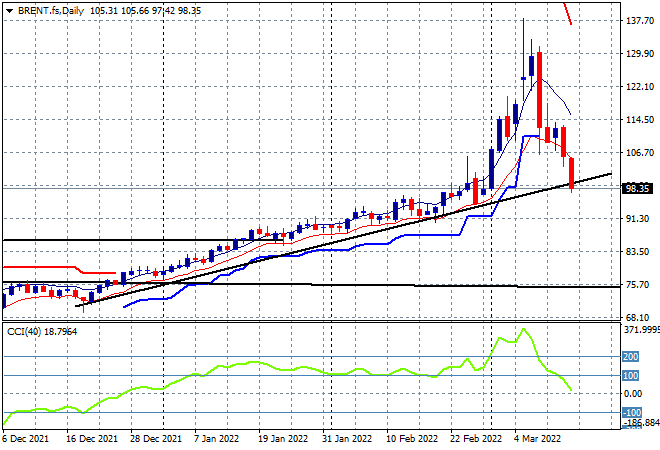

Wall Street bounced back sharply overnight as oil prices tanked as traders await the next FOMC meeting. The continuing war in Ukraine is still weighing on bond markets as well, with the 10 year Treasury range trading around the 2.1% level, remaining at a new three year high, while currency markets were mostly contained as the USD is still strong against everything. Commodity prices took another hit with Brent crude losing over 6% to a three week low, just above the $100USD per barrel level, while gold lost nearly 1% to finish near the $1920USD per ounce level.

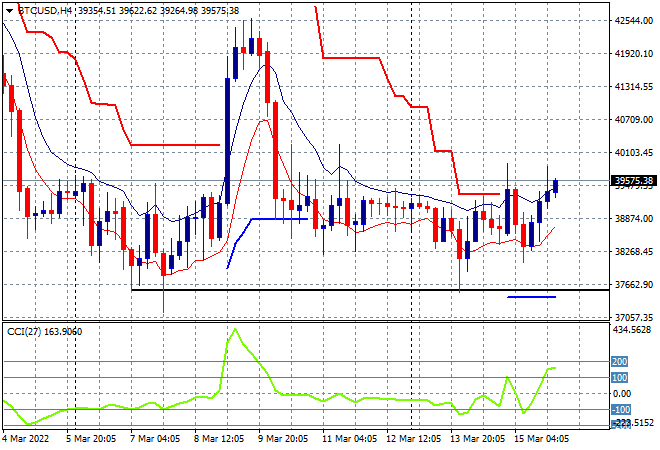

Bitcoin has seemingly bottomed out here with some intrasession buying overnight sending it up through the $39K level for a new high for the week – early days yet but potentially promising as it climbs above short term resistance:

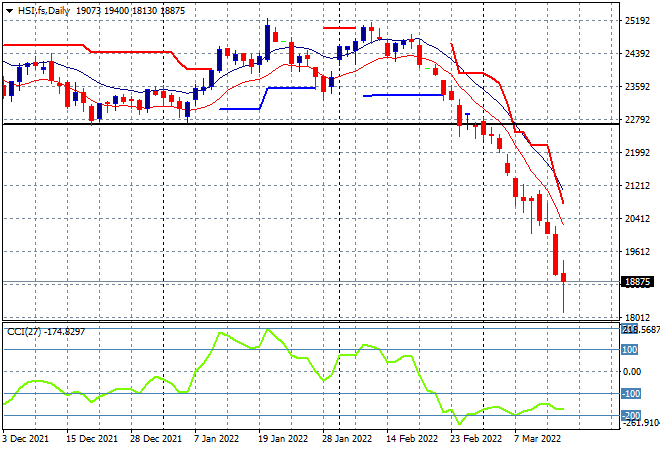

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares crashed with the Shanghai Composite finishing nearly 5% lower in one of its worst days in years, closing at 3063 points while the Hang Seng Index went even further, down nearly 6% to finish at 18415 points. This adds on to the previous “worst day since 2008”, with price action just one way for now as everything sells off. Momentum remains in an extremely oversold mode as the fallout from the tech wreck could get worse here:

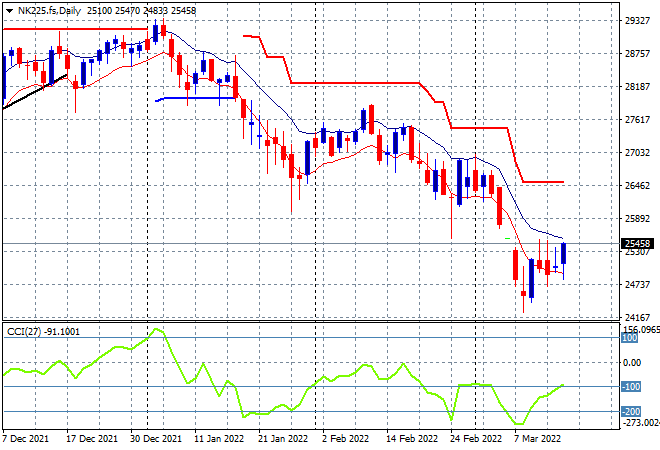

Japanese stock markets were the odd ones out, helped by a much lower Yen as the Nikkei 225 closed around 0.2% higher at 25346 points. The daily futures chart is showing some potential upside here as the possibility of a bottom is brewing even as the last couple of closes don’t look so promising, but Wall Street’s overnight surge may get things going shortly:

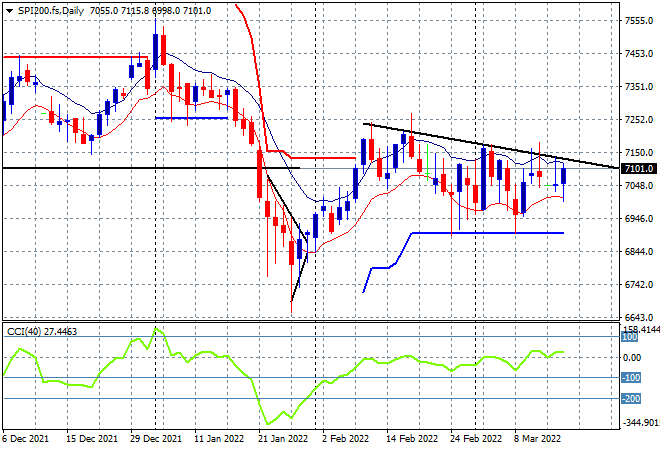

Australian stocks sold off mainly due to commodity weakness with the ASX200 finishing 0.7% lower to retrace again below the 7100 point level, closing at 7097 points. SPI futures are up half a percent or more on the Wall Street rally, with the steady but still quite low Aussie dollar hopefully helping steady the market amid the risk off mood in China. Watch the lower resistance line overhead that needs to be taken out as daily momentum is back into the positive zone but not yet indicating a breakout:

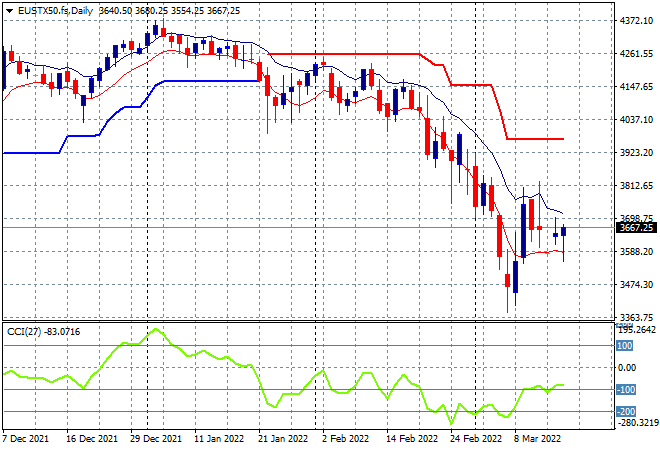

European shares' solid start to the trading week has stalled out again with scratch sessions across the continent, although post close futures are indicating a more positive return later tonight. The Eurostoxx 50 index finished a handful of points lower to 3738 points with a dead cat bounce still likely here. To properly bottom out here requires a solid close above the former support, now staunch resistance at the 4040 point area with a swing trade on its way beforehand with a solid close above the high moving average at the 3800 level:

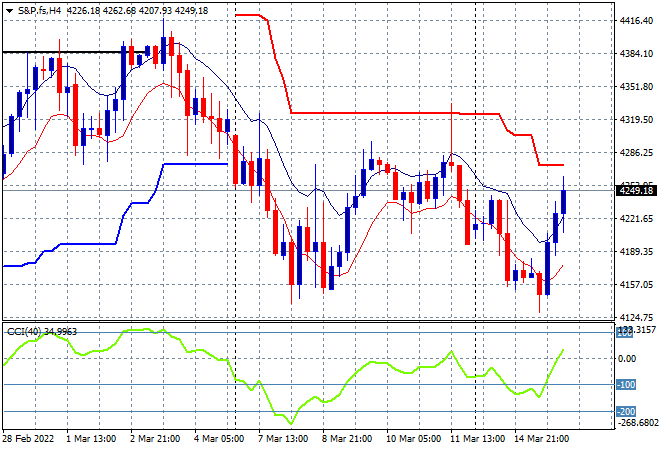

Wall Street finally made some traction and found strong bids across the complex with the NASDAQ Composite finishing nearly 3% higher while the S&P500 gained some 2% to finish at 4262 points. This rally still keeps price action contained below four hourly and daily overhead ATR resistance but gives some potential in the short term to make a new weekly high if it can breach the 4300 point level. As I said previously, keep watching oil markets for the catalyst, as lower prices at the pump will help sentiment here:

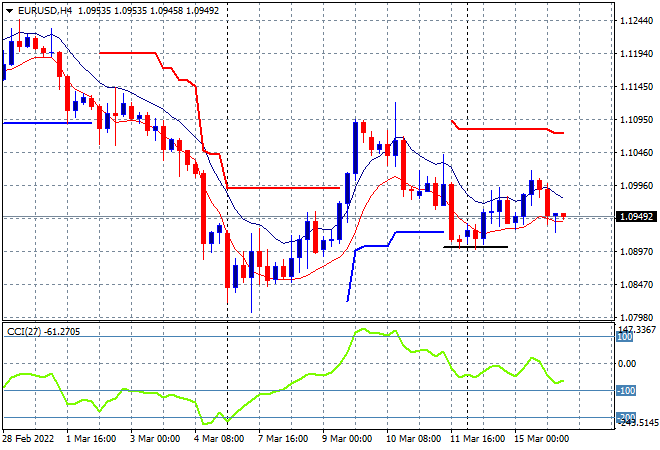

Currency markets are still seeing a lot of USD strength although the Euro remains somewhat supported with a mild pullback to finish at the mid 1.09 level overnight. The Ukrainian invasion continues to keep a lid on risk taking here with the four hourly chart showing a return to the dominant downtrend, with this week’s target still at the previous weekly lows near the 1.08 level, but watch for a potential break above the high moving average and towards the 1.10 for a snap rally if peace talks take off again:

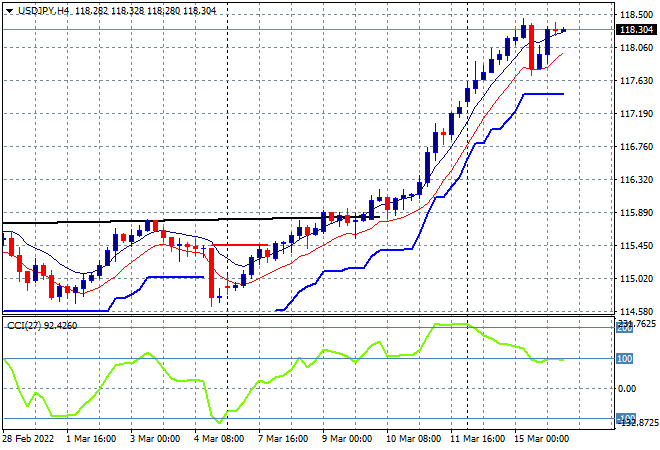

The USDJPY pair finally paused its push higher, keeping above the 118 level overnight as we all catch breath from this 300 pip plus rally in less than a week. The USD has become the safe haven choice with momentum now reverting from its extremely overbought stage that could be presaging a sharp reversal here as price action should revert to mean here soon, but it seems new multi year highs cannot be discarded lightly:

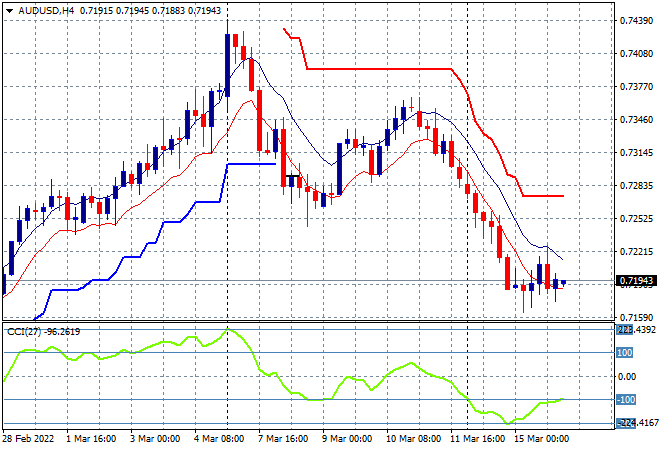

The Australian dollar also paused on its big rollover, seemingly finding a bottom overnight at the 72 handle as commodity prices pull back from their recent exuberance. Last night saw the Pacific Peso contained but still well below the previous intraweek low at the 72.40 level that had strong buying support with short term momentum now extremely oversold:

Oil markets continue their post-crazy breakout with a major reversal back as Brent crude lost nearly 6% overnight, finishing below the $100USD per barrel level for another solid daily new low. Daily ATR support is broken properly as is prior support at the $106 level, so watch for any major pullbacks (and daily closes, not intrasession volatility) below the psychologically important $100USD level:

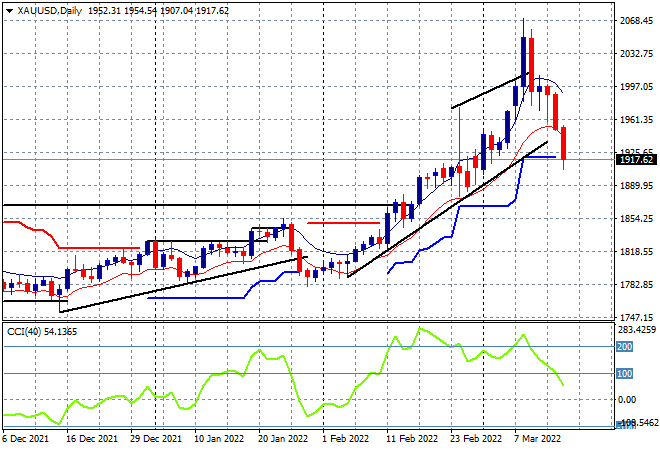

Gold was smacked down again overnight, continuing its major retracement below the $2000USD per ounce level as it follows other precious and industrial metals that got way out of hand in recent weeks. Daily momentum is now just at a neutral setting with daily ATR support nominally broken so watch for a further consolidation possibly down to the $1900 level next: