Asian stock markets are struggling to gain traction in the last session of the trading week with Chinese shares pulling back after their stonking mid week rallies, while local markets end on a better note. Last night’s interest rate hike by the BOE is being overshadowed a lift in Euro as the USD is weakening against most of the majors, although its still going strong against Yen. Meanwhile oil prices are lifting off again with both WTI and Brent crude soaring back above the $100USD per barrel levels as gold can’t seem to make headway here as it comes up against short term resistance at the $1950USD per ounce level:

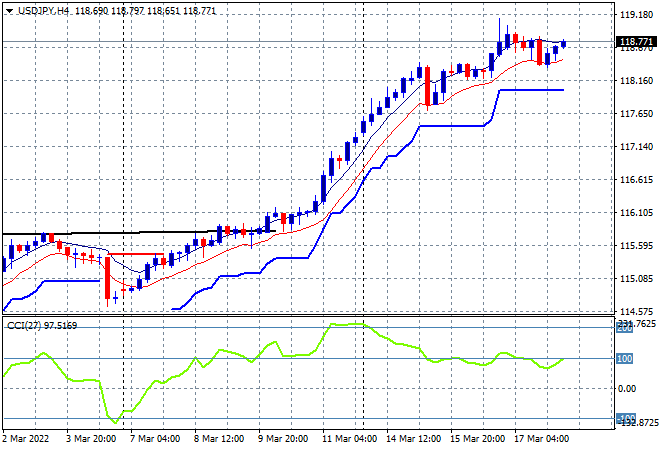

Mainland Chinese shares are pausing their sharp bounceback with the Shanghai Composite currently down 0.2% to be just above 3200 points while the Hang Seng Index is slumping, now down 2% mid session at 21008 points. Japanese stock markets have stalled after their recent advance, with the Nikkei 225 putting in a scratch session, currently at 26664 points with the USDJPY pair still on track but going sideways in the last 24 hours after it finds a modicum of resistance at the 119 handle:

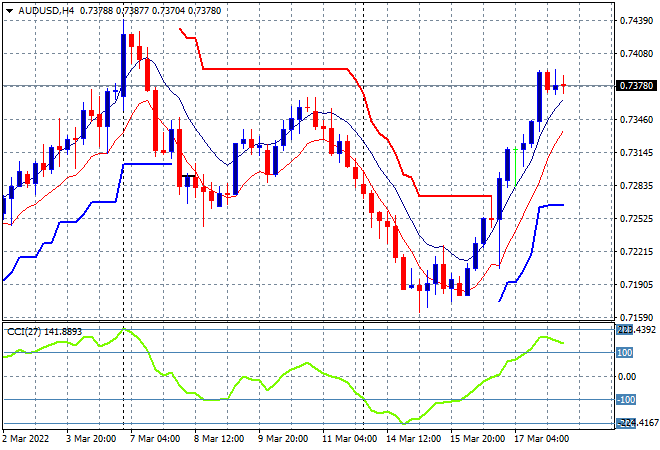

Australian stocks are doing well as we head into the close, with the ASX200 up 0.4% to 7281 points. Meanwhile the Australian dollar is treading water after zooming through the 73 handle following yesterday’s unemployment print and the bounceback in commodity prices as it sits just under the previous weekly high:

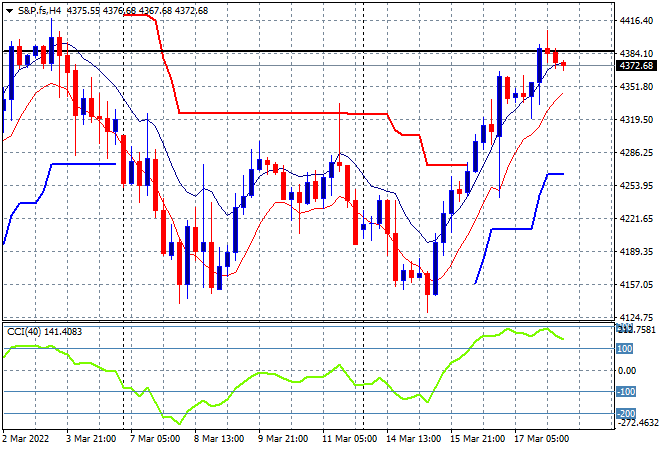

Eurostoxx and Wall Street futures are steady as risk sentiment once again amid a lift in oil prices. The S&P500 four hourly chart shows price ready to tackle the next layer of strong resistance at the 4400 point level that hasn’t been breached for several weeks, but short term momentum is possibly rolling over here:

The economic calendar finishes the week with Euro wide balance of trade figures, then US existing home sales and some Federal Reserve member speeches to keep an ear out for.