow off 0.5% while the NASDAQ lost 0.4% and the S&P500 finished flat at 4461 points. Price action had zoomed above both four hourly and daily overhead ATR resistance as it got back above the 4400 point level, but the potential to move out of this correction phase requires a defence of that former resistance, now support zone:

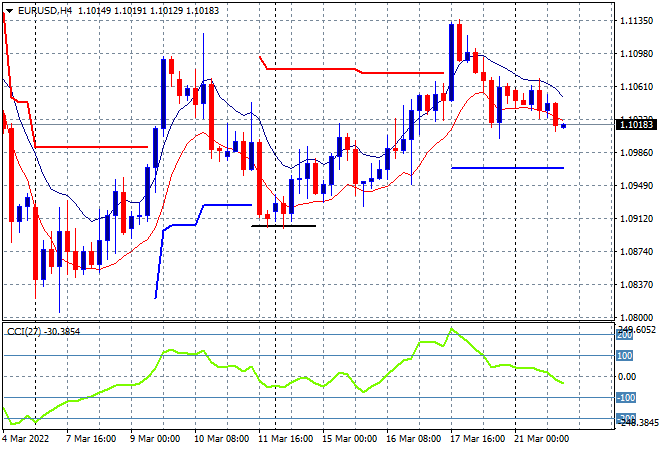

Currency markets saw a continued return to strength for the USD at the start of the trading week, with hawkish Fed comments helping, as Euro pushed down to the lower 1.10 zone overnight. The Ukrainian invasion continues to keep a lid on risk taking here with the four hourly chart showing an inversion of the previous new weekly high with the potential to fallback to the start of war position:

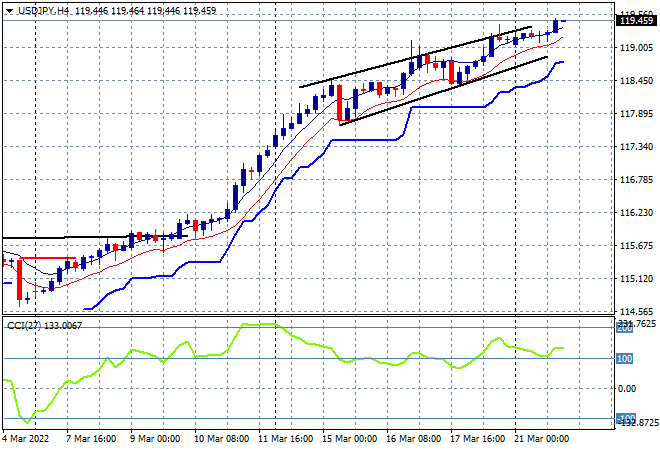

The USDJPY pair continued its push higher, this time properly pushing above the 119 level overnight as the USD builds more strength against Yen. Momentum is nicely overbought status with the flag pattern on the four hourly chart extending into a proper trend channel. Support seems very strong at the 118 handle where I would place an uncle point in the short term:

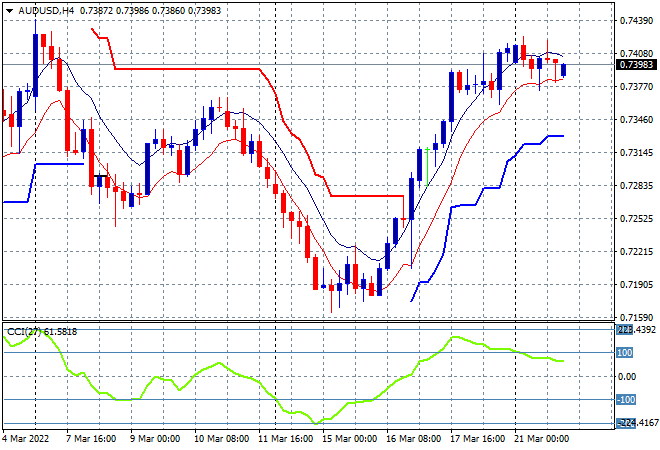

The Australian dollar is on a pause again, oscillating around the 74 handle even as commodity prices bounce back as it tries to push through a new weekly high. The four hourly chart shows a near return to the previous weekly highs with short term momentum nicely overbought although slightly ahead of itself. As expected, this mild pullback could continue for a little while here above the 73.70 level but I still think there’s more upside potential here:

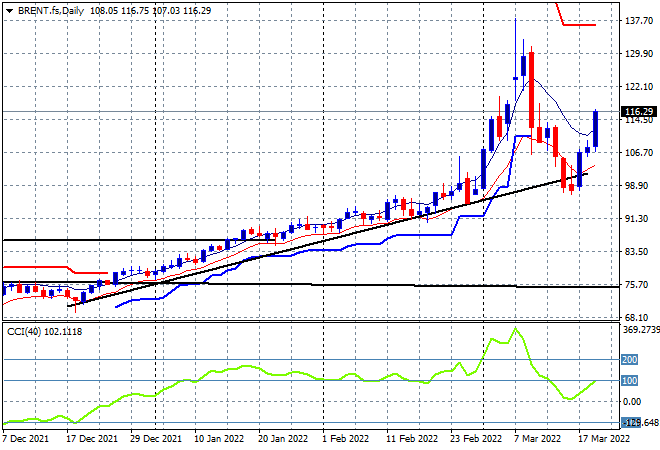

Oil markets bounced back last night after a week of consolidation with strong support at the $100USD per barrel level seeing Brent crude finish more than 6% higher to the $116 level. The psychologically important $100USD level is the clear uncle point going forward with the potential to return to the overshoot highs above the $130 level clearly rising as momentum gets back into the overbought zone:

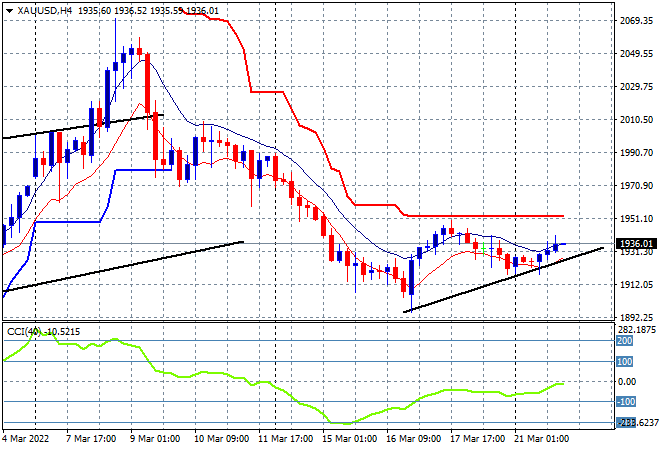

Gold was able to move slightly higher overnight after failing to make headway on Friday night, staying above a nascent uptrend lines from the $1900USD per ounce level bottom, closing at $1936USD per ounce. Four hourly momentum remains negative and overhead ATR resistance remains uncleared in the short term, so this needs a big break above $1950 to keep things moving along or a rollover is imminent: