Overnight stock markets were a little more bullish as anticipation builds for the upcoming Fed meeting. Bond markets had a roundtrip of a night with 10 Year US Treasury yields still pushing around the 3% level with a 50 basis point rise at the next Fed meeting still being priced in. The USD remains strong against everything, still at a 20 year high on the US Dollar Index, although Euro and Pound Sterling were able to stabilise overnight while commodity prices oscillated, as WTI and Brent crude oil both lost some ground, copper up slightly and gold prices only a dollar or two higher, still contained well below the $1900USD per ounce level.

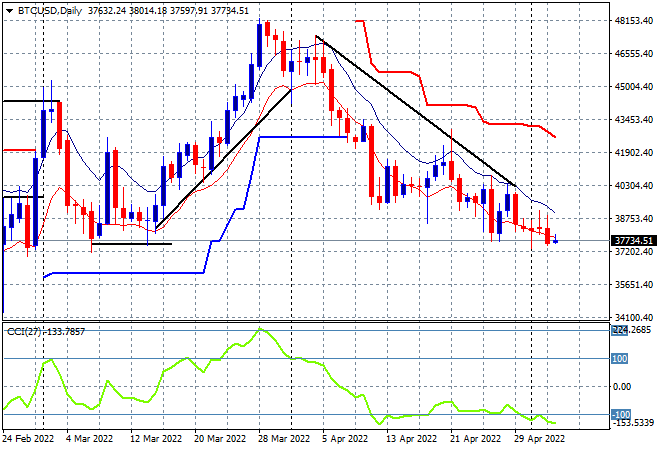

Bitcoin is still on a downward trend from its March highs, making a new daily low overnight as it remains anchored below the $40K level. This is still building for a further retracement down to the February lows at the $37K level, so I’m watching for a breakdown below that level next as daily momentum remains nicely oversold and price action lacks upside potential in the short term:

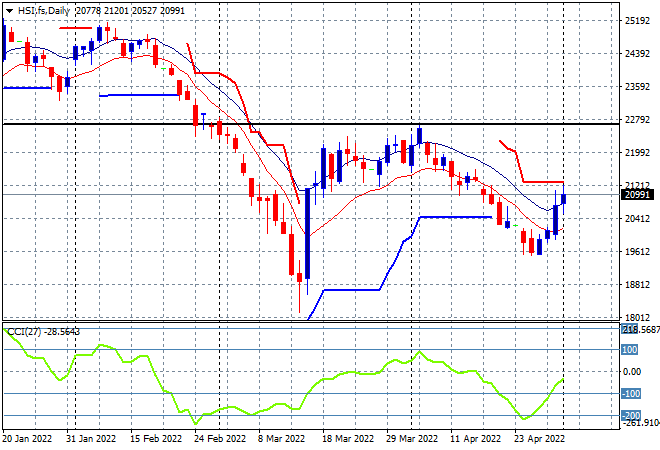

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were closed again for a holiday while the Hang Seng Index put in a scratch session to finish just a handful of points higher at 21101 points. The daily chart shows a potential swing trade brewing here as price action comes up against the trailing daily ATR resistance at the 21000 point level, but the overall picture still points to a return to the early March lows at 18000:

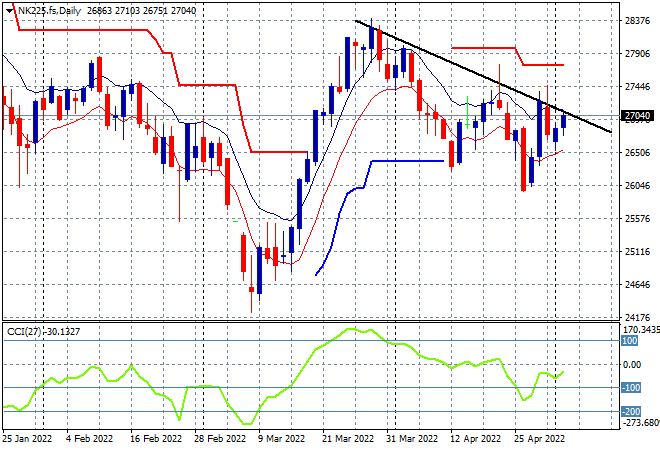

Japanese stock markets were closed for a holiday and won’t reopen until Friday. The daily chart of the Nikkei 225 is still showing a decline with no new daily highs to take out that downtrend line from the March highs although a weaker Yen may provide some more buying support here on the re-open. Price needs to break out above the previous daily highs near the 27500 point level soon with a switch in daily momentum to a more positive state, but I’m still considering a possible rollover here on any further correlated risk bad news:

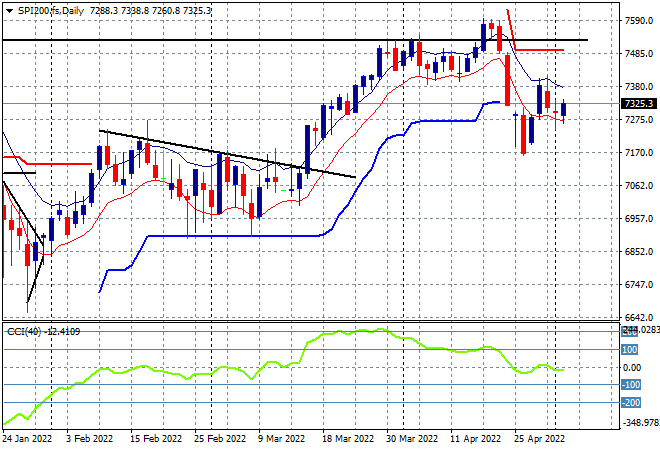

Australian stocks went down and then recovered most of that turn on the back of the RBA rate rise with the ASX200 still losing around 0.4% to finish at 7316 points. SPI futures are up nearly 50 points to take all of this temporary pain back as the 7300 point level proves strong support. The upside potential is still there, but really requires a swift close above the high moving average next around 7400 points:

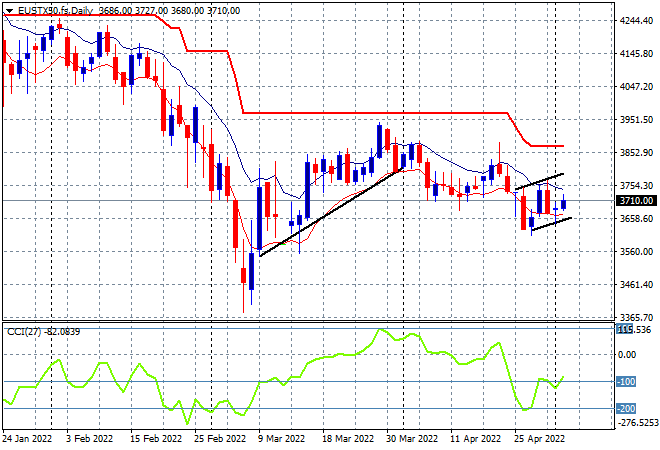

European shares had a much better session across the continent with the Eurostoxx 50 index closing nearly 0.8% higher at 3761 points. The daily chart picture still looks quite bearish – turn it upside down and you’d be a buyer for sure. Price is possibly finding a bottom here at the 3600 point level, with long tails of intrasession buying support helping in the last couple of sessions, but what is required is a larger breakout above the high moving average around the 3730 point level and then well above trailing daily ATR resistance at the 3800 level proper before calling a bottom. I still contend another breakdown with a return to the February lows is brewing, as the energy crisis and Ukrainian invasion risks widen:

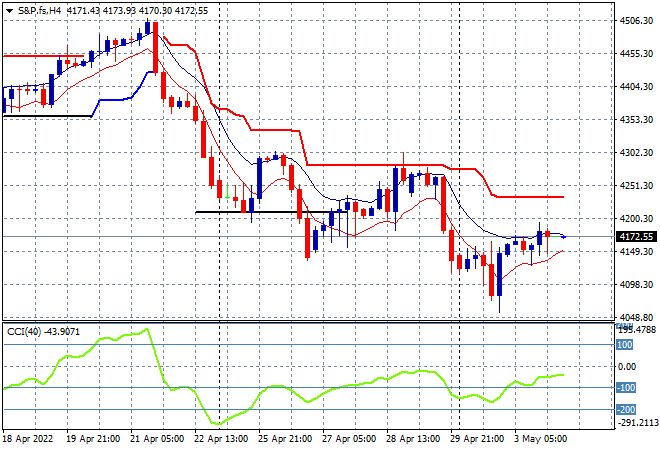

Wall Street made modest gains with the NASDAQ up only 0.2% while the S&P500 lifted nearly 0.5% higher to close at 4175 points. Price action on the four hourly chart looks encouraging but this looks like a repeat of the pattern we’ve seen for several weeks now, with steps down before the meagre BTFD crowd steps in and pulls off only a mild and temporary recovery. As I said before, this is nowhere near a reversal yet with trailing ATR resistance still a distant memory, as another dead cat bounce is setting up here as the medium term target remains at or below the 4000 point level:

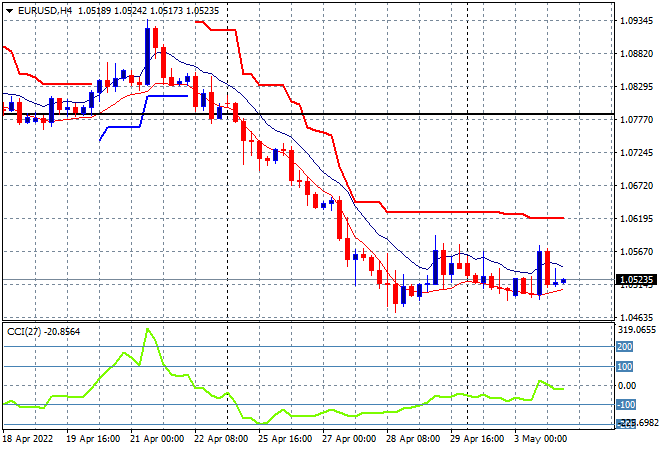

Currency markets remain dominated by a strong USD which continues to push Euro and Pound Sterling around but both finally didn’t make any new lows overnight, with the union currency remaining anchored here at the 1.05 handle. Short term momentum is slowly getting out of oversold conditions again, but another rollover is very possible to head back below last week’s intrasession low at the 1.0460 level on the road down to parity:

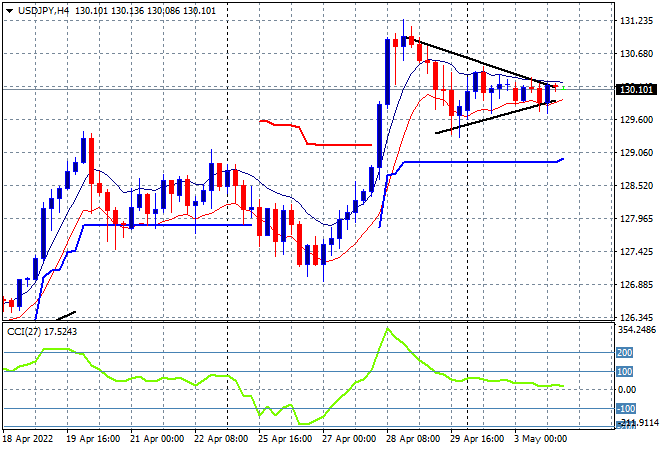

The USD/JPY pair was again almost unchanged overnight as it continues to consolidate following last week’s big move after the BOJ bond market operations, still slightly below the previous highs at the 131 handle. These moves are always filled with caution, but you can’t fight the central bank on this one, so I expect any small retracements to be filled from here:

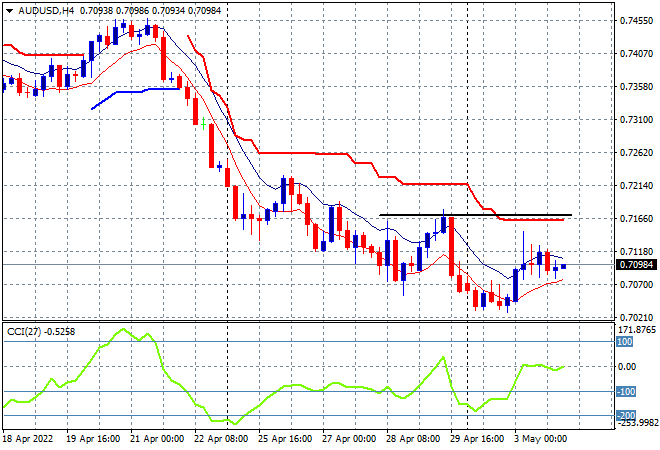

The Australian dollar is still under enormous pressure from USD, following the RBA rate rise, which was met with indifference from overnight markets, sending the Pacific Peso back below the 71 handle. My contention of this being underwhelming is holding here with a rollover back down to the key 70 handle and then into the 60’s as the Federal Reserve will shortly be far more aggressive. Short term momentum remains nominally neutral with a bearish bias for now:

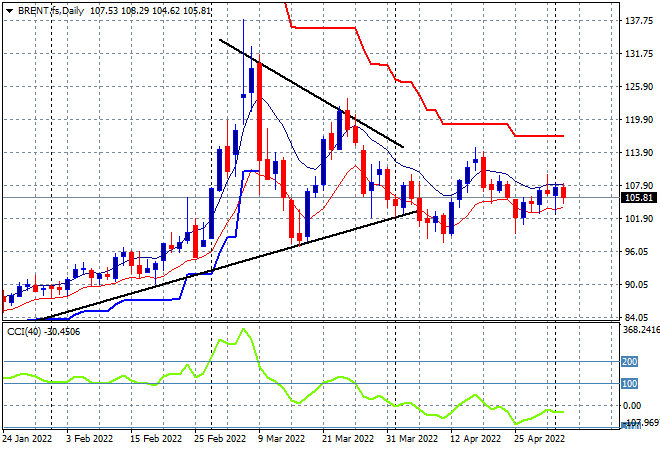

Oil markets continue to stabilise with a go-nowhere session overnight with Brent trying to solidify around the $107USD per barrel support level but failing again to make a substantial new daily high. Daily momentum is still in the negative zone, with a drawback or breakdown below the key $100 level gaining traction, given no new weekly highs being made for sometime now:

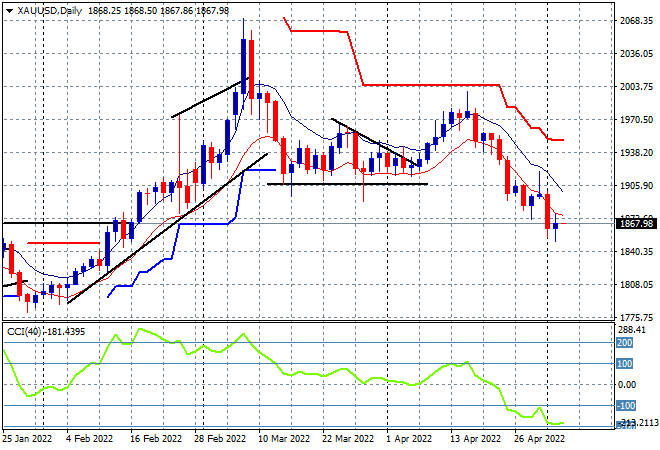

Gold remains under a lot of pressure with its previous selloff still sticking overnight with the $1900USD per ounce level turning into staunch resistance as it finishes at the $1867 level. Daily momentum is still in very deep into oversold territory with the January lows around the $1800 level the next possible downside target: