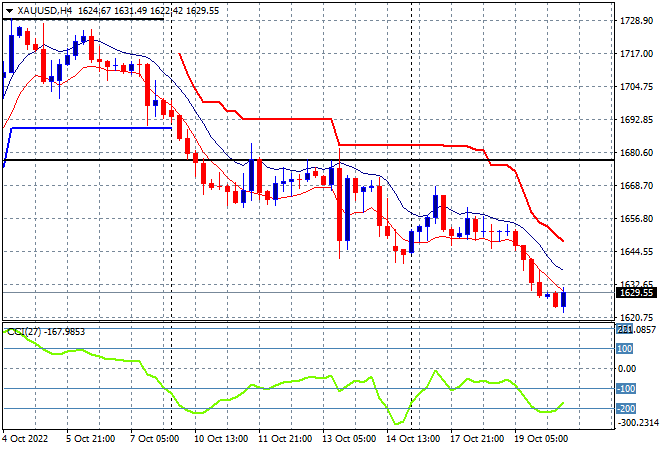

Inflation concerns, a stubbornly hawkish Fed, a slowing China – pick your poison as Asian stock markets fell back again today even further than the weak showing on Wall Street overnight. The USD remains strong against the major currencies with both Euro and Pound Sterling about to break lower while the Australian dollar baulked at today’s weak unemployment print, still holding above the 62 cent level. Oil prices are pushing slightly higher with Brent crude steady at the $92USD per barrel level while gold keeps making new lows as it remains crushed below the $1700USD per ounce level with no upside momentum, currently at $1629:

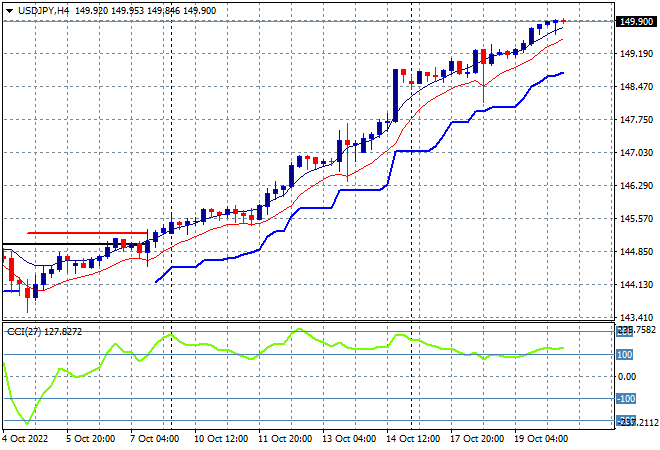

Mainland Chinese share markets are retracing again going into the close with the Shanghai Composite down 0.3% as it heads to the 3030 point level while the Hang Seng Index is crashing again, down more than 2% to 16110 points. Japanese stock markets are also falling back with the Nikkei 225 about to close 1.3% lower at 26900 points, while the USDJPY pair is zooming higher as Yen makes a new 30 year low, now just below the 150 level:

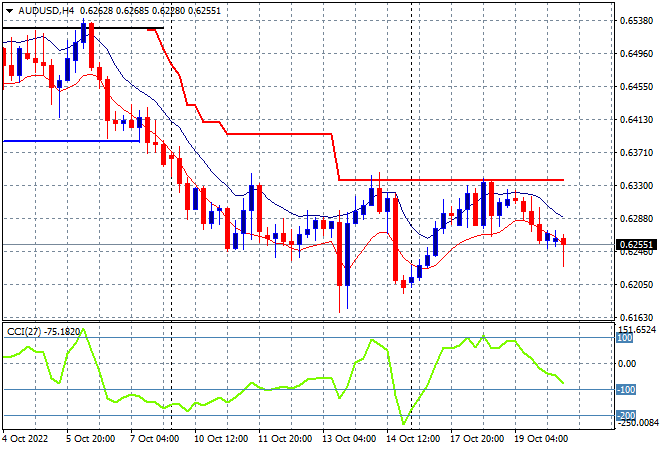

Australian stocks are pushing lower alongside everything else with the ASX200 currently down some 1.3% heading into the close, almost retreating below the 6700 point level. The Australian dollar absorbed the latest unemployment print, teasing the 62 handle but is basically unchanged and looking weak here as it fails to beat the recent highs where resistance lives:

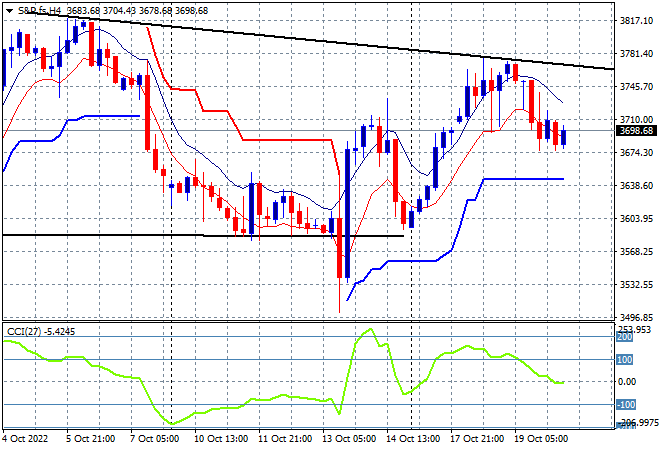

Eurostoxx and US futures are drifting lower as we head into the London session, with the S&P500 four hourly futures chart showing price action failing to get back to the 3800 point level. Medium term and possibly psychological long term resistance at the 4000 point level is a distant memory, with a series of new lows and now negative momentum readings in the short term pointing to more downside volatility:

The economic calendar includes US initial jobless claims plus the latest existing home sales data.