Not much for risk markets to react too overnight as traders continued to evaluate Friday’s NFP job print with the USD gaining some strength earlier in the session although Euro kept on to most of the post NFP gains as the Australian dollar showed its internal weakness. Wall Street returned with a solid result as earnings continued to surprise to the upside.

US bond markets saw a small lift in yields after a big tumble on Friday with the 10 Year Treasury lifting to the 4.09% level while oil prices remained elevated as Brent crude hovered around the $86USD per barrel level. Gold had a short term reprieve against the weaker USD but looks very hesitant at the $1940USD per ounce level.

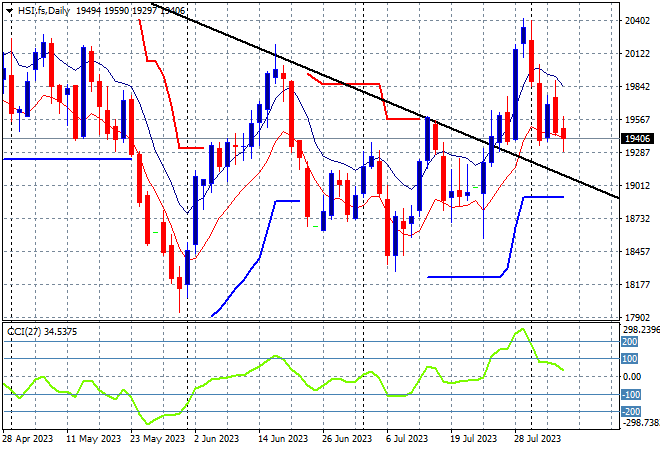

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets falling back sharply into the close with the Shanghai Composite down 0.6% or so to remain below the 3300 point level while in Hong Kong the Hang Seng Index finished dead flat, closing at 19537 points.

The daily chart was showing how the 19000 point level has become strong support as price action bursts above the dominant downtrend (sloping higher black line) following a month long consolidation. This breakout was supposed to have had further legs but daily momentum readings have now retraced back to a more sustainable level so watch for support to firm here at the 19500 point level before another leg up:

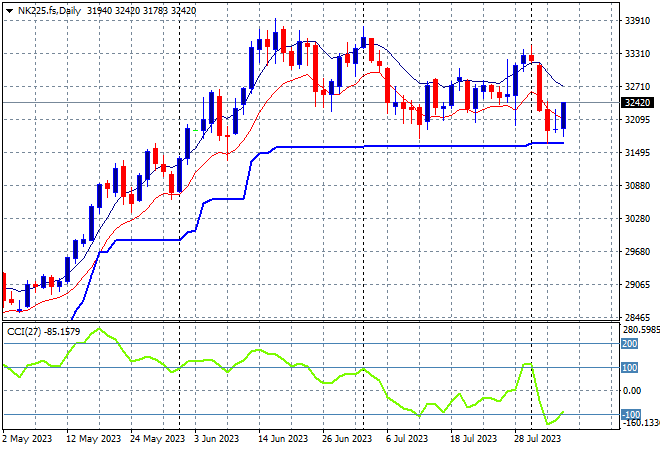

Japanese stock markets were also in hesitation mode with the Nikkei 225 up just 0.2% at 32254 points.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with a welcome consolidation above that level. Daily momentum has now gone oversold instead which is ominous as price action heads to the support zone, with a weaker Yen here not helping:

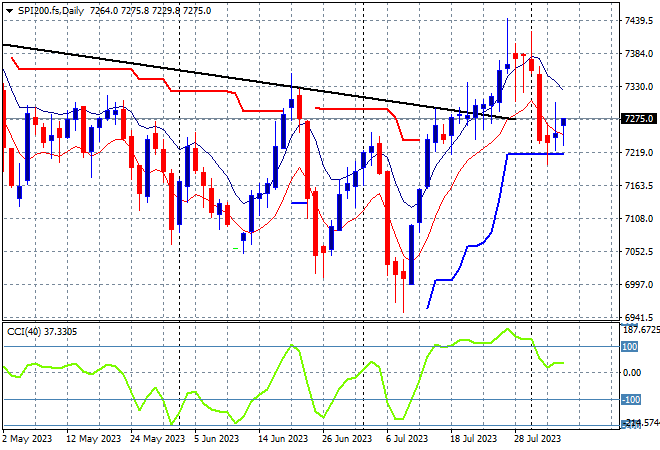

Australian stocks were still the worst in the region with the ASX200 down more than 0.2% to be right on the 7300 point level.

SPI futures are looking a lot better on the bounce on Wall Street overnight, currently up 0.4% so again will test the 7300 point level to see if it has truly firmed as short term support instead of resistance. Medium term price action was slowly getting out of its downtrend with the daily chart showing a breakout here as the June highs are bested but watch daily momentum readings that have fully retraced from being overbought but not yet negative:

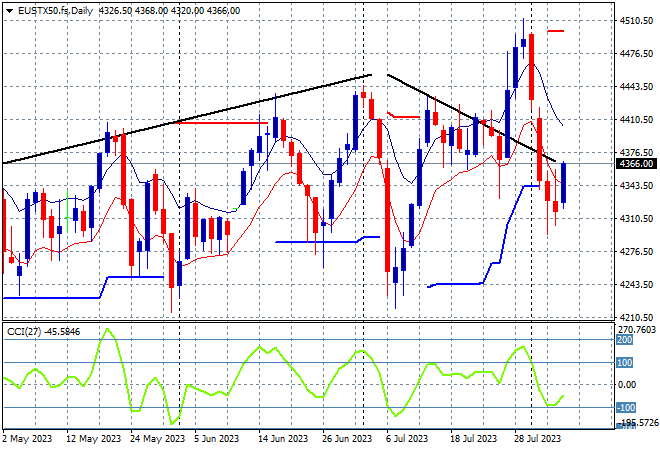

European markets were a bit hesitant with a round of scratch sessions across the continent with the Eurostoxx 50 Index closing just 0.1% higher to remain under resistance at the 4400 point level, finishing at 4337 points.

While the daily chart shows weekly support at 4200 points defended, weekly resistance at the 4400 point resistance level has now re-engaged as this little dip gains momentum with a probable return to the previous weekly lows as daily ATR support has been taken out:

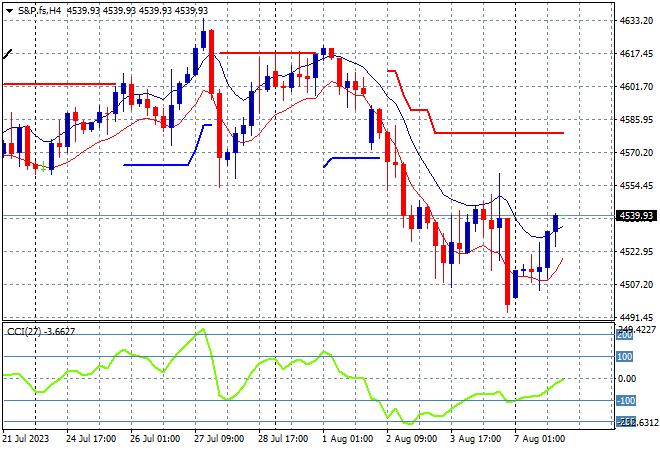

Wall Street finally found some buyers with rises across the board as the NASDAQ gained more than 0.6% while the S&P500 finished nearly 1% higher at 4518 points.

The four hourly chart shows a little bit of optimism returning overnight but its still a long way to go to get back to the previous weekly high at the 4600 point level. On the daily chart, trailing ATR support at the 4500 point area remains key and must be supported this week:

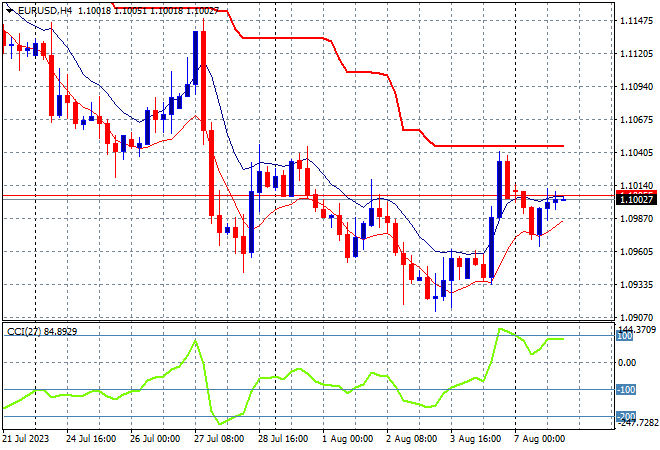

Currency markets tried to keep the USD reversal from Friday’s NFP reaction over the weekend gap but it was fairly weak across the board with only Euro holding on to its gains to settle just above the 1.10 handle overnight.

Euro needs to have a strong return above trailing ATR resistance here on the four hourly chart after halting its week plus long decline and hitting support just above the 1.09 handle Short term momentum has switched to slightly overbought but price action must re-engage to a new weekly high here above the 1.10 mid level soon or we will have another rollover:

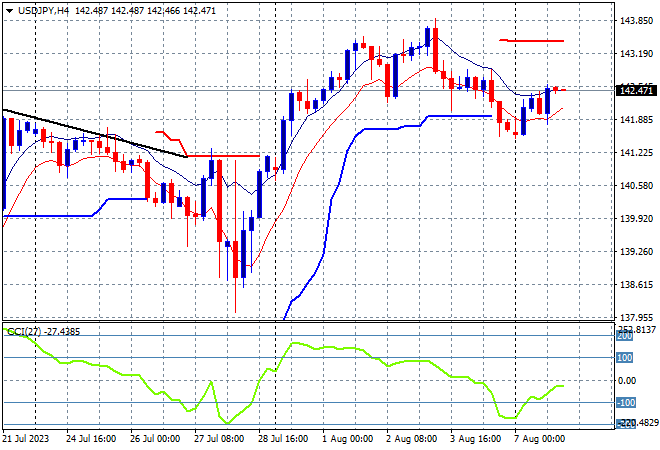

The USDJPY pair was heading into a dip post the NFP print with a fall back to the 141 handle but the weekend gap has seen it return back to the 142 level instead although short term momentum remains slightly negative.

Four hourly momentum had been slightly oversold but not overextended with price action taking back all of last week’s reflation rally in this very quick reversal. There was room for more potential upside as the USD firmed into Friday’s US jobs report but its a wait and see situation here with the 143 handle turning into resistance for now:

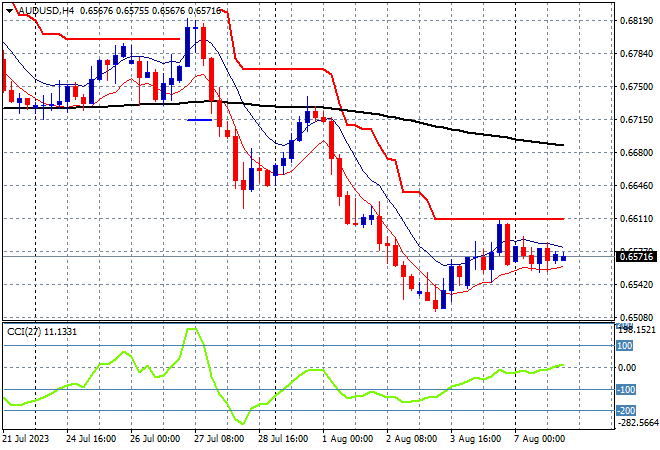

The Australian dollar is still under the pump against King Dollar despite a small post NFP bounce with the Pacific Peso still depressed here just above the mid 65 cent level as the RBA keeps it the weakest of the majors.

The subsequent price action looks fairly weak, confirming the weak mantle for the Aussie as ATR resistance and 200 EMA (black line) are still quite far away in both short and medium term trends. Watch for a potential rollover here as resistance is still too firm – turn this chart upside down and you’d be going long:

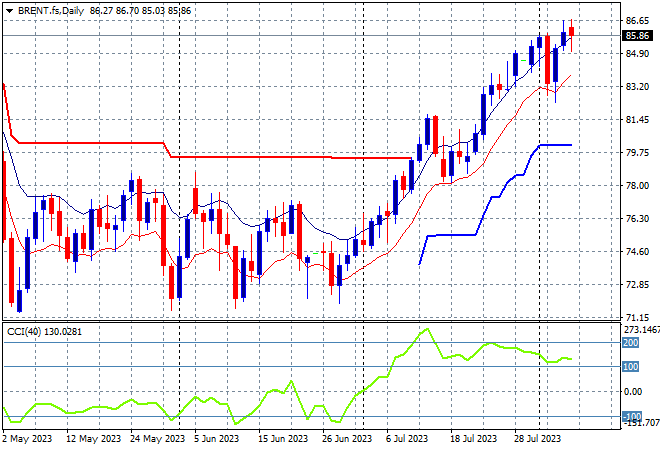

Oil markets are pushing slightly higher again with a new session high although Brent crude actually finished just below the $86USD per barrel level, keeping on to its three month high and current uptrend.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance and setting up for a new potential uptrend:

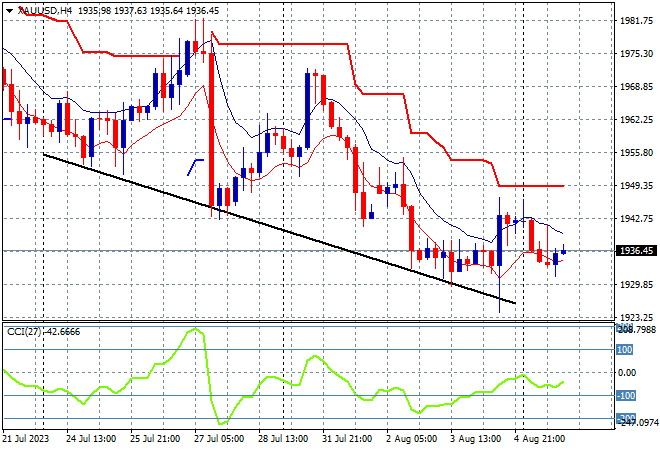

Gold is still trying to stabilise after its rout last week following the Fed’s latest rate rise, but despite a little bounce after Friday’s US jobs report, price action is struggling to get back above the $1940USD per ounce level.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level is likely over as a new two week low made swiftly cannot be returned as such without a lot more effort. Watch for a potential unwinding here down to $1900: