Wall Street was able to bounceback in late trade this morning with tech stocks leading the way while the USD was basically unchanged against the majors as the Australian dollar retraced slightly below the 69 handle. Bond markets are seeing more loosening of yields in anticipation of the next US CPI print with 10-year Treasury yields lifting through the 3.6% level while the commodity complex saw oil prices unchanged and unable to gain ground as Brent crude remains below the $80USD per barrel level while gold steadied at its new monthly high around the $1880USD per ounce level.

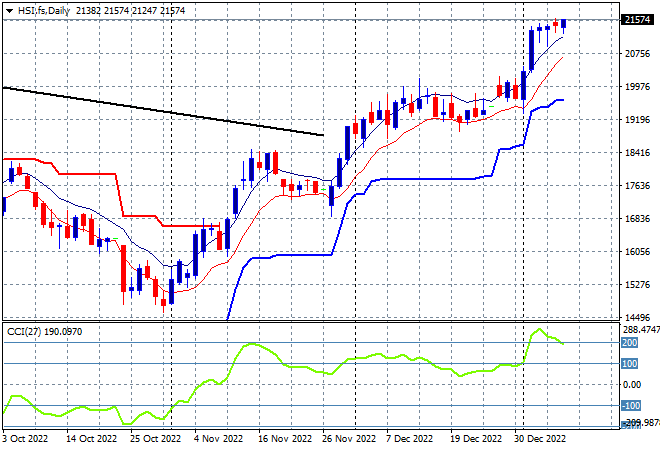

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets drifted sideways with the Shanghai Composite down nearly 0.2% to remain above the 3100 point level, closing at 3169 points while the Hang Seng Index did the same, down 0.3% to remain above the 21000 point level at 21331 points. The daily chart continues to look quite boisterous here with a series of step ups since the nadir in October last year as daily momentum remains in extreme overbought mode. It looks like weekly support at the 19000 point level is quite firm as traders bet on a post zero-COVID economic liftoff, but the question is this move sustainable:

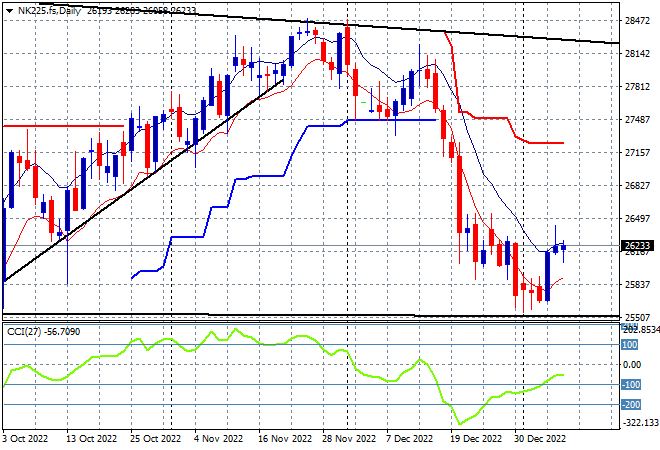

Japanese stock markets have reopened with the Nikkei 225 lifting more than 0.7% to close at 26175 points. There is the potential for a swing long trade to develop here after bottoming out at the 25000 point level. Daily momentum was oversold and support has held here with futures indicating a steady open but to make it sustainable requires another solid close above the high moving average:

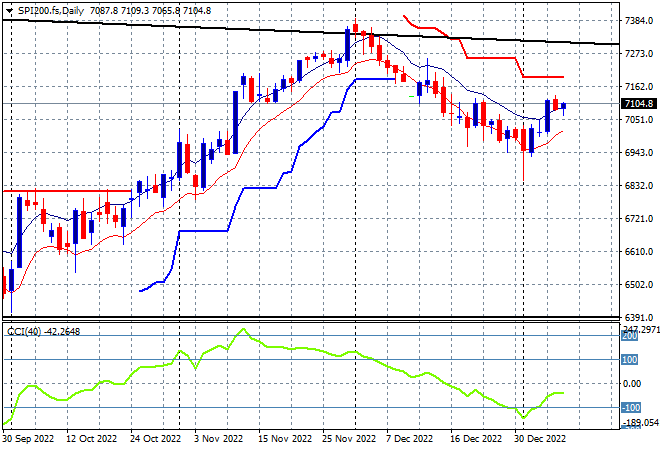

Australian stocks also pulled back slightly, with the ASX200 closing nearly 0.3% lower to close at 7131 points. SPI futures are up over 0.4% to recoup most of those losses due to the bounce on Wall Street overnight. The daily chart has been showing price action and daily momentum in a decline since the start of December with a breakout confirmed if it stays above the high moving average, but it really needs to breakthrough overhead ATR trailing resistance next:

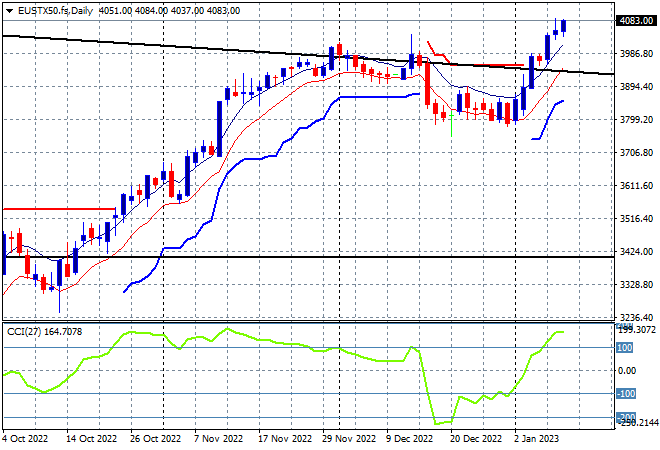

European markets had a slight pause overnight with some hesitant selling and stubbornly high Euro pushing the Eurostoxx 50 Index down 0.3% to remain above the 4000 point level, closing at 4053 points. The daily chart showed key overhead resistance at the 3900 point area under contention before the NFP print as daily momentum built up from a swing trade into a proper breakout. The 4000 point level is the key psychological resistance level that could be turned into support going forward:

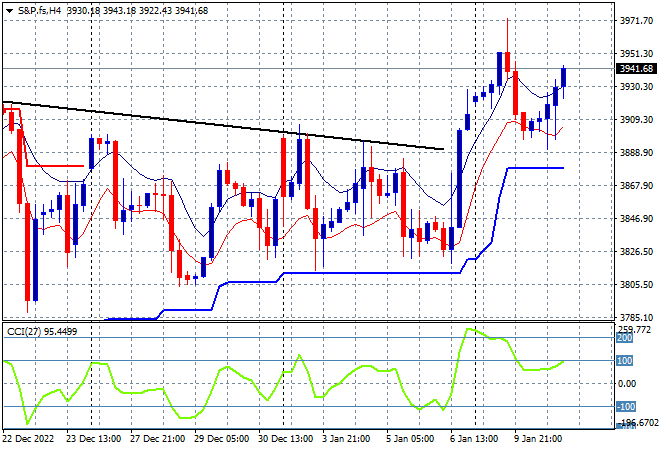

Wall Street bounced back overnight with the NASDAQ making greater strides, moving up 1% while the S&P500 gained some 0.7% to get back above the 3900 point level to close at 3919 points. After breaking the series of lower daily highs since Xmas, price action is still above the dominant medium term trendline after hovering around weekly support at the 3800 point level, but it must punch through the December highs next to seal the deal for the rest of the month before the next NFP:

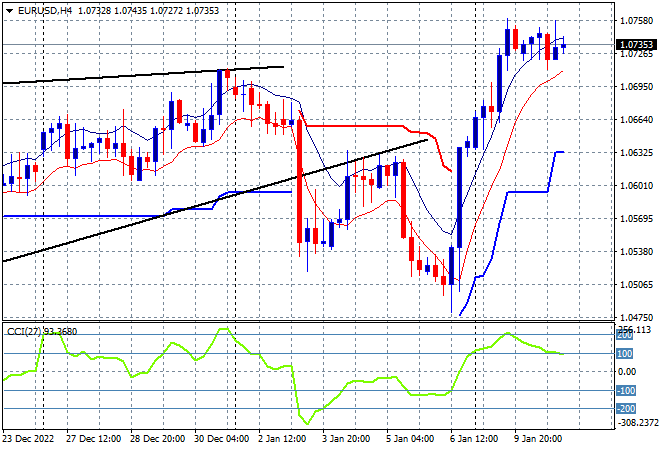

Currency markets again saw a slight wobble in USD but no real change as Euro consolidated above the 1.07 handle overnight after its brisk melt up trade on Friday. This keeps price action not just above the lower edge of a bearish rising wedge but also above the recent weekly highs and while short term momentum is likely overbought and ripe for a small retracement, it should hold at the 1.06 to 1.07 region as 1.05 becomes very firm support:

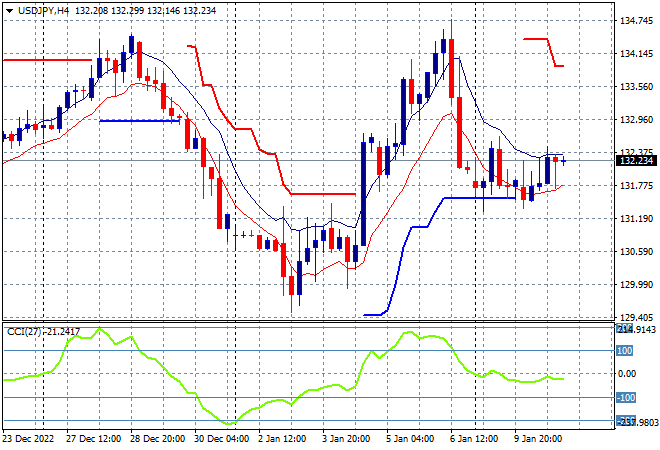

The USDJPY pair is still depressed following the post US jobs report retracement move below the 132 handle with almost no volatility overnight. A swing back up to the Xmas highs around the 134 handle was nearly complete before the NFP print on Friday night, matching the previous end of year highs but unable to extend further. This could find more support at trailing ATR support near the 131 mid level or overshoot back down to the start of year level around 129 or so:

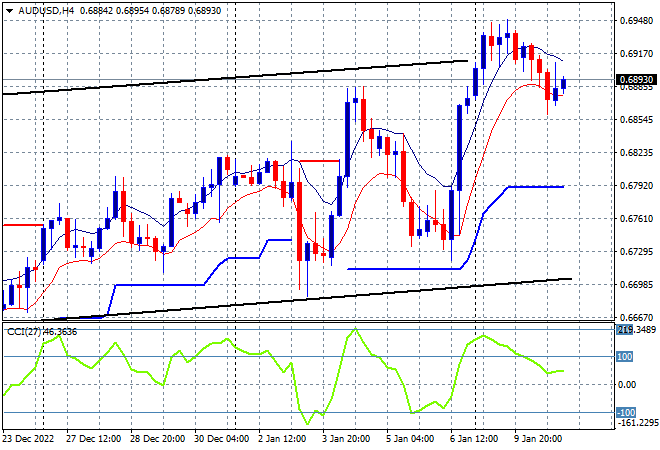

The Australian dollar was unable to extend its own recent gains to retrace below the 69 level with a late bounce almost getting back to that handle this morning. The recent surge back above the 68 handle had found resistance again just below the 69 level with short term momentum now back to the same levels so the question is can the Pacific Peso break through it again or keep oscillating in this broad weekly uptrend channel:

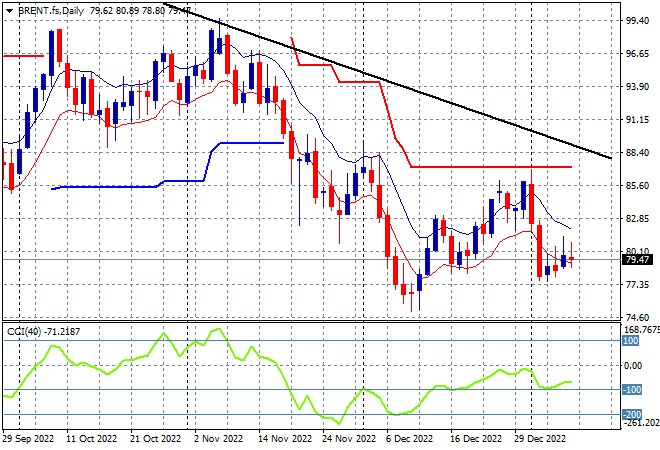

Oil markets remain under pressure as energy prices falter in a warm northern hemisphere with Brent crude stabilising somewhat at the $79USD per barrel level overnight, hovering just above the December lows. Daily momentum is looking to return to oversold settings after failing to get into positive territory with overhead ATR resistance and the dominant downtrend still in play:

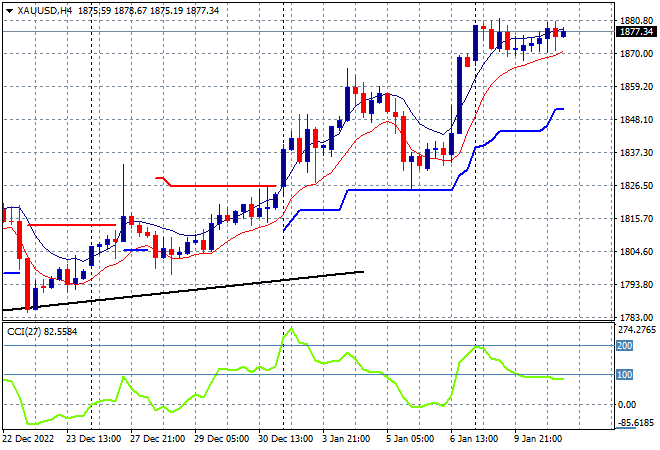

Gold is still being the most resilient undollar, and it slowly melting higher as it maintains a new monthly high at the $1870USD per ounce level. Trailing ATR support at the $1820 level remained intact which is a very solid sign for more upside potential. The key area to watch as 2023 gets underway is for the $1800 zone to turn into a solid area of support, and hopefully not turn into resistance, with a view to staying above the daily uptrend line: