After some stonking rallies recently, stocks had to take a breather overnight, although European shares fell back sharper than expected on higher oil prices while Wall Street had minor scratch sessions. The latest ISM services print proved quite solid, pushing USD higher against the major undollars with Euro again rebuffed at the parity level while Pound Sterling reversed sharply. Ten year US Treasuries lifted slightly, pushing back up to the 3.7% level although interest rate expectations remain firm with 150bps in rises by January. Commodities were split with oil prices rising on the OPEC/Russia production cut agreements, with Brent crude pushed above the $93USD per barrel level while gold remained above $1700USD per ounce level, currently at the $1716 level this morning.

Looking at share markets in Asia from yesterday’s session where Chinese share markets are closed all week for National Day holidays while the Hang Seng Index reopened with gusto, up more than 5% or 1000 points in afternoon trade, closing at 18087 points. The daily futures chart had been showing a very bearish mood for weeks here, with a bear market entrenched as daily momentum remains well deep into negative funk. But this is an obvious blowoff move that could be signalling at least the beginning of the end or the end of a beginning relief rally:

Japanese stock markets were much more modest, with the Nikkei 225 eventually closing nearly 0.5% higher at 27120 points The daily chart shows price action wanting to push aside that dominant downtrend after the recent dead cat bounce at the 28000 point level with former support, now resistance at the 27000 point level now being threatened. Futures are indicating a slight pullback today after the previous bullish engulfing candle with daily momentum sets up but does not yet confirm a nice swing play here, with another close above the high moving average confirming the move:

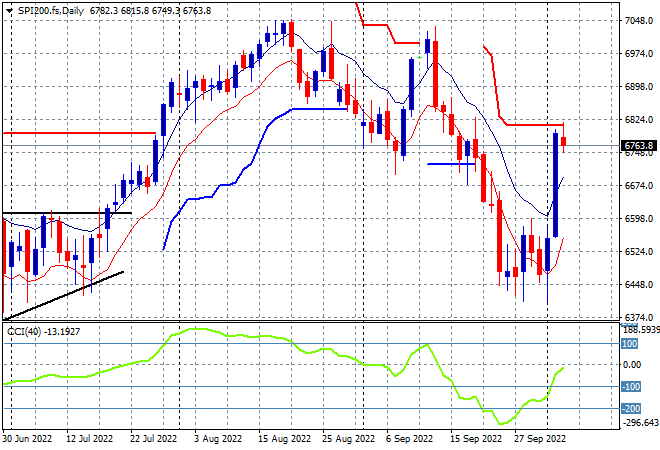

Australian stocks did much better, helped by the lower Aussie dollar with the ASX200 up more than 1.7% to climb above the 6800 point level, closing at 6815 points. SPI futures are indicating a slight pullback on the open today, down 0.4% as Wall Street also retraces overnight. The daily chart shows price wanting to get back to the August highs after hovering around the June lows as daily momentum swings back from full oversold mode, similar to Japanese stocks, but can it clear overhead resistance next:

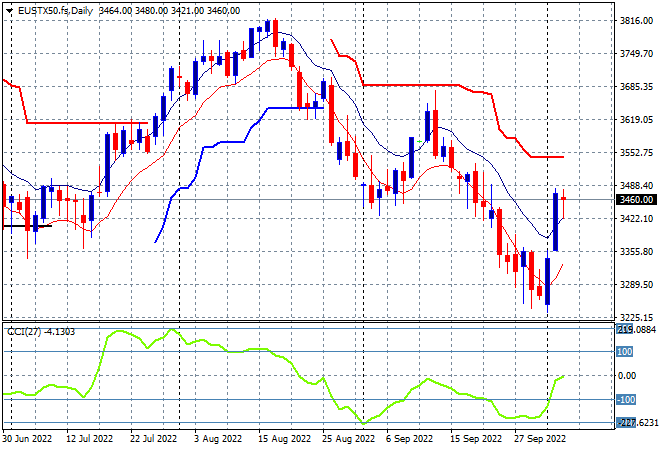

European stocks had steeper falls than Wall Street as the rise in oil prices and hesitation swamped positive risk sentiment, as the Eurostoxx 50 Index eventually finished 1% lower at 3447 points. The daily chart has also seen price action hovering around the June lows at the 3300 level after being exhausted by selling in recent weeks but now we might have seen some exhaustion in buying as daily momentum swings out of its oversold mood, but remains technically neutral. Weekly resistance is not yet taken out at the 3500 point level so I remain cautious:

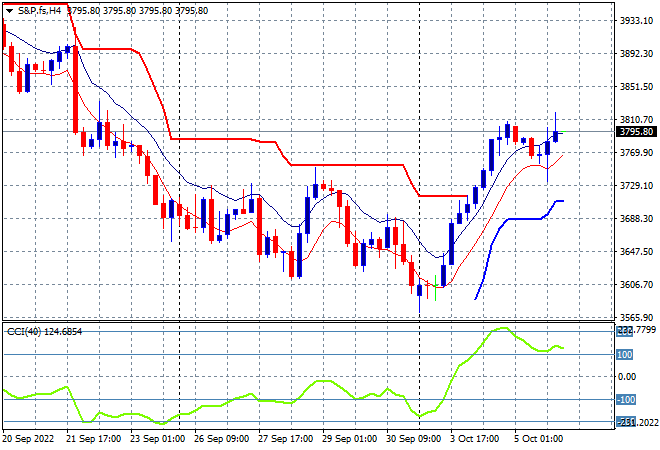

Wall Street had a mild retracement after surging more than 5% in recent days, with the NASDAQ losing just 0.3% while the S&P500 finished off by only 0.2%, closing at 3783 points. The four hourly chart shows price action remaining above key trailing ATR resistance but still hesitant around the 3800 point level. Four hourly momentum and solid price action is pointing to more gains ahead but the real target is the psychologically important 4000 point level, which may yet be out of reach:

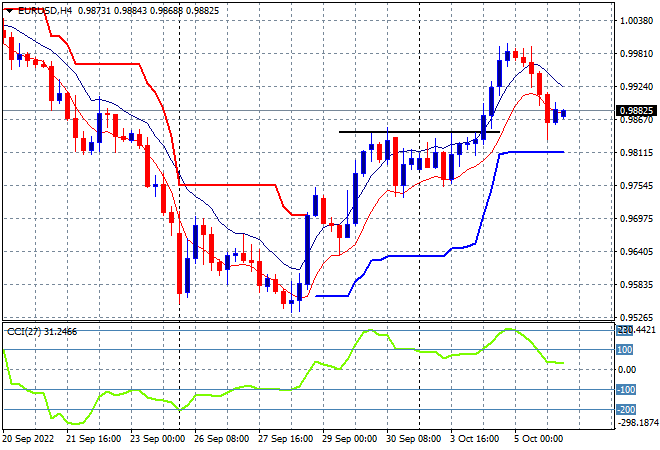

Currency markets came back on the side of USD a little overnight on the back of the ISM services print, with Euro thwarted in its move to get back to parity while Pound Sterling also had a sharp inversion. The union currency had broken out solidly on the four hourly chart, pushing above the 98 handle after setting aside some short term resistance but was unable to make that last push into triple digits. This has been an interesting two week fill since breaking below the key 1.00 level, but as I mentioned yesterday, short term momentum was looking too over extended so this reversion makes sense. Let’s see if it can hold above ATR trailing support at the 98 handle next:

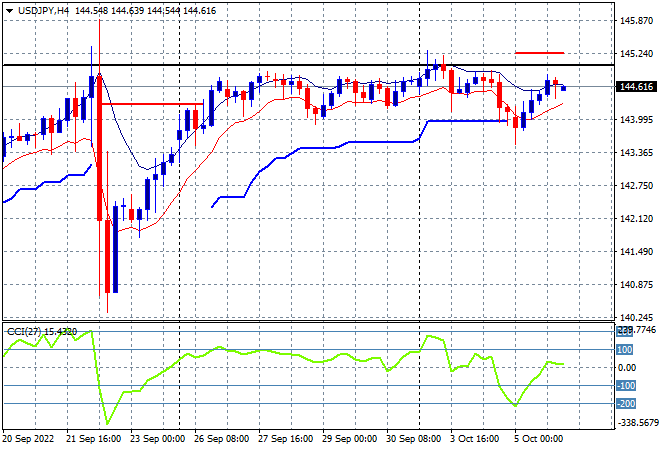

The USDJPY pair was able to get back into its holding pattern after a mild retracement recently, now back above the 144 handle and trailing ATR support on the four hourly chart. Short term momentum has reverted back to neutral after getting somewhat oversold but failing to invert further. There is the possibility of a further selloff here even though risk correlations are all over the place, although the recent North Korean missile shot may have more to with the defensive Yen buying:

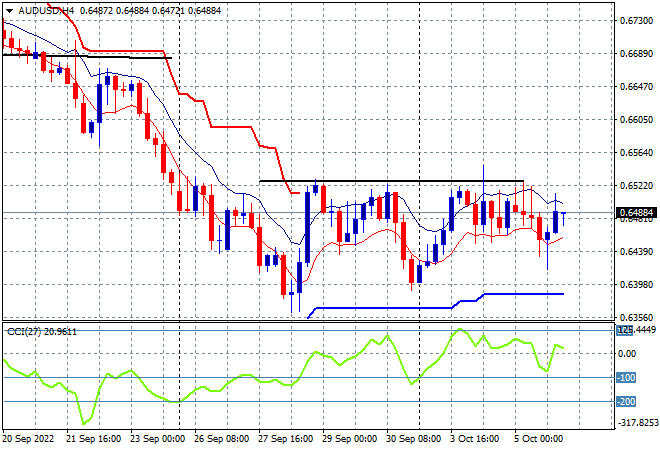

The Australian dollar is still failing to move higher alongside other undollars, remaining contained just below the 65 handle after the latest RBA meeting was a damp squib. This continues to firm my contention that resistance is just too strong at all the previous levels with the 68 handle still the area to beat in the medium term. This swing play has the potential to get back to the 66 level but needs a bigger punch through the high moving average and short term resistance first:

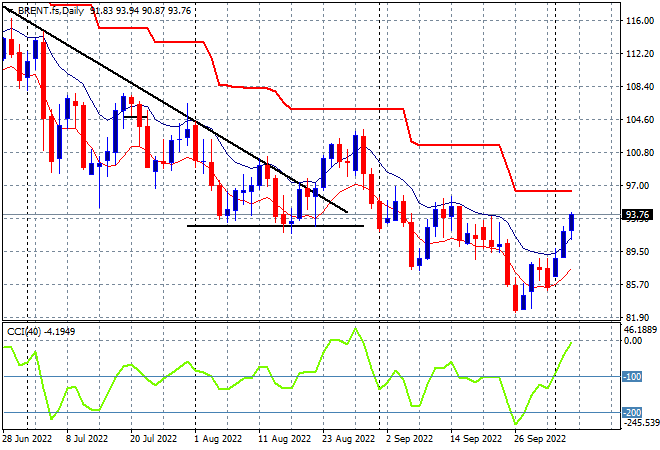

Oil markets are building on their recent gains after a series of attempts to stabilise with the OPEC decision overnight helping Brent crude getting back above the $93USD per barrel level. I still contend that this is still a minor move given that daily momentum had been persistently negative with price action not yet above the high moving average with short term resistance at the $96 level still quite firm:

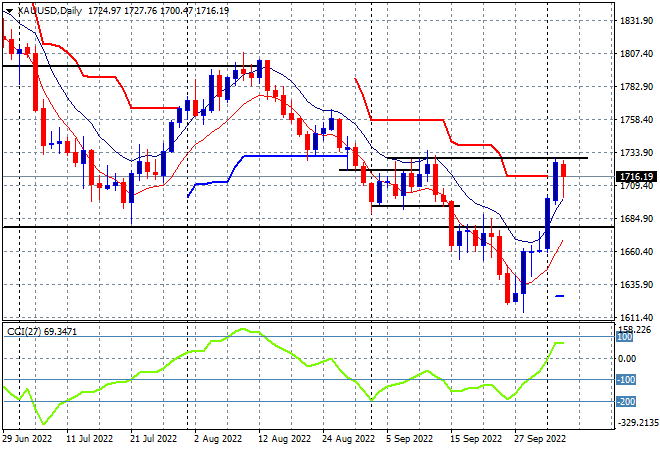

Gold had seen some of the sharpest gains with a surge right through the $1700USD per ounce level alongside other risk markets but also took a breather overnight, finishing below its previous resistance level at $1716. This keeps the shiny metal off the 2020 lows and almost negates the multi-monthly bearish setup as this could be the early stages of a bottoming action: