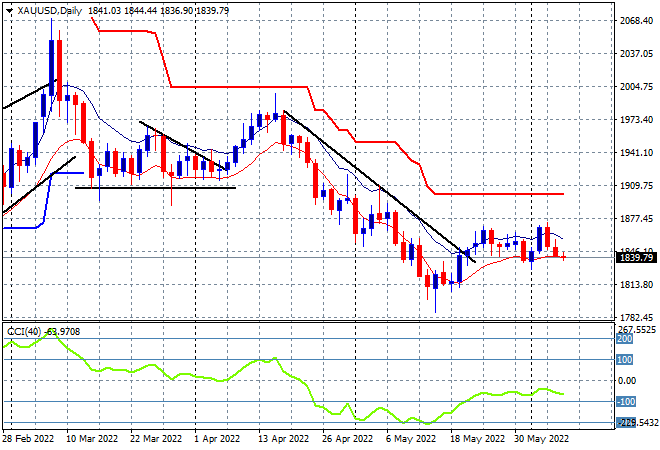

The RBA surprised everyone with an outsized 50bps rate rise this afternoon, sending the Australian dollar briefly higher before it settled back below the 72 level from whence it started this morning. Asian share markets are somewhat mixed with some round tripping and uneasy price action the order of the day across the region, but the ASX200 slumped on the rate rise news. USD remains relatively strong against the majors with both Euro and Pound Sterling drifting lower as we head into the London session. Oil prices are holding steady after their big lift on Friday, with Brent crude still hovering around the $120USD per barrel level while gold is rolling over again after failing to stabilise at the $1850USD per ounce level:

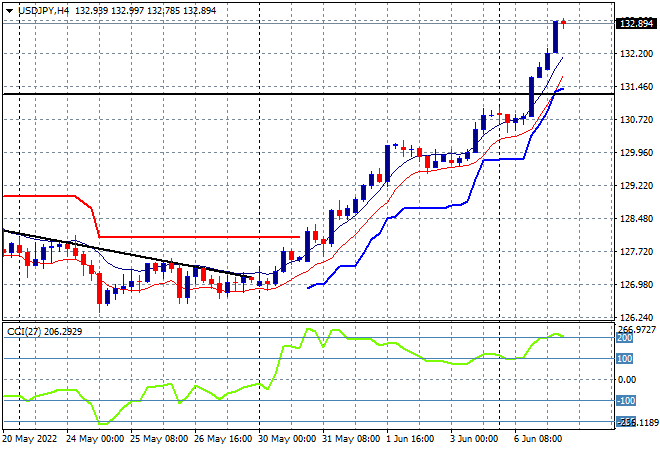

Mainland Chinese share markets are looking to put in scratch sessions today with the Shanghai Composite currently up a handful of points 3239 while the Hang Seng Index has given back more than 0.8% to be down to the 21484 point level. Meanwhile Japanese stock markets are also in wait and see mode, with the Nikkei 225 index closing just 0.1% higher at 27943 points while the USDJPY pair continues to zoom higher, about the threaten the 133 level:

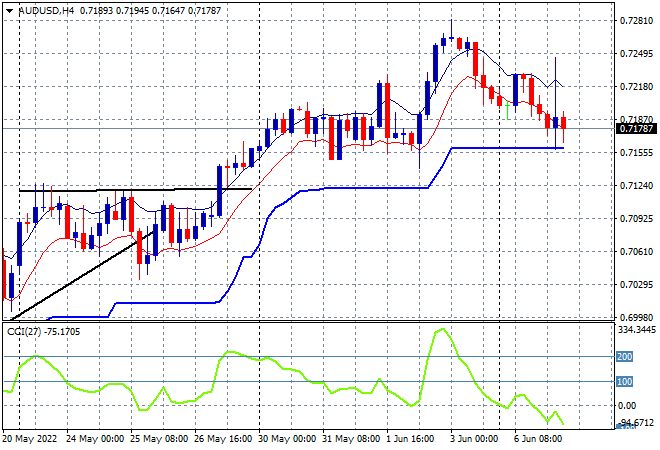

Australian stocks hated the RBA rate hike – for good reason – with the ASX200 losing more than 1.5% to finish at 7095 points while the Australian dollar brushed aside the outsized rate rise and basically returned to where it started the week just below the 72 level against USD as its weekly uptrend slowly consolidates:

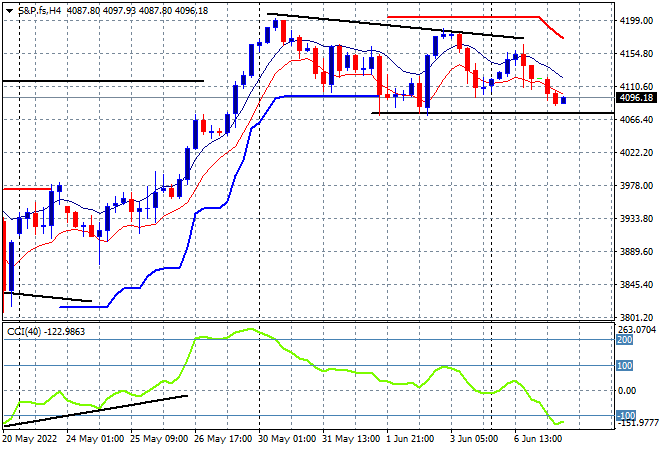

Eurostoxx and Wall Street futures are drifting down slightly as we head into the European open with the S&P500 four hourly futures chart showing price just holding on above key support at the 4100 point level. Short term momentum is neutral at best and is showing nascent signs of a rollover so watch out below:

The economic calendar includes the latest US balance of trade figures and then consumer credit data, with the latest Japanese GDP coming up first thing in the morning.