A turmultous Friday night that was preceded by epic falls in Japanese equities with Wall Street also falling sharply in the wake of the latest official US job report – aka the non farm payrolls – that already had risk markets spooked before the print. Not helping were some poor signalling from Amazon (NASDAQ:AMZN) earnings surrounding consumer sentiment and of course, more war horns going off in the Middle East. Volatility spiked across bond, commodity and currency markets with the latter seeing a big surge in Euro however other major undollars really struggled with the Australian dollar again knocked back to the 65 cent level.

The very weak NFP saw US Treasuries make big moves across the curve with the 10 year down now down nearly 40 points for the week, finishing below the 3.8% level. Meanwhile oil prices flopped despite the Middle East volatility with Brent crude down to a three month low below the $77USD per barrel level. Gold prices were relatively calm as they stabilised somewhat around the $2450USD per ounce level.

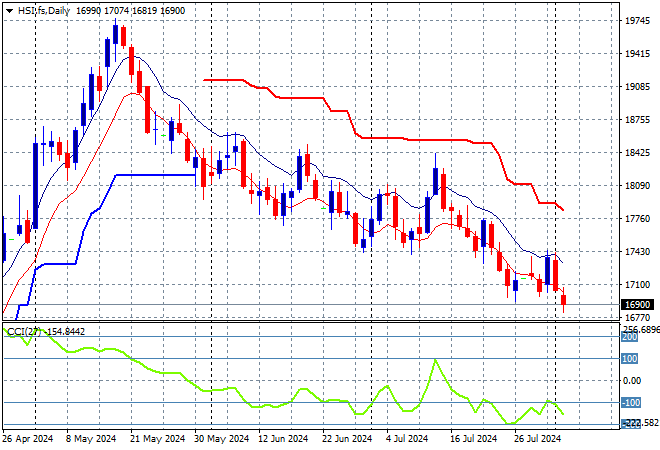

Looking at markets from Friday’s session in Asia, where mainland Chinese share markets tried their the best, relatively speaking, with the Shanghai Composite eventually losing nearly 1% or so to remain under 3000 points while the Hang Seng Index was down 2% to 16925 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move is looming here as the 17000 point level is broken:

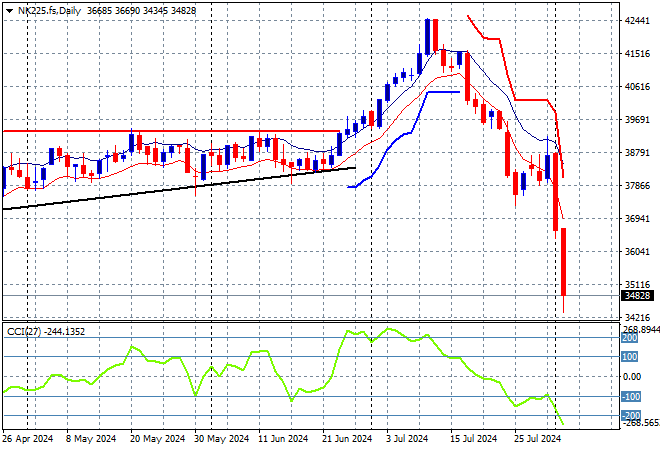

Meanwhile Japanese stock markets had their worst session in years with some massive moves lower with the Nikkei 225 finished more than 5% lower to close at 35909 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term support subsequently broke on that retracement, and then the front fell off. Futures are indicating a gap lower in line with Wall Street’s returns:

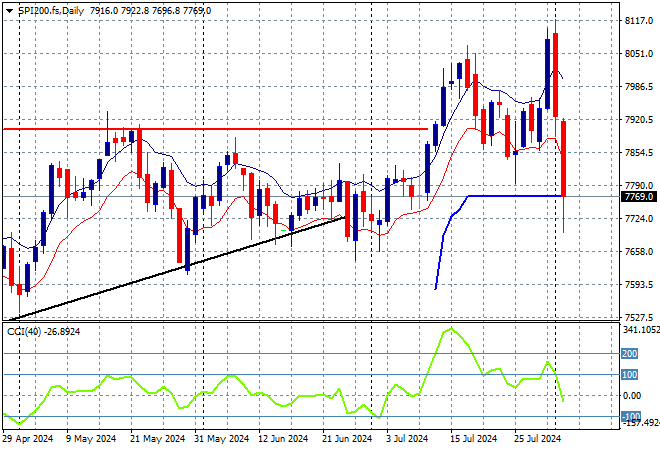

Australian stocks didn’t escape the carnage with the ASX200 closing more than 2% lower to 7943 points.

SPI futures are down at least 1.5% given the falls on Wall Street from Friday so we’re likely to see short and medium term support at the 7700 point level come under pressure as the new trading week gets underway. Momentum isn’t even in negative state yet but this bearish engulfing candle is not a good signal:

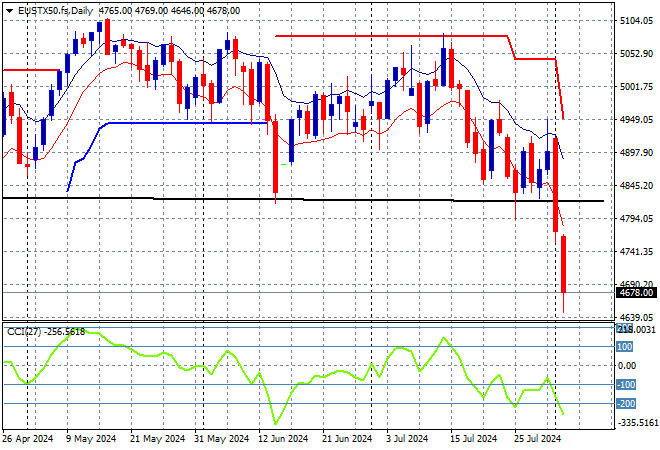

European markets failed miserably to get traction with big selloffs across the continent, despite a much lower Euro as the Eurostoxx 50 Index closing more than 2% lower to 4638 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Instead, former ATR support at the 4900 point level was only a temporary anchor point as we go down into correction territory:

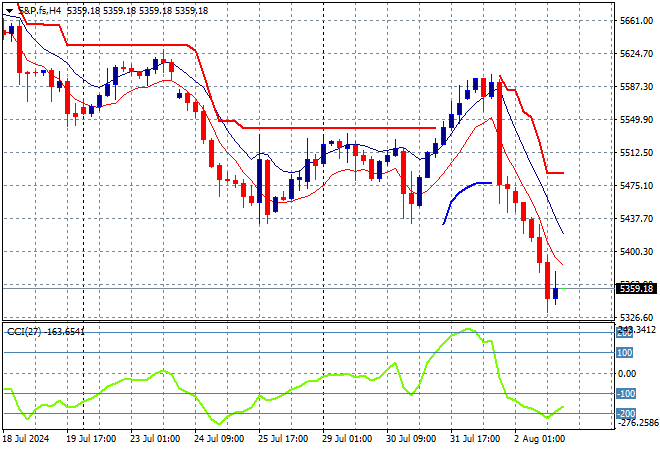

Wall Street still can’t handle the negative waves with the NFP and tech earnings spooking the whole complex with the NASDAQ off by more than 2.4% while the S&P500 lost nearly 2% to close at 5346 points.

The four hourly chart showed resistance overhead that had seemingly been cleared before a wave of negativity struck midweek and keeps coming. Momentum is back to oversold status and is likely to stay here until the dust has settled if at all:

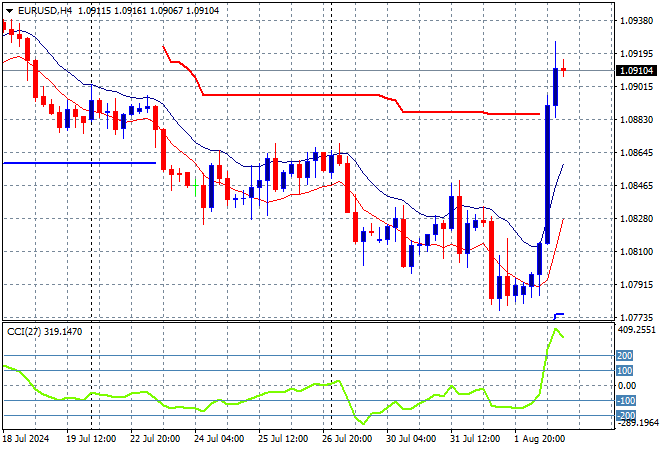

Currency markets remain the most volatile with King Dollar slumping against Euro in the wake of the weak NFP print with the latter pushed straight the 1.09 level as a result.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum building to the upside with the 1.0750 mid level as support but there was still too much pressure from King Dollar. This recovery about ATR support could be unsustainable however so I’m watching for a gap down over the weekend:

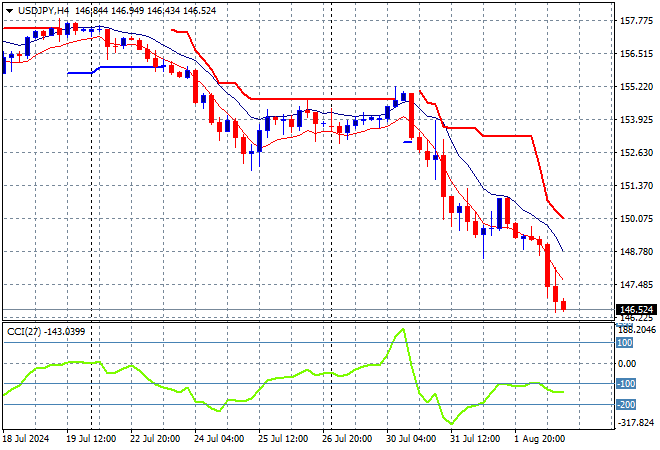

The USDJPY remains on a downwards pattern despite some intrasession volatility overnight with new lows made on Friday night to retrace well below the 147 level for another new monthly low.

This volatility speaks volumes as it once pushed aside the 158 level as longer term resistance, but then was unable to breach the 162 level as it looks like the BOJ intervention could work on the weakening Yen. However the recent rate hike has put paid to this with more than 1000 pips lost in two weeks – more to come?

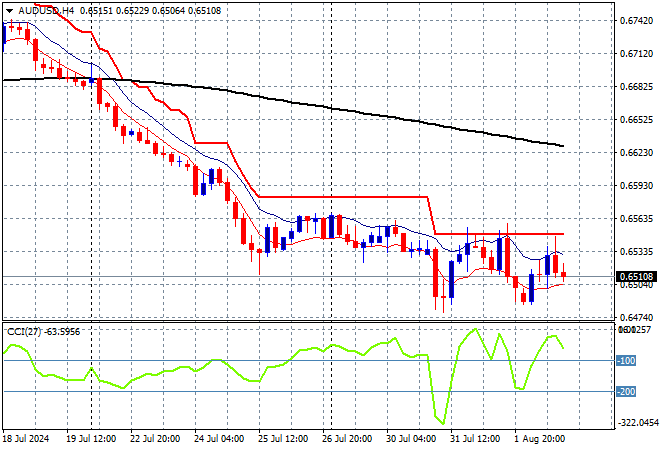

The Australian dollar continues to struggle following the local CPI print and despite the weak NFP, the commodity proxy remained near the 65 cent level amid the risk off mood.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This still looks very weak with medium term support still broken as we await the RBA’s next step:

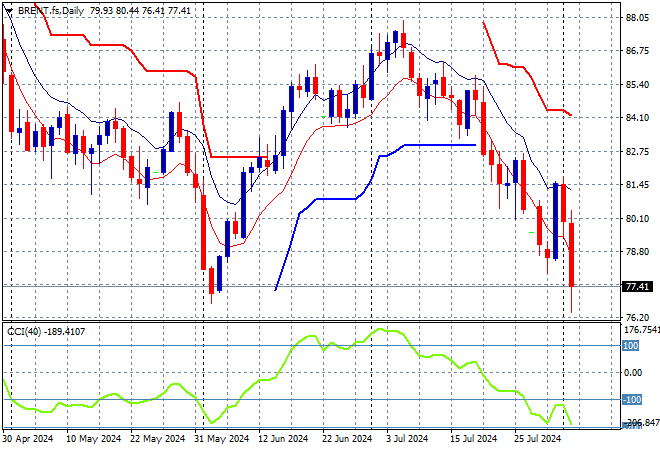

Oil markets love a good old fashioned war in the Middle East but traders may have gotten a little ahead of themselves with another retracement seeing Brent crude return to the May lows at the $77USD per barrel level.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in oversold mode but watch for a potential follow through on this reversal as this swings into higher volatility:

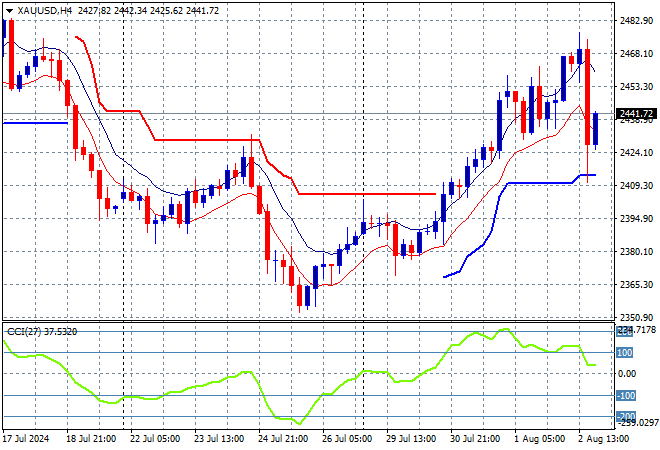

Gold remains somewhat trend after following through on its rebound above the $2400USD per ounce level but is again coming up against some resistance at the $2450 level with price action stalling on Friday night.

While it was the biggest casualty of the reaction to the recent US jobs report, the shiny metal was able to clock up some gains before this reversal, almost hitting the $2500USD per ounce level. The longer term support at the $2300 level remains key but that broken downtrend line from mid July looks like a good opportunity with momentum now nicely overbought: