An exciting series of news events overnight tripped up the great start to the trading week with stocks on both sides of the Atlantic falling amid contraction in US manufacturing and a ratings downgrade by Fitch. S&P futures have dropped further this morning as traders assess the downgrade and also the news of convicted rapist and former President Trump indicted yet again for serious crimes. The USD lifted on a run to safety as traders are still anticipating Friday’s US non-farm payrolls jobs report with the Australian dollar suffering the most, falling straight down to the 66 cent level following yesterday’s pause by the RBA.

US bond markets saw a jump across the yield curve with the 10 year lifting back across the 4% level for a new monthly high while oil prices advanced slightly on their recent gains with Brent crude pushing well above the $85USD per barrel level. Gold is failing to beat back the USD uptrend as it retraces back to the $1950USD per ounce level.

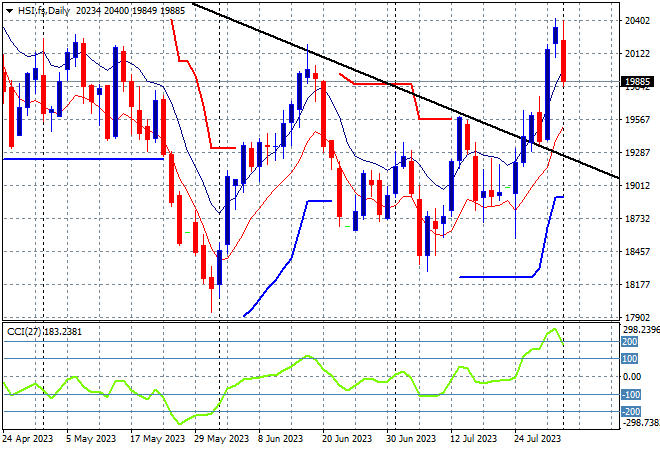

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets had flat sessions with the Shanghai Composite closing just 0.1% lower at 3290 points while in Hong Kong the Hang Seng Index has pulled back 0.3% to just finish above the 20000 point barrier.

The daily chart is now showing how the 19000 point level has become strong support as price action bursts above the dominant downtrend (sloping higher black line) following a month long consolidation. This breakout could have further legs but daily momentum readings are getting into extreme levels and ripe to continue this minor pullback:

Japanese stock markets however are lifting strongly again with the Nikkei 225 closing nearly 1% higher at 33476 points.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with a welcome consolidation above that level. Daily momentum has returned to overbought settings with this retracement down to the support zone probably over for now, as a possible breakout is now brewing on the weakening Yen trend:

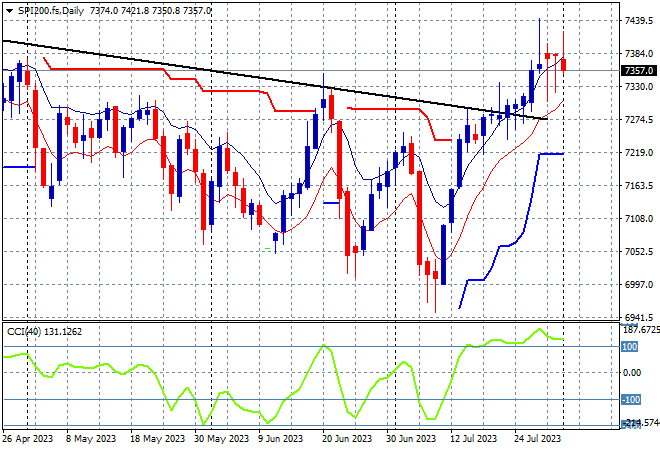

Australian stocks really liked the RBA pause with the ASX200 closing 0.5% higher at 7450 points.

SPI futures however are down more than 0.5% given the mild pullback on Wall Street overnight, as it still looks like that the 7300 point level has firmed as short term support instead of resistance. Medium term price action is slowly getting out of its downtrend with the daily chart showing a breakout here as the June highs are bested but watch daily momentum readings that need to stay overbought:

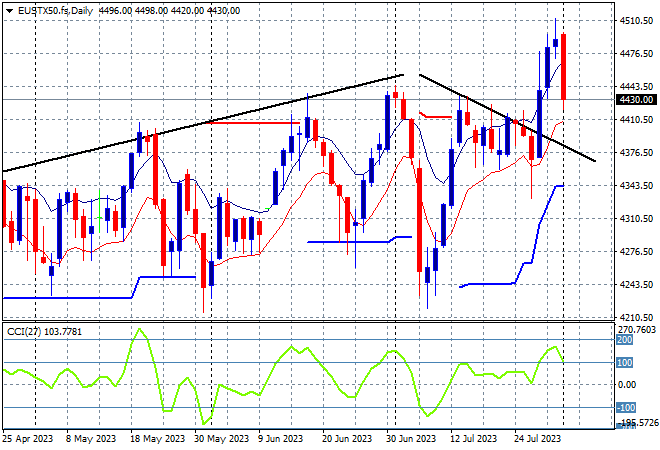

European markets sold off across the continent with the Eurostoxx 50 Index closing more than 1.4% lower to retrace back to resistance at the 4400 point level, finishing at 4407 points.

The daily chart still shows weekly support at 4200 points defended well with weekly resistance at the 4400 point resistance level broken but the daily bearish engulfing candle is worrisome. Watch for a potential pullback to broaden if the 4400 point level is broken tonight:

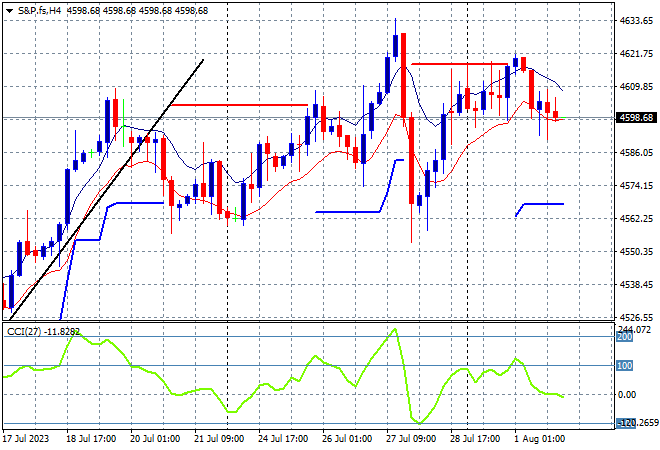

Wall Street also had mild down sessions due to the ratings downgrade as the NASDAQ lost more than 0.4% while the S&P500 finished 0.3% lower at 4576 points.

The four hourly chart is showing a more sideways bent now after the previous weekly uptrend that got a little out of hand recent with a welcome consolidation. The 4600 point zone is still the area to watch going into this week’s NFP print with the growing potential of a short term retracement below the 4550 area:

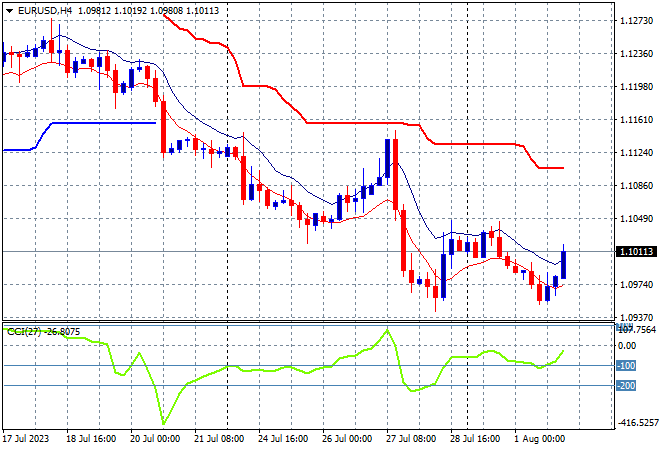

Currency markets remain on the USD side with everyone waiting for the all important Friday night US jobs report – aka non-farm payrolls – but still absorbing this latest Fitch downgrade. This is evidenced by Euro continuing its decline following last week’s ECB meeting although a late blip saw a return to the 1.10 level early this morning.

Euro had halted its week plus long decline after hitting support just above the 1.10 handle mid week before getting slammed back down to the 1.09 handle and then bouncing slightly back on Friday night. Short term momentum remains negative so I’m watching for another rollover tonight:

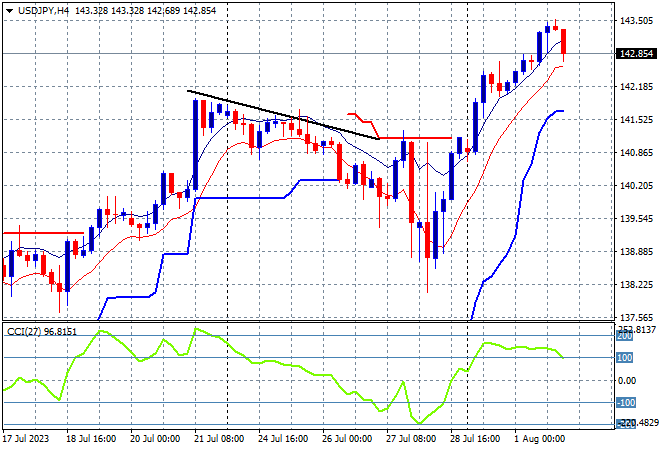

The USDJPY pair is also re-engaging to the upside after last week’s BOJ meeting with an impressive rebound that is keeping the pair above the 142 handle but it may have overstretched with a late selloff pulling it back slightly.

Four hourly momentum is now considerably overbought mode with price action now exceeding the recent weekly highs following a very good weekend gap higher. This leaves room for more potential upside as the USD continues to firm into Friday’s US jobs report but I’m wary of a mild pullback here:

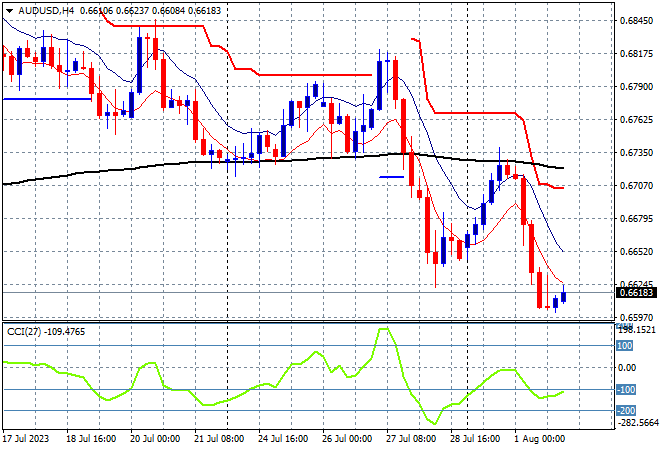

Last week, the Australian dollar was pushed decisively down on ECB dovishness and then again on the US GDP print, keeping the Pacific Peso depressed below the 67 handle and that kept on trend after yesterday’s RBA pause. Overnight the trend was confirmed with a smash down to the 66 cent level as the Aussie is now the weakest of the majors.

Recent price action put ATR resistance and 200 EMA (black line) levels under threat but short term momentum has rolled over into oversold status, confirming a break of weekly support and setting up for more downside below:

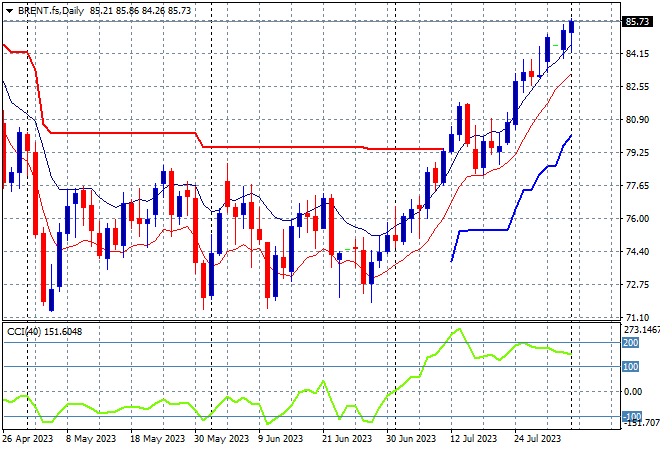

Oil markets are advancing on their recent swift gains with Brent crude lifting again overnight, advancing past the $85USD per barrel level to maintain a three month high.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance and setting up for a new potential uptrend:

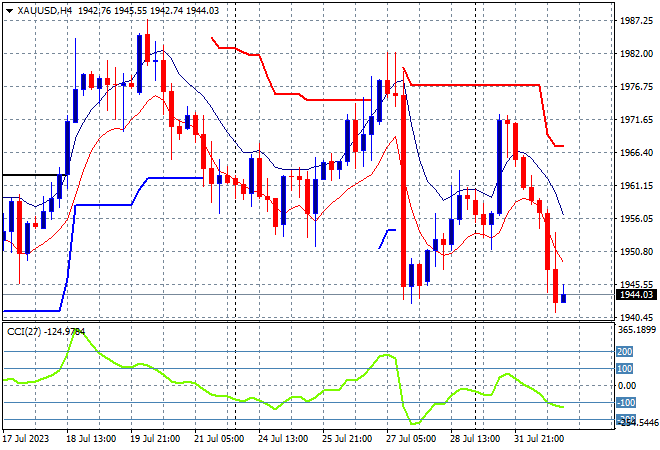

Gold was trying to get back after its mid-session rout last week following the Fed’s latest rate rise, with a fall to the $1940USD per ounce level filled up towards the $1970 level but this was taken back and then some for a new weekly low overnight.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level is likely over as a new two week low made swiftly cannot be returned as such without a lot more effort. Watch for a potential unwinding here down to $1900: