Last night saw risk sentiment sour yet again as more sanctions for Russia’s brutal invasion of Ukraine are likely to have wider implications for the European economy. Wall Street also pulled back sharply as more hawkish comments from the Fed turned into more upside for the USD rose against most of the major currency pairs again, as the Australian dollar pulled back from its post RBA meeting/language change high. Interest rate and bond markets are still confirming more rate rises on the way, with the 10 year Treasury range pushing up towards the 2.6% yield level. Commodities were mixed with both WTI and Brent crude losing 2%, but still well supported above the $100USD per barrel level while gold was flat to finish around the $1920USD per ounce level.

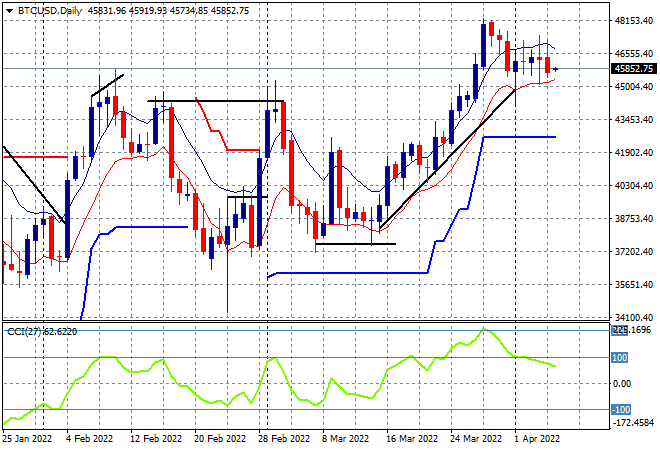

Bitcoin remains quite stable with no big moves overnight, still halting well below the $48K level reached last week and still unable to make a new daily high, finishing this morning at just below $46K. Daily momentum has reverted from overbought levels but still positive as price action remains contained above the low moving average on the daily chart. Watch for a clearance of resistance above the January and February highs as the $50K level is still the next target if support can hold:

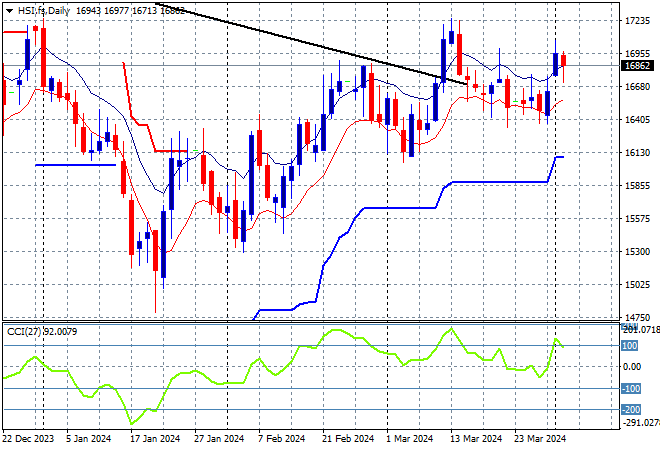

Looking at share markets in Asia from yesterday’s session, where Mainland Chinese share markets remain closed for a holiday. The daily chart of the Hang Seng Index does indicate a potential breakout on the return of trade, having been supported at the 21200 level as it now attempts to clear very strong resistance at the 22600 point level next as momentum builds at this critical juncture:

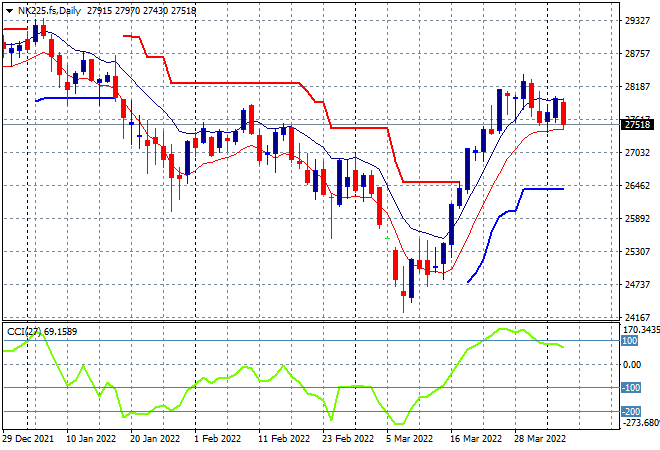

Japanese stock markets ticked over without much of a result as the Nikkei 225 lifted just 0.2% to 27787 points. Futures are indicating a pullback on the open due to the falls on northern hemisphere markets overnight, despite a weaker Yen as daily momentum reverts from its slightly overbought status. I mentioned last week that price action looks toppy, as it reverts back to weekly resistance at the 27500 point level and may begin to fall below the previous February highs, with that low moving average the area to watch for signs of a breakdown:

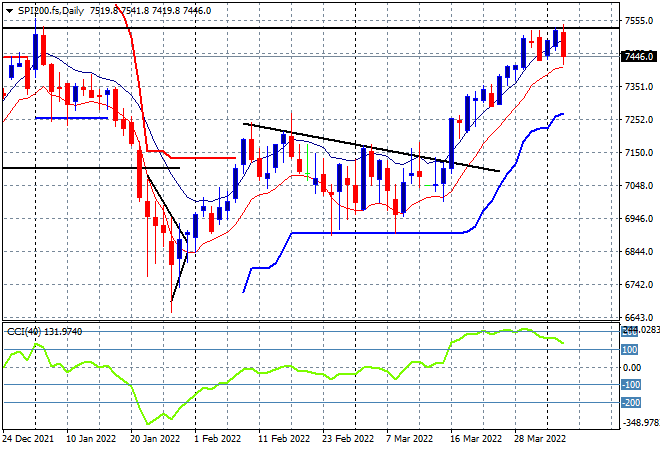

Australian stocks had a similar result, unexpectedly not following through on the positive lead from Wall Street lead overnight with the ASX200 closing 0.2% higher to remain above the 7500 point level. SPI futures are down more than 50 points or so on the risk reversal overnight and the much higher Australian dollar as a headwind. The daily chart continues to show a lot of potential with daily momentum still quite strong but price is finding stiff resistance at the former highs from December last year:

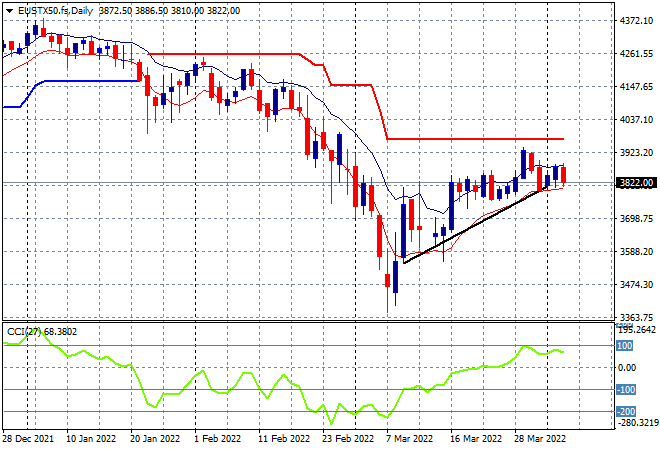

European shares had extremely mixed sessions with only the FTSE putting in a positive result as more sanction fears dominated risk taking. The Eurostoxx 50 index closed 0.8% lower at 3917 points taking back all its previous gains. Price was firming here at the 3800 point zone with building indications of breakout potential but as I said previously, momentum is key and requires a proper overbought reading before getting excited:

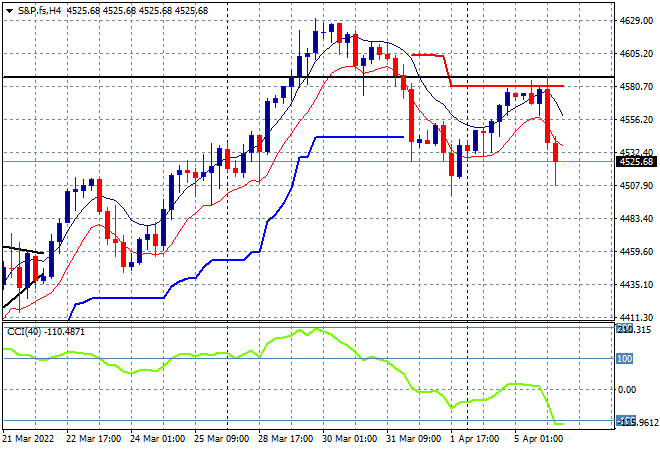

Wall Street took the reversal in risk sentiment and ran with it further, with the NASDAQ losing more than 2% while the S&P500 pulled back over 1.2%, closing at 4525 points. Price action on the four hourly chart now shows a secondary dip after the first one was filled but failed to get back above the previous weekly high at the 4600 point level, with weak momentum painting this picture beforehand. This takes price back to the previous session lows and could be the start of the next dip lower:

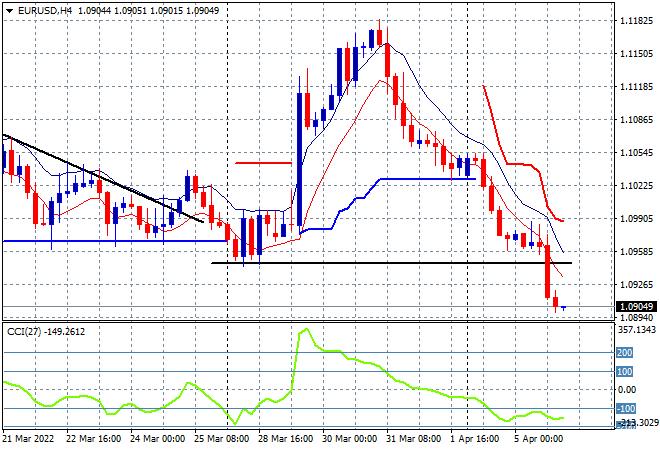

Currency markets continued to see a much stronger USD as a result of the sanctions outcome and a more hawkish Fed, with Euro breaking down below the previous weekly support level at the 1.0950 mid area. The union currency fell right down to the 1.09 handle proper, now having completely wiping out the previous price surge and putting it back on its longer term trendline:

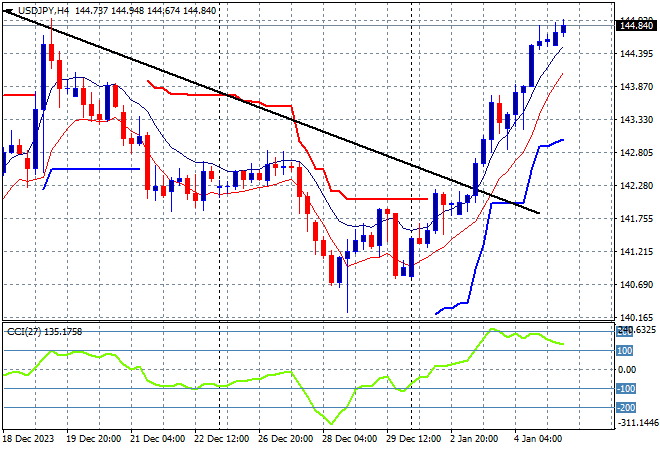

The USDJPY pair had been slowly lifting after a period of consolidation but turned that into a proper breakout overnight, getting back above the 123 handle as a result. It seems previous volatility of recent weeks is back with big moves again, although this is coming up against trailing ATR overhead resistance at the 1283.80 level, the mid point of control when the pair last had a too fast move. Therefore I’m wary of more upside potential here – watch the low moving average to possibly come under threat:

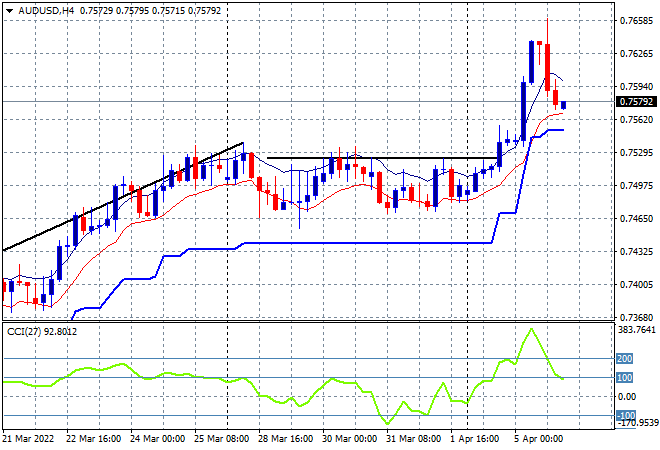

The Australian dollar has pulled back sharply from its post RBA euphoria, almost reaching the 77 handle in the process, before retracing down to the high 75s, still making a new weekly high. This may be shortlived with more upside potential building as commodity prices are likely to rebound in the wake of more Russian sanctions, with Australian exports the big winner. I think the previous weekly highs at around the 75 cent level will act as very firm support going forward in that scenario:

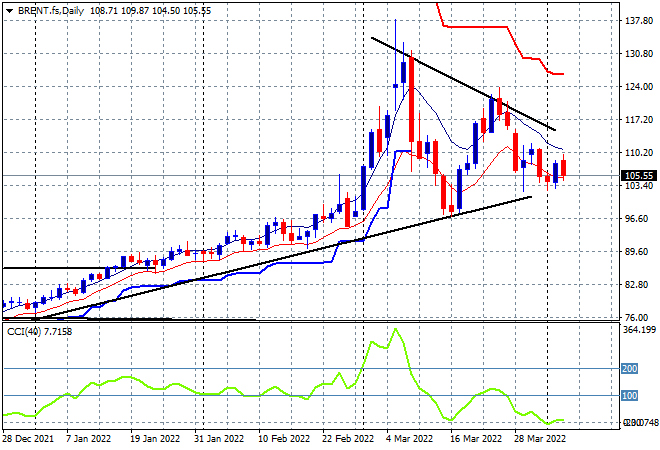

Oil markets are continuing to consolidate following the post invasion Ukrainian highs as part of a multi week structure in this bubblicious chart with Brent crude retracing nearly 2% overnight to the $105USD per barrel level with support firming at the $103 level since last week. The charts of oil leading up to and through this conflict are classic technical bubbles with the second peak lower than the first. This provide a potential continuation move here to flop down to the $100 level as daily momentum reverts back into negative readings:

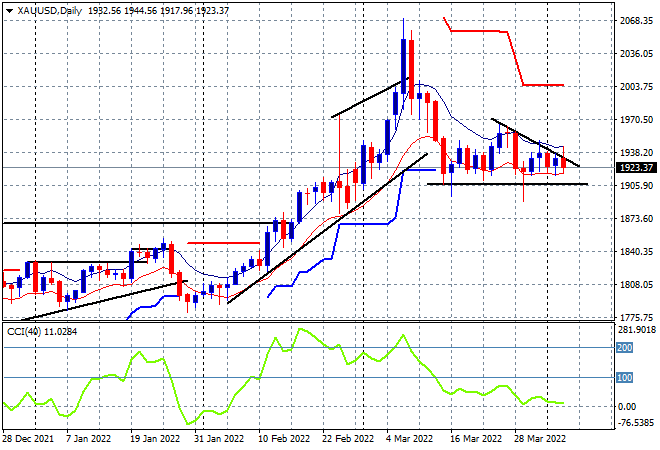

Gold was looking interesting, having defended price above the $1900USD per ounce level, but again did nothing last night to finish flat at the $1923USD per ounce level. Price is coming up against the downtrend from the mid March highs with momentum still basically neutral, with a close above the high moving average at the $1930 area required soon or this will rollover swiftly: