Friday night saw the release of the latest US ISM services PMI which came in hotter than expected, initially sending US Treasury yields higher but these eventually pulled back, giving stocks room to move with Wall Street putting in a stonking session. This will set up a good mood to start the trading week here in Asia with the USD also pulling back against most of the majors with the Australian dollar trying to get out of its two week bottom. The commodity complex saw oil prices lift higher again with Brent crude making a new weekly high, almost hitting the $86USD per barrel level while gold pushed to a near monthly high, heading up a strong result to push above the $1850USD per ounce level.

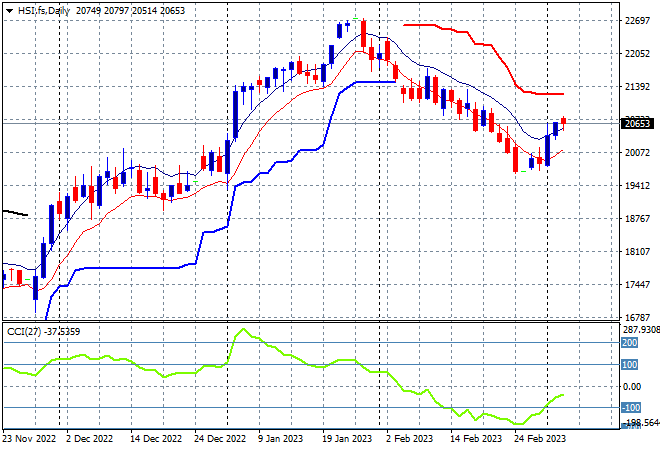

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets held on to a solid session into the close with the Shanghai Composite up 0.5% and still above the 3300 point barrier at 3328 points while the Hang Seng has rebounded from its previous loss, up nearly 0.7% to 20567 points. The daily chart is showing this rollover now possibly reversing although price action is still well below previous ATR support as momentum gets out of oversold territory to set up a swing play. Watch now for this bounce off support at the 20000 point level to be a bit more sustainable:

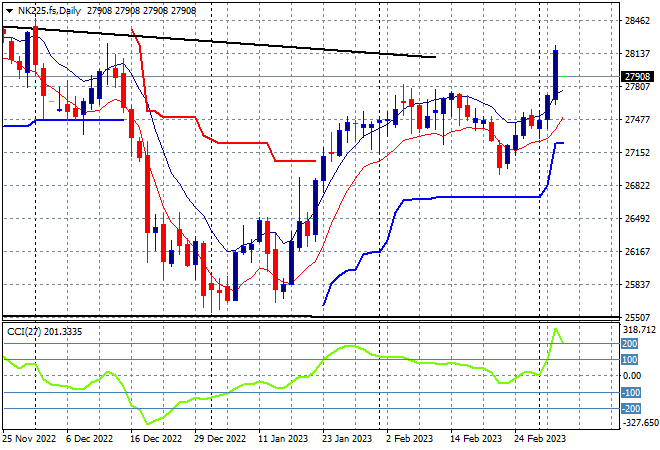

Japanese stock markets soared on the back of a strong employment print with the Nikkei 225 up more than 1.5% to 27927 points. A big bounceback is in effect after last week’s rollover with daily momentum getting back into the overbought zone with support clearly evident at the 27000 point area. Futures now have a clearer picture with a stronger lead which should lead to a solid start to the trading week today with the previous daily high around the 27700 point the support area to defend:

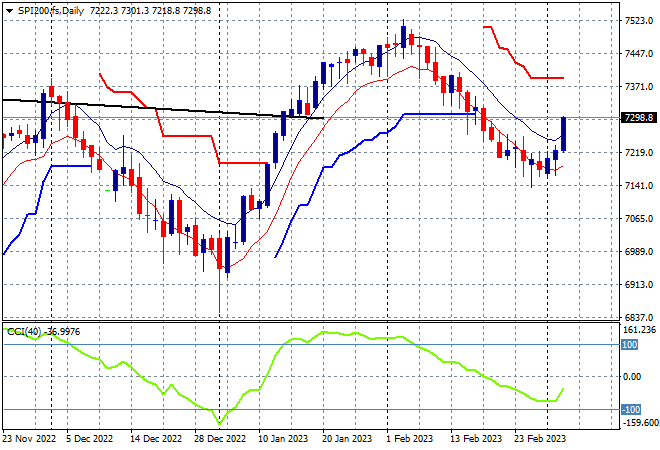

Australian stocks were finally able to put on some gains with the ASX200 closing 0.4% to remain above the 7200 point level at 7283 points. SPI futures are looking very strong indeed, up at least 0.9% on the surge on Wall Street on Friday night. The daily chart was showing a clear downtrend after being unable to take out 7500 points, with a retracement below ATR support at 7200 points now arrested. Price action shows a classic deceleration that is likely to transform into a swing session here but momentum readings remain weak:

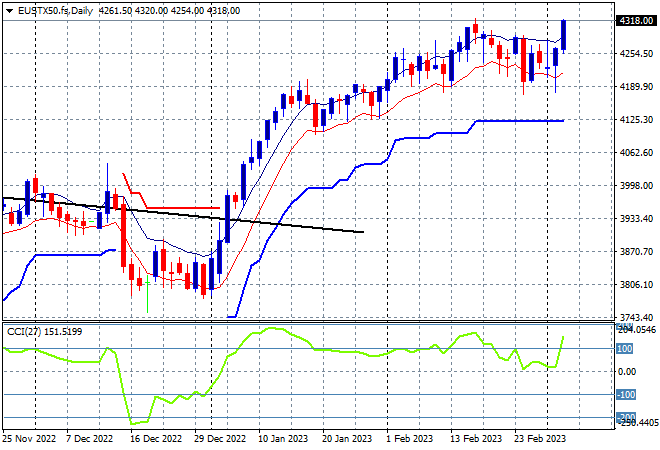

European markets seconded their recent solid session on Friday with a very good result across the continent, with the Eurostoxx 50 Index closing more than 1.2% higher to 4294 points, as it gets back to the recent new weekly high. Futures are indicating a slight extension of those gains as Wall Street lifted further into the close with a strong uptrend still quite evident. Daily momentum has now switched back into properly overbought so this should have legs:

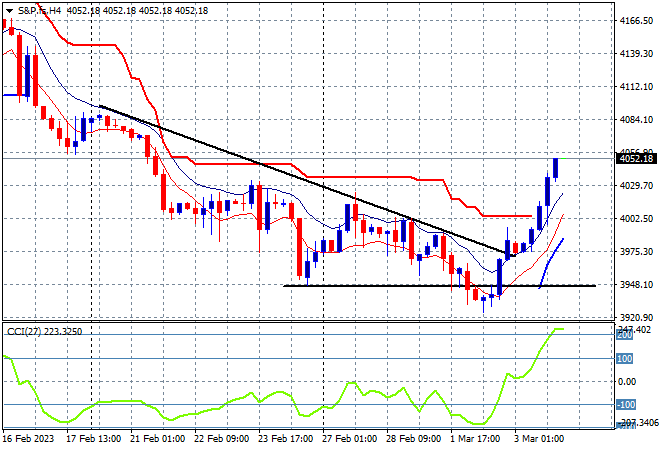

Wall Street was the stand out by confirming its recent reversal with the NASDAQ finishing nearly 2% higher while the S&P500 managed a 1.6% leap higher that finally cleared the key 4000 point support level, closing the week at 4045 points. The four hourly chart shows price action previously trying to breakout above last week’s downtrend with former ATR and psychological support at the 4000 point area now pushed aside as relatively weak resistance. Daily momentum has switched back into very overbought so we could see a mild pullback later tonight before re-engaging to the upside:

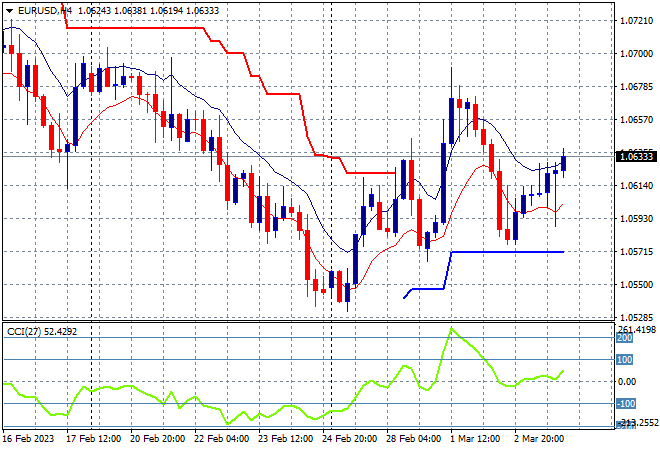

Currency markets were looking to get out of their uber USD strength trend with the latest US PMI print helping Euro get back above the 1.06 handle after recently violently retracing following the European inflation prints. The four hourly chart is looking a bit messy here with price action still below the previous weekly high but a series of higher lows and some positive momentum helping the union currency as we start another trading week but I’m watching strong resistance at the 1.07 handle:

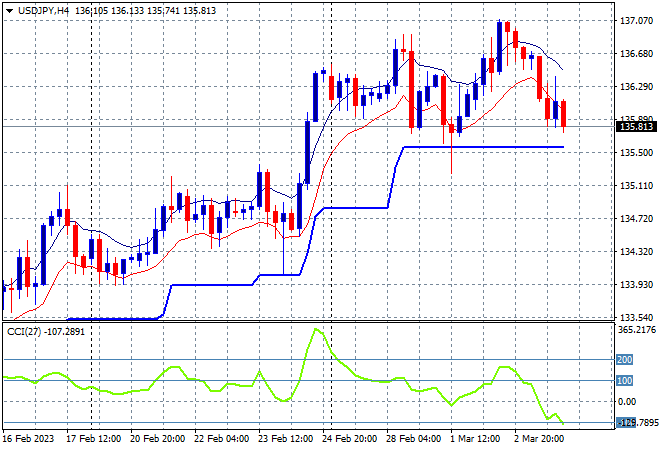

The USDJPY pair was pushed back below its start of week trading position on Friday night after a furtive attempt to break out of its sliding sideways position through the 137 level has been squashed. Short term momentum has returned to negative settings with price action looking to test ATR support again. The daily trend remains intact but watch the mid 135 level for signs of capitulation:

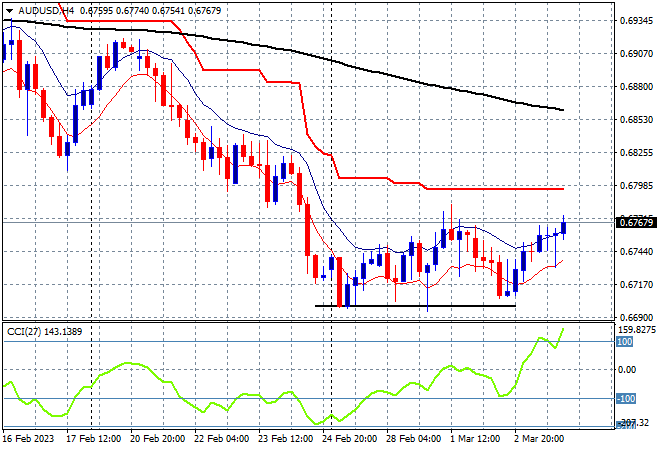

The Australian dollar was able to follow Euro somewhat in sympathy, with a small bounce back to the mid week intrasession high, but still well below overhead resistance, finishing well below the 68 handle on Friday night. Overall price action had been weak following the previous week’s unemployment numbers that has not yet challenged interest rate expectations with the new monthly low basically holding. Short term momentum has picked up swiftly and could see an early test of the 68 level but it may prove short lived:

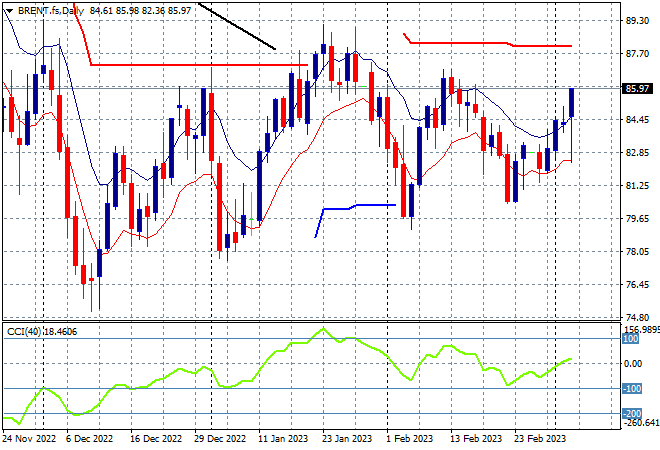

Oil markets are continuing their bounceback with another solid session on Friday night almost pushing Brent crude above the $86USD per barrel level. Daily momentum had sharply inverted into the negative zone but never got oversold, indicating some buying support below and is now finally nominally positive. Overall however, price action has still failed to beat the $88 highs from January which is the short term target here:

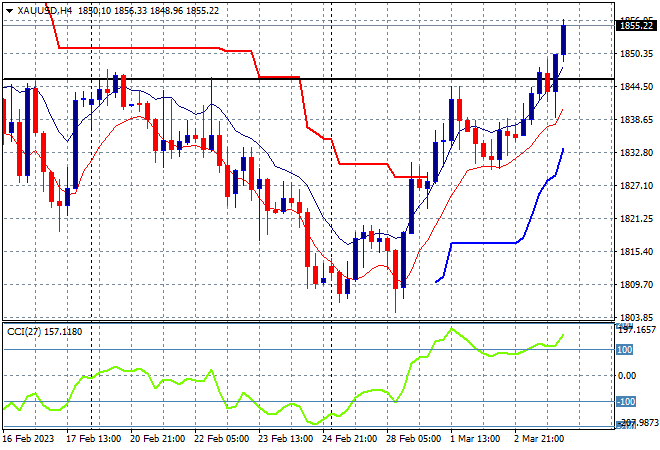

Gold is finally out of its depressed mood with a proper lift off the recent bottom, closing the week out at a two week high above the $1855USD per ounce level and definitely clearing resistance on the four hourly chart. Overhead resistance on the daily chart at the $1850 level is also down so there is more than enough reason to suggest a bottom is in and we’re seeing the start of a new uptrend, but keep in mind that $1800 does seem to be an anchor point: