The latest US retail sales print came in a little hotter than expected on the back of an equally hotter than expected inflation print, sending US stocks higher and the USD up on further Fed rate rise expectations. Currency markets saw a continuation of USD strength with Euro flopping below the 1.07 handle to almost make a new weekly low, while the Australian dollar was pushed back below the 69 cent level. 10 year Treasury yields lifted on the print, up through the 3.8% level to make a new high for the year. The commodity complex saw oil prices fall back slightly with Brent crude pushed below the $86USD per barrel level while gold is still in a depressed funk, falling back again to close at the $1835USD per ounce level.

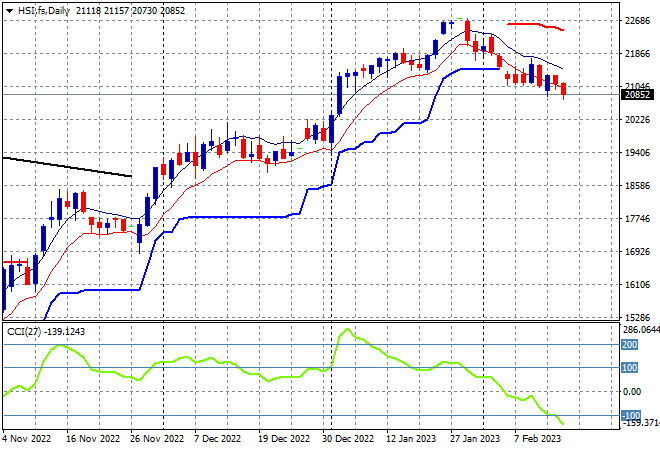

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets sold off straight from the open and faded again going into the close with the Shanghai Composite down 0.4% at 3280 points while the Hang Seng continued its recent falls, down another 1.4% to 20812 points. The daily chart had being showing a nice breakout with daily momentum well overbought but still unable to breach the 23000 point level. Price action has now rolled over through ATR support with momentum crossing into oversold territory as a possible corrective phase is starting to firm here as support at the 20000 point level comes under pressure:

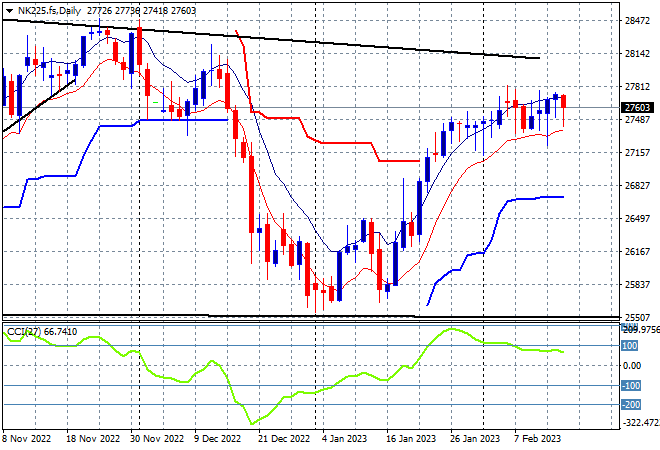

Japanese stock markets were also in retreat with the Nikkei 225 closing 0.6% lower at 27473 points. After bottoming out at the 25000 point level the next level to clear is still 27500 points, which is now coming under pressure as this market slowly melts higher. Daily momentum has reverted out of overbought mode and was suggesting a slide back below the low moving average next but support is holding quite strongly although futures are indicating a pullback on the open:

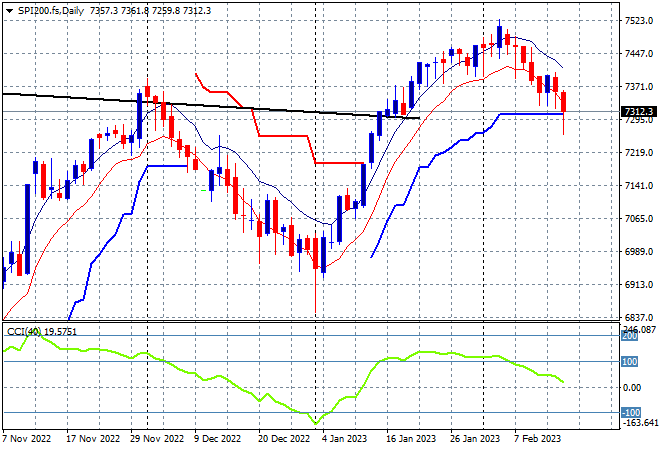

Australian stocks slumped with the ASX200 losing more than 1% to finish below the 7400 point level, closing at 7352 points. SPI futures are up 0.5% on the bounce on Wall Street overnight to try to recover these losses, but the daily chart is showing a clear rollover after being unable to take out 7500 points. A retracement down to ATR support at the 7200 point level looks like firming here as daily momentum continues its reversion from being overbought to almost negative status, but price action is indicating a pause for now:

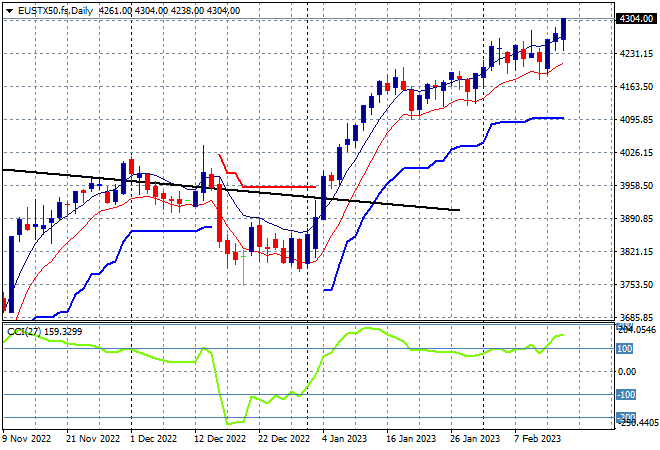

European markets were in a much better mood overnight with the Eurostoxx 50 Index eventually closed 1% higher at 4280 points, holding on to a new weekly high as it continues to outperform Wall Street. The trend above the 4000 point level remains somewhat stable with daily momentum now back into its previously overbought settings. The 4000 point level was the key psychological resistance level here that has now turned into support going forward, with a melt up higher still in effect:

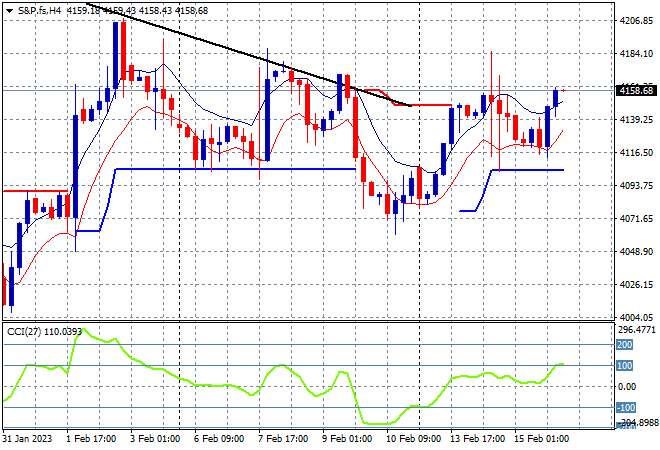

Wall Street was able find some lost confidence following the inflation print with the NASDAQ gained some 0.9% to push through the 12000 point level, while the S&P500 lifted 0.3% to finish at 4147 points. The four hourly chart shows price now pushing above the inflation print volatility, but only just with a modicum of control at the 4150 point level still in play as momentum almost gets into overbought status. The key level to beat this week is last week’s intrasession high at the 4180 point area so I’m watching momentum to build at those levels this evening:

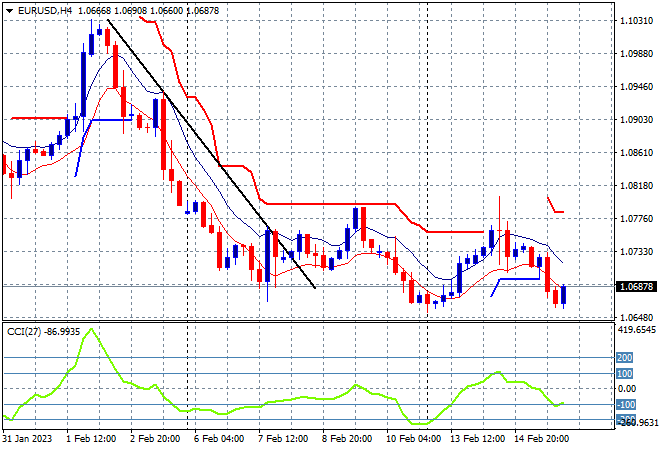

Currency markets reacted strongly at first overnight to the hot US retail sales numbers with USD making or returning to highs against most of the major currencies. Euro fell back below the 1.07 handle to its start of week position which has almost negated its recent bottoming action and rejection of overhead resistance at the mid 1.07 level. I’m watching for a retest below the 1.0650 mid level next:

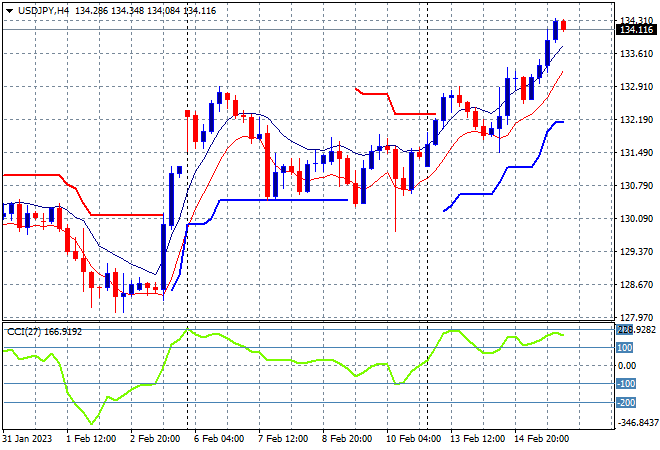

The USDJPY pair lifted up through the 134 handle on the retail sales print as Yen was sold off significantly after the inflation and Japanese GDP print. Short term momentum remains way overbought in this move although price action does look very toppy again in the short term, even though its now above the previous week intreasession high:

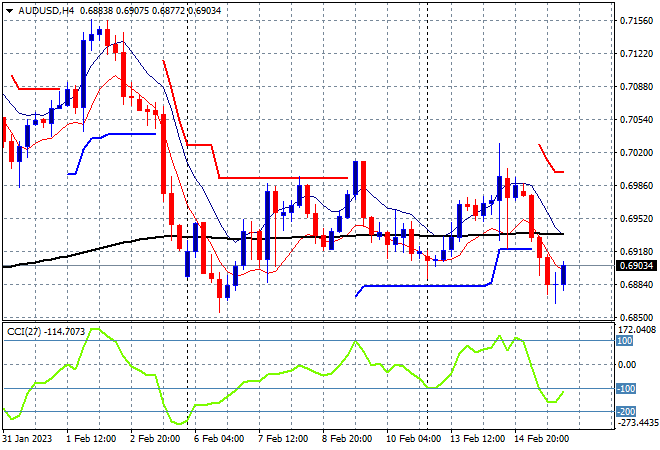

The Australian dollar followed Euro somewhat overnight, pushed down through the 69 handle before reverting slightly above in late trade this morning. This comes after what looked like a bottoming action post the US inflation print and could get even more volatile following today’s unemployment numbers coming soon that may further challenge interest rate expectations. I’m still watching for a potential pullback to the recent weekly lows at the high 68’s but also mindful that this looks like a solid base:

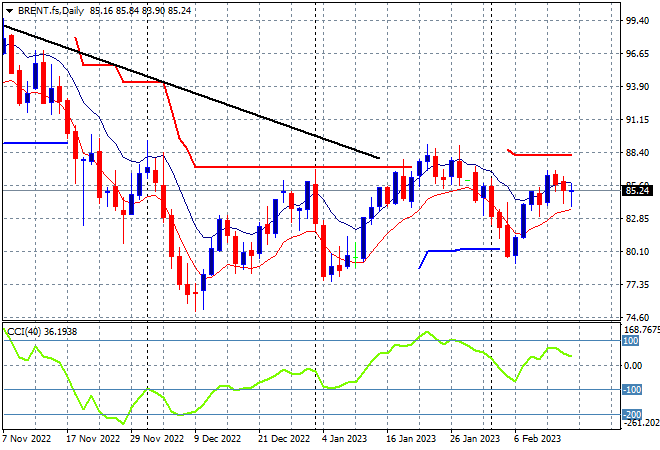

Oil markets are trying to follow through on their recent bounce from the Russian cutbacks but the recent inventory data has not helped keep Brent crude below the $86USD per barrel level to pull back slightly from the recent new weekly high. Daily momentum is finally lifting through the positive zone but is not yet overbought as buying support built above the $84 level but still shy of the $88 highs from January:

Gold remains very depressed as it continues to fall below its recent post NFP lows to make new weekly lows, now at the $1835USD per ounce level despite other undollars almost holding on overnight in the wake of the retail print. This price action negates all of the positive moves in previous weeks with daily momentum remaining quite oversold and all support levels taken out. The slight possibility of a swing trade building here has been negated so watch for further lows: