A subdued day on Asian share markets except in Japan where traders are playing catchup after another long weekend while the newsflow about pending conflict in the Middle East has reversed sentiment a little going into tonight’s session. The USD remains somewhat firm against most of the majors with Yen sliding slightly while the Australian dollar despite recent wage inflation data.

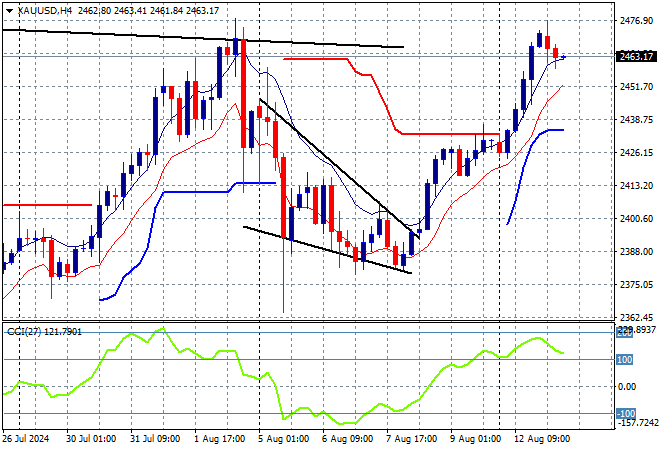

Oil prices are losing a little short term momentum but are still holding on to their gap over the weekend as Brent crude nearly pushes above the $82USD per barrel level while gold pulled back slightly on the lack of evidence of the impending Iranian attack but is holding near its recent highs well above the $2400USD per ounce level:

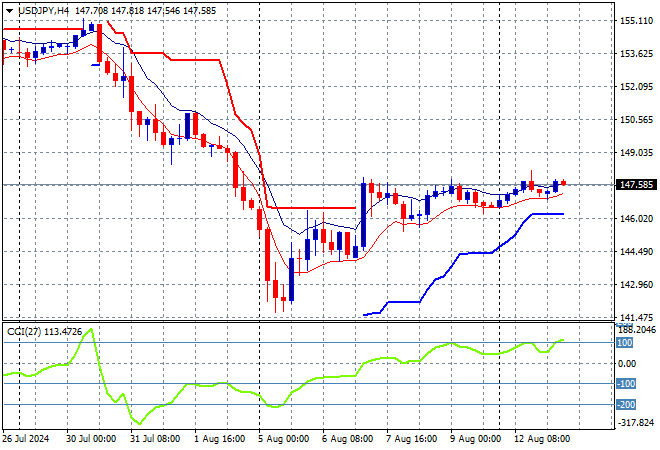

Mainland Chinese share markets are still struggling to find any traction as economic concerns continue to weigh down sentiment as the Shanghai Composite falls more than 0.3% going into the close while the Hang Seng Index is up slightly at 17128 points. Meanwhile Japanese stock markets returned from their long weekend with the Nikkei 225 soaring more than 3% higher to 36232 points while trading in USDPY was much more subdued as it stays just above the 147 handle:

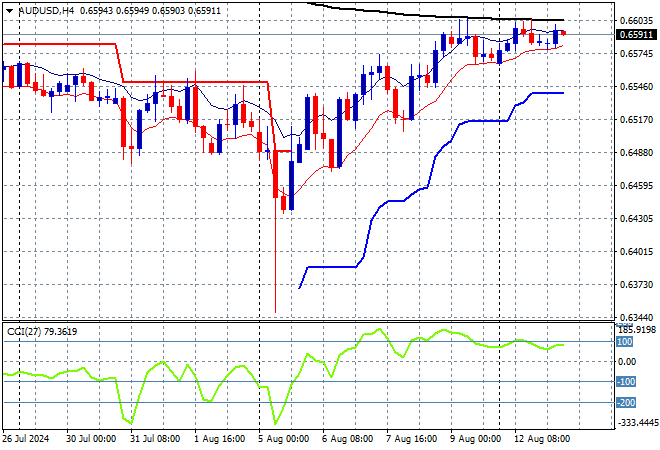

Australian stocks eked out a small gain with the ASX200 lifting just 0.2% gain to close at 7826 points while the Australian dollar is trying to double down on its recent small breakout but still can’t clear the 66 cent level, which just happens to be the 200 day moving average (black line):

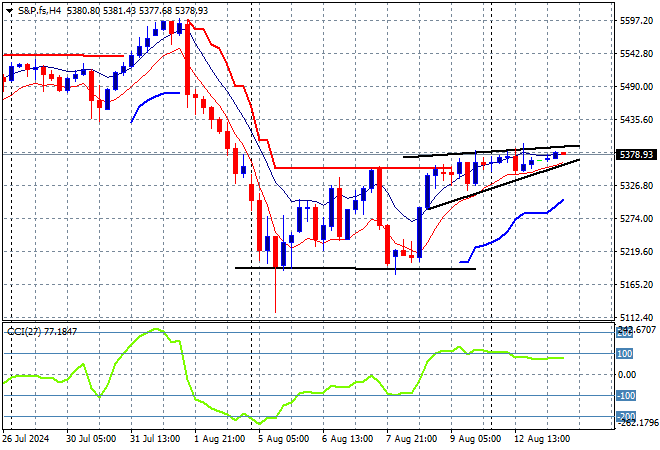

S&P and Eurostoxx futures are up only slightly going into the London session with the S&P500 four hourly chart showing continued stability returning to the major index but a faint bearish rising wedge pattern is slowly forming here as sentiment shifts:

The economic calendar ramps up tonight with the latest UK unemployment figures, the closely watched German ZEW survey then a few Fed speeches.