Wall Street stumbled and fell amid reports on the ailing financial sector and fears that tomorrow’s US jobs report will come in hot and spike interest rates from the Fed yet again, in line with Fed Chair Powell’s recent testimony to Congress. Helping the volatility was Bitcoin and other cryptos falling sharply while currency markets stabilised around the recent surge in USD strength. What’s not calm are the bond markets with yield inversions everywhere, not just in US Treasuries with 10 year yields lifting slightly but still just below the 4% level with 2 year yields retreating below the 5% level. Meanwhile the commodity complex saw oil prices pushed lower again as Brent crude crossed below the $82USD per barrel level while gold is trying to get out of its depressed funk with a lift up through the $1830USD per ounce level.

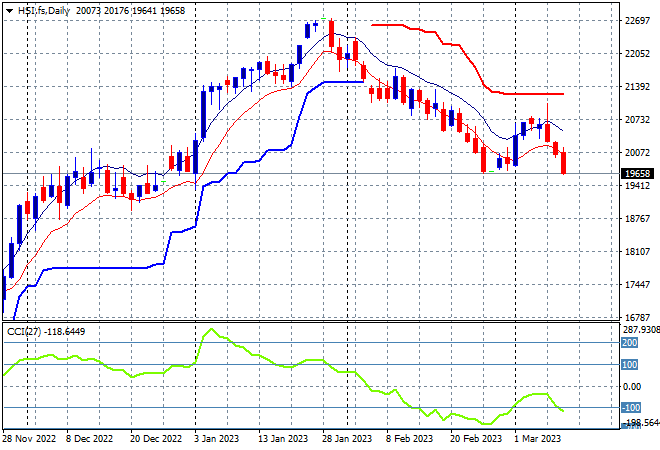

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets sold off going into the lunch break and remain slightly down going into the close with the Shanghai Composite off by 0.2% to remain below the 3300 point barrier at 3276 points while the Hang Seng was treading water, hovering just above the 20000 points level before a late selloff saw if fall 0.6% to close at 19925 points. The daily chart is showing a new rollover underway as price action retraces well below previous ATR support as momentum has returned to oversold territory to the recent weekly lows. This could get ugly:

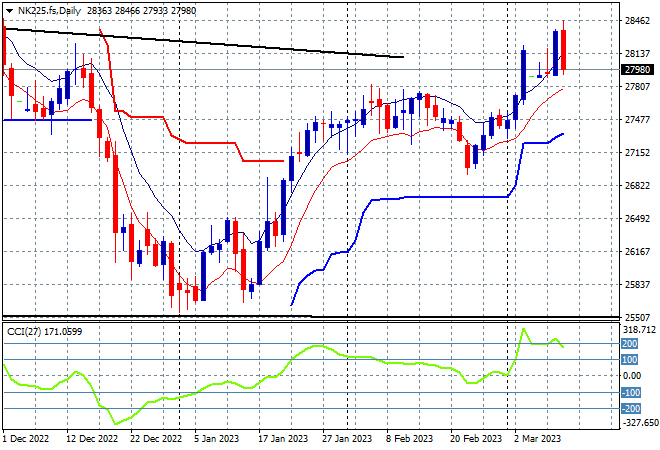

Japanese stock markets however remain the standout by extending last week’s surge with the Nikkei 225 up 0.6% to 28623 points. This big bounceback may not have legs as Yen inverts from tis recent selloff, with futures indicating a big reversal on the open as Wall Street fell sharply overnight. Daily momentum is still well into the overbought zone with support clearly evident at the 27000 point area which has been robustly defended, but watch the low moving average for any crossover action:

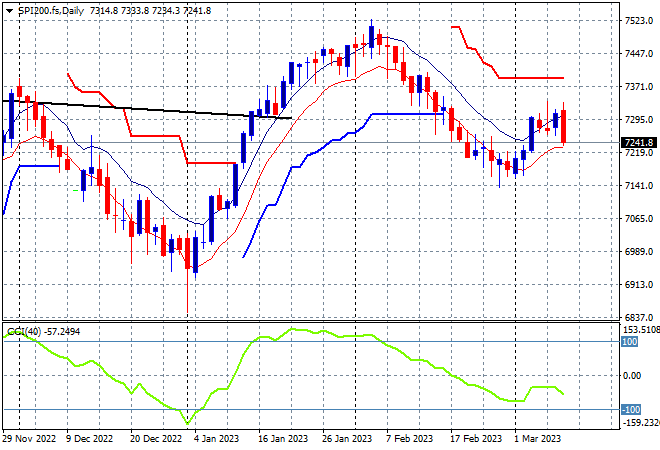

Australian stocks lacked any desire to push forward with the ASX200 barely closing in the green to remain just above the 7300 point level at 7311 points. SPI futures are down more than 1% as Wall Street slumps overnight. The daily chart was showing a clear downtrend after being unable to take out 7500 points, with a retracement below ATR support at 7200 points possibly returning. Price action was actually looking like a proper swing set up here but momentum readings were weak so this looks the bull trap is closing for a rollover back down to 7100 points:

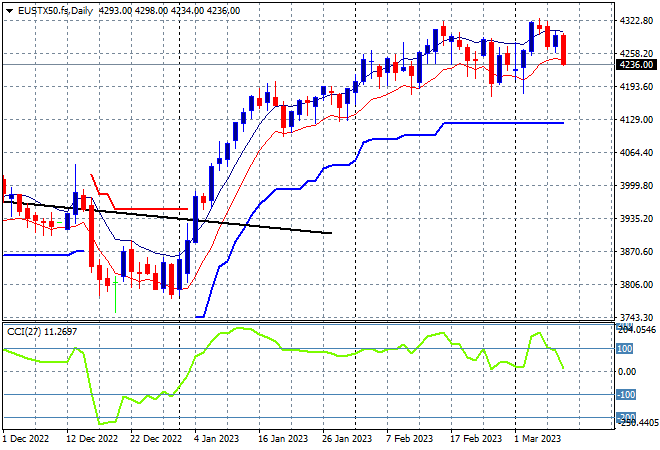

European markets were trying to stabilise across the continent, with mixed results in physical trade as the Eurostoxx 50 Index closed dead flat at 4288 points, as it remains hesitantly below its recent weekly highs. Futures are indicating a pullback however, not quite in line with Wall Street but still putting some doubt into this uptrend with daily momentum now retracing fully from its recent overbought levels. A slightly higher Euro is also providing a headwind as traders await tonight’s NFP report:

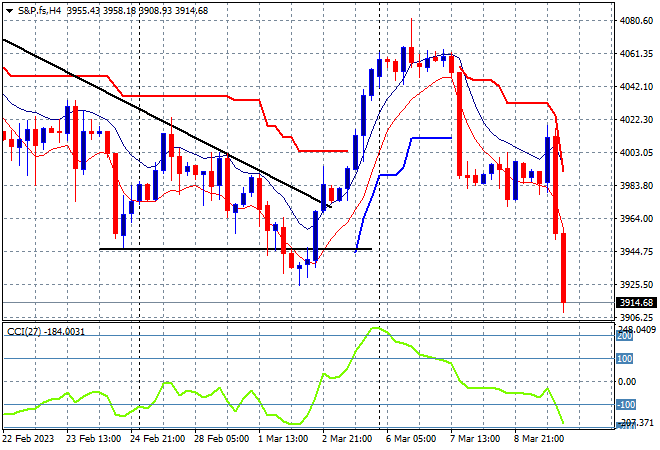

Wall Street has been lacking confidence all week and the overnight volatility from the financial sector pushed the whole edifice over with a new weekly low in the process. The NASDAQ finished 2% lower while the S&P500 lost more than 1.6% to slump down to the 3900 point level, closing at 3918 points. The four hourly chart looks ugly with price action taking out previous levels of weekly support, making new monthly lows as this bull trap closes below recent ATR and psychological support at the 4000 point area. Short term momentum is now oversold so we could see more downside at play here:

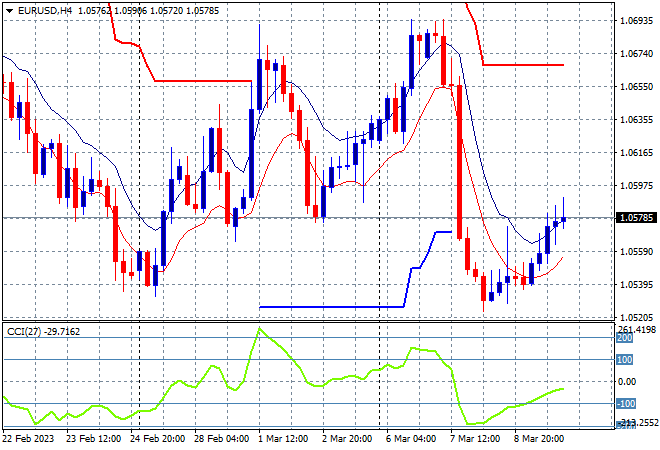

Currency markets remain heavily weighted to USD following Powell’s interest rate comments and taking into account tonight’s NFP print but Euro has managed to lift up slightly off the 1.05 level after making a two week low. This may turn into a trap with price action not that confident and short term momentum not yet positive either and is probably just an overreaction to the recent selloff:

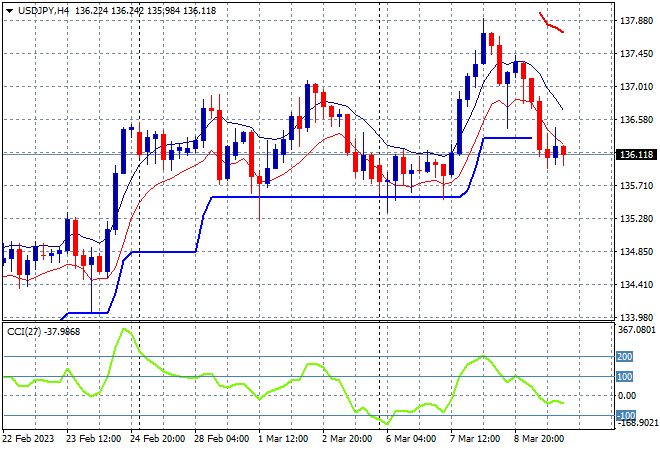

The USDJPY pair equally went the other way due to some safe haven buying in Yen to retrace back to the 136 handle, just above the starting point of the trading week. This is the key support level that must hold on here after a fairly swift reversal of the mid week fling up towards the 137 level instead. Short term momentum has retraced from overbought to negative settings as price action also breaks below short term ATR support:

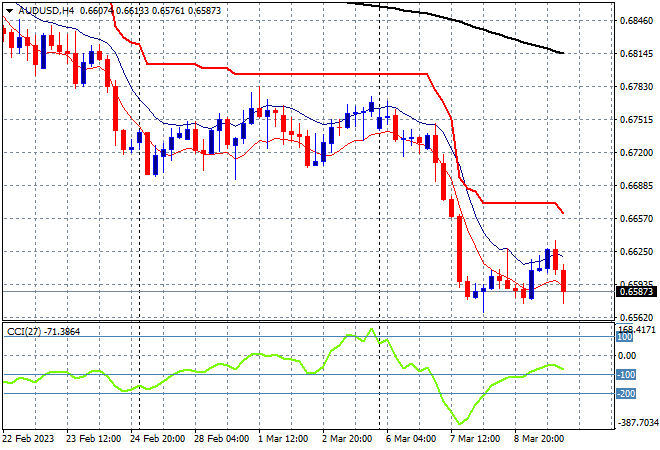

The Australian dollar has remained in the dumps following the RBA meeting and Powell’s comments with selling overnight returning it back to the monthly lows below the 66 cent level. Overall price action had been quite weak following the previous week’s unemployment numbers that has not yet challenged interest rate expectations with this new adjustment confirming trader’s weakness bias against the Pacific Peso. Short term momentum is hugely oversold which could mean some deceleration but I reckon there’s more downside to come:

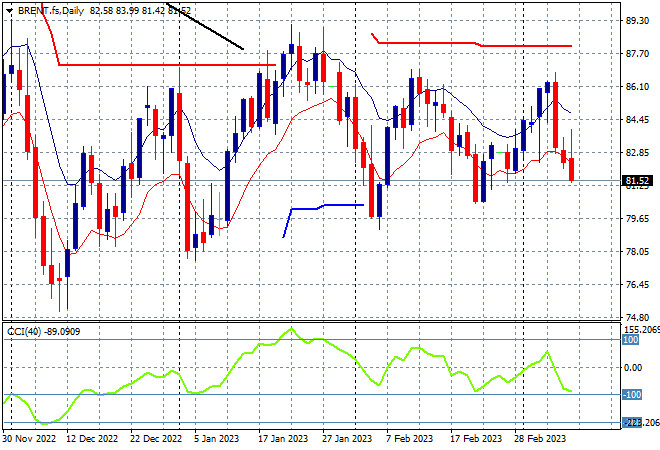

Oil markets were still in retreat mode in the wake of a stronger USD with Brent crude pushed below the $82USD per barrel level for another new daily and weekly low. Daily momentum had only been nominally positive with no new weekly high indicating only a little bit of buying support before this move. Overall however, price action has still failed to beat the $88 highs from January which is the short term target here so watch for any break below the low moving average next:

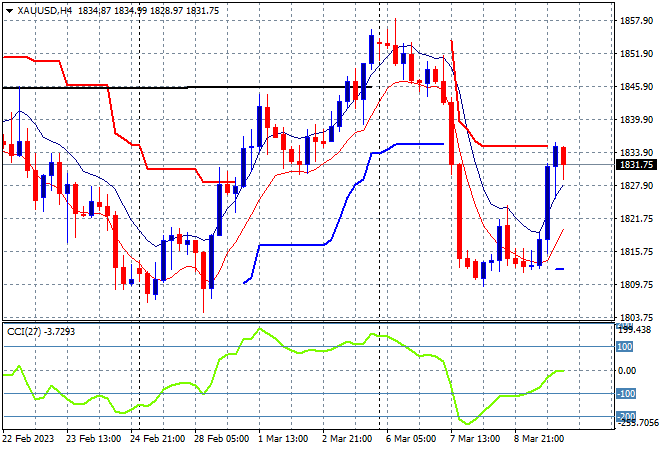

Gold too remains under pressure but caught a strong bounce overnight to lift right off the February lows to just above the $1830USD per ounce level, almost clearing overhead short term resistance in the process. However, overhead resistance on the daily chart at the $1850 level remains the area to beat but that is completely off the table as interest rate expectations change. Watch for a further test of the $1800 level proper: