It was the ECB’s turn this time with an expected 25bps rate rise, but no pause signalling whatsoever as the not-quite a central bank indicating inflation was still a persistent problem across the continent. Wall Street feel again as the regional bank dramas continued to spiral along, despite more positive earnings results, which also led to falls in Europe and will likely see a sour end to the trading week here in Asia. The USD fell back against Euro while the Australian dollar also lifted to almost cross into the 67 cent level. Meanwhile 10 year US Treasury yields pulled back another 5 basis points to a new monthly low at the 3.35% level as oil prices become further depressed with Brent crude remaining at the $72USD per barrel and a new yearly low. Gold continued its breakout above the $2000USD per ounce level, currently at $2050 after another solid session.

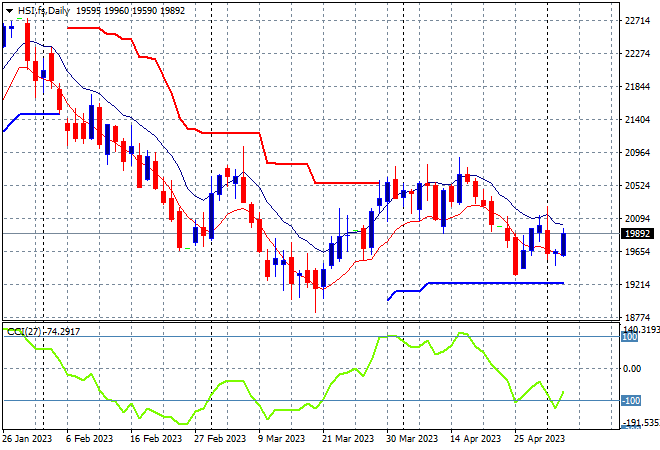

Looking at share markets in Asia from yesterday’s session where Chinese share markets have reopened from their long May Day holidays with the Shanghai Composite up 0.8% to 3350 points while the Hang Seng has lifted 1.3% to close at 19948 points. After closing shy of the 20000 level on Friday the daily chart is still showing resistance building at the 20500 point level before this recent rollover as price action returns to the start of year correction phase. It looks like the 19000 point level is proving an anchor point in recent months that price action continues to draw down to but support is building here:

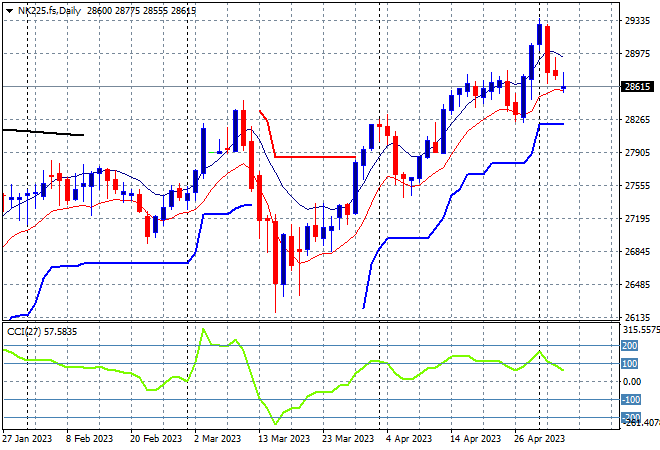

Japanese stock markets are still closed for the rest of the week with Nikkei 225 futures indicating a mild pullback despite larger falls on Wall Street overnight. Overall the trend remains up with some steam taken out as price action looks set to test the low moving average area on the re-open, but depending on risk sentiment could also could threaten trailing ATR support at 28000 points:

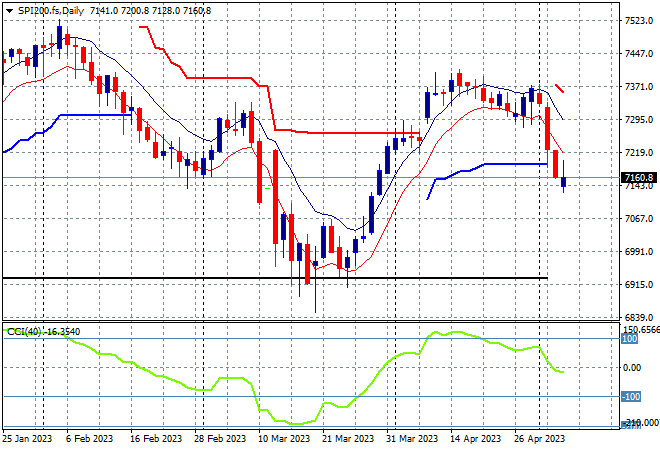

Australian stocks remain under a lot of pressure as the RBA wants to engineer a recession with the ASX200 closing with a scratch session at 7193 points. SPI futures are down at least 0.5% but could break even lower as contagion from US bank stocks and the higher Australian dollar not helping. The attempt to get back to the January levels is completely out of reach now as daily momentum goes into the negative zone and price action is likely to break trailing ATR support. The March lows at the 6900 point level is the likely target here:

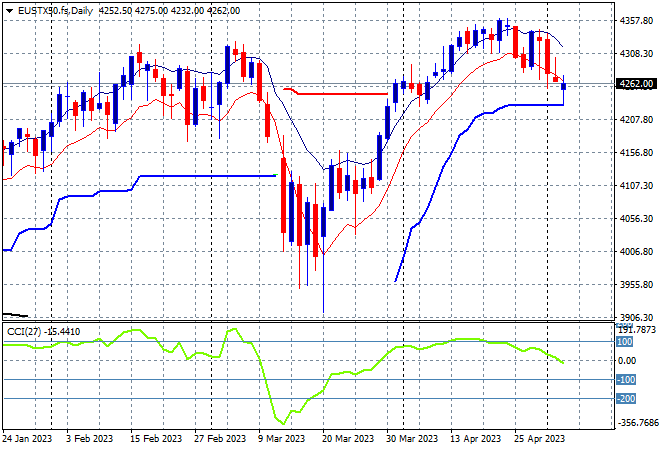

European markets were under the pump throughout the session with the FTSE the biggest loser, down over 1% amid the ECB rate rise with milder falls across the continent, taking the Eurostoxx 50 Index back below the 4300 point level as it closed 0.5% lower to 4287 points. This is still building for a potential breakdown as post close futures follows Wall Street’s banking woes with another pullback below the low moving average likely in tonight’s session. The daily chart shows a possible break to trailing ATR support at the 4200 point level here:

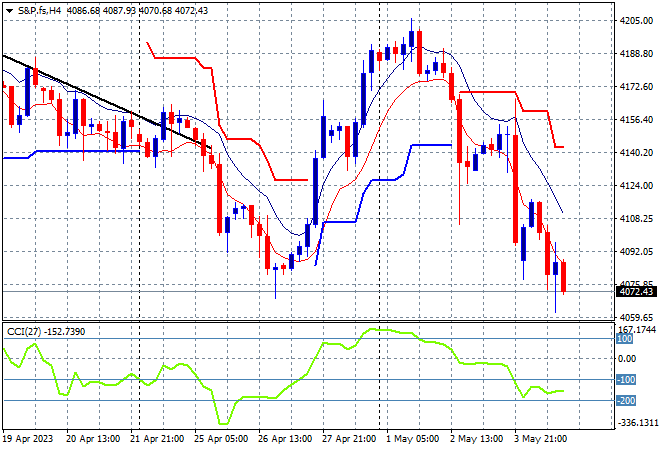

Wall Street continues to be hammered by regional bank stocks with the NASDAQ down another 0.5% while the S&P500 lost nearly 0.8% to remain well below the 4100 point level at 4061 points as volatility builds. The four hourly chart showed price action stalling in the previous session after a big rebound off the early April lows with this break down building as the Fed’s rate hike is overshadowed by the continuing fallout and possible contagion in regional bank failures. A lower weekly close here will likely mean a correction building into next trading week:

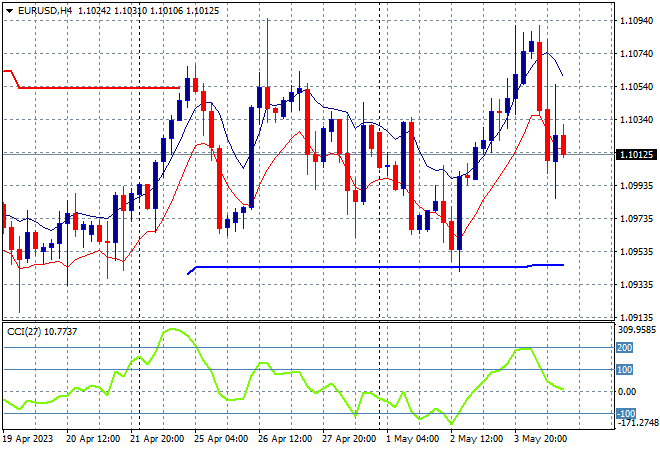

Currency markets were in an anti-USD funk heading into last night’s ECB meeting as most major undollars gained against USD with Euro overbought to start with and pulling back to the 1.10 handle after the rate hike. This still keeps it well off its previous weekly low and support at the low 1.09’s as it was finally able to break through the previous weekly highs. Momentum is back at neutral settings and price action is supportive of further upside if it can clear resistance here:

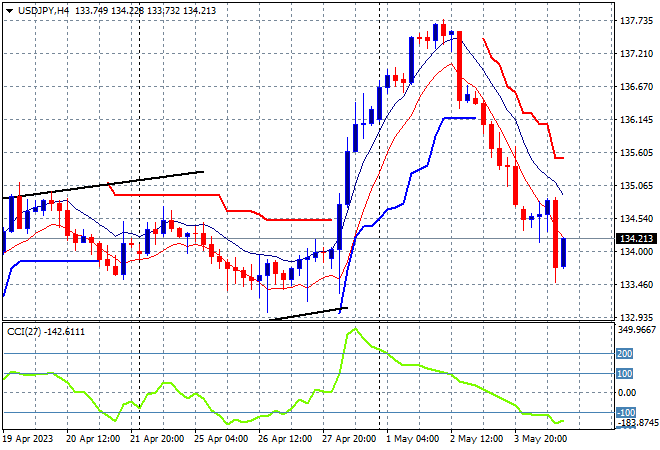

The USDJPY pair came down further again overnight, further negating its big surge from Friday to finish just above the 134 level. This also looks like a lot of Yen safe haven buying as risk sentiment sours but also because of thin trading due to Japanese domestic holidays. Short term momentum readings have now pulled back from extreme overbought into quite oversold readings, moving from a healthy retracement into a proper reversal where former resistance at the 134 level proper which must be defended:

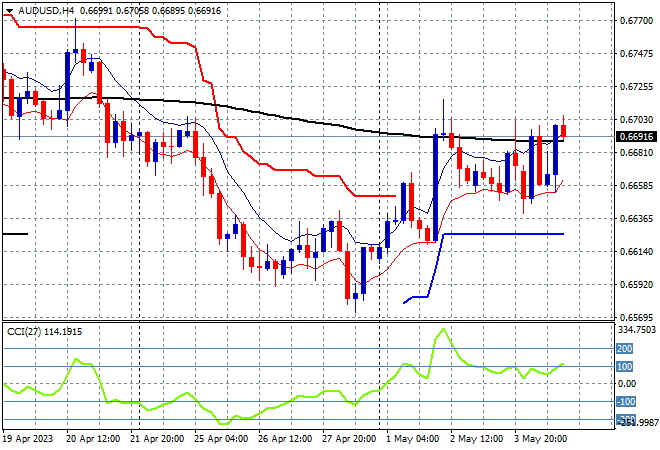

The Australian dollar is now trying to hold onto its post RBA meeting surge in the wake of the Fed and ECB rate hikes and managed to finish just below the 67 handle right on the previous weekly high. This is a much better effort but still requires a final punch through overhead resistance at 67 cents. Short term momentum is wanting to get back into its slightly overbought status but not yet rolled over:

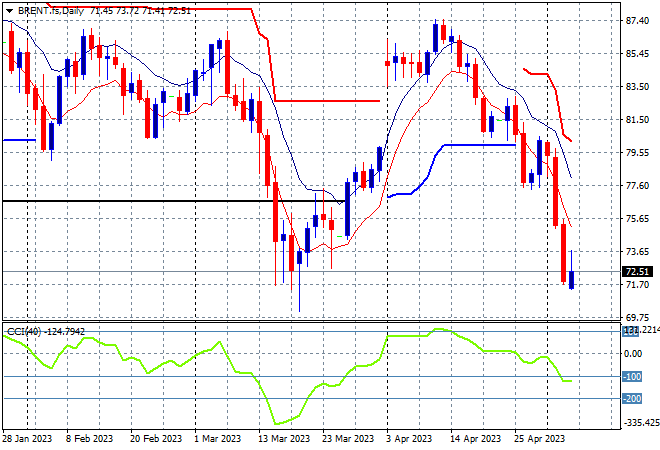

Oil markets continue to fall back sharply on growth concerns with both markers still in retreat mode with some intrasession volatility, with Brent crude remaining at a new monthly low at the $72USD per barrel level. This keeps it below the December levels (lower black horizontal line) but has not yet overshot to the $70 level after breaching trailing ATR support, with daily momentum now getting into oversold mode:

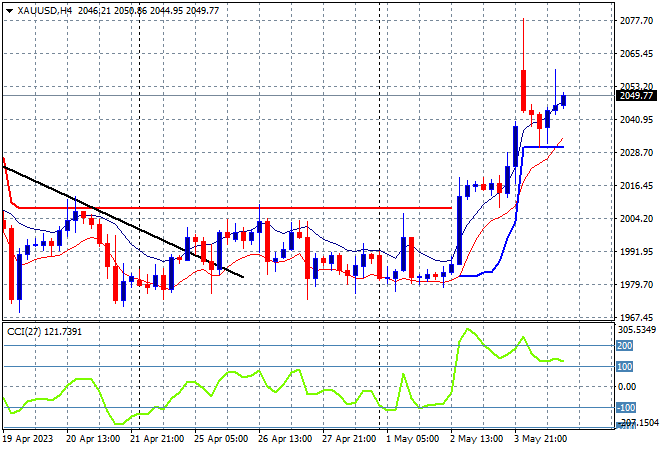

Gold continued its breakout last night on the anti-USD moves with a further surge above the $2000USD per ounce level, finishing at the $2049 level after previously bouncing along at weekly support levels just above the $1980 level. The four hourly chart shows a clear break above trailing ATR resistance and the psychologically important $2000 level with momentum now in the overbought zone – watch for a minor pullback to support those levels going ahead: