US jury says Apple must pay Masimo $634 million in smartwatch patent case

Last night saw risk sentiment improve as North Atlantic markets confirmed their positive reaction to the US NFP print on Friday, with a steady course set for the Fed to raise rates again. The defensive USD rose against most of the major currency pairs again, as the Australian dollar remains stubbornly high. Interest rate and bond markets are still confirming more rate rises on the way, with the 10 year Treasury range trading around the 2.4% yield level. Commodities saw a rebound with both WTI and Brent crude gaining 3%, well supported above the $100USD per barrel level while gold again is trying to bounce off support at the $1900USD per ounce level.

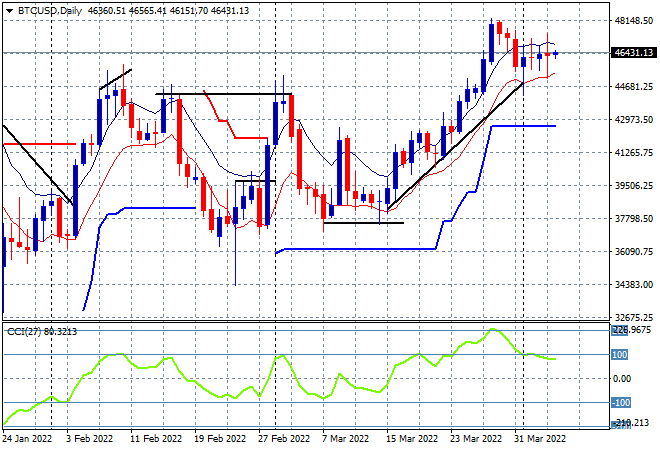

Bitcoin was again quite stable overnight, still halting at the $48K level and unable to make a new daily high. Daily momentum is reverting from overbought levels but still positive as price action remains contained above the low moving average on the daily chart. Watch for a clearance of resistance above the January and February highs as the $50K level is still the next target:

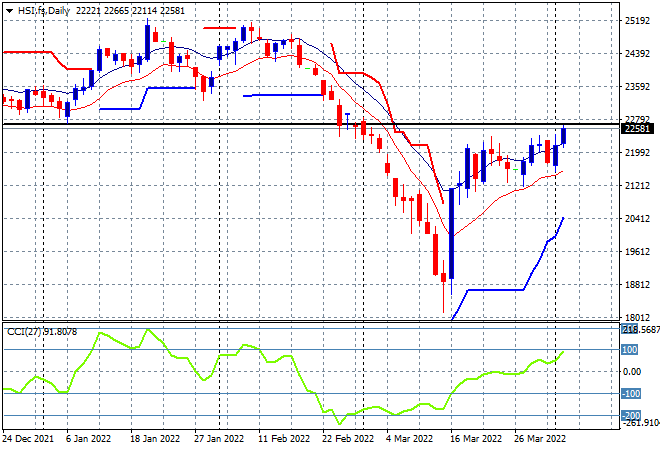

Looking at share markets in Asia from Friday’s session, Chinese share markets were closed for a holiday while the Hang Seng Index lifted strongly, up 1.8% to 22502 points. The daily chart is looking quite resilient here, having been supported at the 21200 level as it now attempts to clear very strong resistance at the 22600 point level next as momentum builds at this critical juncture:

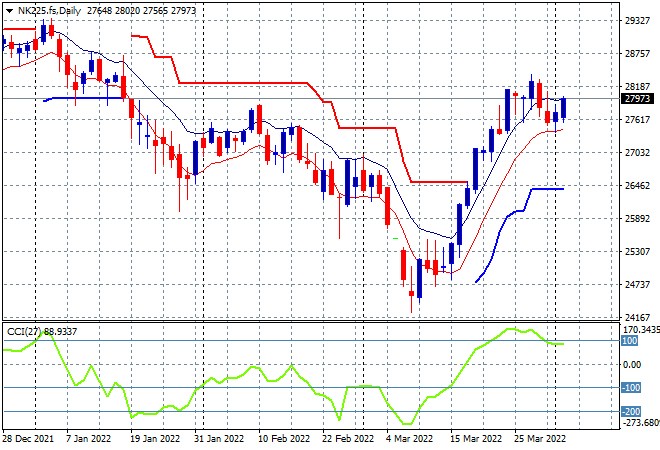

Japanese stock markets moved from retreat to standby mode with the Nikkei 225 putting in a modest lift, closing 0.2% higher at 27736 points. Futures are indicating a solid lift at the start of the trading week, due to a slightly weaker Yen and good risk sentiment overall, although daily momentum has reverting from its slightly overbought status. I mentioned last week that price action looks toppy, as it reverts back to weekly resistance at the 27500 point level and may begin to fall below the previous February highs, but more positive signs are building:

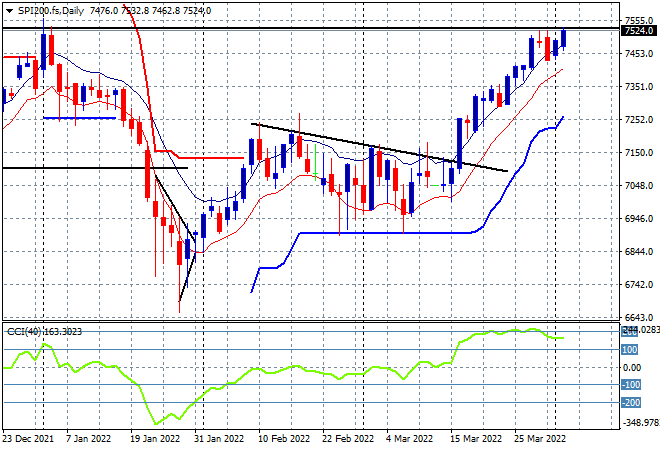

Australian stocks did well, following the modest Wall Street lead on Friday night with the ASX200 closing 0.3% higher to push above the 7500 point level, closing at 7513 points. SPI futures are up at least 50 points so we may see a near 1% rise throughout today’s session, in line with the returns on Wall Street overnight. The daily chart continues to show a lot of potential with daily momentum still quite strong but as price comes up against the former highs from December last year:

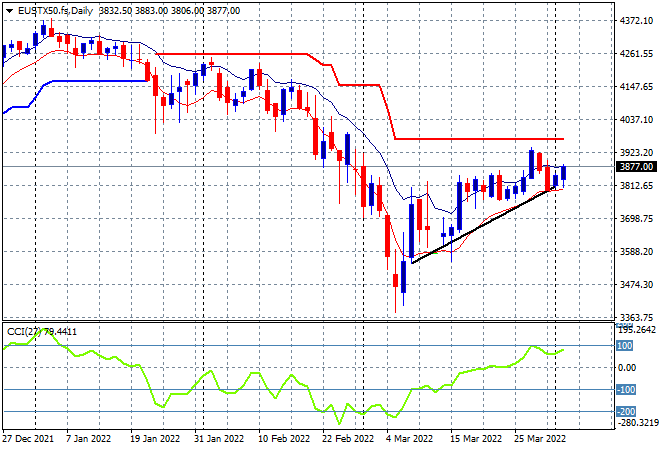

European shares again had fairly solid sessions across the continent to start the trading week, as the Eurostoxx 50 index closed 0.8% higher at 3851 points. Price is firming again here at the 3800 point zone with building indications of breakout potential. Momentum is key here – watch for an overbought reading – as is breaking through overhead daily ATR resistance:

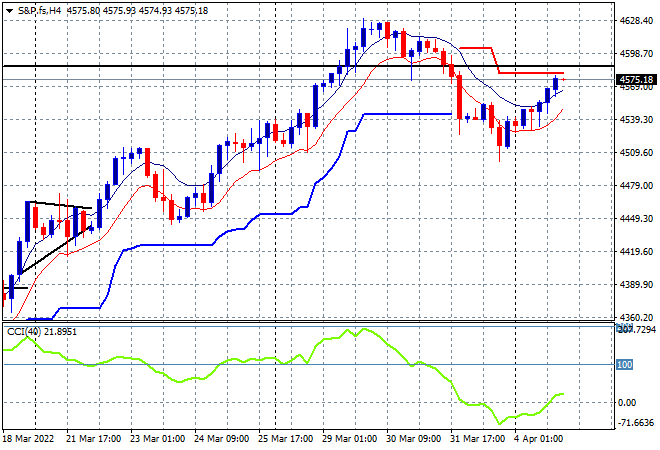

Wall Street was stronger across the board, tech stocks helped by the Musk twitter buyout of course, with the NASDAQ closing 1.9% higher while the S&P500 gained 0.8%, closing at 4582 points. Price action on the four hourly chart is showing a buy the dip that could result in a fill back to the previous weekly high above the 4600 point level, but momentum is still relatively weak and indicates a lack of confidence. While the next medium term target remains the December highs at the 4800 point level, watch for the low moving average to come under threat:

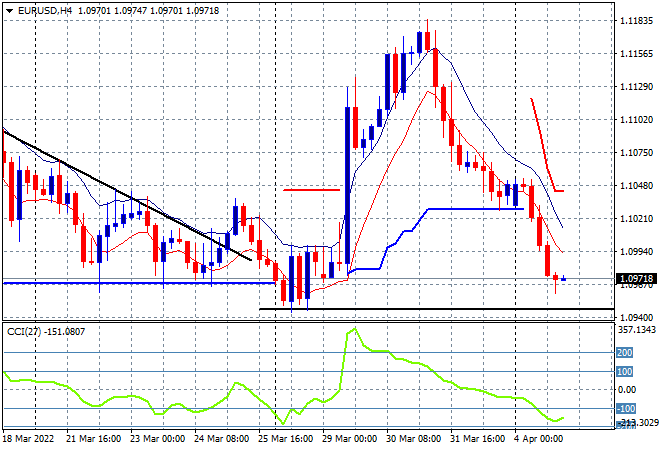

Currency markets continued to see a resurgence in USD strength with the possibilities of more sanctions against Russia pushing Euro much lower. The union currency fell back below the 1.10 level, almost back to the previous weekly low and completely wiping out the previous price surge. Potential is building here to follow through to the 1.09 level:

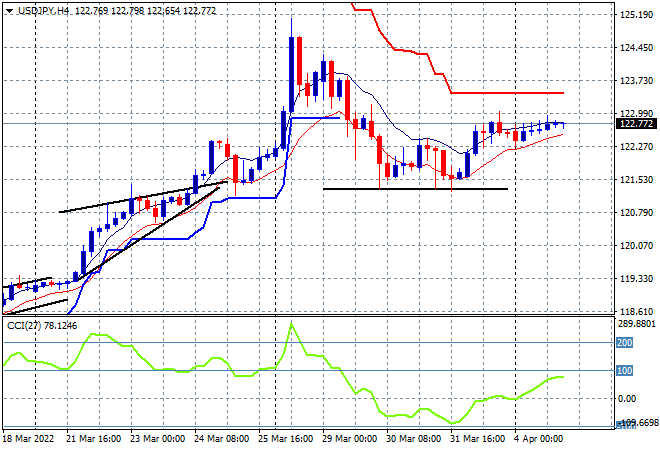

The USDJPY pair had been slowly consolidating at the 121 handle throughout mid last week, and is slowly drifting higher after the Friday night mild breakout above the 122 level. Nothing like the volatility of recent weeks, with near or over 1 handle moves every day, but something is brewing here that could spell more upside. Four hourly momentum has moved from completely neutral to very positive, but not yet overbought:

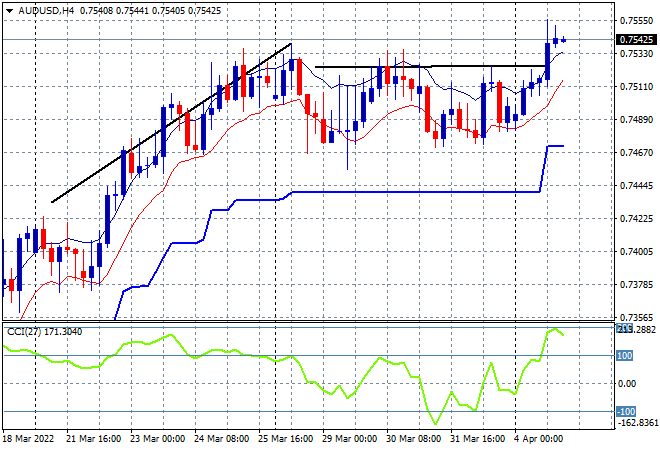

The Australian dollar broke out of its week long containment around the 75 handle against USD, wiping out the bearish rounding top pattern building on the four hourly chart, making a new weekly high in the process. This is all on commodity prices rebounding and may not be sustainable, although momentum is considerably overbought, price action shows a lot of internal resistance building here:

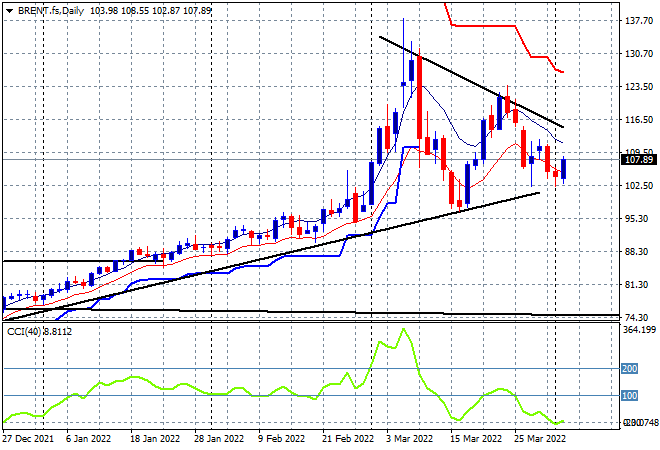

Oil markets are seeing a bit more support building in as part of a multi week structure in this bubblicious chart. Brent crude lifted nearly 3% overnight to the $107USD per barrel level with support firming at the $102 level since last week. The charts of oil leading up to and through this conflict are classic technical bubbles with the second peak lower than the first. This provide a potential continuation move here to flop down to the $100 level as daily momentum reverts back into negative readings:

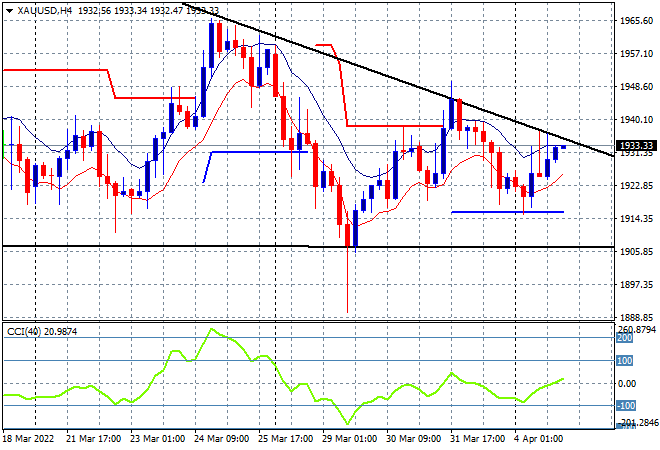

Gold is moving from somewhat contained to interesting, having defended price above the $1900USD per ounce level, but came back last night to start the week at $1933USD per ounce level. Price is coming up against the downtrend from the mid March highs with momentum still basically neutral, with a close above the high moving average at the $1930 area required soon or this will rollover swiftly: