Friday night saw a relatively quiet finish to the trading week without many catalysts to action with most macro news happening over the weekend, particularly the ramping up of Cold War 2.0 in Europe and the Australian election call. Markets are still absorbing the continuing hawkish signals from central banks combined with the volatility in soft and hard commodity markets. The USD rose slightly against most of the major currency pairs again, continuing to push the USD Index higher although the Australian dollar is looking a bit wobbly following the call of the federal election. Interest rate and bond markets are still confirming many more rate rises on the way, with the 10 year Treasury lifting through the 2.7% yield level for the first time in three years. Commodities sold off slightly across the board with WTI remaining below $100USD per barrel while Brent crude lost nearly 1%, to remain just above that psychologically important level. Gold broke out finally to almost get to the $1950USD per ounce level.

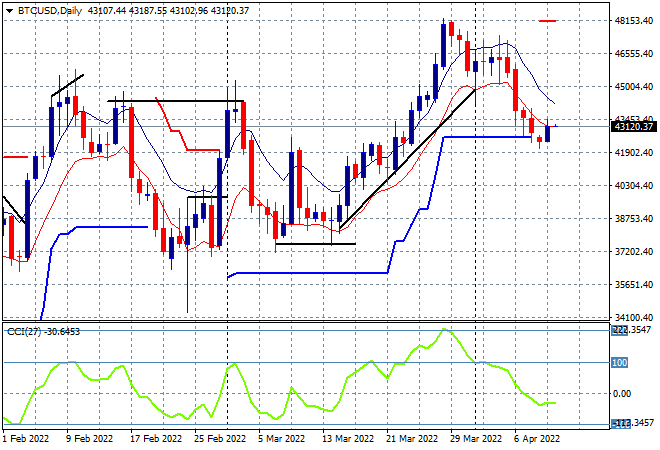

Bitcoin continued its rundown, with price pushing down to daily ATR support at just below the $43K level, which takes it back to the former resistance levels, now support at the January and February highs. There might be a small rebound as weekend trade translates into something a bit more assertive but early days yet as momentum remains quite negative:

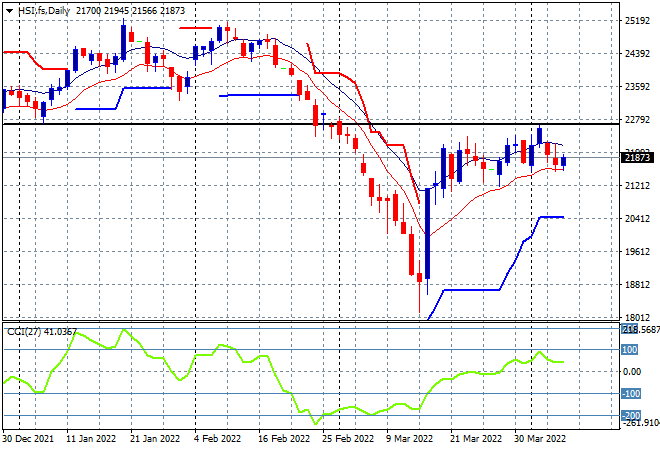

Looking at share markets in Asia from Friday’s session, where mainland Chinese share markets were unsettled given the ongoing COVID domestic problems, but the Shanghai Composite eventually finished up 0.5% to 3253 points while the Hang Seng Index managed to just lift up 0.3% to 21872 points. The daily chart of the Hang Seng Index was indicating a potential breakout having been supported at the 21200 level but the attempt to clear very strong resistance at the 22600 point level next continues to falter here as momentum wanes. Watch the low moving average that could break here:

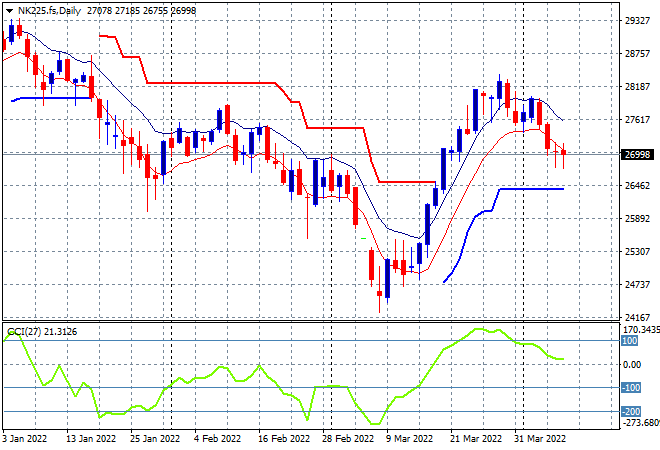

Japanese stock markets were quite unsteady although the Nikkei 225 lifted towards the close to finish 0.3% higher at 26985 points. Futures are indicating some indecision on the open despite a weaker Yen as daily momentum reverts sharply from its slightly overbought status. Price has definitively rolled over back to weekly resistance at the 27500 point level and may begin to fall below the previous February highs, with that low moving average now broken through but there is a lot of intrasession buying support below:

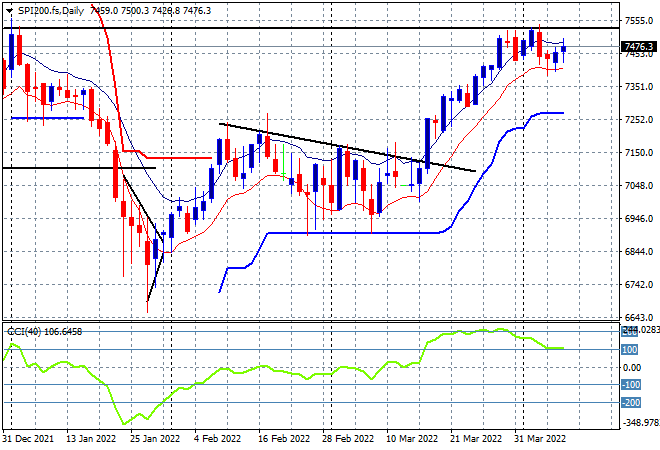

Australian stocks were the best in the region again with the ASX200 closing nearly 0.5% higher, but still shy of the 7500 point level to finish the week at 7477 points. SPI futures are up nearly 0.4% despite mixed results on Wall Street on Friday night with certainty around the election probably a factor in boosting confidence. The daily chart was showing a lot of potential with daily momentum still quite strong but price is finding stiff resistance at the former highs from December last year:

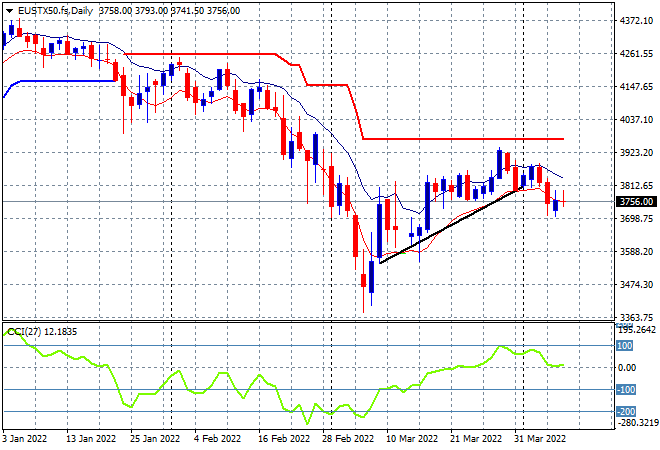

European shares rebounded across the continent but it maybe just short covering as the Eurostoxx 50 index gained 1.4% to finish the week at 3858 points. I still contend we could be seeing a capitulation here as price remains well below the trendline and the low moving average, but watch for potential support to build at the 3700 point level as momentum remains neutral and not yet negative:

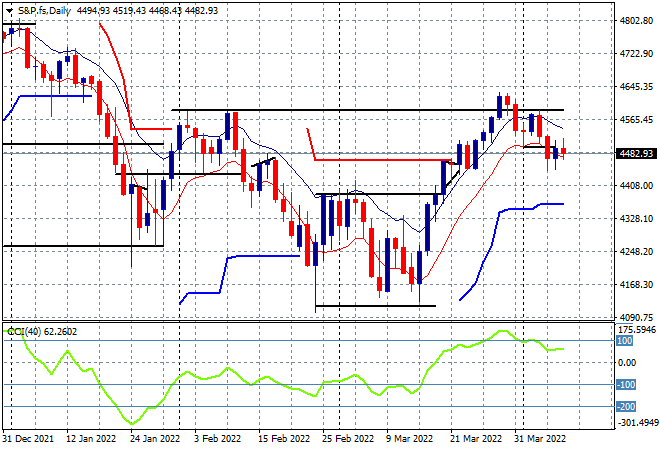

Wall Street again fell back at first in a volatile session where the NASDAQ lost over 1% while the S&P500 eventually steadied to only lose 0.3% to again close below the 4500 point level. Price action on the daily chart is not looking promising with wide ranging sessions that definitely create a picture of a battle between bulls and bears, potentially with the latter winning out. The break below previous support at the 4500 point level maybe shortlived as the BTFD crowd step in but this is messy:

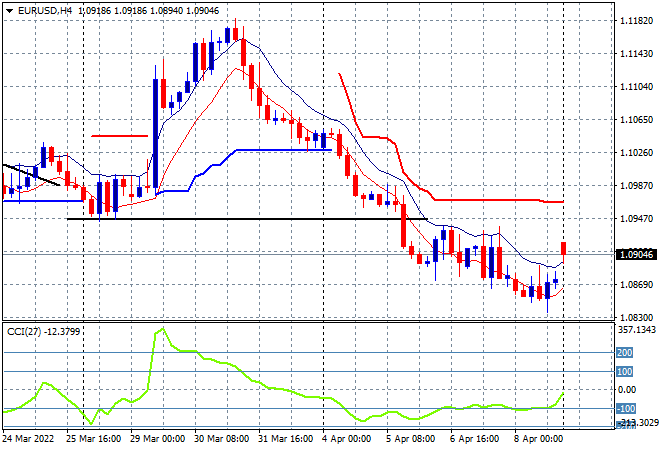

Currency markets continued to see a slightly stronger USD although only small gains were made with Euro still slowly deflating, absorbing the recent ECB minutes. The union currency is still below the 1.09 handle proper, with the now two week long reversal keeping it line with its longer term downtrend – but we’ve had a gap higher this morning as new trade gets underway on more positive European/NATO news:

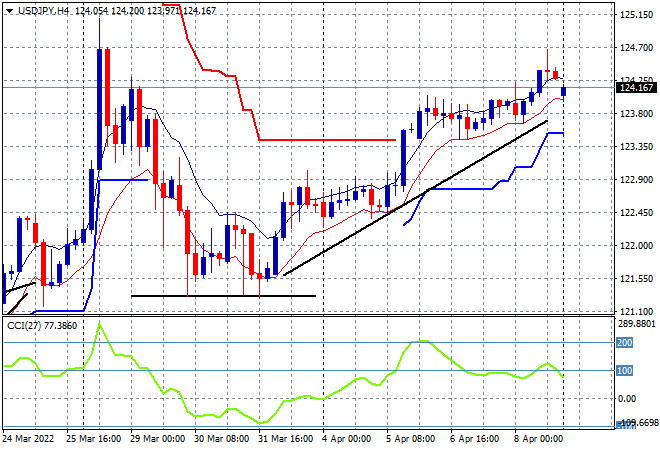

The USDJPY pair continued its uptrend, breaking through the 124 level on Friday night as this weekly uptrend remains intact. This sees price action leaving trailing ATR overhead resistance behind with the growing possibility of heading back to the previous high from late March. Watch that trendline from the March lows and for momentum to remain at overbought levels however:

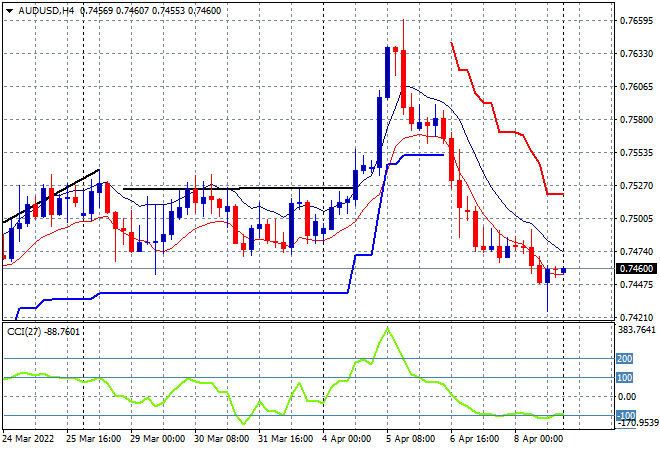

The Australian dollar had looked like finishing its pullback from its post RBA euphoria reversal, but was unable to get back above the 75 handle on Friday night as it slipped further into weakness on the back of lower commodity prices. I still contend this drop could be shortlived with more upside potential building as commodity prices are likely to rebound in the wake of more Russian sanctions, but price has now broken below weekly support which does not bode well:

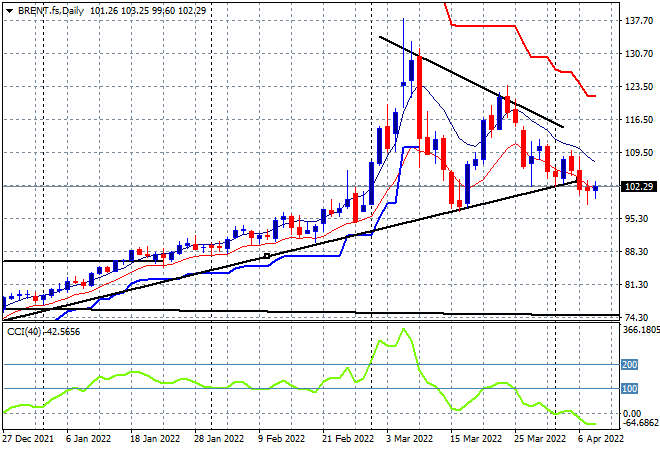

Oil markets had somewhat of a pause in their final session for the week with WTI stabilising just below the $100USD per barrel level while Brent is closely following, finishing at the $102 level, after breaking support at $103 earlier in the week. As I’ve contended for a while now, the charts of oil leading up to and through this conflict are classic technical bubbles with the second peak lower than the first. This provide a potential continuation move here to flop down to the $100 level as daily momentum reverts back into negative readings:

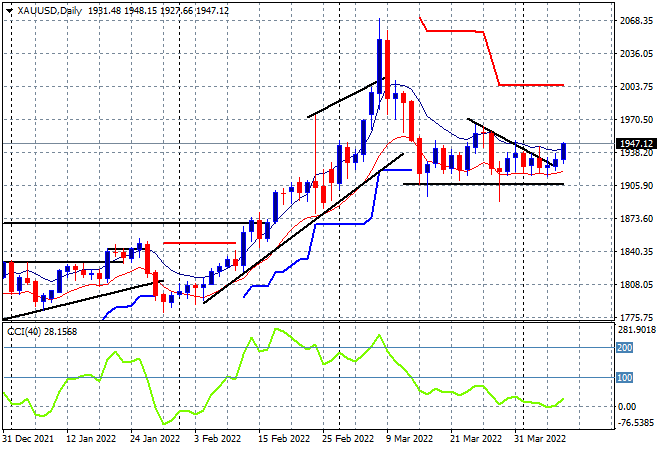

Gold finally made a move on Friday night, after not making a new session low throughout the week, lifting up towards but not above the $1950USD per ounce level. Price was maintaining itself above the psychologically important $1900USD per ounce level with momentum still basically neutral, but as I suggested, a close above the high moving average at the $1930 area was required to get animal spirits going. The next stage is a follow through above the recent false breakout around the $1960 level: