Friday night saw the release of the latest US unemployment print which would normally set the tone for risk sentiment for the rest of the month. It was a fairly solid report, but stocks reacted with only marginally lifts across the risk complex, with European bourses still under pressure. The defensive USD rose against most of the major currency pairs again, although the Australian dollar remains stubbornly high. Volatility in interest rate and bond markets saw the 10 year Treasury pulling lift up to the 2.4% yield level before pulling back slightly, although the yield curve dropped to the lowest level since 2006. Commodities saw continued drops in oil prices with both WTI and Brent crude losing over 3%, but both still remain above the $100USD per barrel level while gold tried to bounce off support at the $1900USD per ounce level again but finished in a weak position.

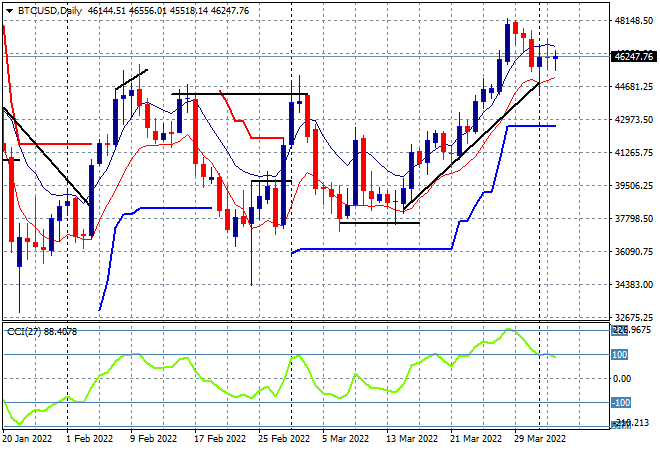

Bitcoin was relatively stable on Friday night and over the weekend, having pulled back midweek after halting at the $48K level following a new monthly high. Daily momentum was considerably overbought and has now reverted back to a neutral, if positive measure so combined with a clearance of resistance above the January and February highs this still keeps the $50K level as the next target:

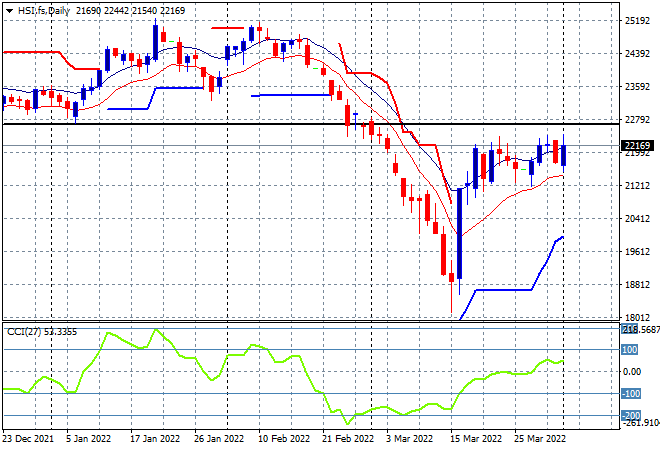

Looking at share markets in Asia from Friday’s session, Chinese shares lifted fast going into the afternoon session, with the Shanghai Composite closing up 0.9% to 3282 points while the Hang Seng Index was down at first amid the chaos around a huge drop of delistings, but eventually finished 0.2% higher to 21837 points. The daily chart is still looking fairly resilient here, having been supported at the 21200 level but needs to clear very strong resistance at the 22600 point level next as momentum is only marginally positive:

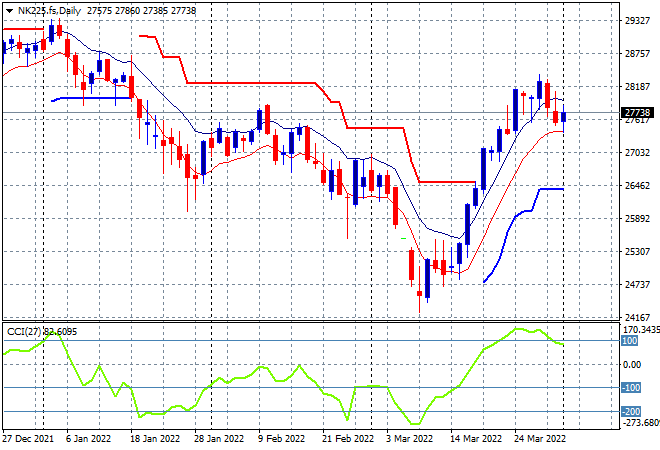

Japanese stock markets remained in retreat mode with the Nikkei 225 down 0.5% to 27665 points. Futures are indicating a small lift at the start of the trading week, despite only modest weakening on Yen on Friday night as daily momentum reverts from its slightly overbought status. I mentioned last week that price action looks toppy, as it reverts back to weekly resistance at the 27500 point level and may begin to fall below the previous February highs. Watch for support to hold at the 27000 point level that must hold:

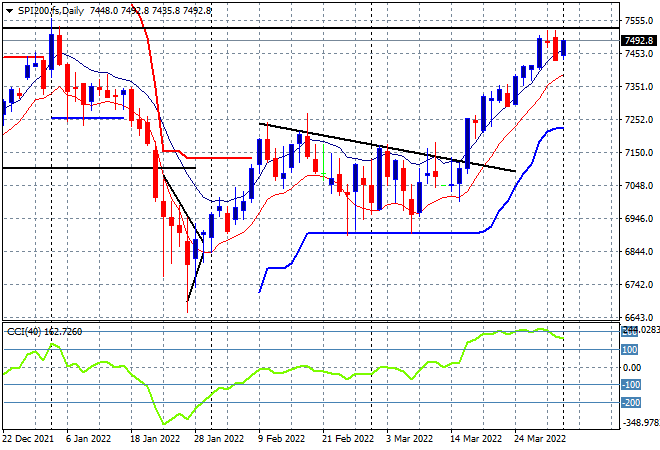

Australian stocks were at first the top performer in the region but sold off going into the close with the ASX200 eventually finishing up 0.1% lower to remain at just below the 7500 point level. SPI futures are up around 20 points or 0.25% or so, in line with the fair to middling returns on Wall Street on Friday night. The daily chart continues to show a lot of potential with daily momentum still quite strong but as price comes up against the former highs from December last year, it appears a stall is underway:

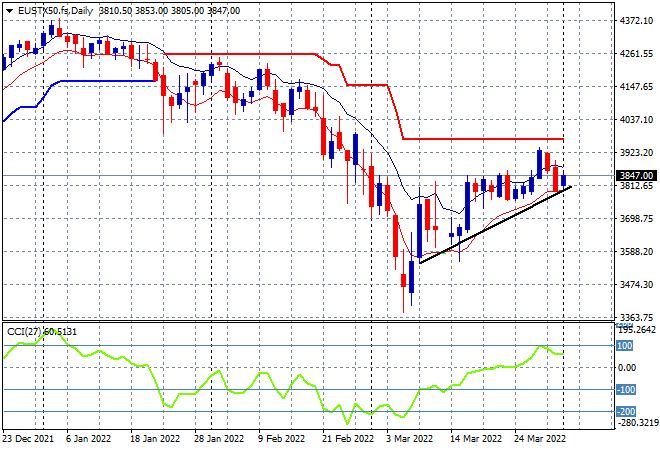

European shares had fairly solid sessions across the continent, albeit with hesitation as the Eurostoxx 50 index closed 0.4% higher at 3918 points. Recent price action had looked better each session but the mid week slump had threatened the uptrend line, as price remains anchored at the 3800 point zone despite some indications of breakout potential. Momentum is key here – as is breaking through overhead daily ATR resistance:

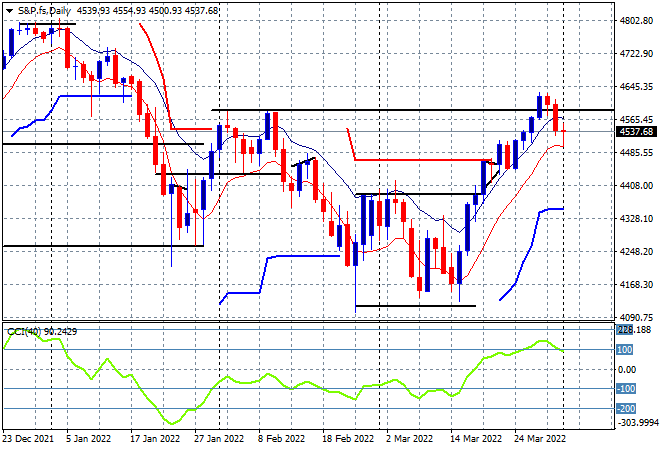

Wall Street had a very similar session, considering the volatility amid the NFP print with the NASDAQ closing just 0.3% higher while the S&P500 finished 0.4% higher, closing at 4545 points, basically where it started the week. Price action on the daily chart is still showing a rebuff of the late January highs with momentum retracing from a slightly overbought status, indicating a lack of confidence. While the next medium term target remains the December highs at the 4800 point level, watch for the low moving average to come under threat next if sentiment continues to sour going into the new trading week:

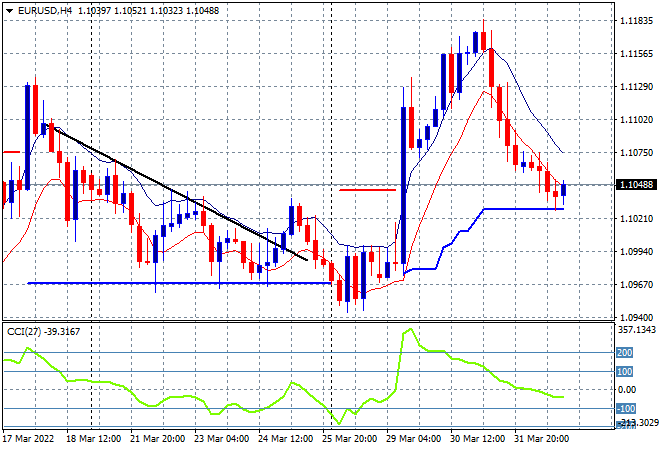

Currency markets continued to see a resurgence in USD strength given the expected NFP print and no real change in the Ukrainian war. Risk sentiment had no real effect either, with the market still forecasting more interest rate hikes from the Fed, keeping Euro contained at the mid 1.10 level. As I said earlier last week, the prior surge was likely overdone with any bad news from the peace talks breaking down sending it swiftly back to previous weekly support, with the potential to follow through to the 1.09 level:

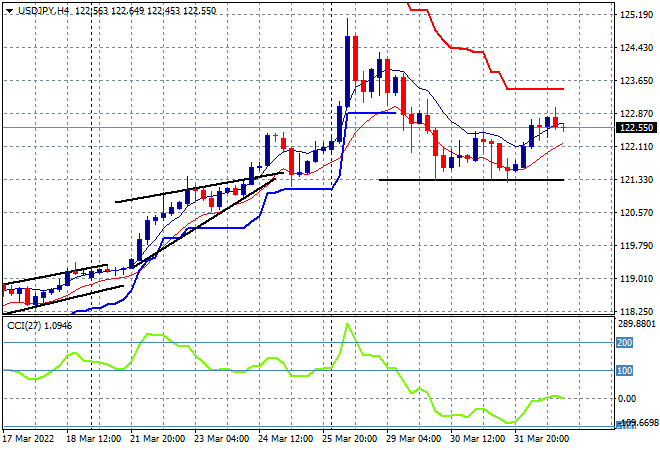

The USDJPY pair had been slowly consolidating here at the 121 handle throughout mid last week, after failing to find any further buying support but saw a small surge later in the week that wasn’t followed through on Friday night. Four hourly momentum has now reverted back to completely neutral settings after being extremely overbought, but is unchanged. I’m still watching for an obvious breakdown below the 121.20 level next:

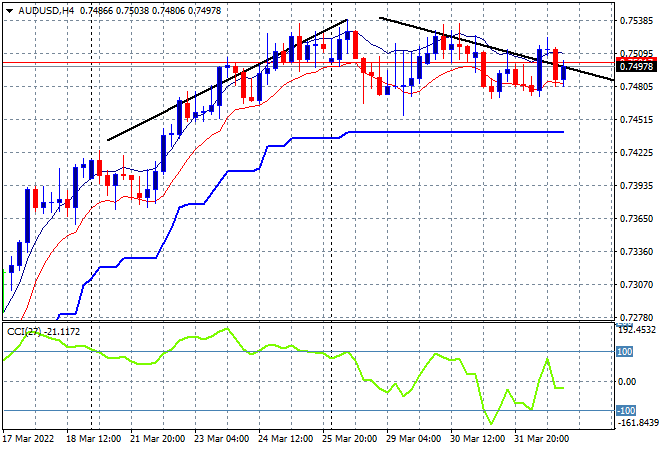

The Australian dollar was also contained, although it has rebuffed the rounding top pattern building on the four hourly chart, turning into a consolidation/sideways mode instead at just below the 75 handle, even as commodity prices come off the boil. Watch the 74 level acting as strong support in the short term:

Oil markets are seeing further weakness as the bubble like chart conditions continue to unwind, with Brent crude sold off to finish at the $104USD per barrel level on Friday night. The charts of oil leading up to and through this conflict are classic technical bubbles with the second peak lower than the first. This provide a potential continuation move here to flop down to the $100 level as daily momentum getting reverts back into negative readings:

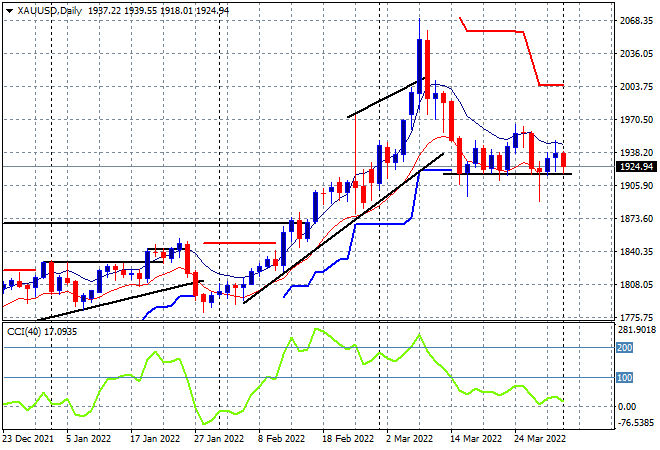

Gold also remains contained above the $1900USD per ounce level, having a very small selloff to finish the week at the $19247USD per ounce level, having failed to make a new daily breakout above the high moving average. Support is looking stronger here at the $1900 level, but I still maintain that a close above the high moving average at the $1930 area is required soon or this will rollover swiftly: